Stock Market Valuations: Addressing Investor Concerns - A BofA Analysis

Table of Contents

Current Market Valuation Metrics: A BofA Overview

BofA employs a range of valuation metrics to assess the market's health. Key metrics include the Price-to-Earnings ratio (P/E ratio), the cyclically adjusted price-to-earnings ratio (Shiller P/E), Price-to-Sales (P/S), and Price-to-Book (P/B) ratios. These metrics offer different perspectives on the relative value of stocks compared to their earnings, sales, or book value. BofA's recent analysis reveals the following:

- P/E Ratios: The S&P 500 currently shows a P/E ratio of [insert current data from BofA's analysis], compared to its historical average of [insert historical average data]. Specific sector P/E ratios show [insert data points, e.g., Technology sector at X, Financials at Y]. This suggests [interpret the data - e.g., a premium valuation in certain sectors, a discount in others].

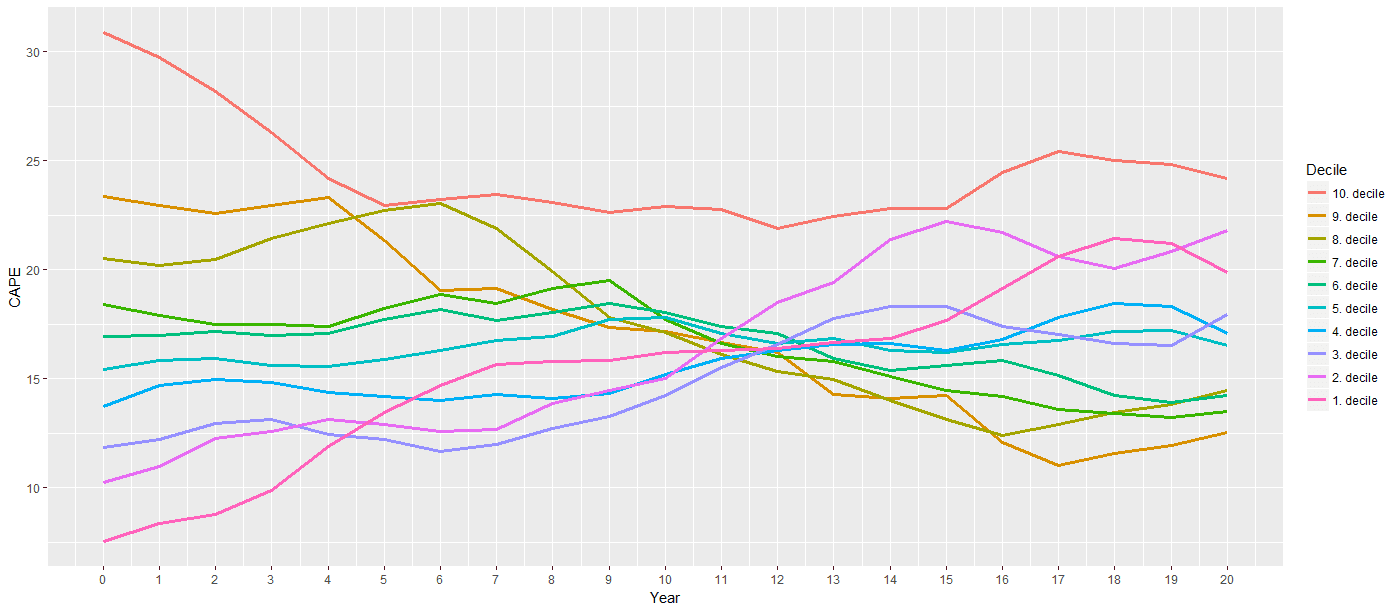

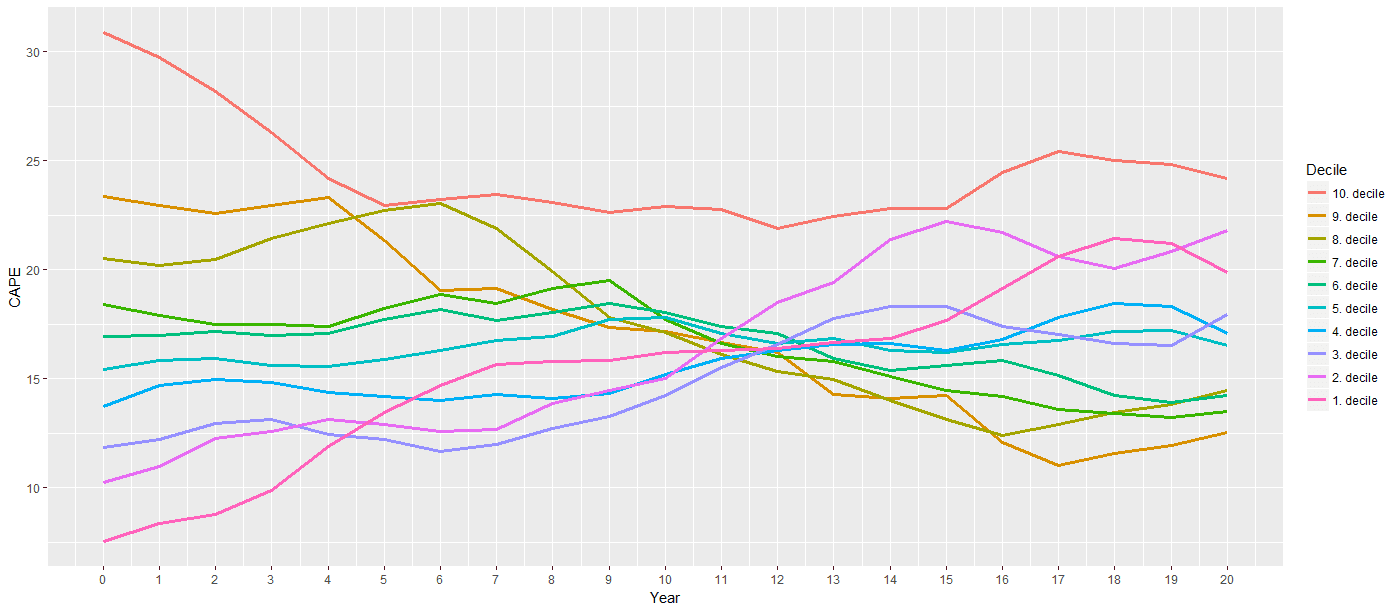

- Shiller P/E: BofA's analysis of the Shiller P/E ratio, which smooths out short-term earnings fluctuations, indicates [insert BofA's findings and interpretation].

- Price-to-Sales & Price-to-Book: These metrics offer additional insights into the market's valuation, considering sales revenue and book value. BofA's research highlights [insert key findings regarding P/S and P/B ratios and their implications]. Significant deviations from historical norms in these ratios could suggest [explain the possible implications – e.g., potential for correction, sustained growth].

Identifying Overvalued and Undervalued Sectors

BofA's sector-specific analysis pinpoints potential overvaluation and undervaluation. This granular approach helps investors identify areas for strategic allocation.

- Potentially Overvalued Sectors: BofA's research suggests that [list sectors, e.g., certain technology sub-sectors, specific consumer discretionary companies] are potentially overvalued. Reasons include high growth expectations, potentially inflated valuations driven by speculative bubbles, and signs of froth in certain markets.

- Potentially Undervalued Sectors: Conversely, BofA points to sectors such as [list sectors, e.g., energy, certain cyclical sectors showing strong fundamentals] as potentially undervalued. This undervaluation might stem from market corrections, temporary setbacks, or a mispricing of long-term potential. Strong fundamentals and discounted prices can signal attractive investment opportunities.

- Macroeconomic Factors: The current macroeconomic environment, including [mention relevant factors such as interest rate hikes, inflation levels, geopolitical risks], significantly influences sector valuations. BofA's analysis incorporates these factors to provide a comprehensive perspective.

Key Risks and Opportunities in the Current Market

BofA's analysis highlights both significant risks and compelling opportunities within the current market landscape:

- Key Risks: Potential risks identified by BofA include the impact of interest rate hikes on valuations, persistent inflation eroding corporate profits, and the ongoing impact of geopolitical uncertainty. These factors can negatively impact stock market valuations and lead to market corrections.

- Investment Opportunities: Despite the risks, BofA has identified specific investment opportunities in sectors with strong underlying fundamentals and attractive valuations. These opportunities, however, require careful consideration of the accompanying risks.

- Risk Mitigation: BofA's analysis suggests several risk mitigation strategies, including diversification across different sectors and asset classes, and a focus on companies with robust balance sheets. A well-diversified portfolio helps to mitigate the risk associated with investing in individual sectors.

BofA's Recommendations for Investors

Based on their comprehensive analysis of stock market valuations, BofA offers the following recommendations:

- Overall Outlook: BofA's overall outlook on the market is [summarize BofA's view – e.g., cautious optimism, watchful waiting].

- Investor Strategies: BofA advises investors to consider a diversified investment strategy, carefully allocating assets across different sectors and asset classes, tailoring their portfolios to their risk tolerance.

- Asset Allocation: Specific asset allocation suggestions based on BofA's research should include [provide examples: e.g., reducing exposure to high-growth tech sectors, increasing allocations to value stocks, allocating a portion to defensive sectors].

- Risk Management: Investors should actively manage risk by [provide actionable advice: e.g., regular portfolio rebalancing, setting stop-loss orders, and keeping a long-term perspective].

Conclusion

Understanding stock market valuations is critical for informed investment decision-making. BofA's analysis provides a valuable perspective on current market conditions, highlighting both potential risks and opportunities. The current valuation metrics reveal a mixed picture, with certain sectors showing signs of overvaluation while others appear undervalued. Investors should carefully consider the risks associated with the current market environment and employ appropriate risk mitigation strategies. To gain a deeper understanding of stock market valuations and to improve your stock market analysis, consult BofA's full report for detailed insights and more specific recommendations on how to manage your stock market investments. By understanding stock market valuations, you can make more informed investment decisions.

Featured Posts

-

La Finca Roc Agel Un Vistazo A La Residencia Privada De Charlene

May 26, 2025

La Finca Roc Agel Un Vistazo A La Residencia Privada De Charlene

May 26, 2025 -

Naomi Campbells Potential Met Gala 2025 Absence The Anna Wintour Conflict

May 26, 2025

Naomi Campbells Potential Met Gala 2025 Absence The Anna Wintour Conflict

May 26, 2025 -

D C Pride 2024 A Comprehensive Guide To The Events And Festivities

May 26, 2025

D C Pride 2024 A Comprehensive Guide To The Events And Festivities

May 26, 2025 -

F1 Live Timing Data Monaco Grand Prix 2024

May 26, 2025

F1 Live Timing Data Monaco Grand Prix 2024

May 26, 2025 -

Pressure Mounts Ex Israeli Female Soldiers Advocate For Gaza Captive Release

May 26, 2025

Pressure Mounts Ex Israeli Female Soldiers Advocate For Gaza Captive Release

May 26, 2025

Latest Posts

-

Alcaraz And Swiatek Dominate Roland Garros Opening Matches

May 28, 2025

Alcaraz And Swiatek Dominate Roland Garros Opening Matches

May 28, 2025 -

Alcarazs Soaring Confidence Vs Swiateks French Open Challenges

May 28, 2025

Alcarazs Soaring Confidence Vs Swiateks French Open Challenges

May 28, 2025 -

Swiatek And Alcaraz Victorious In Roland Garros First Round

May 28, 2025

Swiatek And Alcaraz Victorious In Roland Garros First Round

May 28, 2025 -

Alcaraz Confident Swiatek Struggles French Open Outlook

May 28, 2025

Alcaraz Confident Swiatek Struggles French Open Outlook

May 28, 2025 -

Roland Garros 2024 Alcaraz And Swiateks Opening Wins

May 28, 2025

Roland Garros 2024 Alcaraz And Swiateks Opening Wins

May 28, 2025