Stock Market Rally: Euronext Amsterdam Sees 8% Jump Post-Trump Tariff Announcement

Table of Contents

The Trump Tariff Announcement and its Unexpected Impact

The trigger for this dramatic Euronext Amsterdam stock market rally was a specific Trump administration tariff announcement concerning [Insert specific details of the tariff announcement, e.g., steel and aluminum imports from the EU]. Initial market expectations were largely pessimistic, with many predicting a negative impact on European businesses and a subsequent downturn in the stock market. Instead, the market reacted in a completely opposite direction.

- Specific details of the tariff announcement: [Detailed explanation of the tariff announcement, its scope, and affected industries].

- Initial market reactions before the surge: [Description of the initial cautiousness and negative predictions before the unexpected rally].

- Key sectors most affected by the announcement (initially expected): [List of sectors initially anticipated to be negatively impacted, e.g., manufacturing, automotive]. The surprising positive reaction suggests a complex interplay of factors beyond the immediate impact of the tariffs.

Analysis of the Euronext Amsterdam 8% Surge

The 8% jump in the Euronext Amsterdam stock market was a significant event. This wasn't a slow, gradual increase; it was a sharp and rapid surge, indicating a strong shift in investor sentiment. Trading volume also spiked dramatically, further confirming the intensity of the rally.

- Key performance indicators (KPIs) showcasing the rally: [Include specific data points, such as the index's opening and closing values on the day of the surge, percentage change, and comparison to previous days]. Charts and graphs would visually reinforce this data.

- Examples of top-performing stocks: [List a few examples of stocks that experienced particularly significant gains, specifying the percentage increases].

- Comparison to other European stock markets: [Compare the Euronext Amsterdam performance to other major European exchanges like the London Stock Exchange or the Frankfurt Stock Exchange. Did they experience similar gains or was Amsterdam an outlier?]

Factors Contributing to the Euronext Amsterdam Rally Beyond the Tariffs

While the Trump tariff announcement served as a catalyst, the 8% surge in the Euronext Amsterdam stock market is unlikely to be solely attributable to this single event. Several other factors likely contributed to the positive market sentiment.

- Positive economic data contributing to the rally: [Mention any positive economic indicators released around the same time, such as strong employment figures, positive GDP growth, or increased consumer confidence].

- Changes in investor sentiment or speculation: [Discuss any shifts in investor behavior, such as a change in risk appetite or increased speculation driven by other news or market trends].

- Impact of geopolitical events (if applicable): [Analyze if any other geopolitical events, unrelated to the tariffs, might have influenced investor confidence and contributed to the rally]. The surprising outcome may indicate a resilience in the market or a reaction to pre-existing positive trends that the tariff announcement inadvertently amplified.

Long-Term Implications for the Euronext Amsterdam Stock Market

The sustainability of this Euronext Amsterdam stock market rally remains uncertain. While the 8% jump was impressive, it's crucial to consider potential risks and challenges that could reverse this trend.

- Potential risks and challenges moving forward: [Discuss potential risks, such as lingering uncertainty about the tariffs, global economic slowdown, or geopolitical instability].

- Expert opinions and market forecasts: [Include expert opinions and market forecasts to provide a balanced perspective on the future trajectory of the Euronext Amsterdam stock market].

- Long-term implications for investors: [Offer advice to investors, cautioning against impulsive decisions based on short-term market fluctuations and emphasizing the importance of long-term investment strategies].

Conclusion: Understanding the Euronext Amsterdam Stock Market Rally

The unexpected Euronext Amsterdam stock market rally, marked by an 8% jump following the Trump tariff announcement, highlights the complex interplay of factors influencing stock market behavior. While the tariffs acted as a catalyst, positive economic data, shifts in investor sentiment, and other geopolitical events likely contributed significantly to this surge. Understanding these factors is crucial for investors navigating the complexities of the Euronext Amsterdam stock market. To stay informed about future developments and to gain a deeper understanding of market trends and investment strategies, continue to follow updates and utilize reliable market research resources. Stay informed on the Euronext Amsterdam stock market and its future performance.

Featured Posts

-

M56 Delays Cheshire Deeside Border Traffic Update

May 24, 2025

M56 Delays Cheshire Deeside Border Traffic Update

May 24, 2025 -

Trumps Air Traffic Control Plan The Root Of Newark Airports Problems

May 24, 2025

Trumps Air Traffic Control Plan The Root Of Newark Airports Problems

May 24, 2025 -

Glastonbury Festival Us Bands Potential Appearance Creates Buzz

May 24, 2025

Glastonbury Festival Us Bands Potential Appearance Creates Buzz

May 24, 2025 -

La Chine En France Une Repression Impitoyable Des Dissidents

May 24, 2025

La Chine En France Une Repression Impitoyable Des Dissidents

May 24, 2025 -

Solutions For Nyt Connections Puzzle 646 March 18 2025

May 24, 2025

Solutions For Nyt Connections Puzzle 646 March 18 2025

May 24, 2025

Latest Posts

-

Successfully Negotiating A Final Job Offer Tips And Strategies

May 24, 2025

Successfully Negotiating A Final Job Offer Tips And Strategies

May 24, 2025 -

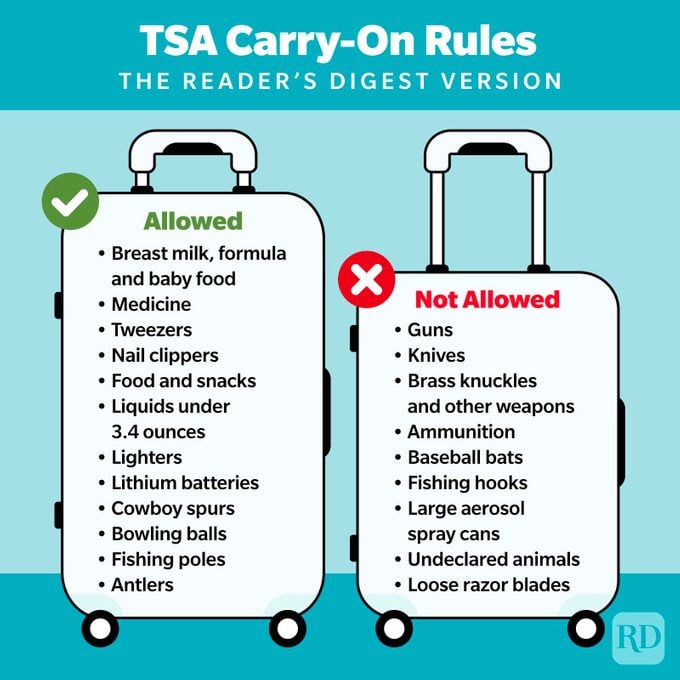

New Southwest Airlines Policy Restrictions On Portable Chargers In Carry On Bags

May 24, 2025

New Southwest Airlines Policy Restrictions On Portable Chargers In Carry On Bags

May 24, 2025 -

Can You Still Negotiate After A Best And Final Job Offer

May 24, 2025

Can You Still Negotiate After A Best And Final Job Offer

May 24, 2025 -

Southwest Airlines Important Changes To Carry On Baggage Including Portable Chargers

May 24, 2025

Southwest Airlines Important Changes To Carry On Baggage Including Portable Chargers

May 24, 2025 -

The End Of Ryujinx Switch Emulator Project Halted After Nintendo Contact

May 24, 2025

The End Of Ryujinx Switch Emulator Project Halted After Nintendo Contact

May 24, 2025