Stock Market Valuation Concerns: BofA's Rationale For Investor Confidence

Table of Contents

BofA's Key Arguments for a Positive Market Outlook

BofA's confidence isn't blind optimism; it's rooted in several key observations and strategic considerations. They base their positive market outlook on a combination of strong fundamentals, long-term growth potential, and a focus on robust risk management.

Strong Corporate Earnings and Profit Margins

BofA points to robust corporate earnings as a key support for current valuations. Despite economic headwinds, many companies have demonstrated resilience and exceeded expectations.

- Examples of Strong Performers: The technology sector, particularly companies involved in artificial intelligence (AI) and cloud computing, have shown exceptional growth. Similarly, the energy sector has benefited from increased demand and higher prices. Specific examples like [insert example company names and brief explanation of their performance] showcase this strength.

- Resilient Consumer Spending: Despite inflation, consumer spending has remained relatively robust in certain segments, bolstering corporate revenue streams. This indicates a degree of underlying economic strength that supports continued profitability.

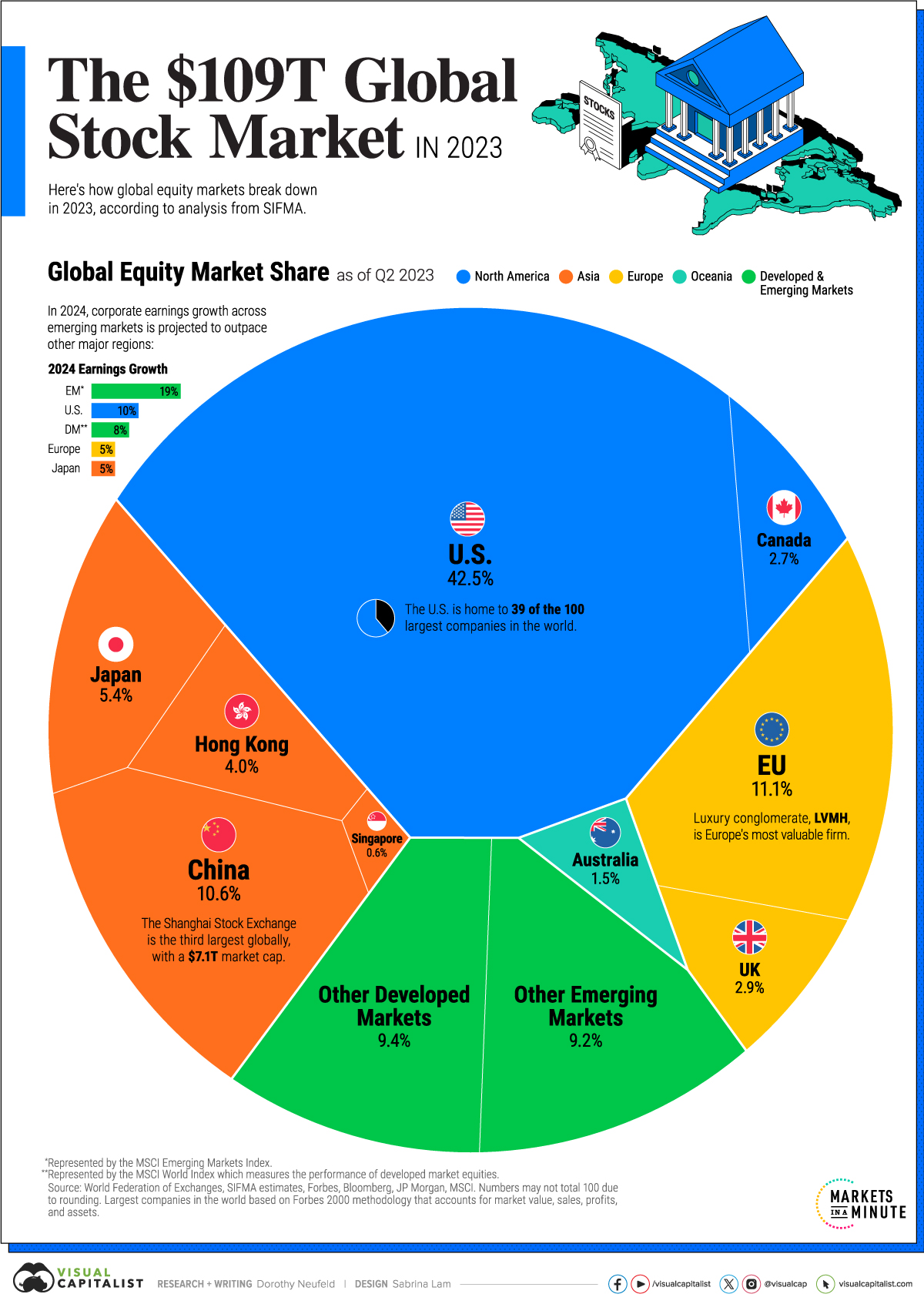

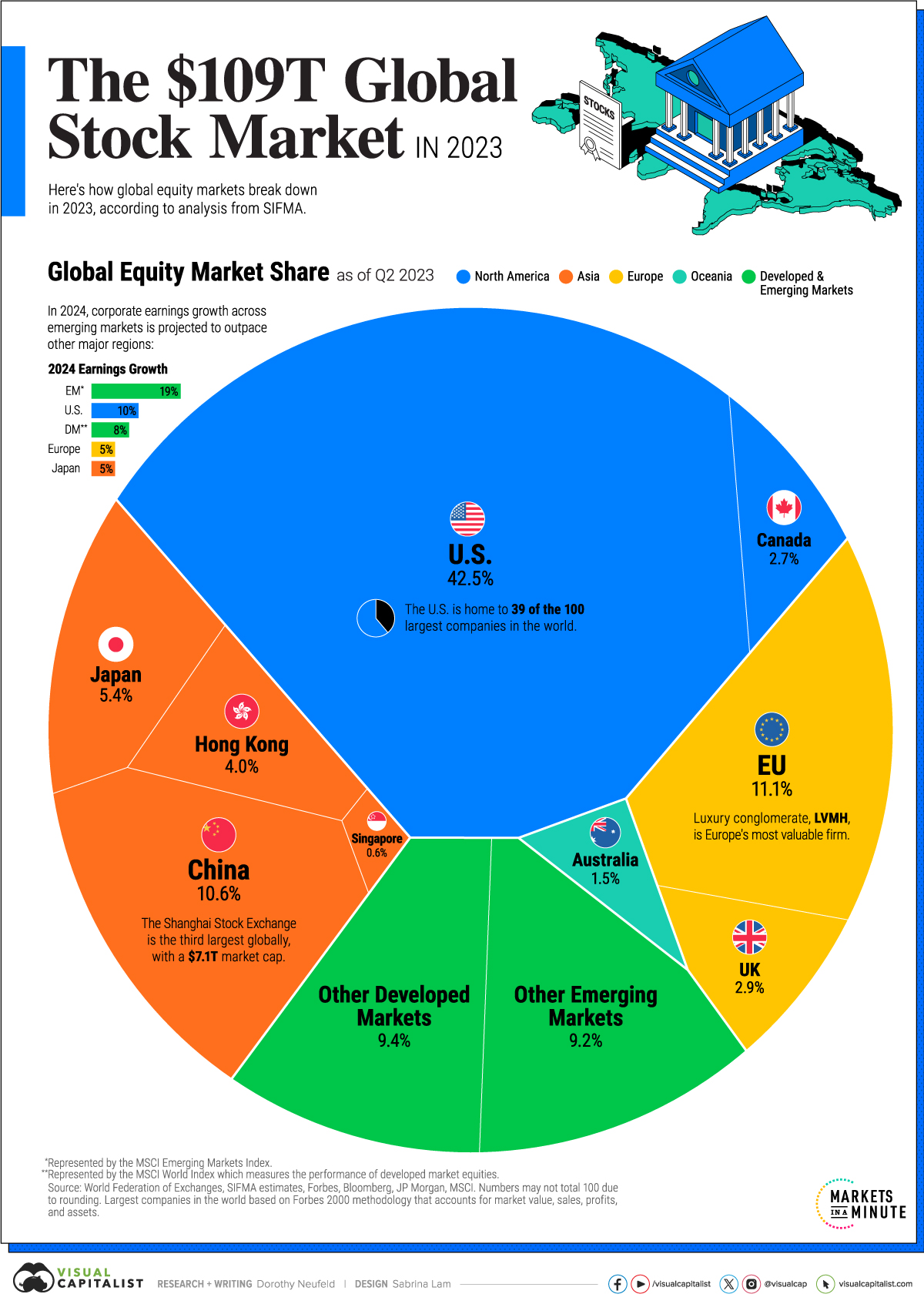

- S&P 500 Earnings Growth: While specific data points will fluctuate, the overall trend in S&P 500 earnings growth (cite source if possible) further validates BofA’s assessment of strong corporate performance and its impact on stock market valuation. This positive earnings momentum contributes significantly to investor confidence and justifies, to some extent, the current elevated stock prices.

Focus on Long-Term Growth Potential

BofA emphasizes the importance of considering long-term growth prospects rather than solely focusing on short-term market fluctuations. Their perspective highlights the transformative potential of several key trends.

- Emerging Technologies: The rapid advancements in artificial intelligence (AI), renewable energy, and biotechnology are poised to drive significant economic growth in the coming decades. These innovative sectors represent substantial opportunities for investors with a long-term horizon.

- Demographic Trends: Global demographic shifts, such as the expanding middle class in developing economies, fuel continued demand for goods and services, creating long-term growth opportunities for businesses.

- Innovation and Profitability: Continuous innovation is crucial for maintaining competitiveness and driving future corporate profits. BofA likely acknowledges that companies adapting to technological advancements and demonstrating an innovative spirit are better positioned for long-term success. This long-term view is crucial for navigating short-term market volatility.

Strategic Asset Allocation and Risk Management

BofA advocates a diversified investment strategy to mitigate risks associated with potentially high valuations in certain sectors. They emphasize the importance of a tailored approach based on individual risk tolerance.

- Diversification Across Asset Classes: BofA likely suggests diversification across different asset classes, including stocks, bonds, real estate, and potentially alternative investments, to reduce overall portfolio volatility.

- Risk Tolerance Assessment: Understanding your own risk tolerance is crucial. BofA likely emphasizes the importance of assessing your investment goals and time horizon to determine an appropriate risk level.

- Portfolio Adjustments: Adapting your portfolio allocation based on market conditions is vital. BofA likely recommends regularly reviewing and adjusting your holdings to reflect changes in market valuations and your personal circumstances.

Addressing the Valuation Concerns Directly

While maintaining a positive outlook, BofA acknowledges that certain sectors might be overvalued and that interest rates and inflation play a significant role in shaping the market.

Acknowledging Overvaluation in Certain Sectors

BofA likely acknowledges that specific sectors might be experiencing overvaluation, driven by various factors.

- Sectors Exhibiting Overvaluation: Certain growth sectors, particularly those fueled by speculative investment, might show signs of overvaluation. [Insert examples, citing potential metrics like high P/E ratios].

- Contributing Factors: Low interest rates in the past have potentially inflated asset prices in some sectors, creating vulnerabilities. Speculative bubbles can also contribute to overvaluation, increasing the risk of sharp corrections.

- Navigating Overvalued Sectors: BofA likely advises investors to approach these sectors with caution, emphasizing thorough due diligence and a selective approach. They may recommend a more conservative allocation to potentially overvalued areas.

The Role of Interest Rates and Inflation

Interest rates and inflation are crucial factors influencing stock market valuation.

- Impact of Rising Interest Rates: Rising interest rates increase borrowing costs for companies, potentially impacting profitability and reducing the attractiveness of higher-valued stocks.

- Inflation and Corporate Profitability: High inflation erodes profit margins if companies can't pass on increased costs to consumers. BofA likely analyzes the relationship between inflation, corporate pricing power, and consequent impact on valuations.

- Future Rate Adjustments: BofA's predictions regarding future interest rate adjustments and their potential impact on market valuations are crucial. They likely incorporate these forecasts into their investment strategies.

Utilizing Valuation Metrics for Informed Decision-Making

BofA likely utilizes a variety of valuation metrics to assess market value and make informed investment decisions.

- Key Valuation Metrics: Common metrics include the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and Price-to-Book (P/B) ratio. Understanding these ratios provides valuable insights into a company's valuation relative to its earnings, sales, and book value.

- Interpreting Valuation Data: BofA likely analyzes these metrics across different sectors and companies to identify undervalued or overvalued opportunities. They might compare current valuations to historical averages and industry benchmarks.

- Informed Investment Decisions: By utilizing these metrics and considering other macroeconomic factors, investors can make more informed decisions, mitigating risks and maximizing potential returns.

Conclusion

This article explored BofA's perspective on current stock market valuation concerns. While acknowledging the risks associated with potentially high valuations in certain sectors, BofA points to strong corporate earnings, long-term growth potential, and the importance of strategic asset allocation as reasons for maintaining a positive outlook. Understanding BofA's rationale, along with careful consideration of valuation metrics and risk management, allows investors to make informed decisions.

Call to Action: Understanding stock market valuation is crucial for successful investing. Learn more about BofA's investment strategies and stay informed about market trends to navigate stock market valuation concerns effectively. Contact a financial advisor to discuss your personal investment strategy and risk tolerance and to build a portfolio that aligns with your individual financial goals.

Featured Posts

-

Red Carpet Rule Infractions Causes And Consequences Cnn

May 17, 2025

Red Carpet Rule Infractions Causes And Consequences Cnn

May 17, 2025 -

Red Carpet Etiquette Why Guests Ignore The Rules Cnn

May 17, 2025

Red Carpet Etiquette Why Guests Ignore The Rules Cnn

May 17, 2025 -

Track Roundup All Conference Honors Announced For Athletes

May 17, 2025

Track Roundup All Conference Honors Announced For Athletes

May 17, 2025 -

The Closure Of Anchor Brewing Company What It Means For Craft Beer

May 17, 2025

The Closure Of Anchor Brewing Company What It Means For Craft Beer

May 17, 2025 -

Tom Cruises Unpaid Debt To Tom Hanks The 1 Role He Never Played

May 17, 2025

Tom Cruises Unpaid Debt To Tom Hanks The 1 Role He Never Played

May 17, 2025

Latest Posts

-

Free Severance Streaming Complete Episode Guide And Platforms

May 17, 2025

Free Severance Streaming Complete Episode Guide And Platforms

May 17, 2025 -

Stream Severance For Free Episode Guide And Options

May 17, 2025

Stream Severance For Free Episode Guide And Options

May 17, 2025 -

How To Watch Severance A Free On Demand Guide

May 17, 2025

How To Watch Severance A Free On Demand Guide

May 17, 2025 -

Planning Your Trip To The New Orleans Jazz And Heritage Festival

May 17, 2025

Planning Your Trip To The New Orleans Jazz And Heritage Festival

May 17, 2025 -

New Orleans Jazz Fest A Comprehensive Guide For First Timers

May 17, 2025

New Orleans Jazz Fest A Comprehensive Guide For First Timers

May 17, 2025