Stock Market Today: Analyzing The Impact Of US-China Trade Tensions And UK Trade Agreements

Table of Contents

US-China Trade Tensions and Their Ripple Effect on the Stock Market

The relationship between the US and China has long been a significant driver of global economic stability, and its volatility directly impacts the stock market. The ongoing trade war, characterized by tit-for-tat tariffs and trade restrictions, has created a climate of uncertainty that reverberates across various sectors.

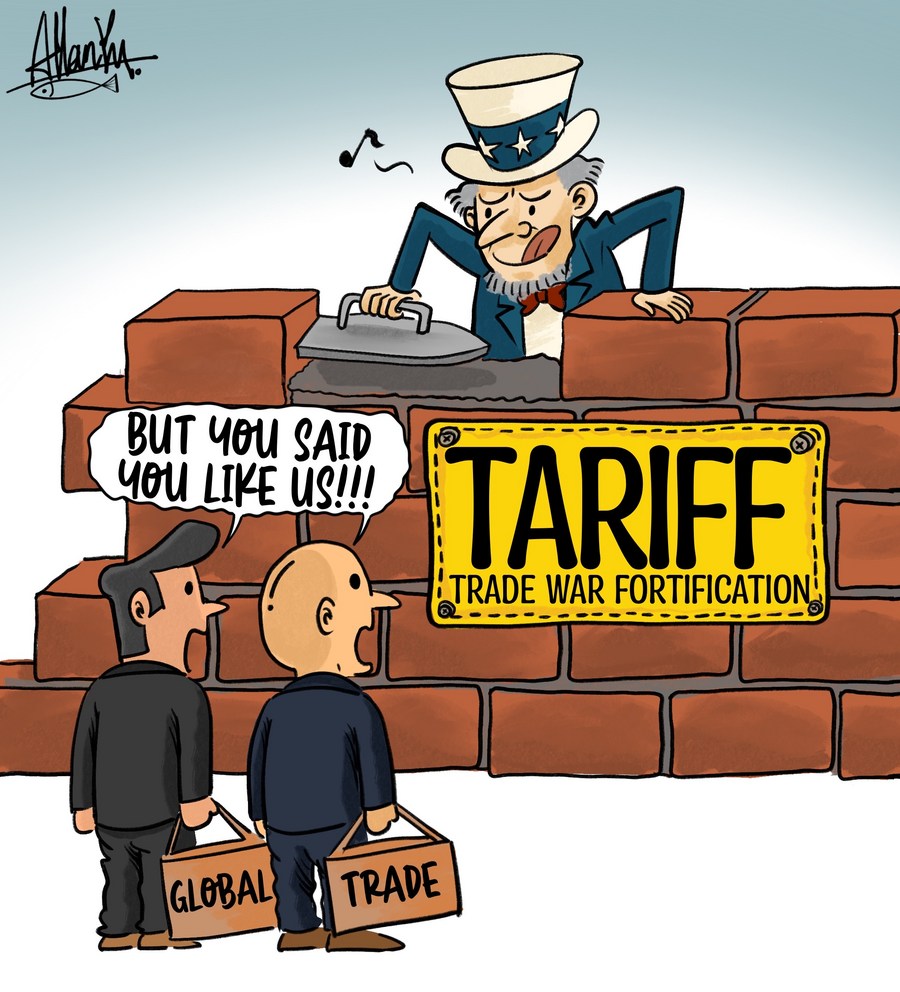

Tariffs and Trade Wars: A Rollercoaster Ride for Investors

The history of US-China trade disputes is marked by escalating tariffs targeting specific sectors. These tariffs have significantly impacted stock prices of related companies.

- Example 1: Tariffs on steel and aluminum impacted the stock prices of companies in the manufacturing sector.

- Example 2: Tariffs on agricultural goods, such as soybeans, negatively affected the share prices of agricultural companies.

- Example 3: Technology companies have faced restrictions and tariffs on crucial components, leading to stock price fluctuations.

The uncertainty surrounding ongoing trade negotiations significantly impacts investor confidence. Periods of heightened trade tensions often correlate with market downturns, as investors become hesitant to commit capital in an unpredictable environment. For example, the stock market indices showed a dip during periods of intense tariff escalations. This uncertainty leads to increased volatility and makes long-term investment planning challenging.

Geopolitical Implications: Beyond the Balance Sheet

The US-China trade war has far-reaching geopolitical implications that further affect the stock market. Disruptions to global supply chains, caused by trade restrictions and sanctions, impact multinational corporations with significant operations in both countries.

- Increased costs and logistical complications reduce profitability, affecting stock valuations.

- Companies are forced to diversify their supply chains, leading to increased investment in other regions.

- Geopolitical instability discourages investment and leads to capital flight, contributing to market volatility.

Experts like [cite a financial analyst and their opinion] point out that these tensions are not simply an economic issue; they represent a broader geopolitical struggle impacting investor sentiment globally.

UK Trade Agreements: Post-Brexit Opportunities and Challenges

Brexit has fundamentally reshaped the UK's trading relationships, creating both opportunities and challenges that significantly impact the UK stock market and, consequently, global markets.

Impact of New Trade Deals: Navigating a New Landscape

The UK has actively pursued new trade agreements post-Brexit, aiming to diversify its economic partnerships. However, the impact of these deals varies across sectors.

- Agreements with the EU: While some agreements have been reached, ongoing trade friction persists, impacting UK-based companies reliant on EU markets.

- Agreements with the US and other countries: These new agreements offer potential export opportunities but also require adaptations to different regulatory frameworks.

- Data on UK stock market performance since Brexit shows a correlation between the signing of new trade deals and positive movements in certain sectors.

The benefits include potential for increased exports and economic growth, but businesses face challenges adapting to new regulations and navigating complex trade procedures.

Uncertainty and Volatility: A Constant Companion

Uncertainty remains a significant factor in the UK's post-Brexit trade landscape. This uncertainty creates volatility in the stock market.

- Concerns about future trade relationships impact investor confidence.

- Potential trade disruptions increase risks for UK-based companies, necessitating agile strategies.

- Financial analysts [cite a relevant financial analyst or report] highlight the need for businesses to adapt swiftly to the changing trade environment. The potential effects on specific sectors are substantial, requiring careful monitoring.

Interconnectedness and Global Market Dynamics

The global nature of financial markets means that events in the US and UK have a ripple effect across the world. The interconnectedness of these markets underscores the importance of considering global events when analyzing the stock market today.

- US-China trade tensions impact emerging markets through reduced demand and disrupted supply chains.

- Brexit has affected European Union stock markets due to economic interdependence and trade links.

- Global investor sentiment plays a crucial role; negative news in one region can quickly spread, influencing market reactions worldwide.

Conclusion

In conclusion, the stock market today is heavily influenced by US-China trade tensions and the UK's post-Brexit trade agreements. These events create uncertainty and volatility, affecting various sectors and impacting investor confidence globally. The interconnected nature of global markets means that events in these two major economies have far-reaching consequences. To effectively manage your investments and navigate the complexities of the stock market today, staying informed about global economic and political developments is crucial. Utilize resources like reputable financial news outlets and market analysis tools to track market trends and analyze global trade relations effectively. Understanding these geopolitical factors is key to making informed investment decisions in the dynamic world of the stock market today.

Featured Posts

-

Grand Slam Track Kingston Your Guide To Watching And Streaming

May 11, 2025

Grand Slam Track Kingston Your Guide To Watching And Streaming

May 11, 2025 -

Sylvester Stallone A Directorial Flop You Probably Didnt Know About

May 11, 2025

Sylvester Stallone A Directorial Flop You Probably Didnt Know About

May 11, 2025 -

The Crazy Rich Asians Tv Series Henry Goldings Reaction And Fan Excitement

May 11, 2025

The Crazy Rich Asians Tv Series Henry Goldings Reaction And Fan Excitement

May 11, 2025 -

Sports Stadiums A Key To Breaking The Downtown Doom Loop

May 11, 2025

Sports Stadiums A Key To Breaking The Downtown Doom Loop

May 11, 2025 -

Aaron Judges 2024 Season A Yankees Magazine Deep Dive

May 11, 2025

Aaron Judges 2024 Season A Yankees Magazine Deep Dive

May 11, 2025