Stock Market Valuation Anxiety: BofA Offers A Calming Perspective

Table of Contents

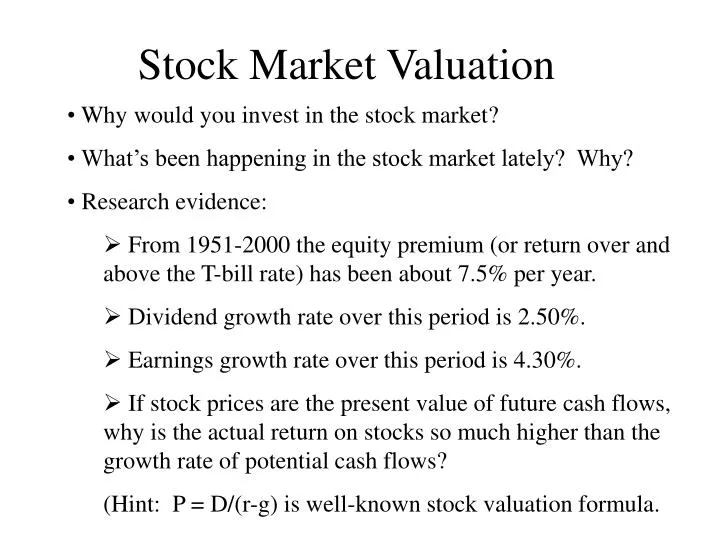

BofA's Assessment of Current Market Valuations

BofA's overall stance on current market valuations tends to be cautiously optimistic, acknowledging both the potential risks and opportunities present. While acknowledging elevated valuations in certain sectors, they emphasize the need for a nuanced, sector-specific analysis rather than a blanket judgment. Their assessments are typically supported by a robust analysis of various valuation metrics and historical comparisons.

-

Key valuation metrics BofA uses: BofA analysts utilize a range of metrics, including the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), Price-to-Book ratio (P/B), and dividend yield, to gauge the relative value of different stocks and sectors. They also consider factors like growth rates, interest rate environments and future earnings projections.

-

Comparison to historical valuations: While some sectors might appear expensive compared to historical averages, BofA often points out that these averages don't always perfectly predict future performance. They acknowledge that factors such as technological advancements and changing economic landscapes can affect valuations, requiring a more nuanced analysis than a simple comparison to past data. Context is key.

-

Sector-specific valuation insights: BofA's research often highlights significant variations in valuations across different sectors. Some sectors might be considered relatively overvalued, while others may present attractive buying opportunities. Their reports usually delve into these sector-specific insights, providing a detailed breakdown of the factors influencing valuations in each area.

-

Potential headwinds: BofA acknowledges the significant headwinds facing the market, including persistent inflation, the impact of rising interest rates on corporate profitability, and ongoing geopolitical uncertainties. These factors are critical considerations when assessing current valuations.

Addressing Investor Anxiety and Fear of Missing Out (FOMO)

The stock market's inherent volatility can trigger strong emotional responses in investors. The fear of missing out (FOMO) – the anxiety of potentially losing out on gains – is a particularly prevalent phenomenon. This often leads to impulsive decisions that can be detrimental to long-term investment goals.

-

Psychological impact of market volatility: Market fluctuations can trigger a fight-or-flight response, causing investors to make hasty decisions based on fear rather than rational analysis. This can result in selling low and buying high, undermining overall portfolio performance.

-

Dangers of emotional decision-making: Emotional investment decisions are often poor investment decisions. Panic selling during market downturns or chasing hot stocks based on hype can lead to significant losses.

-

Importance of a long-term investment strategy: A well-defined long-term strategy helps mitigate the impact of short-term market fluctuations. This strategy should align with your risk tolerance, financial goals and time horizon.

-

Managing FOMO and making rational choices: To combat FOMO, focus on your long-term goals and stick to your investment plan. Regularly review your portfolio, but avoid frequent trading based on short-term market movements. Consider diversification to mitigate risk.

BofA's Recommended Investment Strategies for Navigating Volatility

BofA's investment strategies for navigating market volatility typically emphasize a balanced approach combining risk management and opportunistic investing.

-

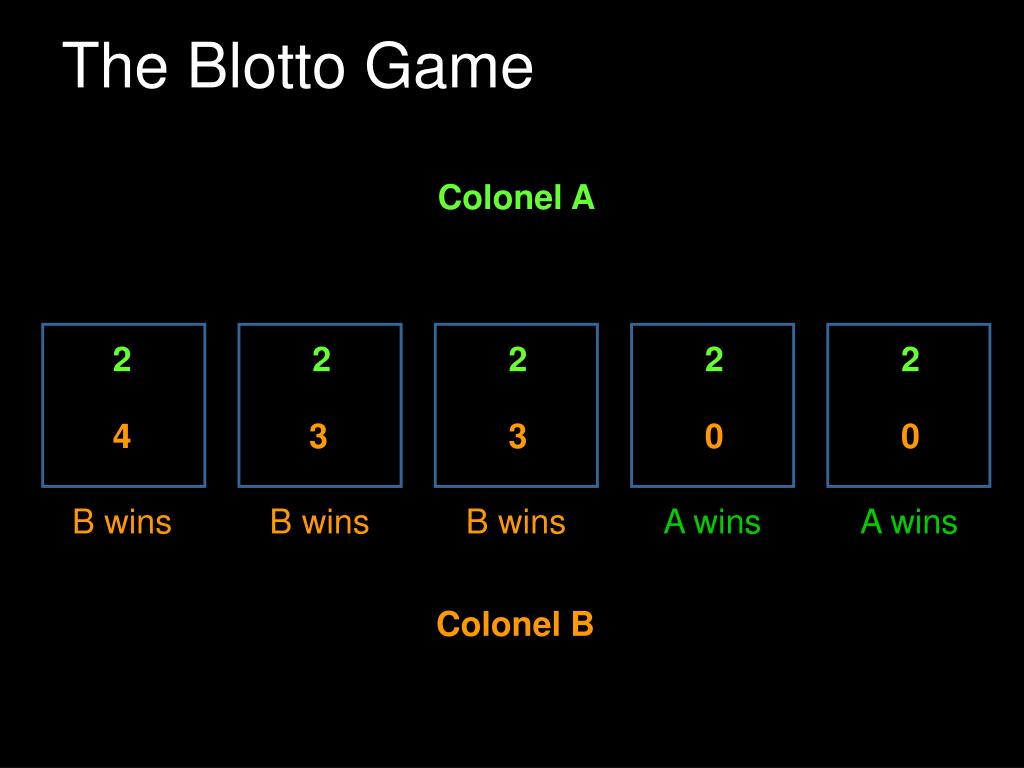

Specific asset classes: BofA might suggest a mix of asset classes, including equities (stocks), bonds, real estate, and potentially alternative investments, to diversify risk and potentially enhance returns. The precise allocation would vary depending on risk tolerance.

-

Importance of diversification: Diversification across different sectors, asset classes, and geographies is crucial to reduce the impact of market downturns on an investor's portfolio. Don't put all your eggs in one basket.

-

Managing risk during uncertainty: Strategies such as stop-loss orders can help limit potential losses during periods of market uncertainty. Regular portfolio reviews are critical.

-

Benefits of dollar-cost averaging: Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals regardless of market price, can help mitigate the risk of investing a lump sum at a market peak.

The Importance of Long-Term Investing in the Face of Short-Term Volatility

Short-term market volatility is a normal part of the investment cycle. Focusing on long-term growth is key to successfully navigating these fluctuations.

-

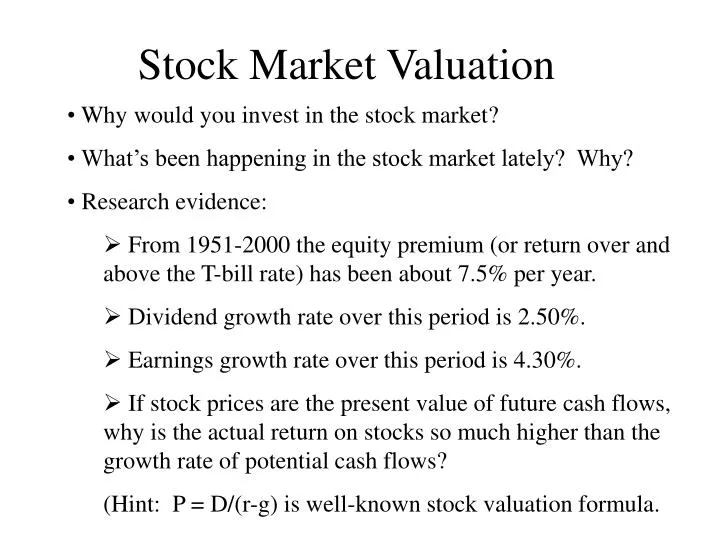

Statistical evidence of long-term market growth: Historically, the stock market has shown a consistent upward trend over the long term, despite periodic corrections and bear markets.

-

Examples of historical market corrections and recoveries: Numerous historical examples demonstrate the market's ability to recover from significant downturns.

-

Riding out market downturns: During market downturns, avoid panic selling. Maintaining a long-term perspective and sticking to your investment plan is crucial.

Conclusion:

BofA's perspective on current stock market valuations emphasizes a cautious optimism, highlighting sector-specific opportunities while acknowledging significant headwinds. Their recommended investment strategies focus on diversification, risk management, and a long-term approach. Don't let stock market valuation anxiety control your investment decisions. Develop a robust strategy to navigate stock market volatility by understanding your risk tolerance, setting clear financial goals, and regularly reviewing your portfolio. Learn more about BofA's insights on stock market valuations and consider consulting a financial advisor to create a personalized investment plan that aligns with your specific needs and circumstances.

Featured Posts

-

What Is Creatine A Guide To Its Uses And Effects

May 15, 2025

What Is Creatine A Guide To Its Uses And Effects

May 15, 2025 -

2023 Los Angeles Dodgers Offseason A Comprehensive Analysis

May 15, 2025

2023 Los Angeles Dodgers Offseason A Comprehensive Analysis

May 15, 2025 -

In Trumps World How Aircraft Influence Political Favoritism

May 15, 2025

In Trumps World How Aircraft Influence Political Favoritism

May 15, 2025 -

Butlers Big Game Golden State Warriors Defeat Houston Rockets

May 15, 2025

Butlers Big Game Golden State Warriors Defeat Houston Rockets

May 15, 2025 -

Dimereis Sxeseis Kyproy Oyggarias Epikairopoiisi Gia To Kypriako Kai Tin Ee

May 15, 2025

Dimereis Sxeseis Kyproy Oyggarias Epikairopoiisi Gia To Kypriako Kai Tin Ee

May 15, 2025

Latest Posts

-

Kim And Snells Mlb Friendship Positive Influence On Korean Baseball Players

May 15, 2025

Kim And Snells Mlb Friendship Positive Influence On Korean Baseball Players

May 15, 2025 -

Dodgers Roster Update Hyeseong Kim Called Up Report

May 15, 2025

Dodgers Roster Update Hyeseong Kim Called Up Report

May 15, 2025 -

How A Friendship Between Ha Seong Kim And Blake Snell Aids Korean Players Success

May 15, 2025

How A Friendship Between Ha Seong Kim And Blake Snell Aids Korean Players Success

May 15, 2025 -

Kim Hyeseongs Two Steals And Homer Highlight Dodgers Doubleheader Sweep In Okc

May 15, 2025

Kim Hyeseongs Two Steals And Homer Highlight Dodgers Doubleheader Sweep In Okc

May 15, 2025 -

Dodgers Promote Inf Hyeseong Kim Report Details

May 15, 2025

Dodgers Promote Inf Hyeseong Kim Report Details

May 15, 2025