Stocks Fall Amid US Fiscal Uncertainty: Market Unease Deepens

Table of Contents

Debt Ceiling Debate and its Market Impact

The current debt ceiling standoff in the US represents a significant threat to the nation's financial stability and is a primary driver of the recent market volatility. The US government's ability to borrow money is capped by the debt ceiling, and if Congress fails to raise it, the country risks defaulting on its debt obligations. This scenario would have catastrophic consequences for the US and the global economy.

- Potential government shutdown scenarios and their market effects: A failure to raise the debt ceiling could lead to a partial or complete government shutdown, halting crucial government services and impacting economic activity. This uncertainty creates fear and instability, causing investors to pull back from the market.

- Impact on investor confidence and risk appetite: The ongoing debt ceiling debate erodes investor confidence, leading to a decreased risk appetite. Investors become hesitant to invest in stocks and other assets perceived as risky, leading to market declines.

- Historical precedents of debt ceiling crises and their market reactions: History offers several examples of debt ceiling crises that caused significant market disruptions. These precedents highlight the potential for severe negative consequences if a resolution isn't reached promptly. Analyzing these past events offers valuable insights into potential future market reactions.

- Analysis of the potential for a downgrade in US credit rating: A failure to address the debt ceiling could result in a downgrade of the US credit rating by major rating agencies. This would increase borrowing costs for the government and could trigger further market turmoil.

Inflationary Pressures and Rising Interest Rates

Persistent inflation continues to be a major headwind for the stock market, exacerbating the effects of US fiscal uncertainty. High inflation forces the Federal Reserve to implement tighter monetary policy, leading to rising interest rates.

- The Federal Reserve's response to inflation and its impact on interest rates: The Fed's aggressive interest rate hikes aim to curb inflation but also increase borrowing costs for businesses and consumers. This slows economic growth and reduces corporate earnings, negatively impacting stock valuations.

- The relationship between interest rates and stock valuations: Higher interest rates make bonds more attractive relative to stocks, diverting investment away from equities. This shift in investor preference contributes to lower stock prices.

- How rising interest rates affect borrowing costs for businesses and consumers: Increased borrowing costs make it more expensive for businesses to invest and expand, and for consumers to borrow money for purchases. This dampens economic activity and negatively impacts corporate profits.

- The impact of inflation on consumer spending and economic growth: High inflation erodes purchasing power, leading to reduced consumer spending. This decrease in demand can slow down economic growth and further negatively impact the stock market.

Geopolitical Risks and Global Market Uncertainty

Geopolitical instability further complicates the market outlook, adding another layer of uncertainty to the already challenging environment created by US fiscal uncertainty.

- The ongoing war in Ukraine and its impact on energy prices and global supply chains: The war in Ukraine has significantly disrupted global energy markets and supply chains, leading to higher energy prices and inflationary pressures.

- Tensions between the US and China and their effect on trade and investment: Strained US-China relations create uncertainty in global trade and investment flows, further affecting market sentiment.

- Other geopolitical factors influencing investor sentiment: Political instability in other regions of the world contributes to overall market anxiety and risk aversion, exacerbating the negative impact of US fiscal uncertainty.

Sector-Specific Impacts of US Fiscal Uncertainty

US fiscal uncertainty doesn't impact all sectors equally. Some are more vulnerable than others.

- Impact on technology stocks (growth vs. value): High-growth technology stocks, often valued based on future earnings, are particularly sensitive to rising interest rates, while value stocks may prove more resilient.

- Effects on energy and commodity markets: Energy and commodity prices are influenced by geopolitical events and inflation, leading to volatility in these sectors.

- Consequences for the financial sector: Banks and financial institutions are directly affected by interest rate changes and the overall economic climate.

- Impact on consumer discretionary spending: Rising interest rates and inflation reduce consumer spending on discretionary items, impacting companies in this sector.

Conclusion

The recent stock market decline is a direct result of the confluence of several factors, most notably the ongoing US fiscal uncertainty stemming from the debt ceiling debate. Coupled with persistent inflationary pressures, rising interest rates, and global geopolitical risks, investor confidence is significantly weakened, leading to increased market volatility. The near-term outlook remains cautious, with the resolution of the debt ceiling crisis being paramount to restoring market stability. Stay informed about developments surrounding US fiscal uncertainty and its potential impact on your investments. Regularly monitor market trends and consider diversifying your portfolio to mitigate risks associated with US fiscal uncertainty and its various related economic challenges.

Featured Posts

-

Big Rig Rock Report 3 12 Key Updates From 98 5 The Fox

May 23, 2025

Big Rig Rock Report 3 12 Key Updates From 98 5 The Fox

May 23, 2025 -

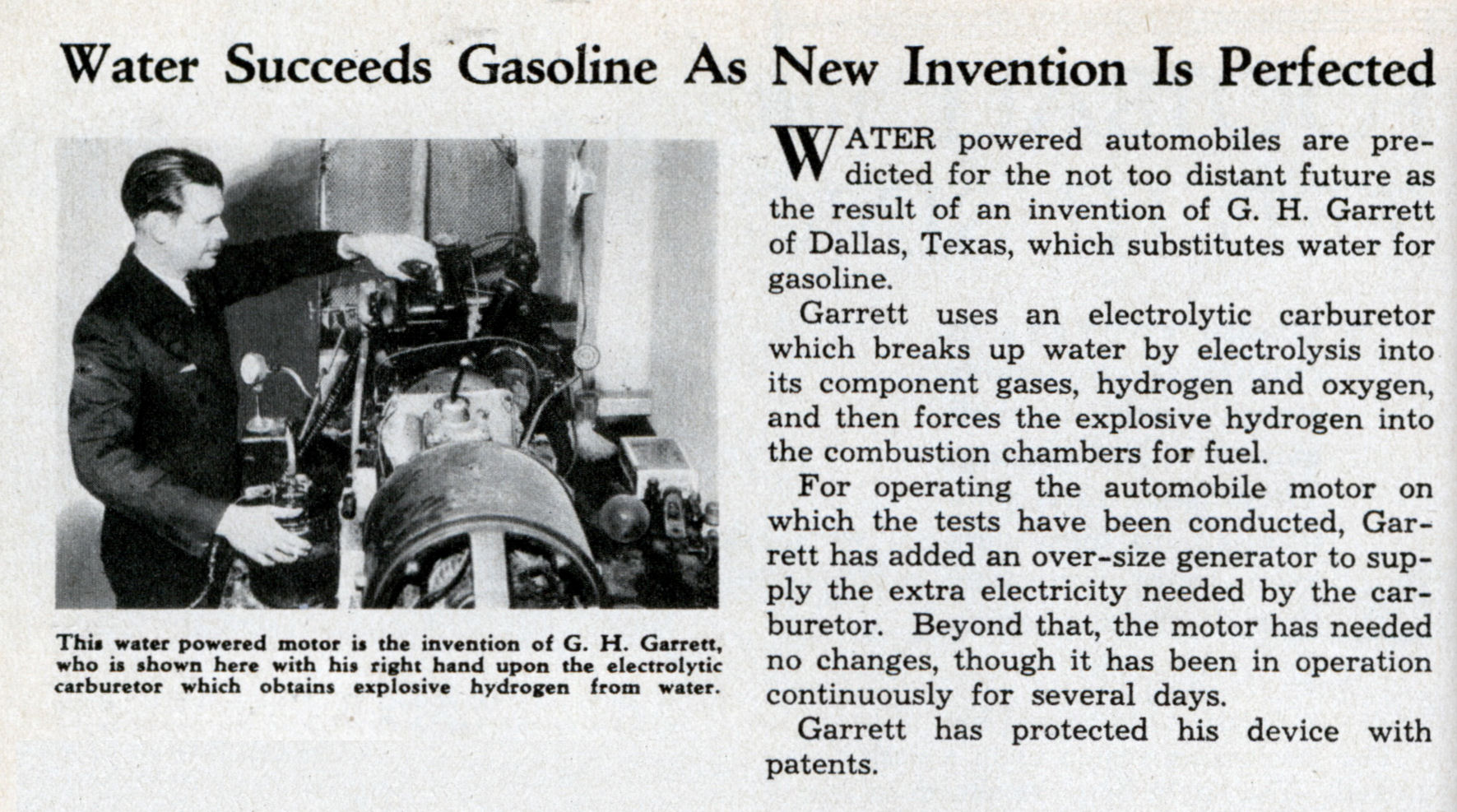

Cientificos Britanicos Crean Motor De Combustion Con Tecnologia De Agua

May 23, 2025

Cientificos Britanicos Crean Motor De Combustion Con Tecnologia De Agua

May 23, 2025 -

Movies To Watch Before They Leave Hulu This Month

May 23, 2025

Movies To Watch Before They Leave Hulu This Month

May 23, 2025 -

The One Percent Budget Crisis How Clintons Veto Threats Shaped Policy

May 23, 2025

The One Percent Budget Crisis How Clintons Veto Threats Shaped Policy

May 23, 2025 -

Tour De France 2027 Grand Depart From Edinburgh Scotland

May 23, 2025

Tour De France 2027 Grand Depart From Edinburgh Scotland

May 23, 2025

Latest Posts

-

16 Mart Burc Yorumu Kisilik Analizi Ve Oezellikleri

May 23, 2025

16 Mart Burc Yorumu Kisilik Analizi Ve Oezellikleri

May 23, 2025 -

Mz

May 23, 2025

Mz

May 23, 2025 -

Balik Burcu 16 Mart Dogum Tarihi Oezellikleri

May 23, 2025

Balik Burcu 16 Mart Dogum Tarihi Oezellikleri

May 23, 2025 -

16 Martta Dogmus Olanlarin Burcu Balik Burcu Oezellikleri

May 23, 2025

16 Martta Dogmus Olanlarin Burcu Balik Burcu Oezellikleri

May 23, 2025 -

Mz 12

May 23, 2025

Mz 12

May 23, 2025