Stock Market Valuations: Why BofA Thinks Investors Shouldn't Panic

Table of Contents

BofA's Rationale for a Cautiously Optimistic Outlook

BofA's cautiously optimistic outlook on stock market valuations isn't based on blind faith; it stems from a thorough analysis of several key factors. Their perspective emphasizes a long-term view, acknowledging short-term volatility as a natural part of the market cycle.

Considering the Long-Term Perspective

BofA's analysis likely emphasizes the historical context of market fluctuations, highlighting that periods of volatility are normal parts of the economic cycle. Panicking during these times is often counterproductive.

- Comparison to past market corrections and subsequent recoveries: History shows that even significant market downturns, like the dot-com bubble burst or the 2008 financial crisis, have ultimately been followed by periods of substantial growth. Examining these past events provides valuable perspective. Analyzing the recovery periods helps investors understand the resilience of the market.

- Emphasis on the long-term growth potential of the underlying economy: BofA likely points to long-term economic fundamentals, such as population growth, technological innovation, and productivity improvements, as drivers of future market growth. These factors contribute to sustained increases in corporate earnings and overall market value.

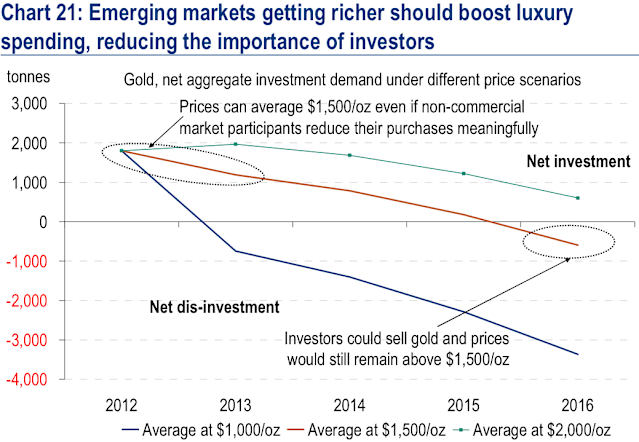

- Data showcasing the resilience of the market over extended timeframes: Presenting data that demonstrates the market's long-term upward trend, even considering short-term corrections, helps reinforce the message of patience and long-term perspective. This data can include charts and graphs showing historical market performance over decades.

Analyzing Current Interest Rates and Inflation

BofA's assessment probably factors in the impact of interest rates and inflation on stock valuations. These macroeconomic factors significantly influence investor behavior and corporate profitability.

- Discussion of the Federal Reserve's monetary policy and its potential effects on market performance: The Federal Reserve's actions, such as interest rate hikes or quantitative easing, directly impact borrowing costs and overall market liquidity. Understanding the Fed's policy is critical for assessing its influence on stock valuations.

- Analysis of inflation's influence on corporate earnings and investor sentiment: High inflation erodes purchasing power and can impact corporate profit margins. BofA's analysis likely includes an assessment of how inflation is currently affecting corporate earnings and investor confidence. This impacts the perceived value of future earnings and influences discount rates applied to valuation models.

- Examination of the relationship between interest rates and discount rates used in valuation models: Higher interest rates generally lead to higher discount rates used in valuation models, making future earnings seem less valuable in present terms. BofA’s analysis likely incorporates these relationships. Understanding this dynamic is important for comprehending how changes in interest rates affect stock prices.

Key Factors Influencing Stock Market Valuations

Understanding the factors driving stock market valuations is crucial for investors. BofA's analysis likely focuses on several key areas.

Earnings Growth Projections

Future corporate earnings growth is a primary driver of stock valuations. BofA's predictions in this area are critical to their overall outlook.

- Analysis of industry-specific growth forecasts: Different sectors exhibit varying growth trajectories. BofA's analysis likely includes a breakdown of earnings growth projections across various industries, considering factors like technological disruption and regulatory changes.

- Discussion of the impact of technological advancements and innovation: Technological innovation can significantly influence corporate earnings, creating new opportunities and disrupting existing industries. BofA likely highlights the role of technology in driving future earnings growth.

- Considerations of geopolitical risks and their influence on corporate earnings: Geopolitical events, such as trade wars or international conflicts, can have a significant impact on corporate earnings and stock valuations. BofA's assessment likely considers these risks.

The Role of Investor Sentiment

Investor psychology plays a significant role in determining stock market valuations. Market sentiment can create short-term price swings independent of fundamental factors.

- Explanation of how fear and greed can impact stock prices: These powerful emotions drive market behavior, leading to overreactions to both good and bad news. Understanding this psychological aspect is critical for rational investment decision-making.

- Analysis of market sentiment indicators: Various indicators, such as the VIX (volatility index) or investor surveys, provide insights into current market sentiment. BofA likely considers these indicators in its analysis.

- Discussion on the influence of media coverage and market narratives: Media narratives and market commentary can influence investor sentiment, sometimes leading to irrational market behavior. BofA's perspective probably accounts for this influence.

Strategies for Navigating Current Stock Market Valuations

Even with a cautiously optimistic outlook, managing risk is crucial. BofA likely advocates for a well-defined investment strategy.

Diversification as a Risk Mitigation Strategy

Diversification is a cornerstone of sound investment strategy. Spreading investments across different asset classes reduces overall portfolio risk.

- Examples of diversifying investments (bonds, real estate, etc.): Diversification extends beyond just stocks; including bonds, real estate, and other asset classes helps cushion against losses in any single sector.

- Importance of matching investment time horizon with asset class risk: Longer-term investors can tolerate more risk than those with shorter time horizons. Asset allocation should reflect this time horizon.

- Benefits of strategic asset allocation: A well-defined asset allocation strategy aligns risk tolerance with investment goals. This requires careful consideration of individual circumstances and risk appetite.

Long-Term Investing Approach

BofA likely emphasizes the importance of a long-term investment approach to navigate market fluctuations.

- Emphasis on ignoring short-term market noise: Short-term volatility is normal. Focusing on long-term goals helps investors avoid making impulsive decisions based on short-term market fluctuations.

- Advantages of dollar-cost averaging: Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, helps mitigate the risk of investing a lump sum at a market peak.

- Importance of sticking to a well-defined investment plan: A well-defined plan provides a roadmap for investment decisions, helping investors stay disciplined and avoid emotional reactions to market events.

Conclusion

While current stock market valuations may seem high to some, BofA's analysis suggests a more nuanced view. By considering long-term growth prospects, analyzing current economic indicators like interest rates and inflation, and understanding the influence of investor sentiment, a more balanced perspective emerges. This doesn't mean ignoring risks; instead, adopting a diversified portfolio and employing a long-term investment strategy are crucial for navigating the complexities of stock market valuations. Don't let short-term fluctuations derail your financial goals. Continue to monitor stock market valuations and make informed decisions based on sound financial planning. Remember, understanding stock market valuations is key to successful long-term investing.

Featured Posts

-

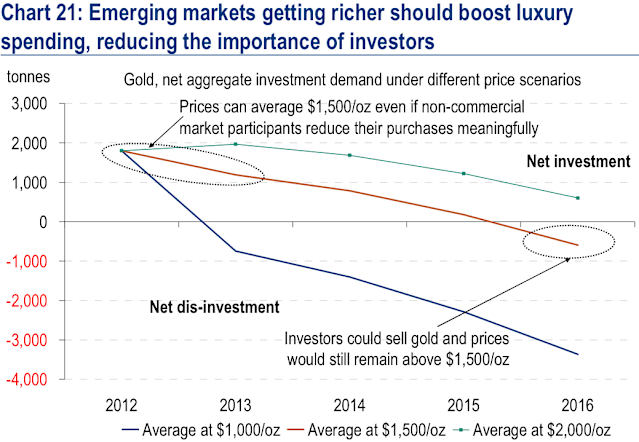

Obstrel Ukrainy Analiz Masshtabnoy Ataki Rf 200 Raket I Dronov

May 16, 2025

Obstrel Ukrainy Analiz Masshtabnoy Ataki Rf 200 Raket I Dronov

May 16, 2025 -

Who Are Carneys Cabinet Picks A Business Perspective

May 16, 2025

Who Are Carneys Cabinet Picks A Business Perspective

May 16, 2025 -

Chandler Simpsons Breakout Game Rays Complete Padres Sweep

May 16, 2025

Chandler Simpsons Breakout Game Rays Complete Padres Sweep

May 16, 2025 -

The Impact Of Forced Military Discharge One Master Sergeants Experience

May 16, 2025

The Impact Of Forced Military Discharge One Master Sergeants Experience

May 16, 2025 -

The Vercel La Liga Dispute Examining The Ethics Of Internet Censorship And Copyright Protection

May 16, 2025

The Vercel La Liga Dispute Examining The Ethics Of Internet Censorship And Copyright Protection

May 16, 2025

Latest Posts

-

Long Shot To La The Story Of Players Name S Dodgers Opportunity

May 16, 2025

Long Shot To La The Story Of Players Name S Dodgers Opportunity

May 16, 2025 -

From Forgotten Prospect To La Dodger Players Name S Journey

May 16, 2025

From Forgotten Prospect To La Dodger Players Name S Journey

May 16, 2025 -

Dodgers Unsung Hero His Path To The Big Leagues In La

May 16, 2025

Dodgers Unsung Hero His Path To The Big Leagues In La

May 16, 2025 -

Predicting The Padres Vs Yankees Series A Look At San Diegos Potential 7 Game Win

May 16, 2025

Predicting The Padres Vs Yankees Series A Look At San Diegos Potential 7 Game Win

May 16, 2025 -

2025 Mlb Season Padres Chances Against The Cubs At Wrigley

May 16, 2025

2025 Mlb Season Padres Chances Against The Cubs At Wrigley

May 16, 2025