Stock Market Prediction: Outperforming Palantir In 3 Years - 2 Top Picks

Table of Contents

Understanding the Palantir Opportunity and its Risks

Palantir undeniably occupies a unique space in the data analytics market. Its sophisticated platforms cater to government agencies and large enterprises needing to sift through massive datasets. However, this success comes with caveats.

Palantir's Strengths and Weaknesses:

Palantir boasts impressive strengths: a strong pipeline of government contracts, a truly innovative data analytics platform, and a potential for significant future growth in the burgeoning field of artificial intelligence. But its high valuation raises concerns about potential overvaluation. Furthermore, its dependence on a relatively small number of key clients creates considerable risk. The competitive landscape is also intensifying, with established players and agile startups vying for market share.

- Strong government contracts pipeline: Provides a stable revenue stream, but exposes the company to geopolitical and budgetary risks.

- Innovative data analytics platform: A key differentiator, but requires continuous investment in research and development to maintain its competitive edge.

- High valuation and potential overvaluation: A major risk factor, making the stock susceptible to price corrections.

- Dependence on a few key clients: Concentrated revenue streams increase vulnerability to changes in client relationships or budgets.

- Competitive landscape with established players: Companies like Microsoft and Google pose significant competitive challenges.

Top Pick #1: Snowflake – A Data-Driven Growth Story

Our first top pick for outperforming Palantir is Snowflake (SNOW). Snowflake's cloud-based data warehousing solution offers a compelling alternative, particularly for businesses seeking scalability and flexibility.

Investment Thesis:

Snowflake's success stems from its ability to provide a highly scalable, cost-effective, and secure data warehousing platform. Its superior market penetration in the cloud data warehousing space, coupled with its strong revenue growth and profitability, positions it for significant long-term growth. Its business model is designed for high margins, and its experienced management team adds confidence. While still valued highly, its valuation is considered relatively more reasonable compared to Palantir's current price-to-earnings ratio. (Note: Past performance is not indicative of future results. This analysis is for informational purposes only and not financial advice.)

- Superior market penetration in the cloud data warehousing market: Snowflake is a clear leader in this rapidly expanding sector.

- Strong revenue growth and profitability: Demonstrates a robust and sustainable business model.

- Scalable business model with high margins: Ensures consistent profitability and future growth potential.

- Experienced management team: Provides the leadership and expertise to navigate the complexities of the market.

- Lower valuation compared to Palantir: Offers a potentially more attractive risk-reward profile.

Top Pick #2: CrowdStrike – Disrupting the Cybersecurity Sector

Our second pick is CrowdStrike (CRWD), a leading player in the rapidly growing cybersecurity market. CrowdStrike leverages cutting-edge cloud-native technology to provide endpoint protection, significantly improving threat detection and response capabilities.

Investment Thesis:

CrowdStrike’s investment thesis hinges on its first-mover advantage in the cloud-based endpoint protection market and the rapid expansion of this market. Its strong intellectual property portfolio protects its innovative technology, creating a sustainable competitive advantage. The potential for strategic partnerships further strengthens its position in the industry, and it generally enjoys a lower risk profile than Palantir. Again, this analysis is for informational purposes only and is not financial advice.

- First-mover advantage in emerging technology: CrowdStrike has established itself as a market leader in cloud-based endpoint protection.

- Rapidly expanding market opportunity: The cybersecurity market is experiencing significant growth, fueled by the increasing reliance on digital technologies.

- Strong intellectual property portfolio: Protects its competitive advantage and ensures a strong barrier to entry for competitors.

- Potential for strategic partnerships: Creates opportunities for further market expansion and technological advancements.

- Lower risk profile compared to Palantir: A more diversified customer base and established market position reduce some risk factors.

Developing a Robust Investment Strategy

Successfully navigating the stock market requires a well-defined strategy that accounts for both growth potential and risk mitigation.

Diversification and Risk Management:

Remember, successful stock market investing involves diversification and rigorous risk management. Investing in individual stocks carries inherent risk. Don't put all your eggs in one basket.

- Diversify your portfolio across different sectors and asset classes: Reduce your overall risk by spreading your investments.

- Conduct thorough research and understand the inherent risks: Thoroughly investigate any stock before investing.

- Consider your personal risk tolerance and investment goals: Align your investments with your individual financial situation and objectives.

- Consult with a financial advisor before making significant investment decisions: Seek professional guidance to tailor your strategy to your specific needs.

Conclusion

While Palantir presents a compelling story, its high valuation and inherent risks warrant careful consideration. Snowflake and CrowdStrike, with their strong growth trajectories, robust business models, and potentially more reasonable valuations, represent promising alternatives for investors aiming to outperform Palantir in the next three years. However, it's crucial to remember that these are potential opportunities, and past performance does not guarantee future success. This analysis is for informational purposes only and does not constitute financial advice.

Start your journey to outperforming Palantir today! Research Snowflake (SNOW) and CrowdStrike (CRWD) and discover their potential. Remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions. You can find more information on these companies by visiting their respective websites or researching reputable financial news sources.

Featured Posts

-

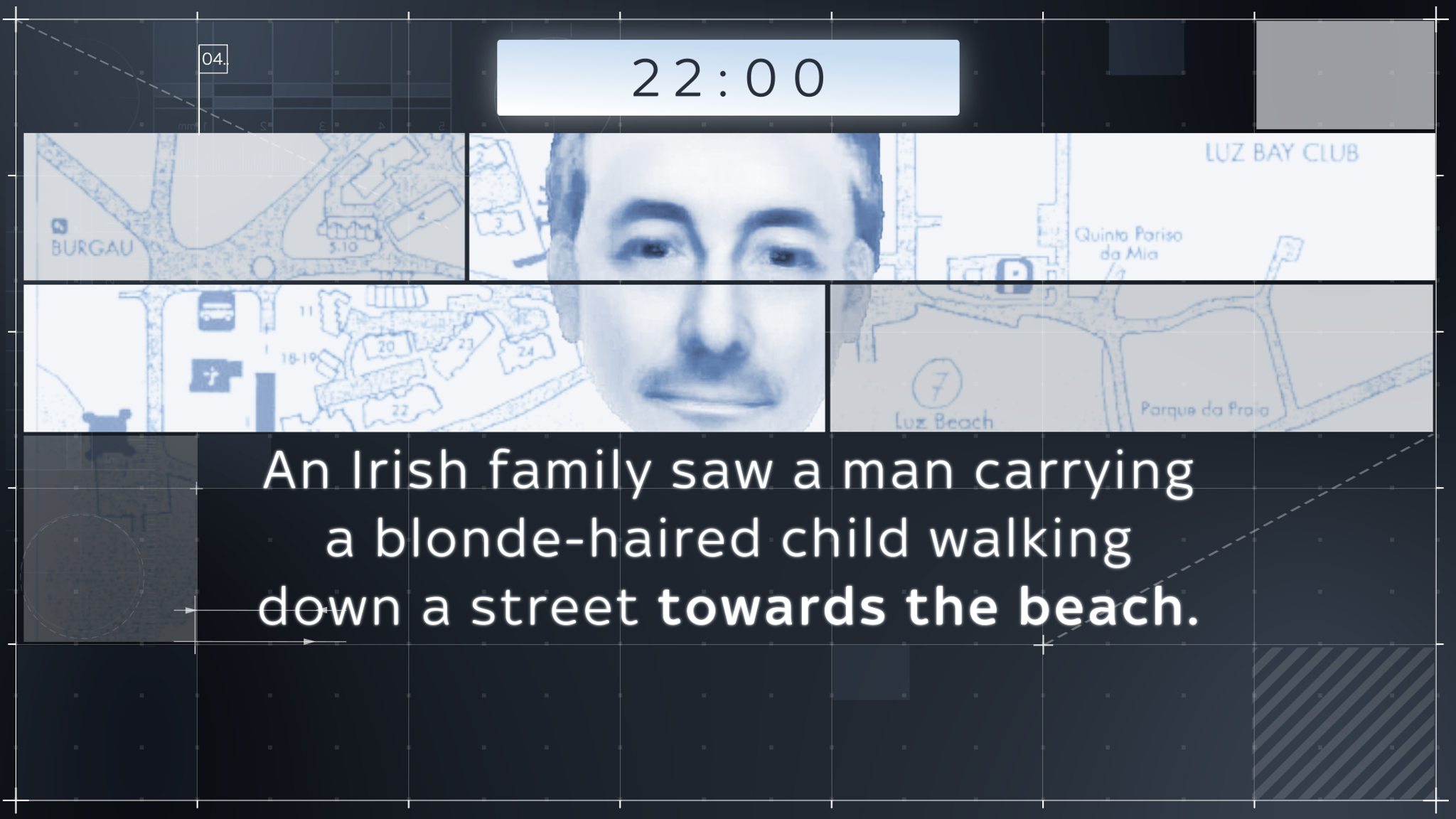

Madeleine Mc Cann Imposter Detained At Uk Airport

May 09, 2025

Madeleine Mc Cann Imposter Detained At Uk Airport

May 09, 2025 -

Ihsayyat Fyraty Me Alerby Alqtry Mqarnt Badayh Me Alahly Almsry

May 09, 2025

Ihsayyat Fyraty Me Alerby Alqtry Mqarnt Badayh Me Alahly Almsry

May 09, 2025 -

Pam Bondi And The Epstein Files A Vote On Transparency

May 09, 2025

Pam Bondi And The Epstein Files A Vote On Transparency

May 09, 2025 -

Japa The Uks Changing Visa Policy For Nigerians And Pakistanis

May 09, 2025

Japa The Uks Changing Visa Policy For Nigerians And Pakistanis

May 09, 2025 -

F1 Insider Montoya On Doohans Confirmed F1 Plans

May 09, 2025

F1 Insider Montoya On Doohans Confirmed F1 Plans

May 09, 2025