Stock Market Valuations: BofA Assures Investors, Addressing Valuation Concerns

Table of Contents

BofA's Key Arguments for a Positive Stock Market Outlook

BofA's positive stock market outlook rests on several key pillars. Their analysis suggests a continued period of growth, driven by robust corporate earnings and supportive economic indicators. They see several factors driving this positive sentiment.

- Strong Corporate Earnings Growth: BofA forecasts continued, albeit potentially moderating, growth in corporate earnings, driven by sustained consumer demand and ongoing technological advancements. This expectation underpins their belief that current stock prices are justifiable.

- Favorable Economic Indicators: The bank points to positive economic indicators, such as low unemployment rates (in many regions) and consistent, albeit slowing, GDP growth, as further support for their positive outlook. These indicators suggest a resilient economy capable of supporting higher stock valuations.

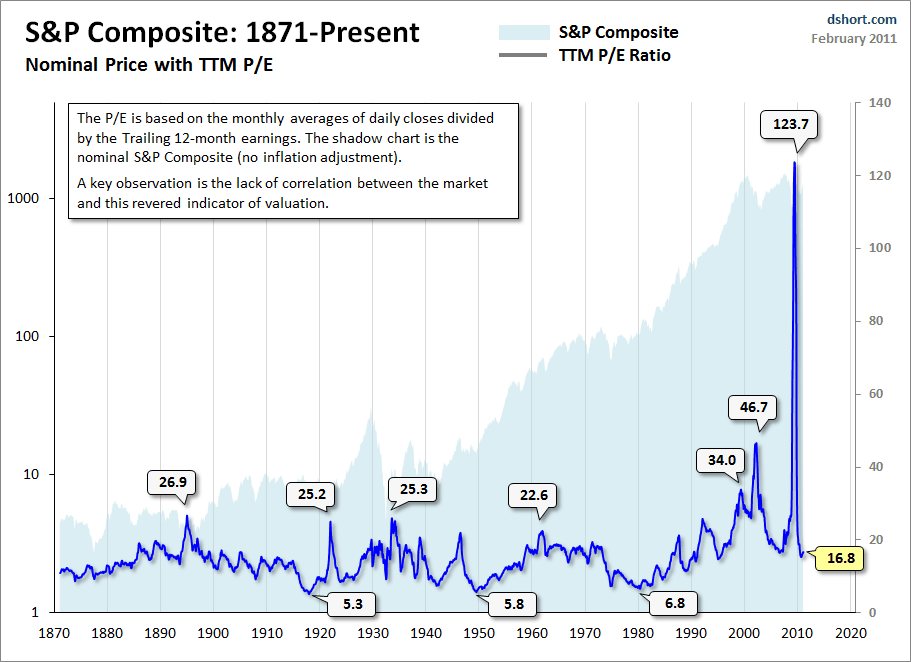

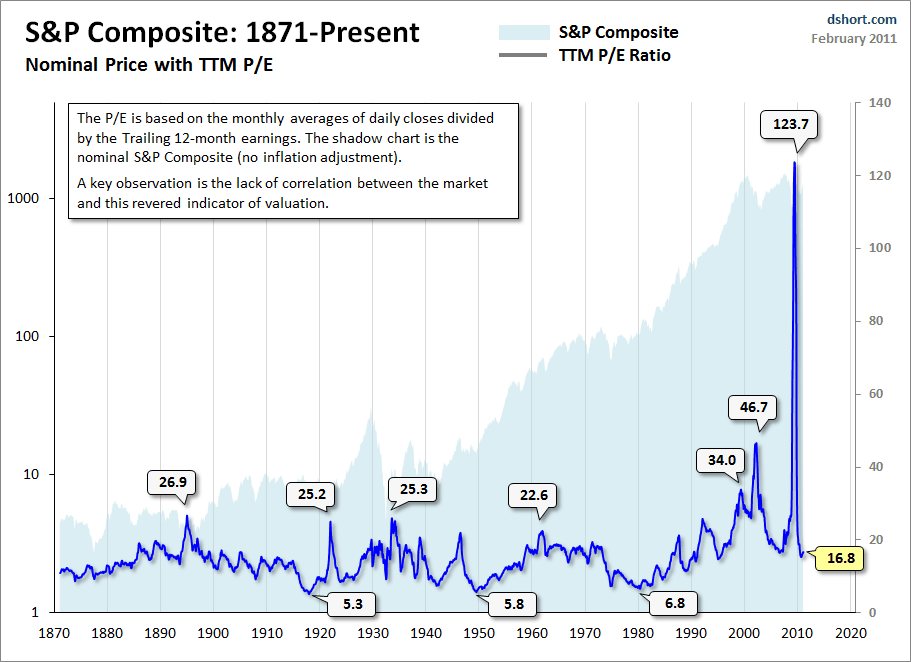

- Moderate P/E Ratios (in certain sectors): While acknowledging elevated P/E ratios in some sectors, BofA argues that these are not universally high compared to historical averages across the entire market, and are often justified by strong future earnings expectations. They highlight specific sectors demonstrating lower than average P/E ratios showing significant growth potential.

Addressing Concerns about Overvaluation

Despite BofA's optimism, concerns about stock market overvaluation remain valid. Many investors point to historically high P/E ratios in certain sectors as a sign of potential market correction. BofA addresses these concerns by highlighting several key factors:

- Low Interest Rates: Persistently low interest rates globally continue to influence valuations, making equities more attractive compared to fixed-income investments. This low-cost borrowing environment supports higher valuations for companies.

- Technological Disruption and Innovation: The rapid pace of technological innovation justifies premium valuations for companies leading in these sectors, as their future growth potential is substantial. BofA's analysis specifically highlights the tech sector as a significant driver for overall market growth, and as a key sector for future investment.

- Strong Balance Sheets: Many companies entering this period have strong balance sheets, capable of weathering potential economic slowdowns, further justifying premium valuations based on the potential for sustained growth.

BofA acknowledges the risk of a market correction but believes that the current valuations are largely supported by fundamental factors.

BofA's Strategies for Navigating Current Valuations

Based on their analysis, BofA suggests several investment strategies for navigating the current market environment. These strategies emphasize diversification and risk management.

- Sector Rotation: BofA recommends a strategic approach to sector rotation, focusing on sectors demonstrating strong growth potential with moderate P/E ratios while reducing exposure in overvalued segments.

- Strategic Asset Allocation: Diversification across different asset classes, including equities, bonds, and alternative investments, is crucial for mitigating risk.

- Focus on High-Growth Sectors: The firm recommends prioritizing investments in sectors driving technological innovation, such as technology and healthcare, while carefully assessing valuations within those areas. However, they warn that sector rotation and asset allocation require careful consideration and appropriate risk management strategies.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Consult with a financial professional before making any investment decisions.

Alternative Perspectives and Considerations

It is crucial to acknowledge that not all analysts share BofA's optimistic outlook. Some analysts express concerns about a potential bear market, pointing to the potential for a market correction based on historically high valuations in certain sectors. These differing viewpoints highlight the importance of independent research and a comprehensive understanding of multiple perspectives before making investment decisions.

- Bear Market Predictions: Some market analysts predict a potential bear market, citing overvaluation and concerns about economic growth slowing more sharply than BofA's forecasts.

- Inflationary Pressures: Rising inflation could exert downward pressure on stock valuations, impacting corporate earnings and investor sentiment. This is a crucial element of risk assessment that requires careful monitoring.

- Geopolitical Risks: Global geopolitical events could also introduce significant volatility, negatively affecting market sentiment and prompting corrections.

Considering diverse perspectives is essential for making sound investment decisions.

Conclusion: Making Informed Decisions on Stock Market Valuations

BofA's analysis presents a relatively optimistic outlook for stock market valuations, emphasizing strong corporate earnings and favorable economic indicators. However, concerns about overvaluation remain, and it's vital to acknowledge differing perspectives and conduct thorough research before making any investment decisions. Remember to assess your own risk tolerance and investment goals carefully. Stay informed about stock market valuations and make well-considered investment decisions based on your individual circumstances. Consult with a financial advisor for personalized guidance on how to manage your portfolio effectively within this challenging market environment.

Featured Posts

-

Poslednji Pozdrav Andelki Milivojevic Tadic Tuga Kolega I Prijatelja

May 20, 2025

Poslednji Pozdrav Andelki Milivojevic Tadic Tuga Kolega I Prijatelja

May 20, 2025 -

Urgent Hmrc Correspondence And What You Need To Do

May 20, 2025

Urgent Hmrc Correspondence And What You Need To Do

May 20, 2025 -

Wayne Gretzkys Daughter Paulina Makes Rare Appearance With Husband

May 20, 2025

Wayne Gretzkys Daughter Paulina Makes Rare Appearance With Husband

May 20, 2025 -

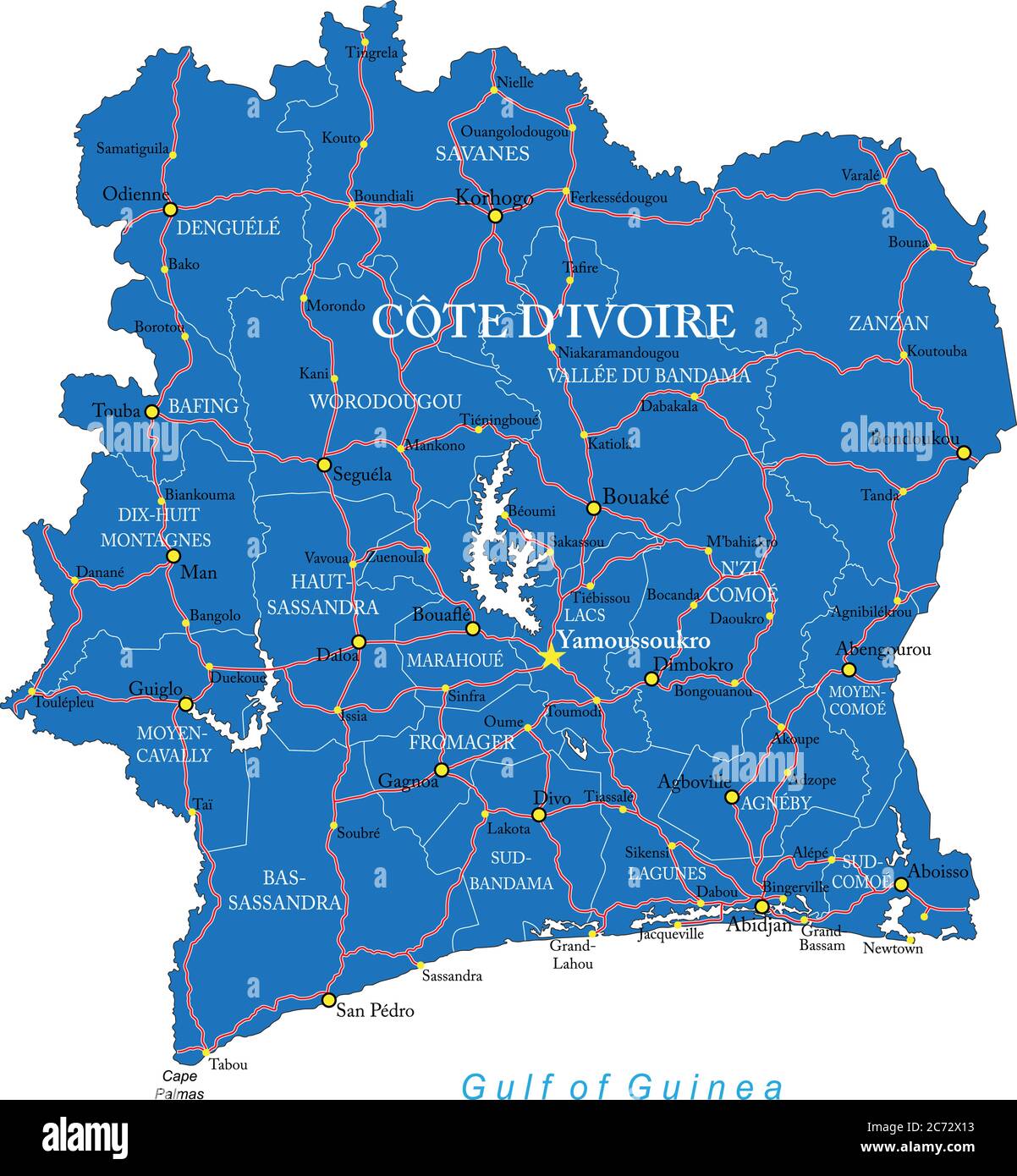

Cote D Ivoire Le Port D Abidjan Et Ses Performances 2022

May 20, 2025

Cote D Ivoire Le Port D Abidjan Et Ses Performances 2022

May 20, 2025 -

Woede Bij Fenerbahce Na Tadic Incident Harde Aanpak Gepland

May 20, 2025

Woede Bij Fenerbahce Na Tadic Incident Harde Aanpak Gepland

May 20, 2025

Latest Posts

-

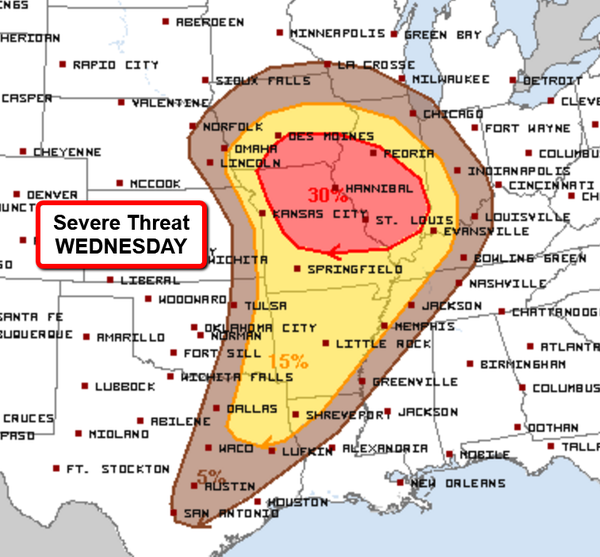

Fast Moving Storms Recognizing And Responding To Damaging Winds

May 20, 2025

Fast Moving Storms Recognizing And Responding To Damaging Winds

May 20, 2025 -

Prepare For High Winds A Guide To Fast Moving Storms

May 20, 2025

Prepare For High Winds A Guide To Fast Moving Storms

May 20, 2025 -

Bundesliga Leverkusen Victory Delays Bayerns Championship Party Kane Sidelined

May 20, 2025

Bundesliga Leverkusen Victory Delays Bayerns Championship Party Kane Sidelined

May 20, 2025 -

Staying Safe During Fast Moving Storms With High Winds

May 20, 2025

Staying Safe During Fast Moving Storms With High Winds

May 20, 2025 -

Boosting Resilience Practical Steps For Improved Mental Well Being

May 20, 2025

Boosting Resilience Practical Steps For Improved Mental Well Being

May 20, 2025