Stock Market Valuations: BofA's Case For Investor Calm

Table of Contents

BofA's Key Arguments for a Measured Approach to Stock Market Valuations

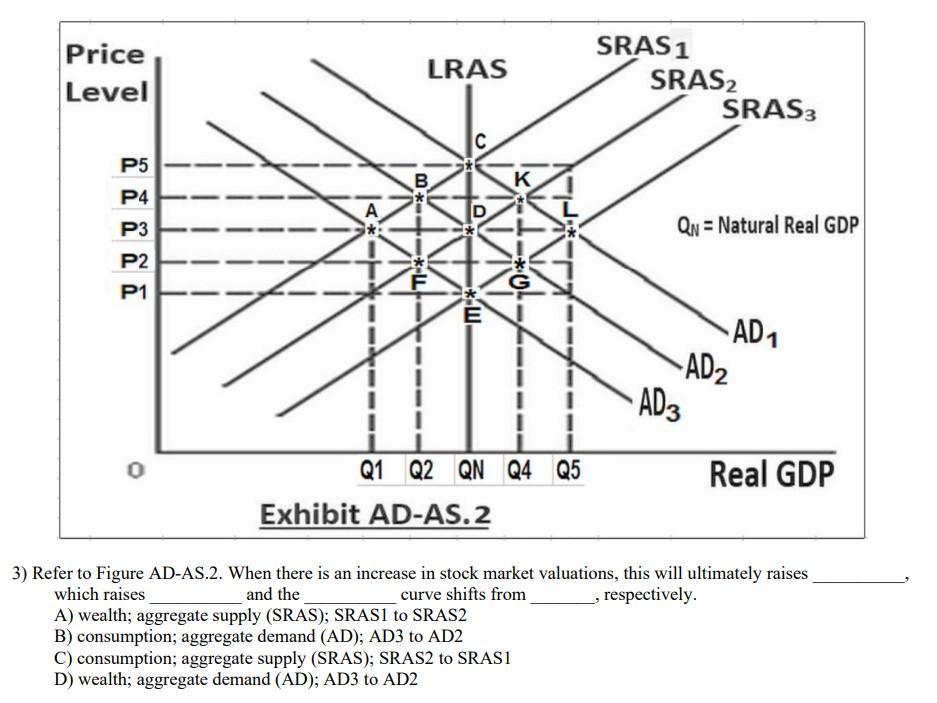

BofA's assessment of the current stock market landscape rests on several pillars, suggesting that while caution is warranted, panic is unwarranted. Their analysis considers a multitude of factors, leading them to advocate for a measured, rather than reactive, investment strategy.

Moderating Inflation and Interest Rate Expectations

A key component of BofA's argument centers on the moderating pace of inflation and the potential impact on interest rate hikes. The bank's analysts believe that the aggressive interest rate increases implemented by central banks are starting to yield positive results, leading to a cooling of inflationary pressures.

- BofA's Forecasts: BofA projects a gradual decline in inflation throughout the remainder of the year and into 2024, forecasting a rate closer to the central bank's target. Their models incorporate various economic indicators, including consumer price indices (CPI) and producer price indices (PPI).

- Impact on Earnings Growth: This moderation in inflation is expected to positively influence future earnings growth projections for corporations. Reduced inflationary pressures translate to lower input costs for businesses, potentially boosting profit margins.

- Data and Models: BofA's analysis relies on a combination of econometric models, historical data analysis, and insights from their extensive network of industry experts to support their claims. Their forecasts aren't predictions set in stone, but rather probabilistic assessments based on currently available data.

Strong Corporate Earnings and Profitability

Despite macroeconomic headwinds, BofA highlights the resilience and robust performance of many corporations. Their analysis reveals that corporate earnings remain surprisingly strong, exceeding expectations in several key sectors.

- Strong-Performing Sectors: BofA identifies sectors like technology, healthcare, and select consumer staples as displaying notable strength in earnings, despite broader economic anxieties. These sectors demonstrate an ability to weather economic downturns more effectively.

- Future Earnings Growth Projections: BofA's projections for future earnings growth remain relatively positive, suggesting that companies are successfully navigating challenges and maintaining a solid foundation for profitability. These projections are carefully calibrated based on their assessment of future demand, cost structures, and overall economic conditions.

- Impact on Market Valuations: The robust performance of corporate earnings provides a strong underpinning for current market valuations, suggesting that many stocks are fairly valued or even undervalued, depending on the specific sector and company.

Valuation Metrics Suggesting Fair or Undervalued Sectors

BofA's assessment utilizes a range of valuation metrics, including price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and other relevant metrics, to evaluate the attractiveness of various sectors and individual stocks.

- Undervalued Sectors: Based on their analysis, BofA identifies certain sectors as potentially undervalued relative to their historical averages and future growth prospects. This indicates potential opportunities for investors willing to take a long-term perspective.

- Comparison to Historical Averages: By comparing current valuations to historical averages, BofA provides context and helps investors determine whether current prices reflect fair value or represent a buying opportunity.

- Limitations of Valuation Metrics: BofA acknowledges the limitations of relying solely on valuation metrics. They emphasize the importance of considering qualitative factors, such as management quality, competitive landscape, and technological innovation, when making investment decisions.

Long-Term Growth Potential and Technological Innovation

BofA's outlook is not solely focused on short-term market fluctuations. Their analysis emphasizes the long-term growth potential of the economy and specific sectors fueled by technological advancements.

- Impact of Technological Advancements: BofA highlights the transformative impact of technological advancements like artificial intelligence (AI), cloud computing, and biotechnology on future market growth. These technologies are creating new industries and disrupting existing ones, presenting significant investment opportunities.

- Technological Trends: The bank's analysts identify specific technological trends likely to drive significant growth over the next decade, providing investors with a framework for identifying promising investment avenues.

- Long-Term Implications: BofA emphasizes the importance of taking a long-term perspective when evaluating stock market valuations. Short-term volatility should not overshadow the substantial long-term growth potential presented by technological innovation and a generally positive global economic outlook.

Addressing Counterarguments and Potential Risks

While BofA presents a relatively optimistic outlook, they acknowledge potential risks and counterarguments that could impact stock market valuations.

Geopolitical Uncertainty and its Impact on Stock Market Valuations

Geopolitical instability remains a significant concern, potentially impacting market valuations.

- Specific Geopolitical Risks: BofA, like other analysts, identifies various geopolitical risks, such as escalating conflicts, trade tensions, and political instability in key regions, as potential threats to market stability.

- Factoring in Geopolitical Risks: BofA incorporates these risks into their overall assessment by assigning probabilities to various scenarios and adjusting their valuations accordingly. This approach acknowledges uncertainty and attempts to quantify its potential impact.

- Mitigation Strategies: Investors can mitigate the impact of geopolitical risks through diversification, hedging strategies, and a thorough understanding of the potential implications of global events on their investment portfolios.

Recessionary Concerns and Their Influence on Stock Market Valuations

The specter of a potential recession remains a significant concern for investors.

- BofA's Recessionary Scenarios: BofA analyzes various recessionary scenarios, assessing the probability and potential severity of an economic downturn. Their analysis incorporates macroeconomic indicators and historical data to arrive at their probabilities.

- Impact on Valuation Estimates: BofA incorporates their recessionary scenarios into their stock market valuation estimates, providing a range of potential outcomes rather than a single point forecast. This acknowledges uncertainty and allows for a more nuanced understanding of the potential risks.

- Navigating a Recession: Strategies for navigating a potential recession include increasing portfolio diversification, focusing on defensive assets, and maintaining sufficient liquidity to weather potential market downturns.

Conclusion

BofA's analysis suggests that while market volatility is understandable given recent events and global uncertainty, current stock market valuations don't necessarily signal an impending crash. Their assessment, which takes into account moderating inflation, strong corporate earnings, and long-term growth potential, points towards a measured approach. While risks, such as geopolitical uncertainty and recessionary concerns, remain, a balanced perspective, considering both opportunities and potential downsides, is warranted. The key takeaway is that a knee-jerk reaction based solely on short-term market fluctuations can be detrimental to long-term investment success.

Call to Action: Understanding stock market valuations is crucial for making informed investment decisions. Learn more about BofA's insights and develop a robust investment strategy tailored to your risk tolerance. Don't let market fluctuations dictate your long-term approach to stock market valuations. Conduct thorough research, diversify your portfolio, and consult with a financial advisor to make informed decisions about your investments.

Featured Posts

-

Revolutionizing Voice Assistant Development Open Ais Latest Tools

May 10, 2025

Revolutionizing Voice Assistant Development Open Ais Latest Tools

May 10, 2025 -

Solve Nyt Strands Game 354 Hints For Thursday February 20

May 10, 2025

Solve Nyt Strands Game 354 Hints For Thursday February 20

May 10, 2025 -

Luis Enriques Psg Transformation How They Won The Ligue 1 Title

May 10, 2025

Luis Enriques Psg Transformation How They Won The Ligue 1 Title

May 10, 2025 -

Nyt Strands Hints And Answers Thursday February 20 Game 354

May 10, 2025

Nyt Strands Hints And Answers Thursday February 20 Game 354

May 10, 2025 -

Warren Buffetts Legacy Examining The Canadian Billionaire Successor

May 10, 2025

Warren Buffetts Legacy Examining The Canadian Billionaire Successor

May 10, 2025