Stock Market Pain: Investors Push Prices Higher Despite Risks

Table of Contents

Ignoring the Red Flags: Why Investors Are Pushing Prices Up

Why are investors seemingly ignoring significant risks and pushing stock prices higher? Several factors contribute to this perplexing behavior, leading to a feeling of impending "stock market pain" for many.

Inflationary Pressures

High inflation erodes purchasing power, yet many investors seem to be discounting this risk.

- Many are betting on companies able to pass increased costs onto consumers. This strategy relies on consumer resilience and continued demand, which isn't guaranteed in a high-inflation environment.

- Others are hoping for a swift return to pre-inflationary economic conditions. This optimistic outlook overlooks the potential for sustained inflation, potentially leading to a prolonged period of economic stagnation.

- This optimism, however, overlooks the potential for sustained inflation to dampen economic growth. Reduced consumer spending and increased production costs could significantly impact corporate profitability, resulting in stock market corrections and investor pain.

Rising Interest Rates

Increased interest rates make borrowing more expensive, impacting corporate profitability and potentially triggering a recession. This is a significant contributor to the feeling of "stock market pain".

- Investors are currently betting on corporate resilience and continued strong earnings. This assumption may prove optimistic if interest rate hikes persist and stifle economic growth.

- However, the impact of higher interest rates on debt servicing and future investments is a significant concern. Companies with high levels of debt may struggle, leading to potential defaults and further market instability.

- A potential market correction due to interest rate hikes represents a significant "stock market pain" risk. Investors need to carefully consider the impact of higher rates on their portfolios and adjust their strategies accordingly.

Geopolitical Instability

Global conflicts and tensions create uncertainty, which normally negatively impacts markets. However, current market behavior seems to be discounting this significant risk factor, contributing to the overall feeling of "stock market pain."

- Investors may be focusing on specific sectors benefiting from increased defense spending or resource scarcity. This sector-specific approach can be profitable but also exposes investors to heightened risk if geopolitical situations change.

- The inherent risks of global instability are not fully reflected in current valuations, potentially indicating a bubble. Overvaluation in certain sectors could lead to sharp corrections when geopolitical tensions escalate.

- Ignoring the geopolitical factors contributes to the overall feeling of "stock market pain" among cautious investors. A balanced assessment of geopolitical risks is crucial for informed investment decisions.

The Psychology of a Bull Market: Fear of Missing Out (FOMO)

The current bull market is also driven by powerful psychological factors that amplify the potential for "stock market pain."

Herd Mentality

Investors are often influenced by the actions of others, leading to a self-reinforcing cycle of price increases.

- The fear of missing out (FOMO) can drive individuals to invest even when they recognize the underlying risks. This emotional decision-making can lead to poor investment choices.

- This behavior can lead to overvaluation and increased vulnerability to market corrections. When the herd turns, the potential for losses can be substantial.

- Understanding herd mentality is crucial in navigating stock market pain. Rational decision-making, independent of market sentiment, is vital for long-term success.

Speculative Investments

Increased speculative activity in areas like meme stocks and cryptocurrencies adds to market volatility.

- While some investors profit from these trends, many are left with significant losses. The inherent risk in speculative investments should not be underestimated.

- This contributes to the overall feeling of risk and uncertainty in the market, amplifying stock market pain. The volatility in these markets can significantly impact overall portfolio performance.

- Understanding the inherent risk in speculative investments is key to reducing potential losses. Investors should only allocate a small portion of their portfolio to high-risk, speculative assets.

Potential Outcomes and Mitigation Strategies

The future remains uncertain, with the potential for both a mild correction or a more severe downturn. Understanding potential outcomes and implementing appropriate mitigation strategies is crucial to minimizing "stock market pain".

A Soft Landing or a Crash?

The market's future trajectory is uncertain, highlighting the need for cautious optimism and proactive risk management.

- Careful portfolio diversification is a crucial mitigation strategy. Spreading investments across different asset classes reduces the impact of any single market downturn.

- Regularly reviewing investment strategies and adjusting as needed can help alleviate stock market pain. Adapting to changing market conditions is vital for long-term success.

- Seeking professional financial advice can provide valuable insights and guidance. A financial advisor can help you develop a personalized investment strategy tailored to your risk tolerance and financial goals.

Protecting Your Investments

Several strategies can help mitigate risk and lessen the impact of market volatility.

- Diversification across asset classes (stocks, bonds, real estate, etc.). This reduces the overall risk of your portfolio.

- Establishing a long-term investment horizon to weather short-term market fluctuations. A long-term perspective allows you to ride out market downturns.

- Understanding your own risk tolerance before making investment decisions. Only invest in assets that align with your comfort level with risk.

Conclusion

The current stock market situation presents a paradox: rising prices despite significant underlying risks. While investors are pushing prices higher, fueled by FOMO and a perceived resilience of the market, the potential for "stock market pain" remains significant. Inflation, rising interest rates, and geopolitical instability are all factors that could trigger a correction. By understanding these risks and implementing effective mitigation strategies, investors can better navigate the current market landscape and protect their investments. Don't ignore the warning signs; proactively manage your portfolio to lessen potential stock market pain. Learn more about diversifying your investments and building a resilient portfolio to mitigate future stock market pain.

Featured Posts

-

Anchor Brewing Companys Closure A Legacy In Beer Comes To An End

Apr 22, 2025

Anchor Brewing Companys Closure A Legacy In Beer Comes To An End

Apr 22, 2025 -

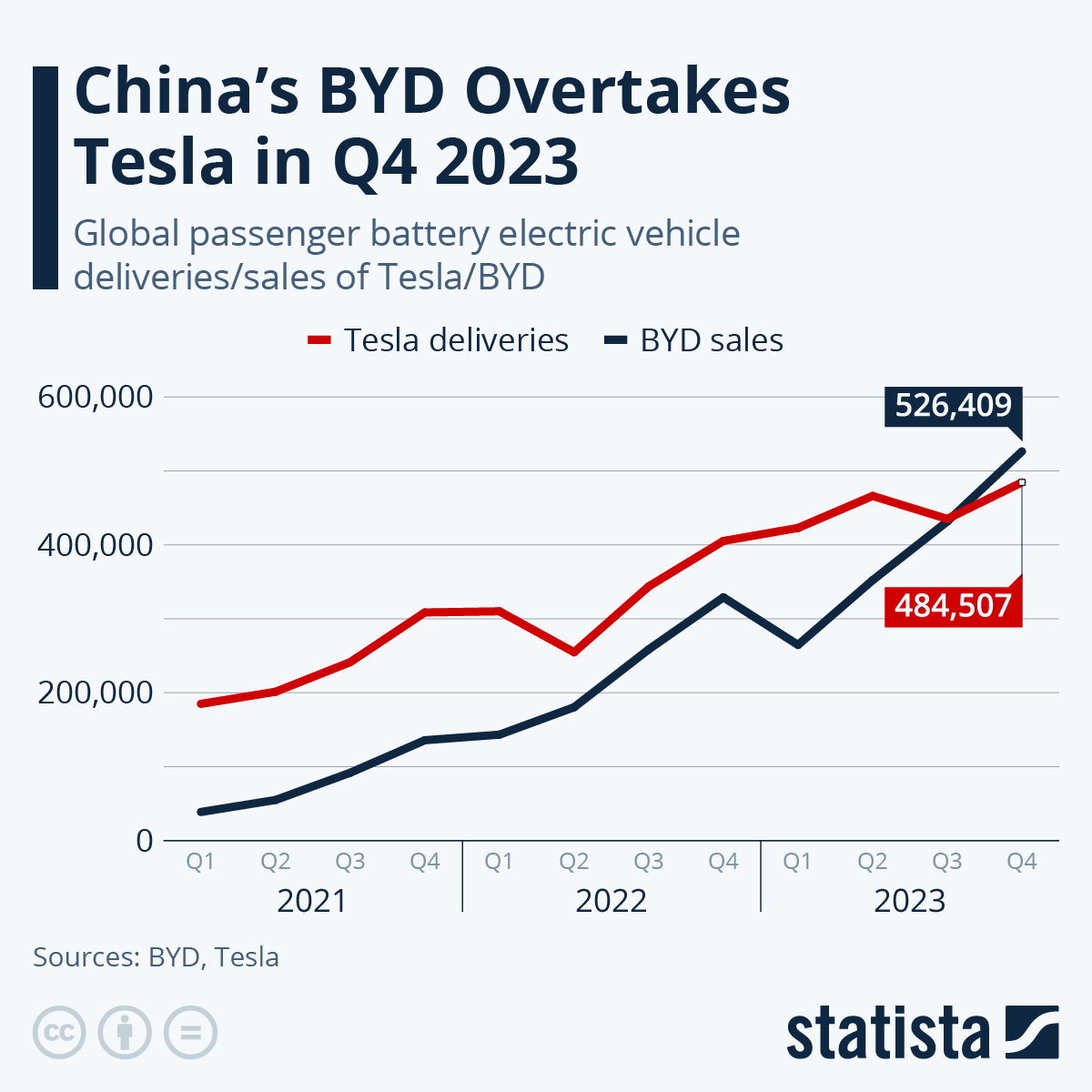

New Partnership Saudi Aramco And Byd Explore Electric Vehicle Innovation

Apr 22, 2025

New Partnership Saudi Aramco And Byd Explore Electric Vehicle Innovation

Apr 22, 2025 -

How Tariffs Threaten Chinas Export Led Growth Model

Apr 22, 2025

How Tariffs Threaten Chinas Export Led Growth Model

Apr 22, 2025 -

Lab Owner Pleads Guilty To Falsifying Covid Test Results

Apr 22, 2025

Lab Owner Pleads Guilty To Falsifying Covid Test Results

Apr 22, 2025 -

Overcoming The Hurdles Robots And Nike Sneaker Production

Apr 22, 2025

Overcoming The Hurdles Robots And Nike Sneaker Production

Apr 22, 2025