Strong Retail Sales Data Delays Expected Bank Of Canada Rate Reduction

Table of Contents

The Bank of Canada's anticipated interest rate reduction has been thrown into question following the release of surprisingly strong retail sales data. This unexpected surge in consumer spending signals a more resilient economy than previously forecast, leading economists to revise their predictions about future monetary policy. This article delves into the implications of this data and what it means for the Canadian economy, particularly regarding the timing of a potential Bank of Canada rate reduction.

Robust Retail Sales Figures Exceed Expectations

The latest retail sales data has surprised economists and market analysts alike. Figures released on [Insert Date of Release] showed a [Insert Percentage]% increase in retail sales compared to [Previous Period - e.g., the previous month or year]. This surpasses expectations, which had predicted a much more modest growth rate of [Insert Expected Percentage]%. This robust performance indicates a stronger-than-anticipated consumer spending environment.

Several sectors contributed significantly to this impressive growth. The automotive sector experienced a particularly strong upswing, with sales rising by [Insert Percentage]%, driven by [mention specific factors, e.g., new vehicle releases, government incentives]. The furniture and home improvement sectors also showed remarkable strength, reflecting [mention contributing factors, e.g., continued housing market activity, renovations]. Electronics sales also contributed positively, suggesting consumer confidence remains relatively high.

- Specific percentage increase in retail sales: [Insert Percentage]%

- Key contributing sectors and their growth rates: Automotive ([Percentage]%); Furniture ([Percentage]%); Electronics ([Percentage]%)

- Comparison to previous months/years' sales figures: [Compare to previous periods, highlighting the significant difference]

- Regional differences in retail sales performance: [Discuss regional variations, mentioning stronger or weaker performing areas]

Impact on Bank of Canada's Monetary Policy

The Bank of Canada's current monetary policy aims to control inflation, currently hovering around [Insert Current Inflation Rate]%. The central bank's target inflation rate is [Insert Target Inflation Rate]%. The unexpectedly strong retail sales data complicates the bank's strategy. This robust spending suggests the economy is not as weak as previously thought, reducing the urgency for an immediate interest rate cut.

While a rate cut was widely anticipated to stimulate the economy, the resilient consumer spending indicates the economy might not require such intervention. This strong data strengthens the argument for maintaining the current interest rate or even considering a pause before any potential future reductions. The Bank of Canada might instead focus on other monetary policy tools, such as quantitative easing or forward guidance.

- Current Bank of Canada interest rate: [Insert Current Interest Rate]

- Inflation targets and current inflation rates: [Insert Target Inflation Rate] vs. [Insert Current Inflation Rate]

- Reasons why strong retail sales delay rate cuts: Strong consumer spending suggests the economy is more resilient than expected.

- Potential alternative monetary policy adjustments: Quantitative easing, forward guidance, etc.

- Predicted impact on the CAD exchange rate: A delay in rate cuts may strengthen the Canadian dollar.

Implications for Consumers and Businesses

Sustained higher interest rates, even a delay in rate cuts, will impact both consumers and businesses. Consumers will likely face higher borrowing costs, leading to increased mortgage payments and potentially reduced discretionary spending. This could affect consumer confidence and lead to a slowdown in future retail sales.

Businesses, particularly those heavily reliant on debt financing, may postpone investment plans due to higher interest rates, impacting economic growth. The housing market is particularly sensitive to interest rate changes, and any delay in cuts could prolong the period of cooling or even cause further price adjustments.

- Impact of higher interest rates on mortgage payments: [Explain the impact of increased rates on mortgage payments]

- Effects on consumer confidence and spending habits: [Discuss potential negative impact on consumer behavior]

- Potential impact on business investment and expansion plans: [Explain how higher rates could hinder business growth]

- Predicted effects on the housing market: [Discuss potential impacts on housing prices and affordability]

Uncertainty and Future Outlook

The economic landscape remains uncertain. While current retail sales are strong, it is unclear whether this trend will continue. Future shifts in consumer spending, influenced by factors such as inflation, employment levels, and global economic conditions, could significantly impact the Bank of Canada's future decisions.

Upcoming economic indicators, such as inflation data and employment figures, will be closely scrutinized to provide further insight into the state of the Canadian economy. These indicators will inform the Bank of Canada's assessment of the appropriate monetary policy response.

- Key economic indicators to watch (e.g., inflation, employment): [List key indicators and their importance]

- Potential future economic scenarios: [Discuss different possible outcomes]

- Factors that could cause a change in Bank of Canada’s stance: [Mention external and internal factors that can influence the bank's decision]

Conclusion

The unexpectedly strong retail sales data has significantly impacted predictions surrounding the Bank of Canada's interest rate decisions. While a rate reduction was anticipated, the current economic climate suggests a delay is likely, with implications for consumers, businesses, and the Canadian dollar. The situation remains fluid, and ongoing monitoring of economic indicators is crucial. Understanding the nuances of this dynamic situation is vital for informed decision-making.

Call to Action: Stay informed about the evolving economic landscape and the Bank of Canada's monetary policy decisions by regularly checking back for updates on Bank of Canada rate reduction predictions and analysis. Understanding the implications of these shifts is essential for making sound financial decisions in the current market.

Featured Posts

-

Florentino Perez El Real Madrid De Sus Primeros Anos

May 26, 2025

Florentino Perez El Real Madrid De Sus Primeros Anos

May 26, 2025 -

Coheres Legal Fight Addressing Copyright Infringement Allegations

May 26, 2025

Coheres Legal Fight Addressing Copyright Infringement Allegations

May 26, 2025 -

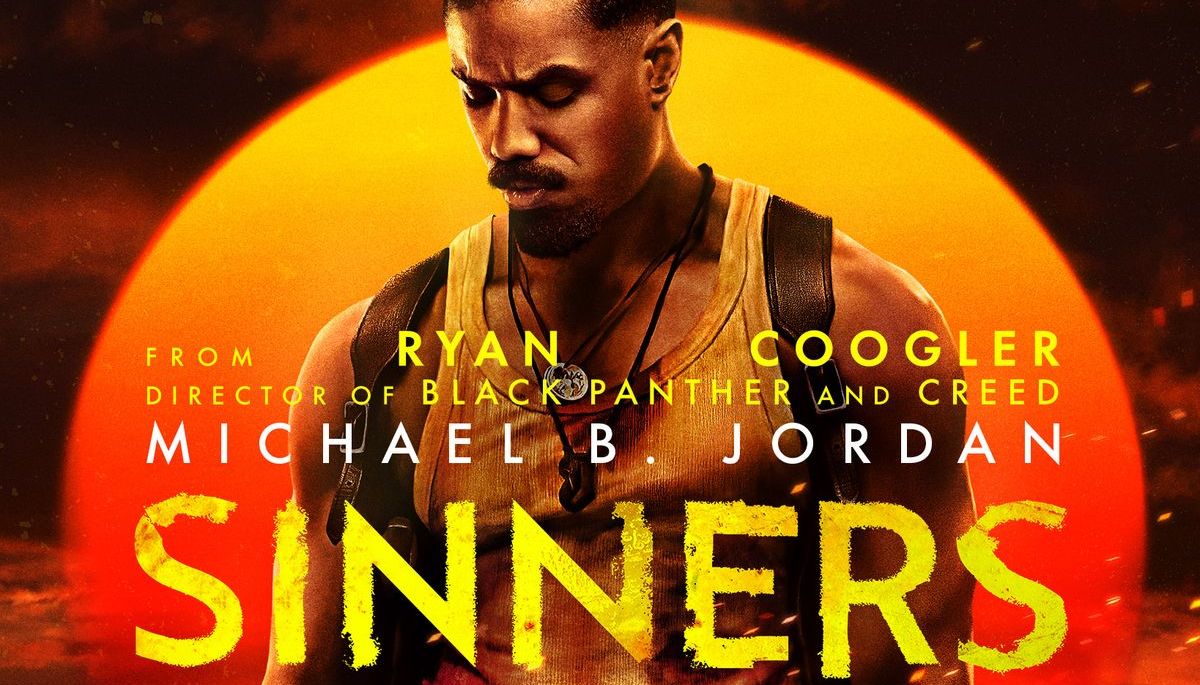

Theatrical Release Of Sinners Louisiana Filmed Horror Movie

May 26, 2025

Theatrical Release Of Sinners Louisiana Filmed Horror Movie

May 26, 2025 -

Southern Vacation Hotspot Rebuts Negative Safety Rating After Shooting Incident

May 26, 2025

Southern Vacation Hotspot Rebuts Negative Safety Rating After Shooting Incident

May 26, 2025 -

Teslas Performance And Elon Musks Anger A Correlation

May 26, 2025

Teslas Performance And Elon Musks Anger A Correlation

May 26, 2025

Latest Posts

-

Agassi Marturie Sincera Despre Presiunea Din Tenis

May 30, 2025

Agassi Marturie Sincera Despre Presiunea Din Tenis

May 30, 2025 -

Tennis Legend Andre Agassi Enters The World Of Professional Pickleball

May 30, 2025

Tennis Legend Andre Agassi Enters The World Of Professional Pickleball

May 30, 2025 -

Nervi De Otel Andre Agassi Marturiseste Am Fost Mai Nervos Decat

May 30, 2025

Nervi De Otel Andre Agassi Marturiseste Am Fost Mai Nervos Decat

May 30, 2025 -

Agassi Joins The Pickleball Pro Circuit His Inaugural Tournament

May 30, 2025

Agassi Joins The Pickleball Pro Circuit His Inaugural Tournament

May 30, 2025 -

Aamir Khans Daughter And Tennis Legend Ira Khans Revelation Following Andre Agassi Meeting

May 30, 2025

Aamir Khans Daughter And Tennis Legend Ira Khans Revelation Following Andre Agassi Meeting

May 30, 2025