Stock Market Reaction To US Fiscal Uncertainty

Table of Contents

Debt Ceiling Debates and Market Volatility

Debt ceiling crises have historically triggered significant market volatility. The very threat of a government default can severely impact investor confidence, leading to sharp stock price declines. The uncertainty surrounding whether the government will meet its obligations creates a risk-off environment, prompting investors to sell equities and seek safer havens like government bonds.

- Examples: The debt ceiling standoffs of 2011 and 2013 resulted in notable drops in the S&P 500 and Dow Jones Industrial Average. Credit rating downgrades further exacerbated these declines.

- Investor Behavior: During periods of heightened fiscal uncertainty, investors tend to become more risk-averse. This leads to decreased investment in equities and increased demand for less volatile assets. This flight to safety can amplify market swings.

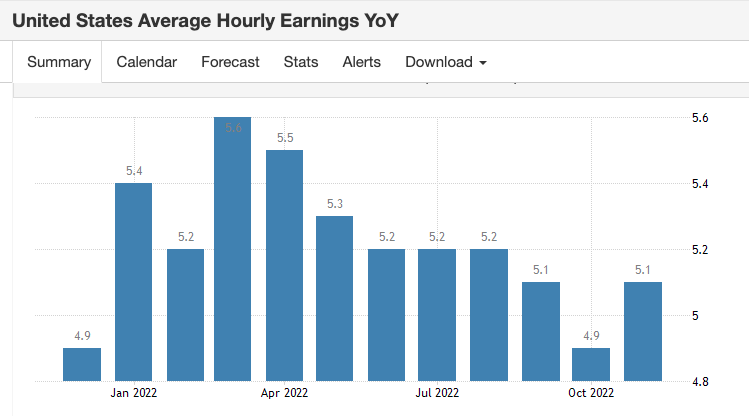

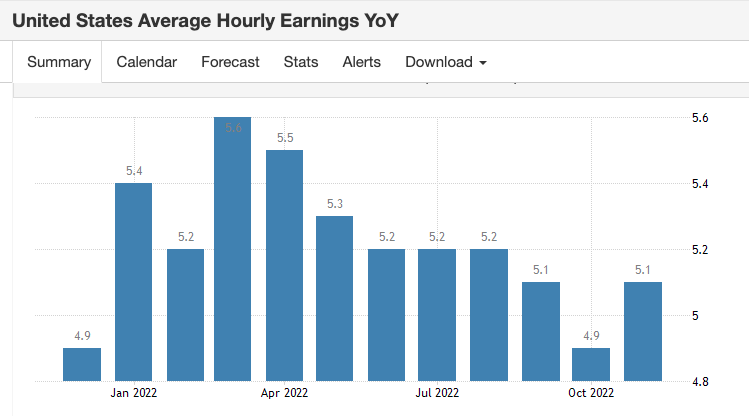

- Market Indices: The S&P 500 and Dow Jones Industrial Average consistently reflect the impact of debt ceiling debates, often experiencing sharp corrections during periods of uncertainty. Analyzing historical data from these indices reveals a clear correlation between fiscal uncertainty and market volatility. [Insert relevant chart/graph here with properly cited source].

Government Spending and Economic Growth

The relationship between government spending and economic growth is complex and often debated. Keynesian economics suggests that increased government spending can stimulate economic activity through the multiplier effect. This effect posits that an initial increase in government spending leads to a larger overall increase in economic output as the money circulates through the economy.

- Keynesian Multiplier: Government spending on infrastructure projects, for instance, creates jobs and boosts demand, leading to further economic activity. This can positively impact stock valuations.

- Stimulating or Hindering Growth: However, excessive government spending can lead to inflation and higher interest rates, potentially hindering economic growth and negatively impacting stock prices. The type and effectiveness of spending are crucial.

- Sectoral Impact: Different types of government spending affect different market sectors. Infrastructure spending benefits construction and related industries, while social programs may boost consumer discretionary spending. Defense spending has its own unique effects on related sectors.

Tax Policy Changes and Corporate Profits

Changes in tax policies significantly affect corporate profitability and investor expectations. Corporate tax rate reductions can boost corporate profits, leading to increased investment, stock buybacks, and higher stock prices. Conversely, tax increases can dampen business activity and reduce investor confidence.

- Tax Cuts and Stock Buybacks: Lower corporate tax rates often lead to increased corporate profits, a portion of which is frequently used for stock buybacks, artificially inflating stock prices in the short term.

- Tax Increases and Consumer Spending: Higher taxes on individuals can reduce consumer spending, impacting demand for goods and services, and consequently, corporate profits.

- Uncertainty and Investment: Uncertainty surrounding future tax policies can deter businesses from making long-term investments, negatively impacting economic growth and stock market performance. Clear, predictable tax policies are vital for investor confidence. Examples like the Tax Cuts and Jobs Act of 2017 can be analyzed to demonstrate this.

The Role of the Federal Reserve

The Federal Reserve's monetary policy plays a crucial role in mediating the effects of fiscal uncertainty. The Fed's actions can either mitigate or exacerbate the impact of fiscal policy on the stock market.

- Conflicts Between Monetary and Fiscal Policies: Conflicts can arise when expansionary fiscal policies (increased government spending) are coupled with contractionary monetary policies (interest rate hikes) by the Fed to control inflation. This creates uncertainty for investors.

- Interest Rates and Quantitative Easing: Interest rate hikes generally reduce inflation but can also slow economic growth, negatively impacting stock prices. Conversely, quantitative easing (injecting liquidity into the market) can boost stock prices, but it also carries risks, such as inflation.

Conclusion: Stock Market Reaction to US Fiscal Uncertainty – Key Takeaways and Future Outlook

US fiscal uncertainty significantly impacts the stock market through various channels: debt ceiling debates cause volatility, government spending affects economic growth, tax policy changes influence corporate profits, and the Federal Reserve's response interacts with all these factors. Current fiscal policy trends and projections suggest [insert concise forecast based on current economic data and expert opinions – e.g., continued volatility is likely in the near term, given the ongoing debates]. However, a stable fiscal environment could lead to a more positive market outlook.

Understanding the stock market reaction to US fiscal uncertainty is crucial for informed investment decisions. Stay tuned for future updates and analyses to navigate this dynamic landscape effectively. Monitor key indicators like the S&P 500, government debt levels, and Federal Reserve announcements to make well-informed investment choices related to US fiscal policy.

Featured Posts

-

Shadman Islams Crucial Innings Secure Bangladeshs Win Over Zimbabwe

May 23, 2025

Shadman Islams Crucial Innings Secure Bangladeshs Win Over Zimbabwe

May 23, 2025 -

Bangladesh Bow Down Zimbabwes Muzarabani Stars In Dominant Test Win

May 23, 2025

Bangladesh Bow Down Zimbabwes Muzarabani Stars In Dominant Test Win

May 23, 2025 -

After Holly Willoughby Whats Next For Itvs Countdown

May 23, 2025

After Holly Willoughby Whats Next For Itvs Countdown

May 23, 2025 -

The Karate Kids Enduring Legacy Impact And Cultural Influence

May 23, 2025

The Karate Kids Enduring Legacy Impact And Cultural Influence

May 23, 2025 -

Understanding Kartels Influence On Rum Culture In Stabroek News

May 23, 2025

Understanding Kartels Influence On Rum Culture In Stabroek News

May 23, 2025

Latest Posts

-

Witkoff A Hamas Deception The Full Story

May 23, 2025

Witkoff A Hamas Deception The Full Story

May 23, 2025 -

Emissary Alleges Hamas Duplicity The Witkoff Story

May 23, 2025

Emissary Alleges Hamas Duplicity The Witkoff Story

May 23, 2025 -

Emissary Reveals Hamas Deception The Witkoff Account

May 23, 2025

Emissary Reveals Hamas Deception The Witkoff Account

May 23, 2025 -

Hamas Deception Witkoffs Account Of Being Duped

May 23, 2025

Hamas Deception Witkoffs Account Of Being Duped

May 23, 2025 -

Witkoff Alleges Hamas Duplicity

May 23, 2025

Witkoff Alleges Hamas Duplicity

May 23, 2025