Stock Market Reaction: 80% Tariffs On China & UK Trade Deal Developments

Table of Contents

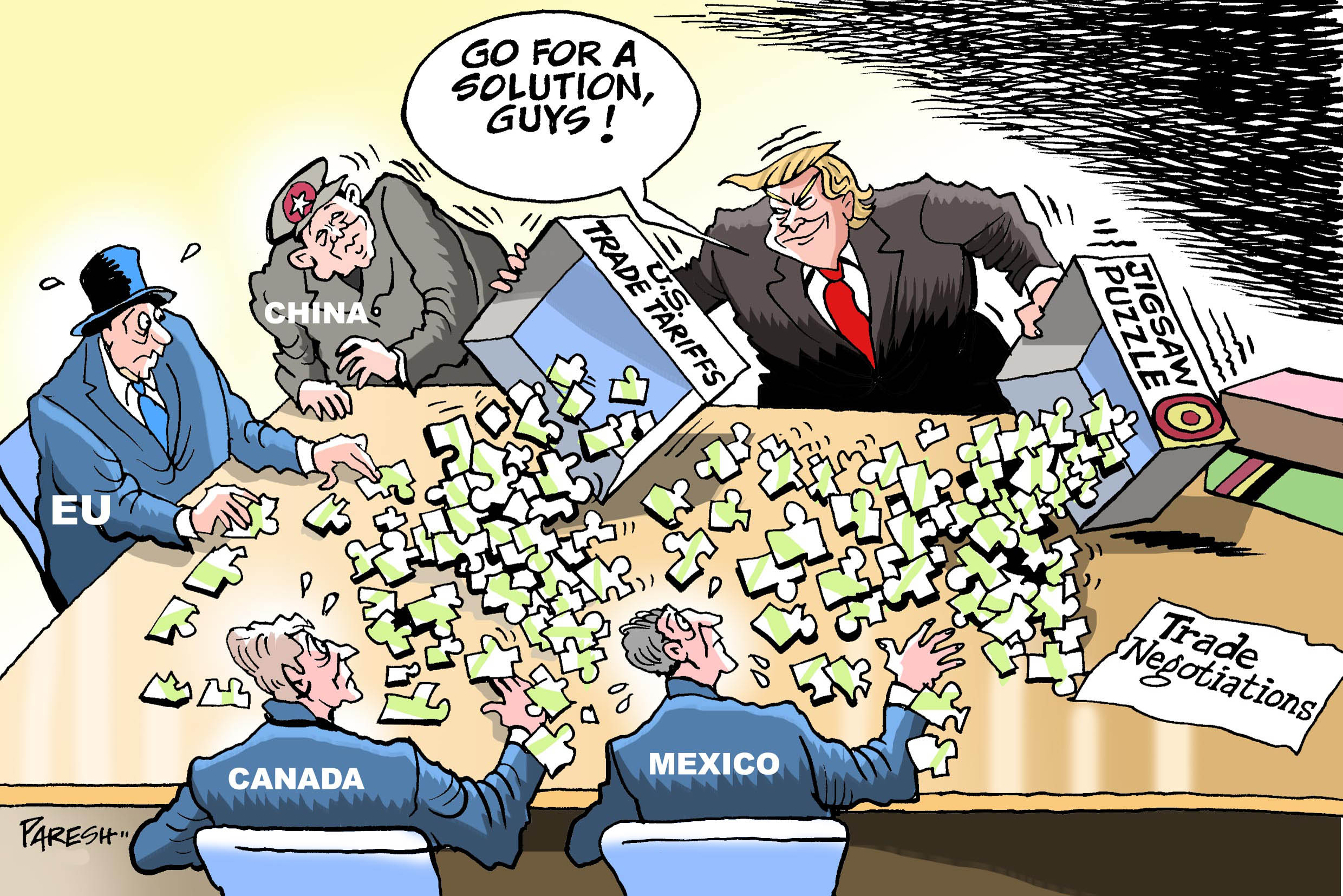

Impact of 80% Tariffs on Chinese Goods on the Stock Market

The imposition of substantial tariffs on Chinese goods would have far-reaching consequences, significantly impacting the stock market reaction. Let's delve into the key areas of concern.

Increased Inflationary Pressures

Tariffs directly contribute to higher prices for consumers. By increasing the cost of imported goods, businesses are forced to either absorb these costs, reducing profit margins, or pass them onto consumers, leading to inflation. This can trigger a domino effect: reduced consumer spending due to higher prices, impacting company earnings and potentially slowing economic growth. Sectors like technology, heavily reliant on Chinese components, and manufacturing, facing increased input costs, are particularly vulnerable.

- Reduced corporate profits: Higher input costs eat into profit margins, impacting stock valuations.

- Decreased consumer confidence: Rising prices erode purchasing power, leading to decreased consumer spending and impacting economic growth.

- Potential for supply chain disruptions: Tariffs can disrupt established supply chains, leading to production delays and shortages.

Shifting Global Trade Dynamics

The threat of 80% tariffs could incentivize companies to relocate their production away from China to mitigate the increased costs. This shift could benefit emerging markets with lower labor costs and favorable trade agreements, creating new investment opportunities but also potentially destabilizing existing economic relationships. Increased trade tensions could further amplify market volatility.

- Restructuring of global supply chains: Businesses will actively seek alternative sourcing locations, leading to significant shifts in global manufacturing.

- Investment opportunities in alternative manufacturing locations: Countries like Vietnam, India, and Mexico could see a surge in foreign direct investment.

- Geopolitical instability: Increased trade tensions can escalate into broader geopolitical conflicts, creating uncertainty in the market.

Stock Market Volatility and Investor Sentiment

Uncertainty surrounding tariffs significantly impacts investor behavior. The fear of reduced corporate earnings and economic slowdown can lead to market corrections or even downturns. Speculation and market sentiment play a crucial role, amplifying both positive and negative stock market reactions.

- Increased market volatility: Uncertainty breeds volatility, leading to significant price swings in the stock market.

- Flight to safety investments (e.g., gold, bonds): Investors may shift towards less risky assets during periods of uncertainty.

- Decreased investor confidence: Negative news and uncertainty erode investor confidence, potentially leading to capital flight.

UK Trade Deal Developments and Their Influence on the Stock Market Reaction

The outcome of the UK's trade negotiations also has a substantial impact on the stock market reaction, both domestically and internationally.

Impact on UK-Based Companies

A new trade deal could offer significant benefits or drawbacks for UK businesses. Increased access to new markets could boost exports, while navigating new trade regulations might present challenges. Sectors like finance and agriculture are particularly sensitive to changes in trade agreements.

- Increased export opportunities: A favorable trade deal could open up new markets for UK goods and services.

- Potential challenges in navigating new trade regulations: New rules and regulations can create complexities and increase compliance costs.

- Changes in supply chains: Businesses may need to adapt their supply chains to account for new trade relationships.

The Pound Sterling and its Fluctuations

The value of the Pound Sterling is intrinsically linked to the UK's economic performance and trade prospects. Uncertainty surrounding trade deals can lead to significant currency volatility, impacting stock market performance. Fluctuations in the pound affect international investment and trade flows.

- Pound volatility impacting import and export costs: Changes in the exchange rate directly impact the price of imports and exports.

- Impact on foreign investment in UK assets: Currency fluctuations can influence the attractiveness of UK investments for international investors.

- Influence on inflation: Changes in the exchange rate can affect the price of imported goods, influencing inflation.

Broader Global Market Implications

The UK's trade deal developments could set precedents, influencing other countries' trade policies and potentially creating ripple effects across global markets. Monitoring global trade agreements and their influence on investment decisions is vital for navigating the complexities of the global economy.

- Uncertainty impacting global investment decisions: The outcome of the UK's trade negotiations creates uncertainty for businesses considering investments in the UK or engaging in international trade.

- Potential for trade wars: Uncertain trade relations can escalate into broader trade conflicts, negatively affecting global economic growth.

- Implications for international cooperation: The UK's trade deal could impact future international trade negotiations and cooperation.

Conclusion

The potential impact of 80% tariffs on Chinese goods and the ongoing developments surrounding the UK trade deal have significant implications for the stock market reaction. Understanding the interplay of these events, including inflationary pressures, shifting global trade dynamics, and currency fluctuations, is essential for navigating the complexities of the market. Staying informed about these developments and carefully analyzing their impact on various sectors is crucial for investors. Continue to monitor the stock market reaction to these significant global events to make informed investment decisions. For more in-depth analysis and expert insights, subscribe to our newsletter and stay updated on future stock market reaction trends.

Featured Posts

-

Hotel Transylvania Everything You Need To Know About The Popular Franchise

May 11, 2025

Hotel Transylvania Everything You Need To Know About The Popular Franchise

May 11, 2025 -

Where To Start A Business Identifying The Countrys Top Locations

May 11, 2025

Where To Start A Business Identifying The Countrys Top Locations

May 11, 2025 -

A Students Guide To City Name Michigan College Life And More

May 11, 2025

A Students Guide To City Name Michigan College Life And More

May 11, 2025 -

The Mlb Speedway Classic A Conversation With Commissioner Manfred

May 11, 2025

The Mlb Speedway Classic A Conversation With Commissioner Manfred

May 11, 2025 -

Enough Is Enough Why We Dont Need Another John Wick Movie

May 11, 2025

Enough Is Enough Why We Dont Need Another John Wick Movie

May 11, 2025