Streamlining Bond Forward Regulations: The Indian Insurers' Perspective

Table of Contents

H2: Current Challenges in Bond Forward Regulations for Indian Insurers

The current regulatory framework surrounding bond forwards presents several significant challenges for Indian insurers. These hurdles impede efficient investment strategies, increase operational costs, and limit the potential returns for these crucial financial institutions.

-

Bullet Point 1: Complex and Ambiguous Regulatory Framework: The existing regulations are often fragmented, overlapping, and unclear, leading to difficulties in compliance and significant uncertainty for insurers. Navigating this labyrinthine system demands substantial resources and expertise, increasing compliance costs significantly.

-

Bullet Point 2: Restrictions on Investment in Certain Types of Bond Forwards: Current regulations restrict investments in specific bond forward instruments, limiting diversification options and potentially hindering the achievement of optimal investment returns. This lack of flexibility restricts insurers' ability to effectively manage risk and maximize profitability.

-

Bullet Point 3: High Compliance Costs: The complexities of the current regulatory environment necessitate substantial investments in compliance infrastructure, personnel, and legal expertise. These high costs eat into profitability and can make it difficult for smaller insurers to compete effectively.

-

Bullet Point 4: Impact on Liquidity Management: Regulatory constraints on trading activities can directly impact an insurer's ability to manage liquidity effectively. This can lead to increased risks and reduced flexibility in responding to market fluctuations.

-

Bullet Point 5: Increased Operational Complexity in Risk Management: Regulatory fragmentation increases the operational complexity of risk management. Insurers need to grapple with multiple regulatory requirements from different agencies, making comprehensive risk assessment and mitigation more challenging.

H3: Case Studies:

Several Indian insurance companies have reported delays in investment decisions and increased operational costs due to the complexities of navigating the current bond forward regulations. For example, one large insurer experienced a significant delay in a planned investment due to ambiguities in the interpretation of a specific regulatory clause, resulting in a loss of potential returns. Another faced substantial legal and compliance costs in addressing a regulatory discrepancy. These cases illustrate the real-world impact of inefficient Bond Forward Regulations on the profitability and operational efficiency of Indian insurers.

H2: Proposed Solutions for Streamlining Bond Forward Regulations

Improving the regulatory environment for bond forwards requires a multi-pronged approach focusing on simplification, harmonization, and increased transparency.

-

Bullet Point 1: Consolidation and Simplification of Existing Regulations: A comprehensive review and consolidation of the existing regulations are needed to eliminate redundancies, inconsistencies, and ambiguities. Clear, concise, and easily understandable guidelines will significantly reduce compliance burdens.

-

Bullet Point 2: Harmonization of Regulations Across Different Regulatory Bodies: Currently, multiple regulatory bodies oversee different aspects of bond forwards, leading to inconsistencies and fragmentation. Harmonizing these regulations under a single, unified framework would greatly simplify the regulatory landscape.

-

Bullet Point 3: Implementing Greater Transparency in the Regulatory Process: Greater transparency in the regulatory decision-making process is crucial to enhance predictability and reduce uncertainty. Regular consultations with industry stakeholders will ensure that regulations are both effective and practical.

-

Bullet Point 4: Leveraging Technology to Improve Efficiency and Reduce Manual Processes in Compliance: Utilizing technology to automate compliance processes can drastically improve efficiency and reduce the administrative burden on insurers. This could involve developing user-friendly online platforms for accessing regulations and submitting compliance reports.

-

Bullet Point 5: Adopting a Risk-Based Supervision Approach: Moving towards a risk-based supervision framework would allow regulators to focus on managing systemic risks more effectively. This approach would be less prescriptive and more adaptable to the evolving needs of the market, leading to a more flexible regulatory environment.

H2: The Benefits of Streamlined Bond Forward Regulations for the Indian Insurance Sector

Streamlining Bond Forward Regulations will deliver significant benefits across the Indian insurance sector and the broader economy.

-

Bullet Point 1: Improved Investment Returns: Improved access to and greater flexibility within the bond forward markets will allow insurers to optimize their investment strategies, leading to higher returns and increased profitability.

-

Bullet Point 2: Enhanced Competitiveness: A more efficient regulatory environment will make the Indian insurance sector more attractive to both domestic and international investors, thereby enhancing its competitiveness on the global stage.

-

Bullet Point 3: Improved Financial Stability: A streamlined regulatory framework will contribute to improved financial stability within the Indian financial system by reducing systemic risk and promoting efficient risk management practices.

-

Bullet Point 4: Contribution to Overall Economic Growth: A thriving insurance sector is vital for economic growth. Streamlined regulations will stimulate growth by unlocking the investment potential of the sector.

-

Bullet Point 5: Increased Investor Confidence: A transparent and efficient regulatory environment will foster increased investor confidence in the Indian insurance market, attracting more capital and furthering the sector's development.

3. Conclusion:

The current complexities in Bond Forward Regulations present significant challenges to the Indian insurance sector, hindering its growth and efficiency. However, through strategic reforms including consolidation, harmonization, increased transparency, technological advancements, and a risk-based approach to supervision, India can create a significantly improved regulatory landscape. The benefits of such streamlining are substantial, promising enhanced investment returns, improved competitiveness, greater financial stability, boosted economic growth, and increased investor confidence. Policymakers and regulators must prioritize the streamlining of Bond Forward Regulations to unlock the full potential of the Indian insurance sector. Insurers themselves should actively participate in the regulatory dialogue, contributing their expertise and experience to shape a more efficient and effective regulatory environment. Efficient and transparent Bond Forward Regulations are not merely a desirable goal; they are fundamental to fostering a robust and thriving Indian insurance sector.

Featured Posts

-

Investing In Palantir Technologies Is It The Right Time To Buy

May 09, 2025

Investing In Palantir Technologies Is It The Right Time To Buy

May 09, 2025 -

Madeleine Mc Cann Case 23 Year Old Womans Dna Test Results Revealed

May 09, 2025

Madeleine Mc Cann Case 23 Year Old Womans Dna Test Results Revealed

May 09, 2025 -

Wynne Evans Road To Recovery Illness Details And Future Plans

May 09, 2025

Wynne Evans Road To Recovery Illness Details And Future Plans

May 09, 2025 -

Analysis The Recent Spike In Bitcoin Mining Activity

May 09, 2025

Analysis The Recent Spike In Bitcoin Mining Activity

May 09, 2025 -

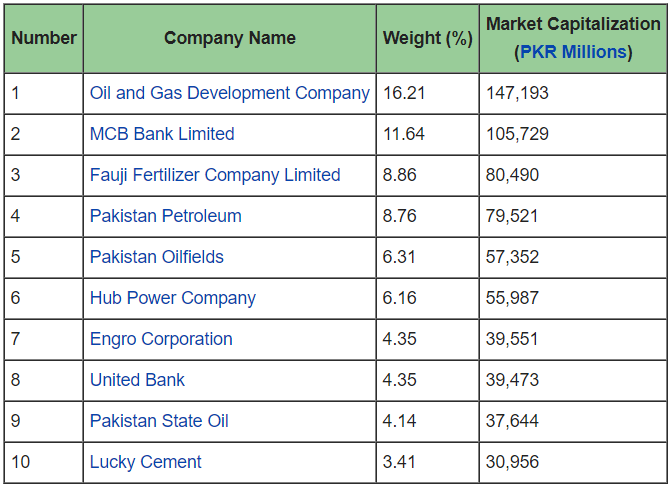

Kse 100 Freefall Operation Sindoor And The Pakistan Stock Market Crash

May 09, 2025

Kse 100 Freefall Operation Sindoor And The Pakistan Stock Market Crash

May 09, 2025