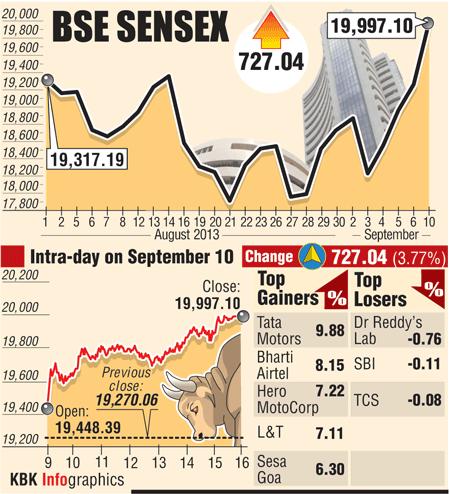

Stocks Surge On BSE: Sensex Rises, Top Gainers Revealed

Table of Contents

The BSE Sensex experienced a dramatic surge today, soaring by an impressive 2.5%—a significant bullish signal for the Indian stock market. This remarkable increase follows a period of relatively stable growth and can be attributed to a confluence of factors, including positive economic indicators and robust global market trends. This article delves into the details of today's trading activity on the BSE, identifying the top-performing sectors and individual stocks, and analyzing the potential contributing factors behind this impressive "Sensex rise." We'll explore the "market surge" and pinpoint the "top gainers" among "BSE stocks."

Sensex's Impressive Rise: Percentage Gains and Volume Traded

The BSE Sensex closed today at 65,287.50, representing a substantial 2.5% or 1,600-point increase. This significant jump in the "BSE index" is noteworthy, exceeding the average daily fluctuation observed in recent weeks. The "trading volume" for the day also saw a significant uptick, reaching approximately 2.2 billion shares traded – suggesting a heightened level of investor participation and a positive "market sentiment." This high volume further underscores the strength of today's "Sensex closing" and indicates robust investor confidence. The elevated trading volume strongly suggests a bullish outlook among investors.

Top Gaining Sectors: Identifying Market Leaders

Several sectors demonstrated exceptional performance, driving the overall "Sensex rise." The "top performing sectors" included:

- Information Technology (IT): The IT sector led the charge, with a remarkable 4% increase. Strong quarterly earnings reports and increasing global demand for IT services fueled this surge.

- Pharmaceuticals: The pharmaceutical sector experienced a 3.5% rise, driven by positive news regarding new drug approvals and promising clinical trial results.

- Financials: The financial sector also showcased strong performance, with a 3% gain, buoyed by positive economic indicators and increased lending activity.

- Energy: The energy sector saw a 2.8% increase, largely due to rising global oil prices.

- Consumer Goods: Positive consumer sentiment contributed to a 2.5% rise in this sector.

This robust "sector performance" reflects a broad-based rally, indicating a healthy and optimistic market outlook. The "BSE sector gainers" collectively contributed significantly to the overall "Sensex rise."

Top Gaining Stocks: Individual Stock Performance Analysis

Several individual stocks delivered exceptional returns today. Here's a look at the "top stock gainers" on the BSE:

- Reliance Industries (+5%): Strong quarterly earnings and positive investor sentiment propelled Reliance Industries to a significant gain.

- Infosys (+4.8%): Strong revenue growth and optimistic future outlook boosted Infosys' stock price.

- HDFC Bank (+4.5%): Continued growth in lending and positive economic indicators contributed to HDFC Bank's strong performance.

- TCS (+4.2%): Positive global demand for IT services resulted in this substantial gain.

- HCL Technologies (+4%): Similar to TCS, HCL Technologies benefited from robust global IT demand.

- Bharti Airtel (+3.8%): Positive developments in the telecom sector contributed to this stock's strong performance.

- ICICI Bank (+3.5%): Similar to HDFC Bank, strong lending activity and investor confidence drove this gain.

- ITC (+3.2%): Continued growth in consumer spending boosted this stock.

- Tata Motors (+3%): Positive global automotive sales contributed to this gain.

- Axis Bank (+2.8%): Strong financial performance and investor confidence propelled this gain.

These "best performing stocks" represent a mix of sectors, showcasing the breadth of today's market rally. The "BSE stock performance" highlights the opportunities available within the Indian stock market. This "individual stock analysis" provides insights into the specific drivers behind their outstanding performance.

Factors Contributing to the BSE Sensex Surge

Several factors contributed to today's impressive "BSE Sensex surge." These "market drivers" include:

- Positive GDP Growth: Recent reports indicating robust GDP growth have boosted investor confidence.

- Lower Inflation: Easing inflationary pressures have eased concerns about interest rate hikes.

- Favorable Government Policies: Government initiatives supporting economic growth have fostered a positive market environment.

- Global Market Trends: Positive trends in global markets, particularly in the US and Europe, have had a spillover effect on the Indian market.

- Strong Corporate Earnings: Many companies have reported better-than-expected quarterly results, further bolstering investor sentiment.

These "economic indicators" and "global market impact" collectively created a positive "market sentiment" contributing to the significant "Sensex rise."

Conclusion: Understanding the BSE Sensex Surge and Future Outlook

Today's significant rise in the BSE Sensex, fueled by strong "sector performance," exceptional "BSE stock performance," and positive macroeconomic factors, represents a strong bullish signal for the Indian stock market. The "top gainers" across various sectors underscore the breadth and depth of this market rally. While predicting the future is always uncertain, the current data suggests a cautiously optimistic outlook for the near term. However, investors should remain vigilant and monitor market developments closely. "Stay tuned for updates on the BSE Sensex," and "follow our analysis for insights into BSE stock movements." "Track the BSE Sensex for future opportunities" by subscribing to our newsletter for daily market updates.

Featured Posts

-

Dodgers Top Minor League Talent A Look At Kim Outman And Sauer

May 15, 2025

Dodgers Top Minor League Talent A Look At Kim Outman And Sauer

May 15, 2025 -

Torpedo Bat Troubles An Mlb All Stars Perspective

May 15, 2025

Torpedo Bat Troubles An Mlb All Stars Perspective

May 15, 2025 -

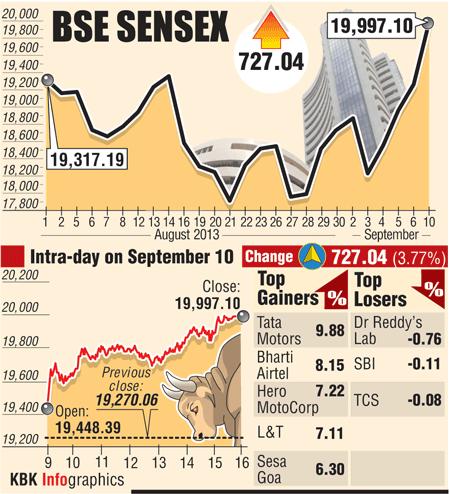

Identifying The Countrys Top Business Growth Areas

May 15, 2025

Identifying The Countrys Top Business Growth Areas

May 15, 2025 -

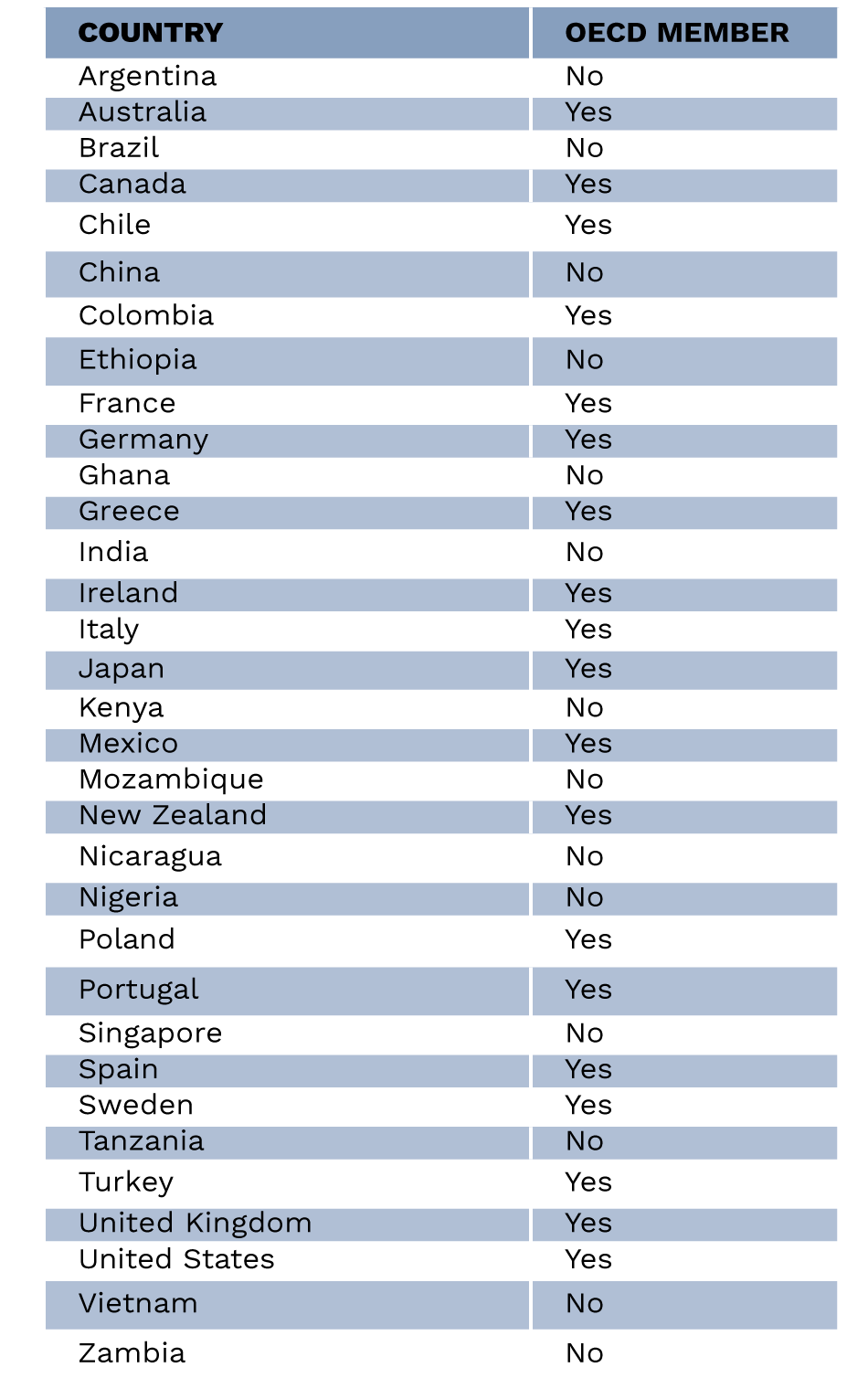

Menendez Case Judge Permits Consideration Of New Sentences

May 15, 2025

Menendez Case Judge Permits Consideration Of New Sentences

May 15, 2025 -

Kibris Sorunu Stefanos Stefanu Nun Coezuem Oenerileri

May 15, 2025

Kibris Sorunu Stefanos Stefanu Nun Coezuem Oenerileri

May 15, 2025

Latest Posts

-

Oakland As Roster Update Muncy In Starting Lineup

May 15, 2025

Oakland As Roster Update Muncy In Starting Lineup

May 15, 2025 -

Cody Poteets Successful Abs Challenge Cubs Pitcher Wins Spring Training Debut

May 15, 2025

Cody Poteets Successful Abs Challenge Cubs Pitcher Wins Spring Training Debut

May 15, 2025 -

Ohtanis Walk Off Home Run Delivers Historic 8 0 Win

May 15, 2025

Ohtanis Walk Off Home Run Delivers Historic 8 0 Win

May 15, 2025 -

Shohei Ohtanis Walk Off Homer Dodgers Historic 8 0 Loss

May 15, 2025

Shohei Ohtanis Walk Off Homer Dodgers Historic 8 0 Loss

May 15, 2025 -

Ohtanis Walk Off Blast Dodgers Suffer Historic 8 0 Defeat

May 15, 2025

Ohtanis Walk Off Blast Dodgers Suffer Historic 8 0 Defeat

May 15, 2025