Stock Market Analysis: Bonds, Dow Futures, And Bitcoin After Tax Bill Passage

Table of Contents

Impact on Bonds

The tax bill's impact on the bond market is multifaceted, primarily stemming from its effects on interest rates and investor sentiment.

Yield Curve Shifts

The relationship between tax policy and bond yields is intricate. Tax cuts often lead to increased government borrowing, potentially pushing up interest rates. This, in turn, affects the yield curve, the graphical representation of yields across different maturities.

- Potential Increases in Bond Yields: Increased government borrowing can increase the supply of bonds, potentially leading to higher yields to attract investors.

- Implications for Long-Term vs. Short-Term Bond Investors: Long-term bond investors are generally more sensitive to yield curve shifts than short-term investors. Changes in long-term yields significantly impact the value of their investments.

- Impact on Inflation Expectations: Tax cuts can stimulate economic growth, potentially leading to increased inflation. Higher inflation expectations usually result in higher bond yields as investors demand a higher return to compensate for the erosion of purchasing power.

Safe-Haven Demand

Bonds are often seen as a safe-haven asset during periods of market uncertainty. Following significant legislative changes like the tax bill, investors may flock to bonds to reduce risk.

- Investor Behavior Following the Tax Bill Passage: Many investors, anticipating market volatility, may have shifted funds into bonds, driving up demand and potentially pushing prices higher.

- Flight-to-Safety Trends and their Impact on Bond Prices: A "flight-to-safety" phenomenon can significantly impact bond prices, leading to price appreciation as demand increases.

- Correlation Between Market Volatility and Bond Demand: Historically, there is a strong negative correlation between market volatility and bond yields. Increased volatility often leads to increased demand for bonds, lowering yields.

Sector-Specific Analysis

The tax bill’s impact varied across different bond sectors.

- Differing Impacts on Various Bond Sectors: Government bonds might have experienced different demand than corporate bonds, depending on investor risk appetite and creditworthiness concerns.

- Credit Rating Implications and their Influence on Bond Prices: Changes in corporate credit ratings due to the bill's impact on profitability could significantly influence the price of corporate bonds.

- Potential for Increased Risk Premiums: Investors might demand higher risk premiums for corporate bonds deemed riskier due to the tax bill's impact on specific industries.

Dow Futures and Stock Market Reactions

The passage of the tax bill triggered immediate and potentially long-term reactions in the Dow futures market and the broader stock market.

Immediate Market Response

The immediate aftermath of the tax bill's passage provided a snapshot of initial market sentiment.

- Market Reactions in the Days Following the Bill's Passage: A thorough stock market analysis of the days following the bill’s passage would reveal immediate price fluctuations, which could be positive or negative depending on market interpretation of the bill’s impact.

- Significant Price Fluctuations or Volatility Spikes: The initial reaction often involved heightened volatility as investors adjusted their positions based on their interpretation of the bill's long-term implications.

- Role of Investor Speculation and Market Sentiment: Investor speculation and overall market sentiment played a significant role in determining the immediate price movements.

Long-Term Implications

The bill's long-term effects are projected to influence corporate earnings and investment decisions.

- Potential for Increased Corporate Earnings and their Effect on Stock Prices: Tax cuts could potentially boost corporate earnings, leading to higher stock valuations.

- Impact of Tax Cuts on Capital Expenditures and Economic Growth: The bill's impact on capital expenditures and overall economic growth would influence long-term stock performance.

- Long-Term Implications for Investor Returns: A detailed stock market analysis would be necessary to assess the long-term implications for investor returns, considering the interplay of various economic factors.

Sectoral Performance

Different sectors reacted uniquely to the tax bill, highlighting the importance of sector-specific analysis.

- Differential Impact on Various Sectors (e.g., Technology, Financials, Healthcare): Sectors like technology, which often benefit from lower corporate tax rates, might have experienced a positive reaction, while others might have shown a more muted or even negative response.

- Reasons Behind These Differing Responses: Understanding why sectors reacted differently requires a detailed analysis of each sector's unique sensitivity to changes in tax policy and economic conditions.

- Importance of Sector-Specific Analysis for Investors: Investors need to undertake a thorough sector-specific stock market analysis to make well-informed decisions about their portfolio allocation.

Bitcoin's Volatility and Tax Implications

Bitcoin's decentralized nature makes its response to the tax bill complex and potentially less directly correlated than traditional assets.

Bitcoin Price Fluctuations

The tax bill's impact on Bitcoin's price was likely indirect and influenced by other factors.

- Price Movements Observed Following the Bill's Passage: Bitcoin's price often moves based on speculation, regulatory changes, and overall market sentiment, rather than immediate reactions to specific legislation.

- Factors Influencing Bitcoin's Price Beyond the Tax Bill: Regulatory uncertainty, adoption rates, and major market events significantly influence Bitcoin's price fluctuations.

- Potential for Increased or Decreased Volatility: The tax bill may have indirectly impacted volatility by influencing investor confidence or regulatory discussions around cryptocurrencies.

Tax Treatment of Cryptocurrency

The tax bill likely had specific implications for how Bitcoin and other cryptocurrencies are taxed.

- Tax Rules Surrounding Cryptocurrency Transactions and Capital Gains: Clear understanding of the tax rules surrounding cryptocurrency transactions and capital gains is vital for Bitcoin investors to comply with tax regulations.

- Potential Challenges in Tax Reporting for Bitcoin Investors: Reporting cryptocurrency transactions accurately can be complex due to the decentralized nature of the market.

- Impact on the Overall Attractiveness of Bitcoin as an Investment: The bill's tax implications could affect Bitcoin's attractiveness as an investment, impacting investor sentiment and market activity.

Future Outlook for Bitcoin

Predicting Bitcoin's future is speculative, but the tax bill could play a role.

- Potential for Increased Regulatory Scrutiny or Adoption of Cryptocurrency: The tax bill may spur increased regulatory scrutiny or, alternatively, increase acceptance of cryptocurrencies in financial systems.

- Impact of the Tax Bill on Overall Market Sentiment Towards Bitcoin: How the bill is interpreted and its overall impact on the financial climate may affect the perception of Bitcoin in the investment world.

- Implications for Long-Term Bitcoin Investors: Long-term investors should carefully consider the potential long-term implications of the bill and their individual risk tolerance before making investment decisions.

Conclusion

The passage of the tax bill has undeniably impacted the stock market, influencing bonds, Dow futures, and even Bitcoin in distinct ways. A comprehensive stock market analysis reveals complex interrelationships between legislative changes and investor behavior. Understanding the nuanced impacts on various asset classes is crucial for informed investment decisions. By carefully considering the implications discussed in this analysis, investors can better navigate the evolving market landscape and optimize their portfolios. Continue to monitor the market and perform your own thorough stock market analysis to make the most informed decisions.

Featured Posts

-

Frank Sinatras Four Marriages A Look At His Wives And Relationships

May 24, 2025

Frank Sinatras Four Marriages A Look At His Wives And Relationships

May 24, 2025 -

When To Fly Around Memorial Day 2025 Avoid The Crowds

May 24, 2025

When To Fly Around Memorial Day 2025 Avoid The Crowds

May 24, 2025 -

Prepad Na Trhu Prace V Nemecku Tisice Prepustenych Z Najvaecsich Spolocnosti

May 24, 2025

Prepad Na Trhu Prace V Nemecku Tisice Prepustenych Z Najvaecsich Spolocnosti

May 24, 2025 -

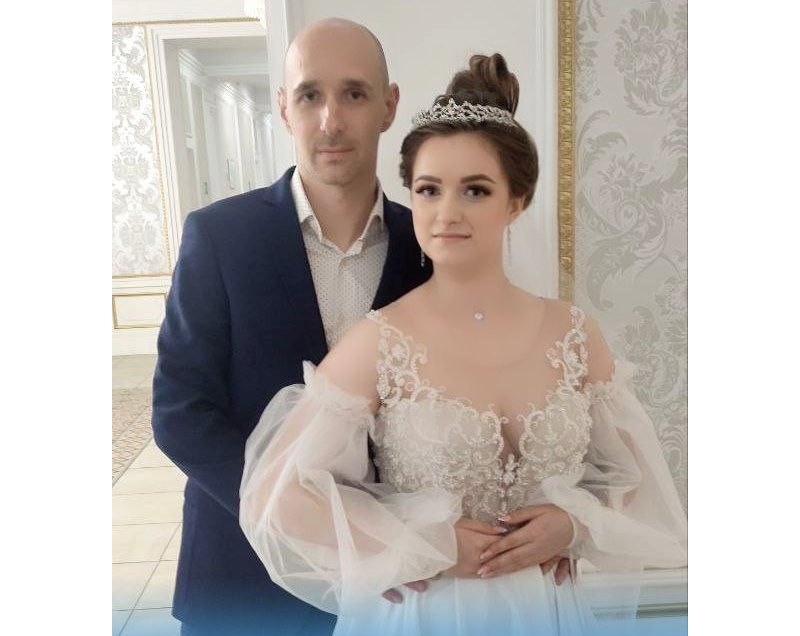

Svadby V Krasivuyu Datu Na Kharkovschine 89 Novykh Semey

May 24, 2025

Svadby V Krasivuyu Datu Na Kharkovschine 89 Novykh Semey

May 24, 2025 -

Ces Unveiled Europe 2024 Date Lieu Et Nouveautes Attendues

May 24, 2025

Ces Unveiled Europe 2024 Date Lieu Et Nouveautes Attendues

May 24, 2025

Latest Posts

-

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth And Sandy Point

May 24, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth And Sandy Point

May 24, 2025 -

Memorial Day Weekend 2025 Ocean City Rehoboth And Sandy Point Beach Forecast

May 24, 2025

Memorial Day Weekend 2025 Ocean City Rehoboth And Sandy Point Beach Forecast

May 24, 2025 -

Official Kermit The Frog Confirmed For Umds 2025 Graduation Ceremony

May 24, 2025

Official Kermit The Frog Confirmed For Umds 2025 Graduation Ceremony

May 24, 2025 -

Hi Ho Kermit University Of Maryland Names Commencement Speaker For 2025

May 24, 2025

Hi Ho Kermit University Of Maryland Names Commencement Speaker For 2025

May 24, 2025 -

Famous Amphibian Delivers Inspiring Commencement Address At University Of Maryland

May 24, 2025

Famous Amphibian Delivers Inspiring Commencement Address At University Of Maryland

May 24, 2025