Stock Market Valuations: BofA's Reassuring Analysis For Investors

Table of Contents

BofA's Methodology: How They Arrived at Their Conclusions

BofA's valuation analysis is a complex process, employing a combination of established models and incorporating current market dynamics. Their conclusions aren't based on gut feeling but on rigorous quantitative analysis. They utilize a multifaceted approach that considers both absolute and relative valuations.

-

Detailed explanation of the Price-to-Earnings (P/E) ratio analysis: BofA likely uses the P/E ratio, a classic valuation metric comparing a company's stock price to its earnings per share. A high P/E ratio might suggest overvaluation, while a low P/E might indicate undervaluation. However, they likely account for variations in P/E ratios across different sectors and growth stages. They might also look at forward P/E ratios (based on projected earnings) in addition to trailing P/E ratios (based on past earnings).

-

Discussion of the role of interest rates in their valuation models: Interest rates significantly impact stock valuations. Higher interest rates generally lead to lower valuations because they increase the opportunity cost of investing in stocks. BofA’s models likely incorporate projections of future interest rate changes and their effect on discounted cash flow analysis.

-

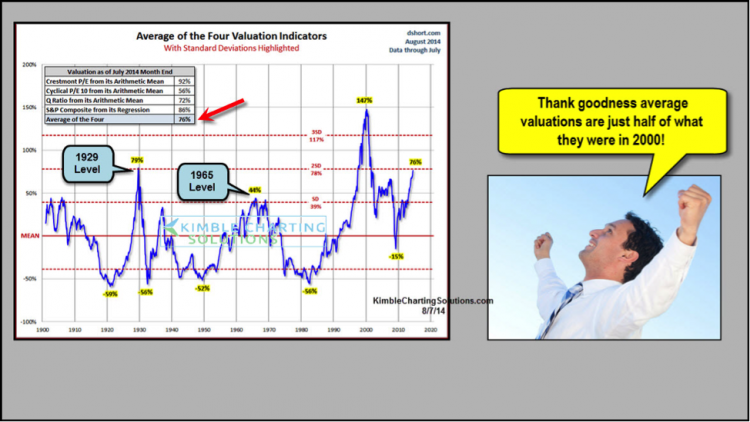

Mention of any other key valuation metrics used (e.g., PEG ratio, Shiller P/E): Beyond P/E ratios, BofA likely considers other metrics. The Price/Earnings to Growth (PEG) ratio adjusts the P/E ratio for a company's growth rate, offering a more nuanced view. The Shiller P/E (CAPE ratio), which uses 10-year average inflation-adjusted earnings, provides a longer-term perspective on valuation, smoothing out short-term earnings fluctuations. These diverse metrics offer a more comprehensive picture than relying on any single indicator.

Key Findings: What BofA's Analysis Reveals About Current Market Valuations

BofA's report concludes that, while not necessarily cheap, current market valuations aren't excessively high, defying some prevailing anxieties. This is particularly relevant considering recent market volatility. The analysis likely highlights a more nuanced picture than overly simplistic narratives.

-

Specific valuation figures reported by BofA: While specific numbers may vary depending on the report, BofA likely provided quantitative data on key valuation metrics. These figures would be compared against historical averages and industry benchmarks.

-

Comparison to historical valuations: The report likely places current valuations within a historical context. Comparing current P/E ratios or CAPE ratios to their long-term averages offers perspective on whether the market is currently expensive, cheap, or somewhere in between.

-

Identification of sectors deemed undervalued or overvalued: BofA's analysis likely identifies specific sectors showing signs of either undervaluation or overvaluation. This sector-specific analysis allows investors to make more informed choices about portfolio allocation.

Factors Contributing to BofA's Positive Outlook

BofA's positive outlook isn't formed in a vacuum. Their analysis takes into account several crucial macroeconomic and corporate factors.

-

Impact of potential recessionary scenarios on valuations: BofA’s analysis likely accounts for the possibility of a recession and its impact on corporate earnings and valuations. This would involve stress testing their models under various economic scenarios.

-

Role of technological advancements in shaping market valuations: The rapid pace of technological change significantly impacts valuations. BofA likely considers the potential for innovation to drive future earnings growth, particularly in technology-related sectors.

-

Analysis of the impact of geopolitical events: Geopolitical uncertainty creates volatility. BofA’s analysis likely assesses the impact of potential risks, like international conflicts or trade wars, and how these events could affect stock valuations. The analysis likely incorporates contingency planning and various scenarios.

Implications for Investors: How to Interpret BofA's Analysis

BofA's analysis provides a useful framework for investors, but doesn't provide a crystal ball. It's crucial to understand the context and implications for your own investment strategy.

-

Recommendations for long-term investors: For long-term investors, BofA’s relatively positive assessment could be reassuring. It might support a continued investment approach focusing on diversified, high-quality holdings.

-

Advice for investors with shorter-term horizons: For those with shorter time horizons, the analysis might suggest caution. While the market might not be drastically overvalued, short-term volatility remains a concern. Diversification and risk management strategies are key.

-

Strategies for mitigating risk in the current market: Regardless of your investment horizon, risk management remains crucial. Diversification across asset classes, regular portfolio rebalancing, and a well-defined risk tolerance are vital steps.

Identifying Undervalued Opportunities

BofA's analysis may highlight specific sectors or asset classes that appear undervalued. This presents opportunities for astute investors. However, thorough due diligence is crucial before acting on these insights. For example, specific undervalued sectors or individual stocks identified in the report might be compelling investment targets.

Conclusion

BofA's analysis offers a reassuring perspective on current stock market valuations, suggesting that despite recent volatility, the market isn't excessively overvalued. Their positive outlook is supported by a careful consideration of macroeconomic factors, corporate earnings, and various valuation metrics. However, remember that the stock market is inherently unpredictable. While this analysis provides valuable insight, remember that thorough due diligence is crucial before making any investment decisions. Learn more about understanding stock market valuations and stay informed about the latest market analyses to make well-informed choices for your investment portfolio. Conduct your own research and consider consulting a financial advisor before making any significant investment decisions. Remember, understanding stock market valuations is an ongoing process requiring vigilance and informed decision-making.

Featured Posts

-

Eleven Years Later Assessing The Enduring Influence Of High Potential

May 09, 2025

Eleven Years Later Assessing The Enduring Influence Of High Potential

May 09, 2025 -

Gen Z And Smartphones Why Androids Redesign Might Not Be Enough

May 09, 2025

Gen Z And Smartphones Why Androids Redesign Might Not Be Enough

May 09, 2025 -

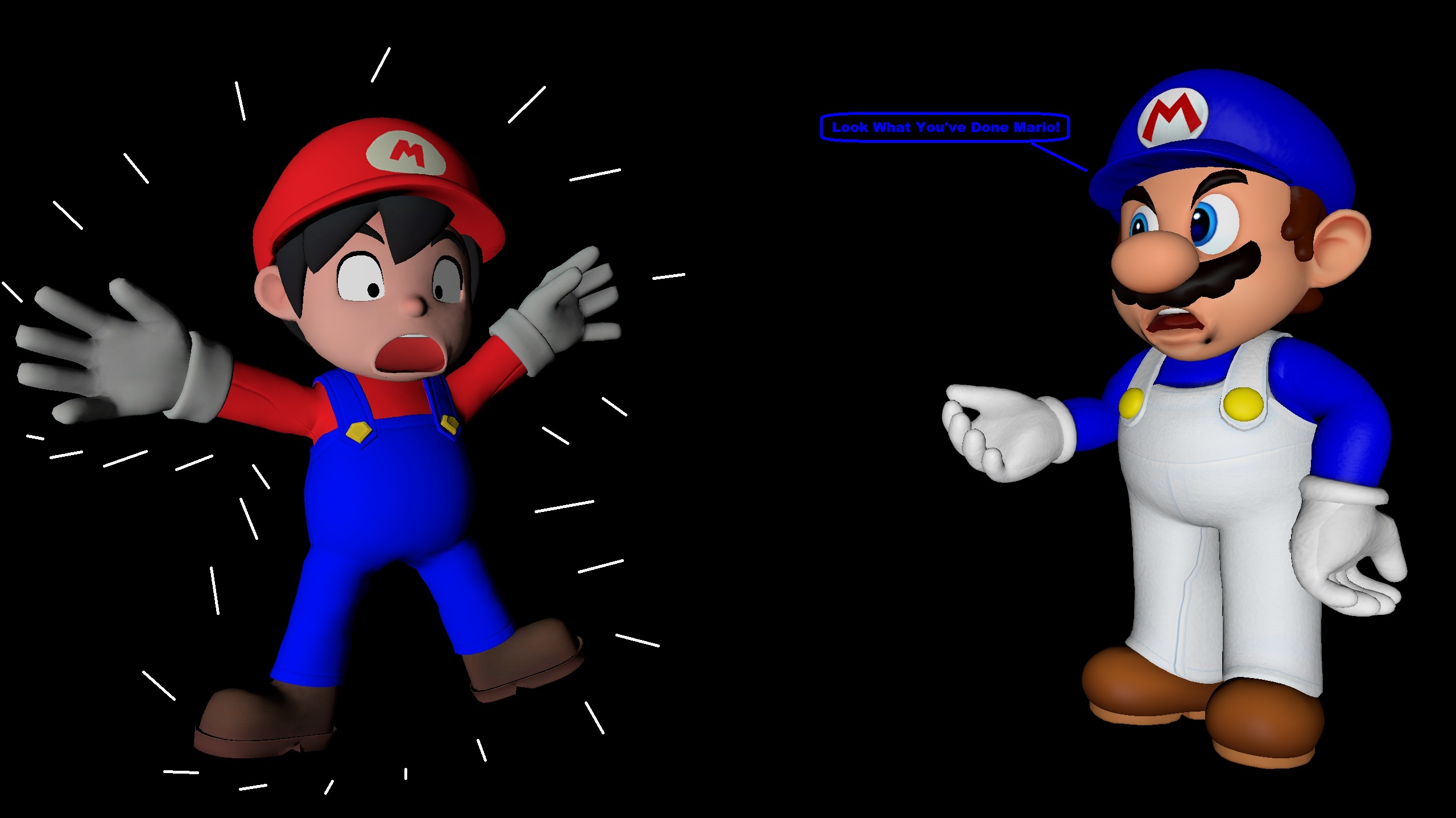

China Market Analysis The Struggles Of Bmw Porsche And Other Foreign Auto Brands

May 09, 2025

China Market Analysis The Struggles Of Bmw Porsche And Other Foreign Auto Brands

May 09, 2025 -

Nyt Spelling Bee April 6 2025 Find The Pangram And All Words

May 09, 2025

Nyt Spelling Bee April 6 2025 Find The Pangram And All Words

May 09, 2025 -

14 Edmonton School Projects Get Green Light Minister Promises Speedy Completion

May 09, 2025

14 Edmonton School Projects Get Green Light Minister Promises Speedy Completion

May 09, 2025