Student Loan Debt: Aggressive Government Action And Borrower Rights

Table of Contents

Recent Government Actions Affecting Student Loan Debt

The government has implemented several initiatives to alleviate the burden of student loan debt. Understanding these actions is crucial to navigating your financial future.

Loan Forgiveness Programs: Eligibility Criteria and Application Process

Several loan forgiveness programs exist, offering the potential for complete or partial debt cancellation. However, eligibility requirements vary significantly.

- Public Service Loan Forgiveness (PSLF): This program forgives remaining federal student loan debt after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. Eligibility requires specific loan types and repayment plans.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payment on your income and family size. After a set number of years (typically 20 or 25), any remaining balance might be forgiven. Specific eligibility criteria apply based on your income and loan type.

Applying for forgiveness usually involves completing an application through the designated government website and providing documentation to prove eligibility. The process can be lengthy and require meticulous record-keeping.

Potential drawbacks: Some programs have strict eligibility requirements, and the application process can be complex. Furthermore, changes in government policy can impact the availability and terms of these programs. Always check for updates to the latest guidelines for student loan forgiveness.

Changes in Repayment Plans and Interest Rates

Recent years have seen significant changes in student loan repayment plans and interest rates. Understanding these changes is essential for managing your debt effectively.

- Extended Pauses: The government has, at times, implemented temporary pauses on student loan payments, offering borrowers much-needed relief during periods of economic uncertainty.

- New Payment Options: New repayment plans have emerged, offering different payment structures and terms to better suit individual financial situations. However, it’s crucial to analyze the pros and cons of each option before committing. Consider factors like the total amount paid over the loan’s lifetime and the impact of interest capitalization.

Changes in interest rates directly impact the total cost of your loans. Higher interest rates increase the total amount you'll pay over the life of your loan, while lower rates reduce the overall cost. Stay informed about student loan interest rates and their potential influence on your monthly payments.

Government Initiatives to Prevent Future Debt Accumulation

To address the root cause of rising student loan debt, the government has also implemented measures aimed at making college more affordable and promoting financial literacy among students.

- Increased Financial Aid: The government has increased funding for federal grants and scholarships, making college more accessible for low- and middle-income students.

- Financial Literacy Programs: Initiatives are underway to improve financial literacy education in schools, empowering students to make informed decisions about financing their education.

- Affordable College Initiatives: Efforts are being made to explore options for making college more affordable, including exploring tuition-free options at certain institutions and offering incentives to reduce the reliance on loans.

The effectiveness of these preventative measures is a subject of ongoing debate, but they represent a critical step in tackling the issue from a preventative standpoint.

Understanding Your Rights as a Student Loan Borrower

Knowing your rights as a borrower is paramount to effectively managing your student loan debt.

Navigating the Complexities of Loan Servicing

Your student loan servicer is responsible for processing your payments, providing customer service, and managing your loan account. Understanding their role is crucial.

- Servicer Responsibilities: Servicers are responsible for accurate billing, providing clear communication, and responding to your inquiries promptly.

- Common Issues: Borrowers frequently experience issues such as inaccurate billing, difficulty contacting representatives, or inconsistent information.

- Resolving Problems: If you encounter problems with your servicer, document all communication and escalate your concerns through formal channels.

Always remember to keep records of all communications and transactions related to your student loan servicing for your own protection.

Protecting Yourself from Scams and Predatory Practices

Be aware of fraudulent schemes targeting student loan borrowers.

- Common Scams: These include loan forgiveness scams, fake loan modification offers, and phishing emails.

- Avoiding Scams: Never share your personal information or loan details unless you're certain of the recipient's legitimacy. Verify information with official government sources.

- Reporting Scams: Report suspicious activity to the Federal Trade Commission (FTC) and your loan servicer immediately. Understanding student loan scams is vital in protecting yourself.

Knowing Your Options for Loan Consolidation and Refinancing

Loan consolidation combines multiple loans into a single loan, potentially simplifying repayment. Loan refinancing replaces your existing loans with a new loan, potentially with a lower interest rate.

- Benefits and Drawbacks: Consolidation can streamline payments, but may not lower your interest rate. Refinancing can lower your interest rate, but may require a credit check and involve fees.

- Eligibility Requirements: Eligibility for both options depends on your credit score, income, and loan types.

- Finding Refinancing Options: Explore reputable lenders and compare options carefully before making a decision.

Remember to carefully research your student loan refinancing options to determine which choice best suits your financial circumstances.

Conclusion: Taking Control of Your Student Loan Debt

This article highlights the significant impact of government actions on student loan debt and underscores the importance of understanding your rights as a borrower. From student loan forgiveness programs and repayment plan changes to protecting yourself from scams, navigating this landscape requires proactive engagement. By staying informed about government policies and utilizing available resources, you can effectively manage your student loan debt and work towards a brighter financial future. Explore your options for student loan forgiveness and repayment plans. Take control of your student loan debt today!

Featured Posts

-

Knicks Coach Thibodeau Seeks Increased Determination Following 37 Point Loss

May 17, 2025

Knicks Coach Thibodeau Seeks Increased Determination Following 37 Point Loss

May 17, 2025 -

Is Refinancing Federal Student Loans Worth It The Ultimate Guide

May 17, 2025

Is Refinancing Federal Student Loans Worth It The Ultimate Guide

May 17, 2025 -

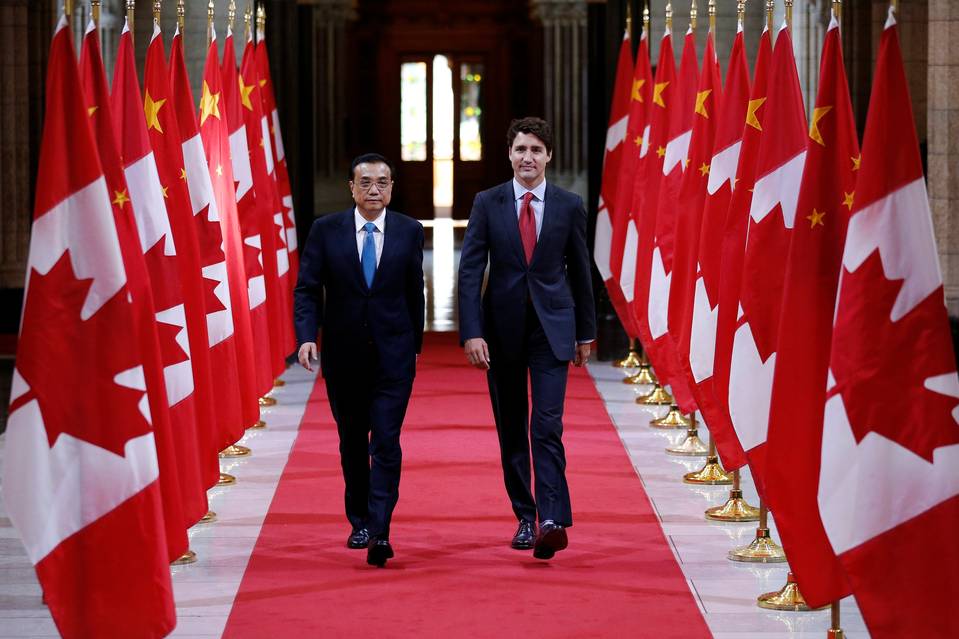

Canada China Trade Deal On The Horizon Ambassadors Recent Statement

May 17, 2025

Canada China Trade Deal On The Horizon Ambassadors Recent Statement

May 17, 2025 -

Lumon Industries Vs Apple Ben Stillers Severance And Corporate Control

May 17, 2025

Lumon Industries Vs Apple Ben Stillers Severance And Corporate Control

May 17, 2025 -

Get The Scoop Moto News On Gncc Mx Sx Flat Track And Enduro

May 17, 2025

Get The Scoop Moto News On Gncc Mx Sx Flat Track And Enduro

May 17, 2025

Latest Posts

-

Noticias Deportivas Y Previsiones Semanales De Prensa Latina

May 17, 2025

Noticias Deportivas Y Previsiones Semanales De Prensa Latina

May 17, 2025 -

Montecarlo 2024 La Alegria Reflejada En El Juego De Alcaraz

May 17, 2025

Montecarlo 2024 La Alegria Reflejada En El Juego De Alcaraz

May 17, 2025 -

Previsiones Deportivas De Prensa Latina Resultados Y Apuestas De La Semana

May 17, 2025

Previsiones Deportivas De Prensa Latina Resultados Y Apuestas De La Semana

May 17, 2025 -

Ban Ket Miami Open 2025 Lieu Djokovic Hay Alcaraz Se Gianh Chien Thang

May 17, 2025

Ban Ket Miami Open 2025 Lieu Djokovic Hay Alcaraz Se Gianh Chien Thang

May 17, 2025 -

La Alegria De Alcaraz Su Camino Al Triunfo En Montecarlo

May 17, 2025

La Alegria De Alcaraz Su Camino Al Triunfo En Montecarlo

May 17, 2025