Stock Market Valuations: BofA's Analysis And Reasons For Investor Calm

Table of Contents

BofA's Current Valuation Assessment

BofA's recent reports present a nuanced view of current stock market valuations. While not outright declaring the market overvalued, their analysis suggests a level of caution is warranted. They haven't issued a blanket "sell" signal, but rather advise investors to be selective and mindful of potential risks. Specific data points from their reports are often not publicly available in detail, but their general conclusions are widely reported.

-

Key valuation metrics used by BofA: BofA, like many other financial institutions, utilizes a range of valuation metrics to assess the market. These include:

- Price-to-Earnings ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating overvaluation.

- Price-to-Sales ratio (P/S): This compares a company's stock price to its revenue per share. It's often used for companies with negative earnings. A high P/S ratio can also signal potential overvaluation.

- Cyclically Adjusted Price-to-Earnings ratio (CAPE): This metric, developed by Nobel laureate Robert Shiller, smooths out earnings fluctuations over a ten-year period, providing a longer-term perspective on valuation. A high CAPE ratio suggests the market may be expensive relative to its long-term earnings power.

-

Comparison of current valuations to historical averages: BofA's analysis often compares current valuation metrics to their historical averages. This helps determine whether current valuations are unusually high or low compared to past market cycles. They frequently point out that while some metrics are elevated, they are not at the extreme levels seen at previous market peaks.

-

BofA's predicted trajectory for valuations in the near future: BofA’s predictions vary depending on the economic scenario they model. Their forecasts generally involve a cautious outlook, suggesting moderate growth with potential for increased volatility, depending on factors such as inflation and interest rate adjustments.

-

Specific sectors or asset classes: BofA frequently highlights specific sectors or asset classes that appear relatively overvalued or undervalued based on their analyses. This allows investors to make more targeted investment decisions. For example, certain technology stocks might be flagged as potentially overvalued, while others in more defensive sectors might appear more attractive.

Factors Contributing to Investor Calm

Despite potential market risks, several factors contribute to the relatively calm investor sentiment:

-

Low interest rates: Historically low interest rates have made equities a more attractive investment compared to bonds, pushing up equity valuations. However, rising interest rates can reverse this trend.

-

Central bank policies: Quantitative easing (QE) programs implemented by central banks have injected significant liquidity into the market, supporting asset prices. However, the unwinding of QE programs can lead to increased market volatility.

-

Investor expectations regarding future economic growth: Investor confidence, or lack thereof, in future economic growth significantly influences market sentiment. Positive growth projections generally bolster equity valuations, while negative projections can trigger sell-offs.

-

Geopolitical events: Geopolitical events and international tensions can create uncertainty and impact investor confidence, influencing market volatility and equity valuations. However, investor response to geopolitical risks varies widely depending on the perceived severity and likelihood of negative consequences.

-

Corporate earnings: Strong corporate earnings reports often support higher stock prices. However, consistent underperformance of earnings can lead to market corrections.

Analyzing Market Volatility and Risk

BofA's risk assessment usually emphasizes the potential for increased market volatility in the near term.

-

Prediction for future market volatility: BofA’s predictions for future volatility often depend heavily on macro-economic factors such as inflation and interest rates, as well as geopolitical risks. They generally recommend investors prepare for potential short-term increases in market volatility.

-

Potential risks: Key risks identified often include inflation, recessionary pressures, and shifts in monetary policy. These can significantly impact stock market valuations.

-

BofA's recommended risk management strategies: BofA usually advocates for diversification, careful portfolio construction, and a long-term investment horizon as key risk mitigation strategies. They frequently advise investors to maintain a balanced portfolio appropriate to their risk tolerance.

Alternative Perspectives and Criticisms

It's important to acknowledge that BofA's analysis isn't the only perspective on stock market valuations.

-

Other financial institutions' views: Other prominent financial institutions may hold differing opinions, offering contrasting valuations and forecasts. It's prudent to consult a variety of analyses to get a broader picture.

-

Potential limitations or biases: BofA's analysis, like any financial analysis, may have limitations or inherent biases. Their research may be influenced by their own investment strategies and client relationships.

-

Arguments for increased investor concern: Some analysts argue that certain valuation metrics remain elevated, suggesting a higher risk of market correction than BofA’s analysis suggests. They might highlight specific vulnerabilities or systemic risks that BofA's report underplays.

Conclusion

BofA's analysis of stock market valuations presents a cautious but not overly bearish outlook. While they don't see an imminent market crash, they emphasize the importance of considering key valuation metrics like P/E, P/S, and CAPE ratios, and remaining aware of macroeconomic risks. Factors like low interest rates, central bank policies, and investor expectations regarding future economic growth significantly influence current market sentiment. However, potential risks, including inflation and geopolitical instability, warrant careful attention. While a degree of investor calm currently prevails, understanding stock market valuations remains crucial.

Call to Action: While BofA's analysis suggests a degree of investor calm, understanding stock market valuations remains crucial for making informed investment decisions. Stay informed on the latest analyses from BofA and other reputable sources to effectively manage your portfolio and navigate the complexities of the stock market. Regularly monitor your investments and stay updated on changes in stock market valuations to optimize your financial strategy. Continuously assess your risk tolerance and adjust your investment strategy accordingly to navigate the ever-changing landscape of stock market valuations.

Featured Posts

-

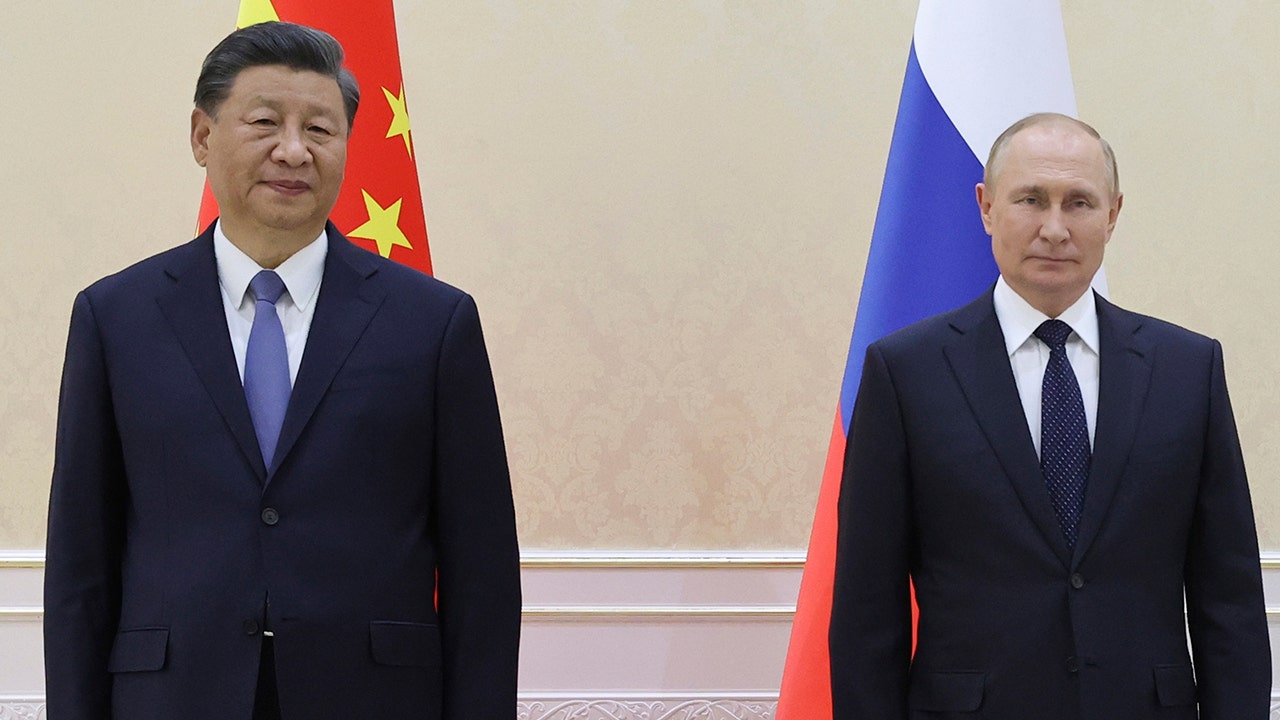

Formal Trade Deal Possible Chinese Ambassadors Remarks On Canada Relations

May 17, 2025

Formal Trade Deal Possible Chinese Ambassadors Remarks On Canada Relations

May 17, 2025 -

New York Knicks Star Player Seeks Reduced Playing Time

May 17, 2025

New York Knicks Star Player Seeks Reduced Playing Time

May 17, 2025 -

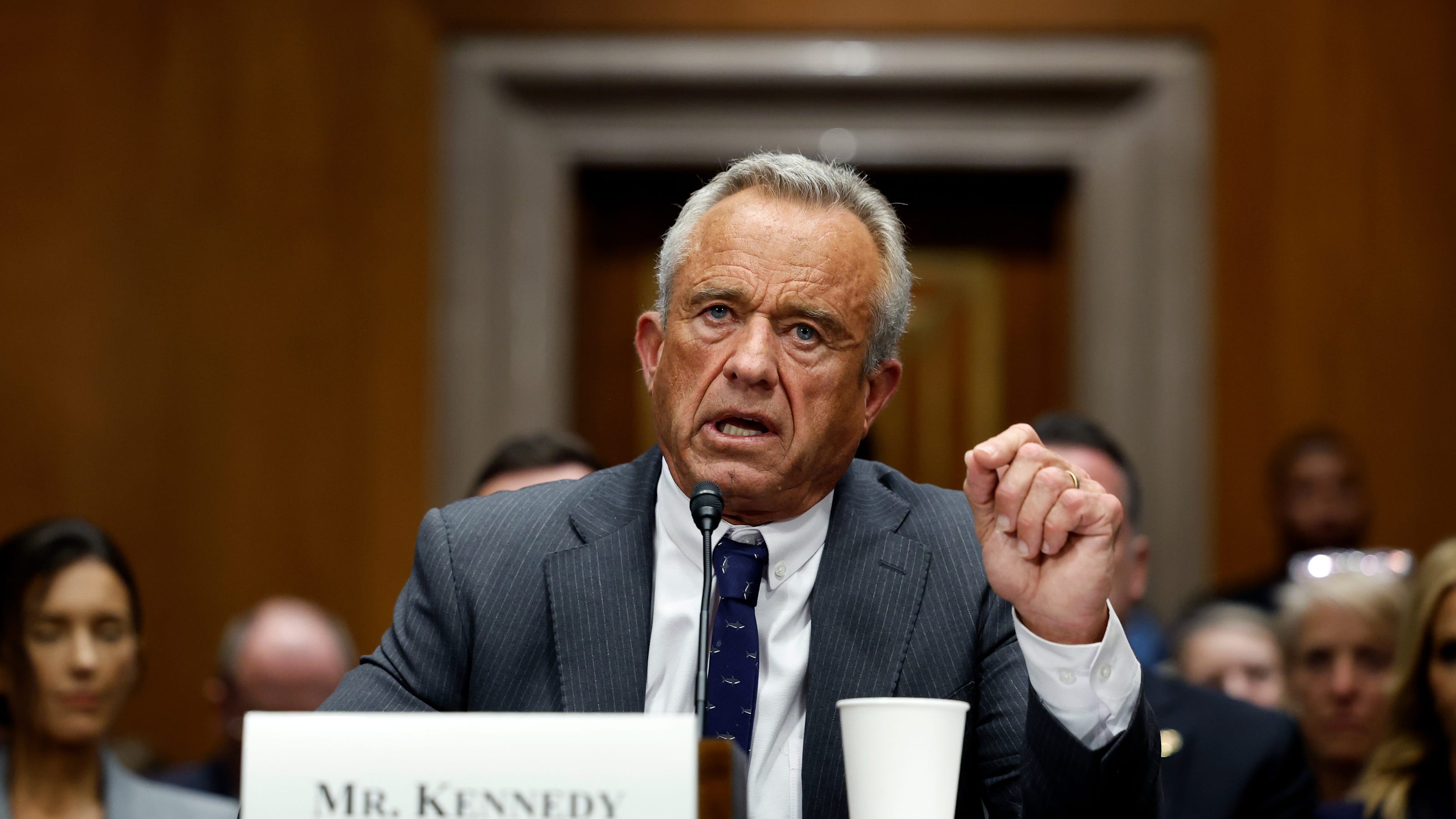

Exclusive Potential Shift In Covid 19 Vaccine Recommendations Under Rfk Jr S Hhs

May 17, 2025

Exclusive Potential Shift In Covid 19 Vaccine Recommendations Under Rfk Jr S Hhs

May 17, 2025 -

Barcelona Espanyol Match 13 Injured After Car Drives Into Crowd

May 17, 2025

Barcelona Espanyol Match 13 Injured After Car Drives Into Crowd

May 17, 2025 -

Microsofts Strategic Changes Impact On The Surface Product Line

May 17, 2025

Microsofts Strategic Changes Impact On The Surface Product Line

May 17, 2025

Latest Posts

-

Tragedia Onibus Universitario Se Envolve Em Grave Acidente

May 17, 2025

Tragedia Onibus Universitario Se Envolve Em Grave Acidente

May 17, 2025 -

Missouri State Board Of Education Welcomes Former Springfield Councilman

May 17, 2025

Missouri State Board Of Education Welcomes Former Springfield Councilman

May 17, 2025 -

Acidente De Onibus Universitario Deixa Mortos E Feridos

May 17, 2025

Acidente De Onibus Universitario Deixa Mortos E Feridos

May 17, 2025 -

Acidente Com Onibus Universitario Numero De Vitimas Ainda Nao Confirmado

May 17, 2025

Acidente Com Onibus Universitario Numero De Vitimas Ainda Nao Confirmado

May 17, 2025 -

Davenport City Council Greenlights Apartment Building Demolition

May 17, 2025

Davenport City Council Greenlights Apartment Building Demolition

May 17, 2025