Succession Planning: Ensuring The Future Of Family Wealth

Table of Contents

Understanding Your Assets and Liabilities

Before embarking on the creation of a comprehensive succession plan, you need a clear understanding of your current financial landscape. This involves meticulously documenting your assets and liabilities, acknowledging both the opportunities and risks involved.

Inventorying Family Assets

Accurately evaluating your family's assets is crucial for effective legacy planning. This includes:

- Real Estate: Residential properties, commercial buildings, land holdings – each requiring accurate valuation based on current market conditions.

- Businesses: Family-owned businesses represent a significant portion of many families' wealth. Professional valuation is essential to understand their true worth and potential future earnings.

- Investments: Stocks, bonds, mutual funds, and other investments must be carefully cataloged, along with their current market value and projected growth potential.

- Intellectual Property: Patents, copyrights, trademarks, and other intellectual property holdings need to be assessed for their current and future value.

Methods for Accurate Assessment: Employing professional appraisers for real estate and businesses is highly recommended. For investments, using online portfolio trackers and consulting with financial advisors ensures accuracy. Meticulous record-keeping of ownership documentation is paramount.

Identifying Liabilities and Potential Risks

A complete picture of your financial position requires acknowledging existing liabilities and potential future risks:

- Debts: Mortgages, loans, credit card debt, and other outstanding obligations need to be identified and quantified.

- Lawsuits: Pending or potential legal actions can significantly impact your net worth and must be factored into your planning.

- Environmental Concerns: Liability related to environmental contamination of properties should be assessed and addressed proactively.

Mitigation Strategies: Developing strategies to minimize liabilities before wealth transfer is key. This might involve debt reduction strategies, insurance policies, and legal counsel to address potential lawsuits. Transparent financial disclosure within the family is essential for trust and cooperation.

Defining Your Family's Goals and Values

A successful succession plan doesn't just focus on numbers; it aligns with your family's values and aspirations. Open communication and a shared vision are essential for achieving a harmonious outcome.

Establishing Clear Objectives

Before devising a strategy, you must define your family's objectives:

- Financial Goals: What level of financial security do you want to provide for future generations? What are your expectations for income generation from your assets?

- Philanthropic Aspirations: Does your family have a desire to support specific charities or causes? How can your wealth be used to make a positive impact on the world?

- Family Legacy: What values and traditions do you want to pass down? How do you envision your family's future?

Facilitating Open Communication: Family meetings, facilitated by a neutral third party if necessary, can help family members openly express their views and work toward a shared vision. Considering the interests of future generations is crucial for a long-term perspective.

Aligning Values with Wealth Transfer Strategies

Your wealth transfer strategy should reflect your family’s values and ethical considerations:

- Charitable Giving: Establishing charitable foundations or making targeted donations can align wealth transfer with philanthropic goals.

- Educational Endowments: Providing funding for education can empower future generations and secure their future.

- Preserving Family Businesses: Developing succession plans for family businesses ensures their continued success and provides ongoing income streams.

Ethical and Social Responsibility: Incorporating ethical considerations into your plan builds a strong foundation for future generations, ensuring responsible stewardship of family wealth.

Developing a Comprehensive Succession Plan

Bringing together your asset assessment, family goals, and values, you can now create a comprehensive succession plan. This involves addressing several key areas.

Legal and Tax Considerations

Navigating the legal and tax landscape is critical for a successful estate plan:

- Wills: A will outlines how your assets will be distributed after your death.

- Trusts: Trusts provide more control over asset distribution and can offer tax advantages.

- Gifting Strategies: Strategic gifting during your lifetime can minimize estate taxes and facilitate wealth transfer.

- Tax Implications: Understanding the tax consequences of different wealth transfer methods is crucial for optimizing your plan.

Professional Advice: Consulting with experienced estate planning attorneys and tax advisors is vital to create a legally sound and tax-efficient plan. Utilizing various estate planning tools, such as irrevocable trusts or GRATs (Grantor Retained Annuity Trusts), can help manage tax implications.

Business Succession Strategies

For family-owned businesses, a robust succession plan is crucial for ensuring continuity:

- Ownership Transition: Carefully planning the transfer of ownership to the next generation is paramount for a smooth transition.

- Management Succession: Identifying and grooming future leaders within the family or outside the family is crucial for business continuity.

- Continuity Planning: Developing strategies to maintain the business's operations and value during the transition period.

Smooth Transition: Professional business consultants can facilitate a smooth ownership and management transition, minimizing disruptions to operations and preserving the business's value.

Family Governance Structures

Establishing clear governance structures can prevent future conflicts and promote cooperation:

- Family Councils: Regular family meetings to discuss financial matters and plan for the future can foster communication and cooperation.

- Trusts: Trusts can provide a structure for managing family wealth and ensuring responsible distribution.

- Mediation Agreements: Having pre-arranged mediation processes in place can resolve disagreements efficiently and prevent costly litigation.

Transparency and Accountability: Open communication, clear rules, and transparent processes are crucial for maintaining harmony and ensuring accountability within the family.

Secure Your Family's Future with Proactive Succession Planning

Effective succession planning is not merely about transferring assets; it’s about preserving your family's legacy, fostering harmony, and ensuring the responsible stewardship of your family wealth. By carefully assessing your assets and liabilities, defining your family's goals and values, and developing a comprehensive plan that addresses legal, tax, and business considerations, you can safeguard your family's future. Remember, seeking professional guidance from experienced estate planners, financial advisors, and legal professionals is crucial for navigating the complexities of wealth transfer and legacy planning. Don't delay – take the first steps toward creating your own succession plan today. Contact a financial professional to help with your family wealth management and legacy planning strategies.

Featured Posts

-

De Complete Gids Voor Tikkie Betalingen In Nederland

May 22, 2025

De Complete Gids Voor Tikkie Betalingen In Nederland

May 22, 2025 -

Manhattan Forgotten Foods Festival Preserving Culinary Traditions Through Rare Ingredients

May 22, 2025

Manhattan Forgotten Foods Festival Preserving Culinary Traditions Through Rare Ingredients

May 22, 2025 -

Naslidki Vidmovi Ukrayini Vid Nato Otsinka Ekspertiv Ta Yevrokomisara

May 22, 2025

Naslidki Vidmovi Ukrayini Vid Nato Otsinka Ekspertiv Ta Yevrokomisara

May 22, 2025 -

Are The Pittsburgh Steelers Targeting A Quarterback In The Nfl Draft

May 22, 2025

Are The Pittsburgh Steelers Targeting A Quarterback In The Nfl Draft

May 22, 2025 -

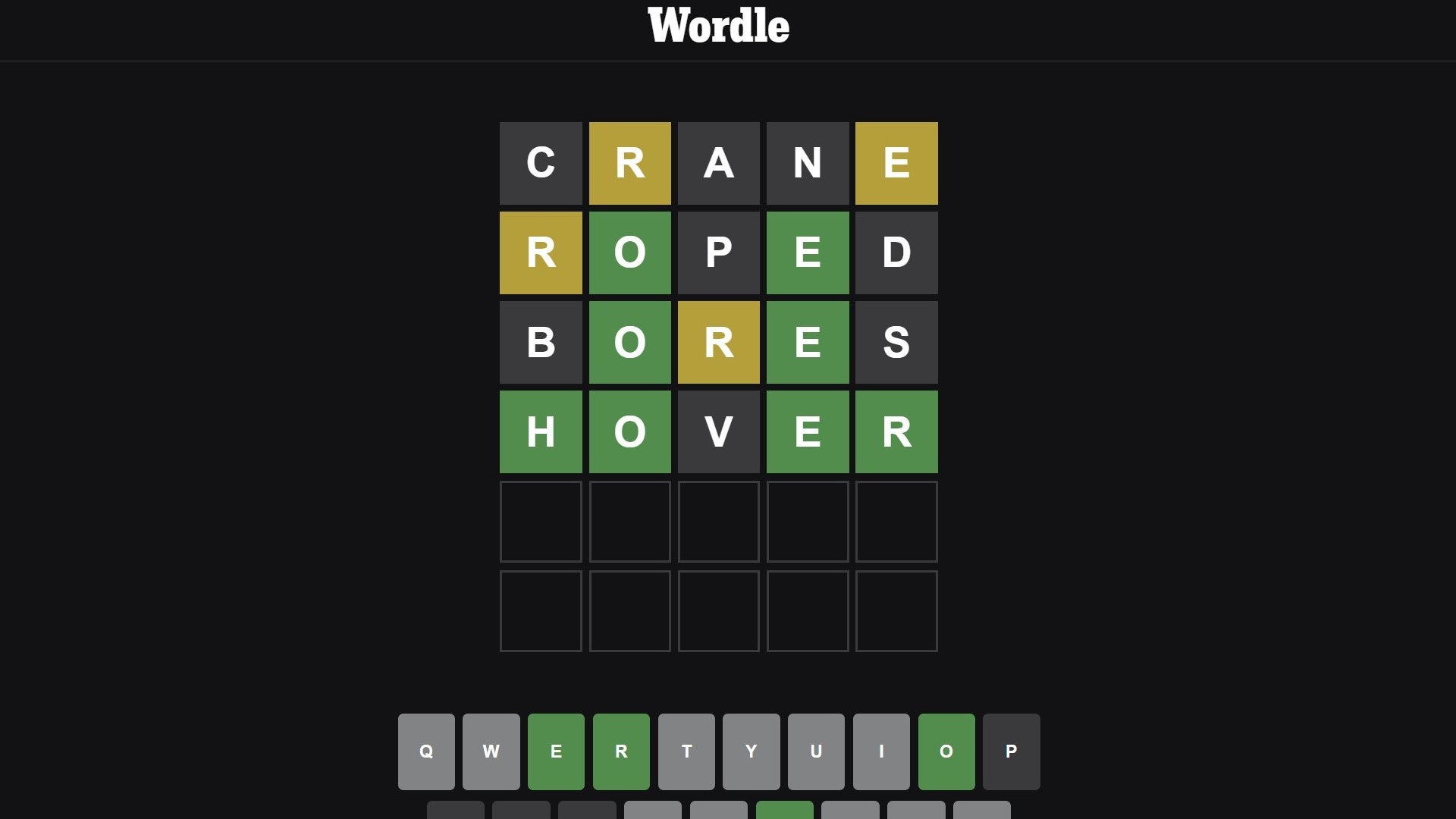

Solve Wordle 1408 April 27th Clues And Answer

May 22, 2025

Solve Wordle 1408 April 27th Clues And Answer

May 22, 2025

Latest Posts

-

Fratii Tate In Bucuresti Parada Cu Bolidul De Lux Dupa Retinere

May 23, 2025

Fratii Tate In Bucuresti Parada Cu Bolidul De Lux Dupa Retinere

May 23, 2025 -

Ankhfad Mstwa Qtr Amam Alkhwr Dwr Ebd Alqadr

May 23, 2025

Ankhfad Mstwa Qtr Amam Alkhwr Dwr Ebd Alqadr

May 23, 2025 -

Ser Aldhhb Eyar 24 22 18 Fy Qtr Alywm Alithnyn 24 Mars

May 23, 2025

Ser Aldhhb Eyar 24 22 18 Fy Qtr Alywm Alithnyn 24 Mars

May 23, 2025 -

Adae Ebd Alqadr Fy Khsart Qtr Amam Alkhwr

May 23, 2025

Adae Ebd Alqadr Fy Khsart Qtr Amam Alkhwr

May 23, 2025 -

Asear Aldhhb Fy Qtr Alithnyn 24 Mars 2024

May 23, 2025

Asear Aldhhb Fy Qtr Alithnyn 24 Mars 2024

May 23, 2025