Stock Market Valuations: BofA's Reassurance For Investors

Table of Contents

BofA's Key Arguments for Moderate Valuations

BofA's analysis of current stock market valuations focuses on several key factors, offering a more nuanced view than simply looking at headline P/E ratios. They encourage investors to look beyond the surface and consider the broader economic picture.

Focus on Earnings Growth

BofA emphasizes the crucial role of future earnings growth in justifying current stock prices. They argue that simply looking at current valuations without considering projected earnings growth paints an incomplete picture.

- Strong Earnings Growth Sectors: BofA highlights sectors like technology, particularly artificial intelligence and cloud computing, and certain segments of the healthcare industry as poised for significant earnings growth in the coming years. These sectors are expected to drive overall market expansion.

- Innovation as a Growth Driver: The firm emphasizes the role of continued innovation and technological advancements as key catalysts for future corporate profits. This includes advancements in areas such as renewable energy, biotechnology, and automation.

- Interest Rate Impact: BofA acknowledges the impact of interest rate hikes on earnings growth projections. While higher rates can increase borrowing costs, potentially slowing growth, the firm believes that the overall impact will be manageable for many strong companies, especially those with healthy balance sheets. They point to selective opportunities even in a higher-rate environment.

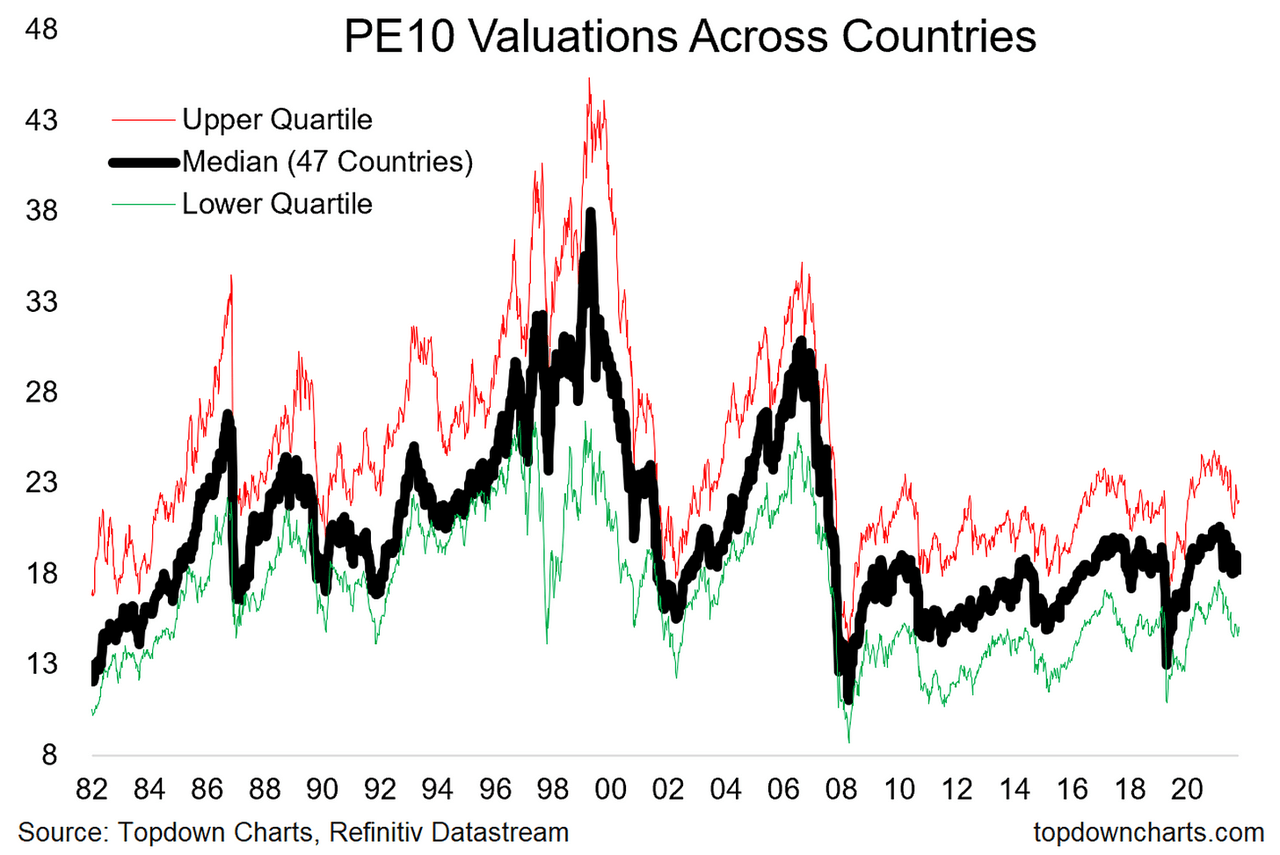

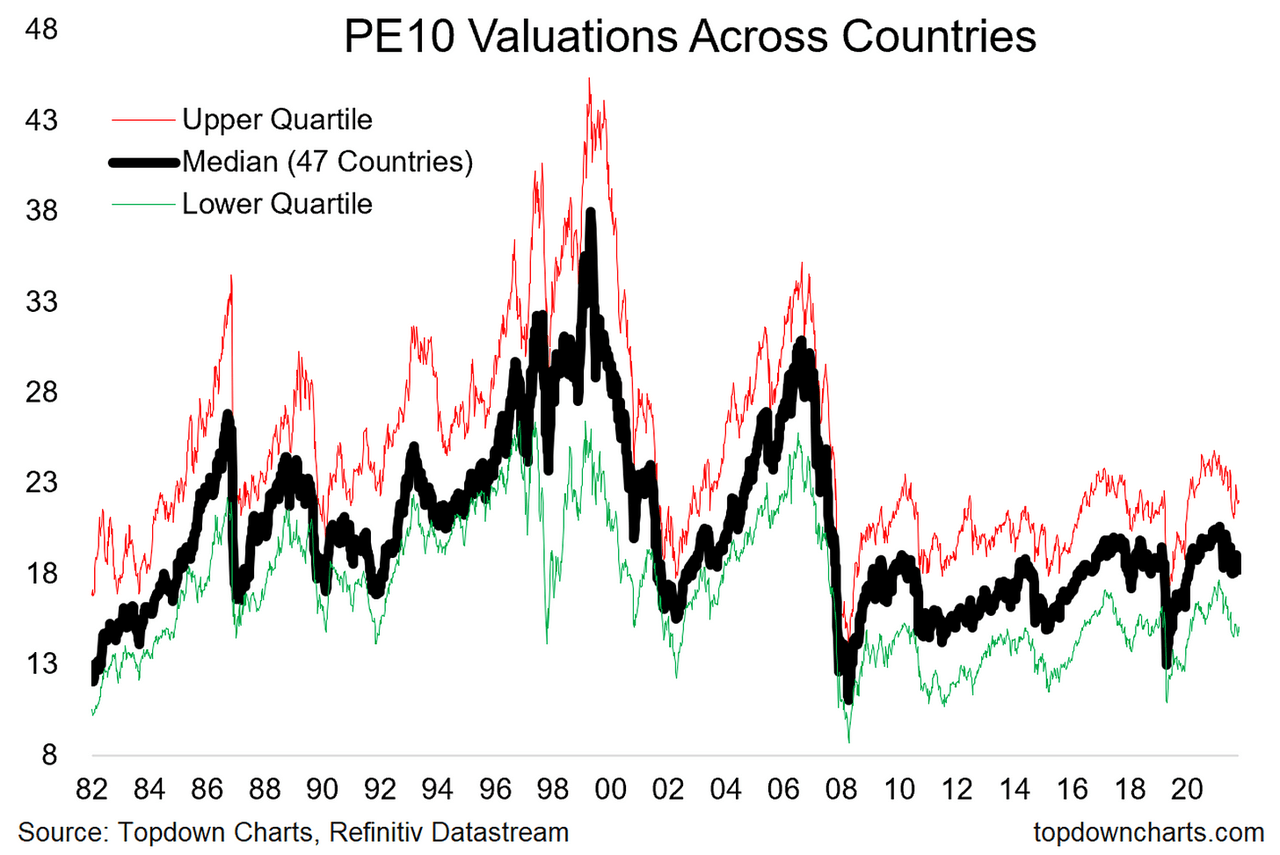

Comparison to Historical Valuations

BofA's analysis frequently involves comparing current equity valuations to historical averages. This helps put current market conditions in perspective. They argue that while current valuations may seem high relative to recent history, they aren't unprecedented when considered against a broader historical context.

- Price-to-Earnings Ratio Analysis: BofA likely presents data comparing current P/E ratios to historical averages, showing that while higher than the recent past, these valuations have been higher at other points in history. This long-term perspective helps temper fears of an immediate market crash.

- Factors Influencing Historical Comparisons: Understanding the factors influencing historical valuation comparisons is crucial. Inflation rates, economic growth, and interest rate environments all contribute to historical P/E ratio variations. BofA's analysis accounts for these factors to make a more accurate comparison.

- Past Market Performance: The firm likely highlights periods in the past where valuation levels were similar to the present, showcasing that while corrections can occur, markets have historically recovered and continued to grow.

Sector-Specific Valuations

Recognizing that not all sectors perform equally, BofA’s analysis doesn't offer a blanket assessment of the market. Instead, they identify sectors they believe are relatively undervalued and those that appear overvalued. This allows investors to adopt a more targeted and nuanced investment strategy.

- Undervalued Sectors: Certain value-oriented sectors, particularly those with strong fundamentals and less sensitivity to interest rate changes, may be identified as relatively undervalued by BofA.

- Overvalued Sectors: Sectors that have seen significant price increases without commensurate earnings growth may be categorized as overvalued, prompting investors to exercise caution.

- Driving Valuation Differences: BofA likely explains the factors driving these sector-specific valuation differences, providing insights into the underlying fundamentals of each sector.

Addressing Investor Concerns about Volatility

Market volatility is a natural part of investing. BofA's analysis helps investors manage these concerns by providing strategies for navigating uncertainty.

Managing Risk in a Volatile Market

BofA likely emphasizes the importance of managing risk in a volatile market, highlighting strategies that can help investors protect their portfolios.

- Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial for mitigating risk. A well-diversified portfolio is better equipped to weather market downturns.

- Long-Term Investment Horizon: BofA likely advocates for a long-term investment horizon, emphasizing that short-term market fluctuations are less impactful on long-term investment goals.

- Risk Tolerance: Understanding and accepting your own risk tolerance is crucial in making informed investment decisions. BofA's advice likely emphasizes aligning your investment strategy with your individual risk profile.

The Importance of Long-Term Investing

BofA reinforces the importance of maintaining a long-term perspective. They caution against making emotional decisions based on short-term market movements.

- Long-Term Benefits: Staying invested over the long term allows investors to benefit from the power of compounding and ride out short-term market corrections.

- Emotional Decision-Making: The firm stresses the negative impact of emotional decision-making, such as panic selling during market downturns, which can significantly hurt long-term returns.

- Historical Market Recoveries: BofA likely points to historical examples of market downturns followed by significant recoveries, reassuring investors that market corrections are a normal part of the investment cycle.

Conclusion

BofA's assessment of stock market valuations provides a measure of reassurance for investors concerned about recent market volatility. By focusing on future earnings growth, comparing current valuations to historical data, and offering sector-specific insights, BofA provides a valuable framework for navigating uncertainty. While risk remains inherent in any investment, understanding BofA's perspective can enable investors to make more informed decisions and build a robust, long-term investment strategy. Don't let short-term market fluctuations derail your long-term financial goals; carefully consider BofA's analysis of current stock market valuations and develop a plan that aligns with your risk tolerance and financial objectives. Learn more about effectively managing your portfolio in light of current stock market valuations and make informed investment decisions today.

Featured Posts

-

Lets Talk John Wick 5 Is The Hype Justified

May 12, 2025

Lets Talk John Wick 5 Is The Hype Justified

May 12, 2025 -

The Great Gatsby Identifying The Men Who Shaped The Novels Characters

May 12, 2025

The Great Gatsby Identifying The Men Who Shaped The Novels Characters

May 12, 2025 -

Legal Action Marjolein Faber Responds To Altered Image At Protest

May 12, 2025

Legal Action Marjolein Faber Responds To Altered Image At Protest

May 12, 2025 -

Scenes De Menages Gerard Hernandez Parle De Son Association Avec Chantal Ladesou

May 12, 2025

Scenes De Menages Gerard Hernandez Parle De Son Association Avec Chantal Ladesou

May 12, 2025 -

John Wick 5 A Franchise In Need Of A Break

May 12, 2025

John Wick 5 A Franchise In Need Of A Break

May 12, 2025

Latest Posts

-

Cerita Sby Pendekatan Tanpa Menggurui Dalam Krisis Myanmar

May 13, 2025

Cerita Sby Pendekatan Tanpa Menggurui Dalam Krisis Myanmar

May 13, 2025 -

Manila School Closures A Result Of Extreme Heat

May 13, 2025

Manila School Closures A Result Of Extreme Heat

May 13, 2025 -

Extreme Heat Wave Prompts School Closures In Major Philippine City

May 13, 2025

Extreme Heat Wave Prompts School Closures In Major Philippine City

May 13, 2025 -

Schools In Manila Close Amidst Dangerous Heat

May 13, 2025

Schools In Manila Close Amidst Dangerous Heat

May 13, 2025 -

Half Of Manilas Schools Closed Amidst Intense Heat Wave

May 13, 2025

Half Of Manilas Schools Closed Amidst Intense Heat Wave

May 13, 2025