Stock Market Today: Dow, S&P 500 Live Updates For May 29

Table of Contents

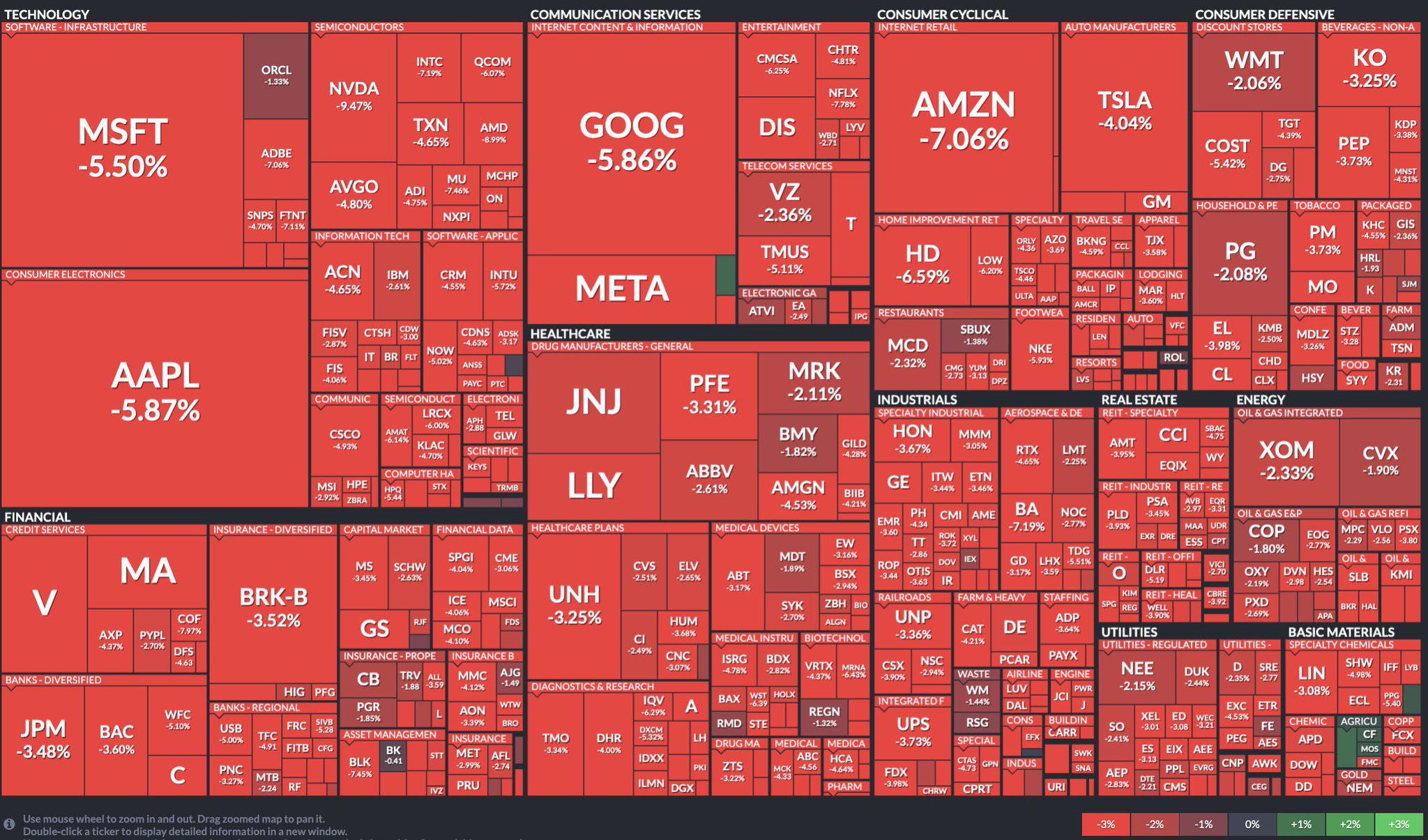

Dow Jones Industrial Average Performance

Opening Prices and Early Trading Activity:

The Dow Jones Industrial Average opened at 33,950.22, showing a slight increase of 0.2% from yesterday's closing. Early trading activity indicated a cautiously optimistic sentiment, with relatively low volume compared to recent volatile sessions.

- Market Indicators: Volatility remained moderate, indicated by the VIX index hovering around 17. Trading volume was slightly below average.

- Sector Performance: The technology sector showed early strength, while energy stocks experienced a slight dip, likely influenced by recent oil price fluctuations. Financials also exhibited cautious optimism.

- Significant Price Changes: Within the first hour, several blue-chip companies such as Apple and Microsoft experienced minor price increases, contributing to the Dow's positive opening.

Midday Market Movements and Influencing Factors:

Midday trading saw a shift in momentum. The Dow experienced a moderate decline of approximately 150 points after the release of weaker-than-expected consumer confidence data.

- Economic News: The unexpected drop in consumer confidence numbers raised concerns about slowing economic growth, putting pressure on the market.

- Company Announcements: News of a potential merger between two major pharmaceutical companies provided a temporary boost to the healthcare sector.

- Global Events: Geopolitical uncertainties in Eastern Europe continued to exert a subtle influence, impacting investor sentiment negatively.

Closing Prices and Day's Summary:

The Dow Jones Industrial Average closed at 33,780.50, a decrease of 0.5% for the day. This represents a slight reversal of early gains.

- Percentage Change: The overall decrease of 0.5% signifies a day of moderate losses.

- Comparison to Previous Day: Compared to yesterday's close, the Dow ended lower, reflecting the impact of the midday market correction.

- Overall Market Sentiment: The market sentiment was cautious, reflecting concerns about economic uncertainties and the potential for future interest rate increases.

S&P 500 Index Performance

Opening Prices and Early Trading Activity for the S&P 500:

The S&P 500 opened at 4,295.75, reflecting a similar, slightly positive trend to the Dow at the beginning of the trading day. However, the early gains were modest.

- Market Indicators: Early trading volume was relatively low, suggesting hesitation among investors.

- Sector Performance: Technology and communication services sectors were among the strongest performers during the early hours.

- Significant Price Changes: The index saw some initial fluctuation around the opening price, before establishing a relatively stable, albeit modestly positive, early trend.

Midday Market Movements and Influencing Factors for the S&P 500:

The S&P 500 followed a similar pattern to the Dow, experiencing a midday pullback influenced by the consumer confidence data.

- Economic News: The weaker-than-expected consumer confidence data affected a broader range of sectors across the S&P 500.

- Company Announcements: The pharmaceutical merger news had a less pronounced effect on the S&P 500 compared to the Dow.

- Global Events: Geopolitical concerns contributed to the overall cautious investor sentiment across the broader market.

Closing Prices and Day's Summary for the S&P 500:

The S&P 500 closed at 4,270.12, demonstrating a 0.6% decrease for the day.

- Percentage Change: The decline mirrors the negative trend seen in the Dow.

- Comparison to Previous Day: Similar to the Dow, the S&P 500 also ended the day lower than the previous close.

- Overall Market Sentiment: The overall market sentiment remained cautious, awaiting further economic data releases and company news for clearer direction.

Key Economic Indicators and News:

The key economic data release for May 29th was the consumer confidence index, which unexpectedly fell to 102.3, signaling a decrease in consumer spending confidence and potentially suggesting slower-than-anticipated economic growth. [Link to source] This, alongside ongoing geopolitical concerns, heavily influenced market performance. There were no other major economic indicators released today impacting the stock market.

Analyst Predictions and Market Outlook:

Analyst opinions remain divided. Some predict a further short-term correction, citing economic uncertainties. Others remain bullish on the long-term prospects for both the Dow and S&P 500, citing strong corporate earnings and anticipated positive economic growth in the second half of the year. [Link to source – Analyst report]

Conclusion: Stock Market Today – Recap and Future Outlook

Today's stock market activity for May 29th saw a mixed performance for both the Dow Jones Industrial Average and the S&P 500. Early optimism was tempered by weaker-than-expected consumer confidence data, resulting in a modest decline for both indices. Geopolitical uncertainty also contributed to a cautious investor sentiment. The coming days will likely see increased volatility depending on further economic data releases and company performance.

Check back tomorrow for "Stock Market Today: Dow, S&P 500 Live Updates" for continuous market analysis and insights. Subscribe to our newsletter or follow us on social media for regular updates on stock prices, live stock market updates, and in-depth market analysis. Stay informed about daily stock market reports and stay ahead of the market trends.

Featured Posts

-

Djokovic Begins French Open Campaign With Victory

May 30, 2025

Djokovic Begins French Open Campaign With Victory

May 30, 2025 -

Del Toro Names Top Video Game World A Shocking Choice

May 30, 2025

Del Toro Names Top Video Game World A Shocking Choice

May 30, 2025 -

Unseeded Eala Stuns Keys Reaches Miami Open Quarterfinals

May 30, 2025

Unseeded Eala Stuns Keys Reaches Miami Open Quarterfinals

May 30, 2025 -

Davidovich Fokina Falls To Alcaraz In Monte Carlo Masters Semifinal

May 30, 2025

Davidovich Fokina Falls To Alcaraz In Monte Carlo Masters Semifinal

May 30, 2025 -

Bad Bunny Entradas Preventa Ticketmaster Y Live Nation Madrid And Barcelona

May 30, 2025

Bad Bunny Entradas Preventa Ticketmaster Y Live Nation Madrid And Barcelona

May 30, 2025