Stock Market Movers: Rockwell Automation Leads The Charge

Table of Contents

Rockwell Automation's Strong Q3 Earnings Report

Rockwell Automation's recent Q3 earnings report significantly exceeded expectations, solidifying its position as a leader in the industrial automation sector. This strong performance is fueled by several key factors.

Exceeding Expectations

Rockwell Automation delivered impressive financial results, showcasing robust growth across key metrics.

- Earnings Per Share (EPS): The company reported an EPS of $2.50, exceeding analyst expectations by $0.15 and representing a 15% increase year-over-year.

- Revenue Growth: Revenue surged by 12% compared to the same quarter last year, reaching $2.1 billion, driven by strong demand across various industrial sectors. This represents a significant improvement over Q2's growth rate.

- Profitability: Operating margins also improved, reaching 22%, indicating increased efficiency and cost control within the company. This is a 2% increase compared to the previous quarter.

This outstanding performance is primarily attributed to increased demand for industrial automation products, driven by factors like ongoing digital transformation initiatives and a global push for improved manufacturing efficiency.

Positive Outlook for Future Growth

Rockwell Automation's management provided positive guidance for the coming quarters, further boosting investor confidence in Rockwell Automation stock.

- Key Growth Areas: The company highlighted strong growth prospects in several key sectors, including food and beverage, life sciences, and automotive manufacturing. These sectors are increasingly adopting automation technologies to improve productivity and meet consumer demand.

- Geographic Expansion: Rockwell Automation is also experiencing robust growth in key international markets, particularly in Asia and Europe, indicating successful global expansion strategies.

- Projected Revenue Growth: Management projects a revenue growth rate of 8-10% for the next fiscal year, signaling continued optimism for the company's future.

Industry Trends Fueling Rockwell Automation's Success

Several significant industry trends are converging to fuel Rockwell Automation's remarkable success and influence Rockwell Automation stock performance.

The Rise of Industrial Automation

The global demand for industrial automation solutions is experiencing unprecedented growth, and Rockwell Automation is at the forefront of this trend.

- Labor Shortages: Many industries are grappling with labor shortages, making automation a necessity for maintaining production levels.

- Increased Efficiency: Automation technologies offer significant improvements in efficiency, reducing waste and optimizing production processes.

- Industry 4.0 Adoption: The widespread adoption of Industry 4.0 technologies, including the Industrial Internet of Things (IIoT) and smart manufacturing solutions, is driving demand for advanced automation systems. Rockwell Automation is a key player in this space, offering a wide range of integrated solutions.

Strategic Acquisitions and Partnerships

Rockwell Automation's strategic acquisitions and partnerships have further enhanced its market position and contributed to its strong financial performance.

- Acquisition of [Insert Company Name if applicable]: [Briefly describe the acquisition and its benefits for Rockwell Automation, e.g., expansion into new markets or technologies].

- Partnerships with [Insert Company Names if applicable]: [Briefly describe key partnerships and their contributions, e.g., expanded product offerings or enhanced technological capabilities]. These collaborations demonstrate Rockwell Automation's commitment to innovation and market leadership.

Analysis of Rockwell Automation Stock Performance

Understanding the recent fluctuations of Rockwell Automation stock is crucial for investors.

Stock Price Fluctuations and Analyst Ratings

Rockwell Automation's stock price has shown significant upward momentum recently.

- Recent Performance: [Provide specific data on stock price changes over a relevant period, e.g., "Over the past three months, Rockwell Automation's stock price has increased by X%, reaching a high of Y." ]

- Analyst Ratings: Many analysts have upgraded their ratings for Rockwell Automation stock, citing strong financial performance and positive industry outlook. [Mention specific analyst firms and their ratings, if available].

- Price Targets: Analyst price targets for Rockwell Automation stock indicate significant potential for further growth. [Mention specific price targets and their implications].

Comparison to Competitors

Rockwell Automation's performance compares favorably to its main competitors in the industrial automation sector.

- Key Competitors: [List key competitors, such as Siemens, Schneider Electric, and ABB].

- Competitive Advantages: Rockwell Automation's strong brand reputation, comprehensive product portfolio, and focus on innovation provide key competitive advantages in the market.

Conclusion

Rockwell Automation's strong performance and positive outlook make it a compelling investment opportunity. Its leadership in the industrial automation sector, coupled with strong financial results and positive industry trends, suggests continued growth. While the stock market is inherently volatile, the factors discussed above indicate a positive trajectory for Rockwell Automation stock. Consider researching further to determine if Rockwell Automation stock aligns with your investment strategy. Stay informed on Rockwell Automation stock and other key stock market movers to make well-informed decisions.

Featured Posts

-

Exclusive Donor Access A Look At Vip Experiences At Trumps Military Events

May 17, 2025

Exclusive Donor Access A Look At Vip Experiences At Trumps Military Events

May 17, 2025 -

Section 230 And Banned Chemicals A Recent E Bay Case Ruling

May 17, 2025

Section 230 And Banned Chemicals A Recent E Bay Case Ruling

May 17, 2025 -

Analiz Rynka I Strategii Razvitiya Biznesa V Perepolnennykh Industrialnykh Parkakh

May 17, 2025

Analiz Rynka I Strategii Razvitiya Biznesa V Perepolnennykh Industrialnykh Parkakh

May 17, 2025 -

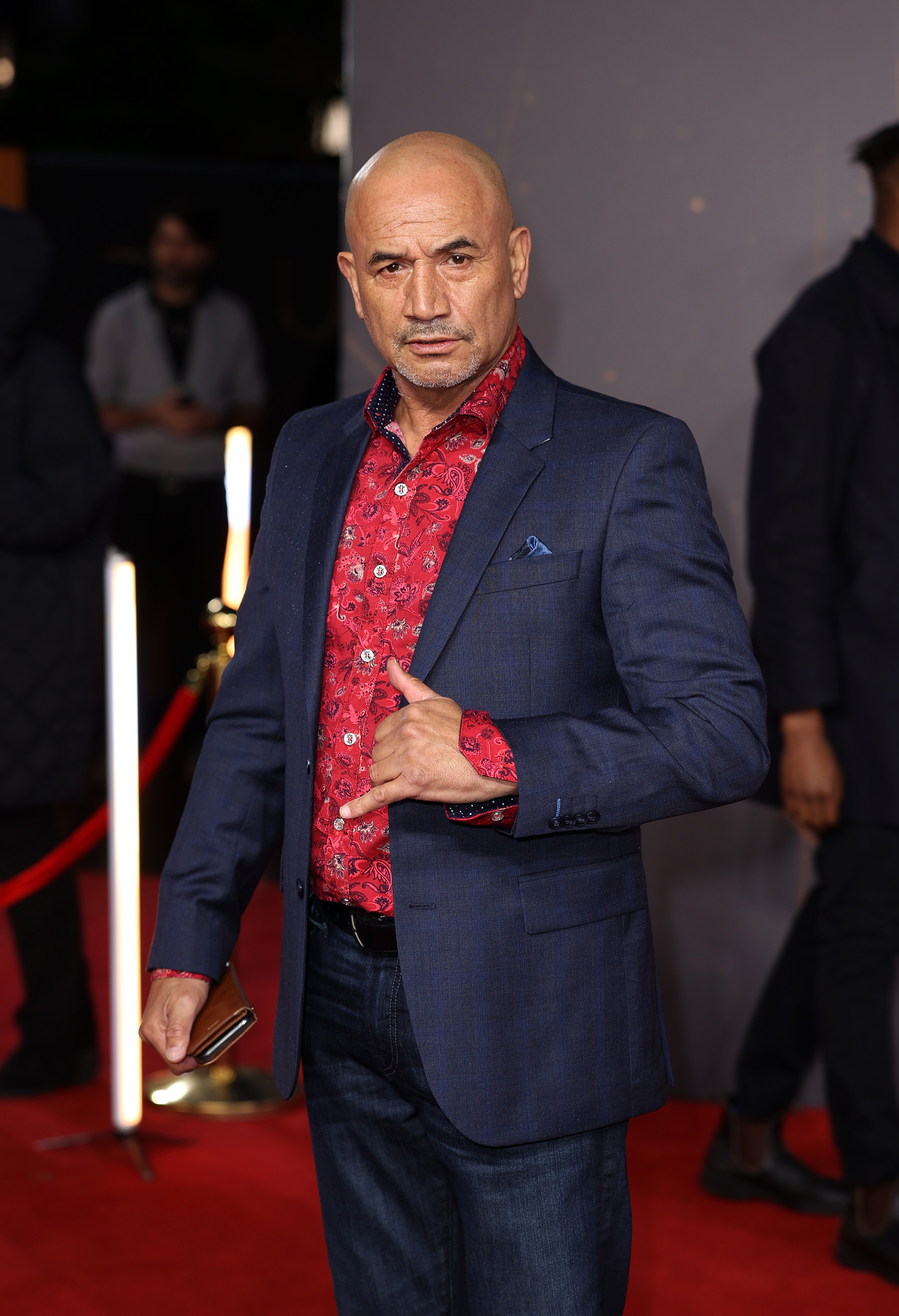

The Listeners March Lineup Focus On End Of The Valley Starring Temuera Morrison

May 17, 2025

The Listeners March Lineup Focus On End Of The Valley Starring Temuera Morrison

May 17, 2025 -

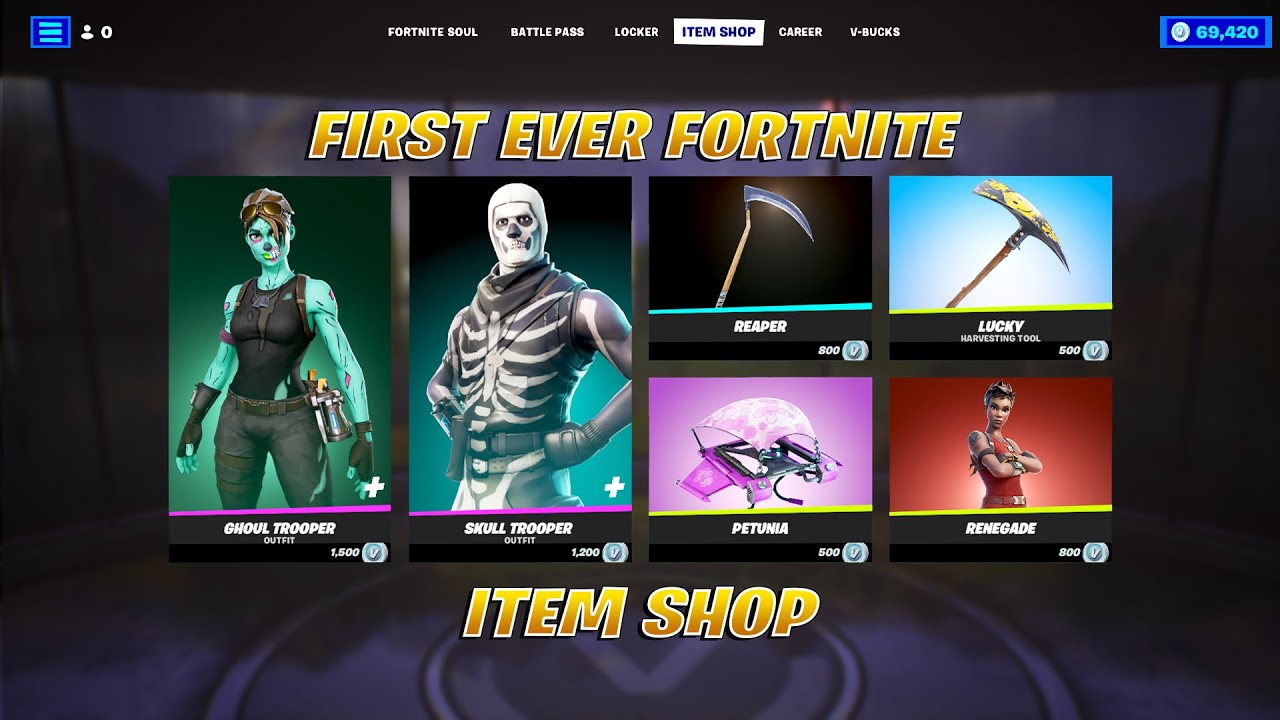

Fortnite Item Shop Update Helpful New Feature Added

May 17, 2025

Fortnite Item Shop Update Helpful New Feature Added

May 17, 2025

Latest Posts

-

Celtics Vs 76ers Prediction A Breakdown Of The Eastern Conference Rivalry

May 17, 2025

Celtics Vs 76ers Prediction A Breakdown Of The Eastern Conference Rivalry

May 17, 2025 -

Tonights Nba Game Hornets Vs Celtics Prediction And Betting Preview

May 17, 2025

Tonights Nba Game Hornets Vs Celtics Prediction And Betting Preview

May 17, 2025 -

A Single Hurdle Why Top Nba Teams Arent Winning Championships

May 17, 2025

A Single Hurdle Why Top Nba Teams Arent Winning Championships

May 17, 2025 -

Celtics Vs Hornets Expert Nba Predictions And Betting Odds For Tonight

May 17, 2025

Celtics Vs Hornets Expert Nba Predictions And Betting Odds For Tonight

May 17, 2025 -

Nbas Top 10 The Biggest Obstacle To A Championship

May 17, 2025

Nbas Top 10 The Biggest Obstacle To A Championship

May 17, 2025