Strong DAX Performance: Frankfurt Equities Market Opening

Table of Contents

Key Factors Contributing to Strong DAX Performance

Several interconnected factors have contributed to the recent strong DAX performance. Analyzing these elements provides a clearer understanding of the current market dynamics and potential future trends.

Positive Economic Indicators

Germany's economy is showing signs of resilience. Positive GDP growth, coupled with encouraging employment figures and rising consumer confidence, paints a picture of sustained economic health. Recent reports from Destatis (the Federal Statistical Office of Germany) have highlighted robust growth in key sectors, boosting investor sentiment and fueling the strong DAX performance.

- GDP Growth: Recent quarters have shown a consistent upward trend in German GDP, exceeding expectations and signaling a healthy economic expansion.

- Employment Figures: Unemployment rates remain low, indicating a strong labor market and contributing to increased consumer spending.

- Consumer Confidence: Surveys suggest increasing consumer confidence, further stimulating economic activity and supporting the DAX's upward trajectory. This positive sentiment directly translates into increased investment and spending.

Strong Corporate Earnings

The strong DAX performance is also significantly driven by robust corporate earnings. Many prominent DAX companies have reported better-than-expected profits during the recent earnings season. This positive performance reflects both strong domestic demand and successful international expansion strategies.

- Automotive Sector Strength: Key players in the automotive sector have demonstrated remarkable resilience, contributing significantly to the overall DAX performance.

- Technology Sector Growth: The technology sector continues its upward trajectory, with several DAX-listed tech companies reporting substantial revenue growth and increased profitability.

- Increased Profit Margins: Many DAX companies have reported improved profit margins, demonstrating effective cost management and strong pricing power.

Global Market Trends

Global market trends play a crucial role in influencing the DAX performance. Positive developments in other major economies, such as the US and China, often spill over into the European market, contributing to a more optimistic outlook. A generally positive global market sentiment enhances investor confidence, leading to increased investment in the DAX.

- Reduced Global Uncertainty: A decrease in geopolitical uncertainty contributes to a more stable global investment environment, positively impacting the DAX.

- Positive International Trade: Increased international trade and global collaboration foster economic growth, supporting the DAX’s upward momentum.

- Stable Currency Exchange Rates: Favorable exchange rates can enhance the profitability of German companies operating internationally, positively impacting the DAX.

Impact of Monetary Policy

The European Central Bank (ECB) plays a significant role in influencing the DAX through its monetary policies. Interest rate decisions and other measures aimed at controlling inflation have a direct impact on investor behavior and market sentiment.

- Interest Rate Adjustments: The ECB's decisions regarding interest rates directly influence borrowing costs for businesses and investors, impacting investment decisions and overall market sentiment.

- Inflation Control Measures: The ECB's strategies to manage inflation influence the attractiveness of the Euro and, consequently, the DAX. Stable inflation is generally positive for stock market performance.

- Quantitative Easing (QE) Programs: Past QE programs have injected liquidity into the market, supporting asset prices and contributing to positive market sentiment.

Implications for Investors

The strong DAX performance presents both opportunities and challenges for investors. A thorough understanding of these aspects is vital for informed investment decisions.

Investment Opportunities

The current market conditions present several attractive investment opportunities within the DAX and related sectors. Careful analysis of individual company performance and sector trends can lead to rewarding investment strategies.

- Sector-Specific Investments: Investors may consider targeting specific sectors showing strong performance, such as technology or industrials.

- Long-Term Growth Potential: The DAX offers the potential for long-term growth based on the strength of the German economy and its global competitiveness.

- Dividend Income: Many DAX companies offer attractive dividend yields, providing a source of passive income for investors.

Risk Assessment

While the outlook is positive, investors must also consider potential risks and challenges. Market volatility and geopolitical events can impact the DAX's performance.

- Geopolitical Risks: Global political instability and potential conflicts can negatively impact market sentiment and investment flows.

- Market Volatility: Sudden shifts in market sentiment can lead to significant price fluctuations, requiring a robust risk management strategy.

- Economic Slowdown: A potential economic slowdown in Germany or the Eurozone could negatively impact DAX performance.

Frankfurt Equities Market Opening – The Broader Picture

The strong DAX performance significantly impacted the Frankfurt equities market opening, influencing various aspects of market activity.

Trading Volume and Activity

The market opening witnessed a substantial increase in trading volume, reflecting heightened investor interest and activity. This surge in activity further emphasizes the impact of the strong DAX performance on the overall market.

Sector-Specific Performance

The strong overall DAX performance was driven by exceptionally strong results in several sectors. Analyzing the contribution of each sector allows investors to identify specific opportunities and tailor their investment strategies accordingly.

Comparison with other European Indices

Comparing the DAX's performance against other major European indices, such as the CAC 40 (France) and FTSE 100 (UK), provides a broader perspective on the current market trends and relative performance. This comparative analysis reveals whether the DAX's strength is a localized phenomenon or reflects a wider European trend.

Conclusion: Understanding and Capitalizing on Strong DAX Performance

The strong DAX performance is a result of a confluence of factors including robust economic indicators, excellent corporate earnings, positive global market trends, and supportive monetary policy. This presents significant opportunities for investors, but also necessitates a cautious approach with a thorough risk assessment. To capitalize on the strong DAX performance, investors should carefully monitor key economic indicators, analyze individual company performance, and diversify their portfolios accordingly. Understanding the DAX market outlook and developing effective DAX investment strategies are crucial for navigating this dynamic market environment. Consider seeking professional financial advice to tailor a strategy that aligns with your risk tolerance and investment goals, maximizing your potential returns while mitigating risks associated with analyzing DAX performance.

Featured Posts

-

Porsche Macan Yfirlit Yfir Nyju Rafmagnsutgafuna

May 24, 2025

Porsche Macan Yfirlit Yfir Nyju Rafmagnsutgafuna

May 24, 2025 -

Is She Still Waiting By The Phone A Relatable Story

May 24, 2025

Is She Still Waiting By The Phone A Relatable Story

May 24, 2025 -

Eiskaltes Ergebnis Der Ueberraschungssieger In Essen

May 24, 2025

Eiskaltes Ergebnis Der Ueberraschungssieger In Essen

May 24, 2025 -

Trump E I Dazi L Effetto A Cascata Sul Mercato Della Moda

May 24, 2025

Trump E I Dazi L Effetto A Cascata Sul Mercato Della Moda

May 24, 2025 -

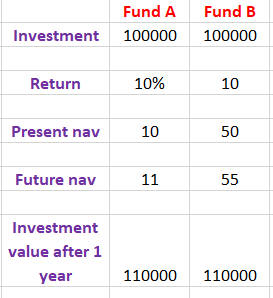

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Latest Posts

-

La Caduta Delle Borse La Reazione Dell Ue Ai Nuovi Dazi

May 24, 2025

La Caduta Delle Borse La Reazione Dell Ue Ai Nuovi Dazi

May 24, 2025 -

11 Drop Amsterdam Stock Exchanges Continued Market Downturn

May 24, 2025

11 Drop Amsterdam Stock Exchanges Continued Market Downturn

May 24, 2025 -

Dazi E Mercati L Unione Europea Di Fronte Al Crollo Delle Borse

May 24, 2025

Dazi E Mercati L Unione Europea Di Fronte Al Crollo Delle Borse

May 24, 2025 -

Three Day Slide Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025

Three Day Slide Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025 -

Guerra Dei Dazi Le Borse Crollano La Ue Risponde

May 24, 2025

Guerra Dei Dazi Le Borse Crollano La Ue Risponde

May 24, 2025