Sudden Departure: Deutsche Bank's Distressed Sales Head Moves To Morgan Stanley

Table of Contents

The Executive's Background and Impact at Deutsche Bank

Before examining the reasons behind the move, let's consider the individual's significant contributions to Deutsche Bank. [Insert Executive's Name], a seasoned professional with [Number] years of experience in investment banking, held a key position within Deutsche Bank's distressed debt sales team. Their expertise in distressed debt, coupled with a strong network of industry contacts, made them a highly valuable asset.

Their contributions to Deutsche Bank were substantial, marked by success in navigating complex transactions and generating significant revenue. While specific figures are often confidential, sources suggest [he/she] played a crucial role in [mention a significant deal or two, if possible, with quantifiable results, e.g., "the successful restructuring of Company X, resulting in a $XX million recovery for investors"].

- Specific Deals Handled: [List notable deals, if possible, with brief descriptions]

- Key Market Relationships: [Mention key relationships built, e.g., with hedge funds, private equity firms]

- Recognition and Awards: [Mention any awards or recognition received, demonstrating their success]

This level of expertise and success in the competitive world of distressed asset sales underscores the significant loss for Deutsche Bank. Keywords like Distressed Debt, Deutsche Bank, Investment Banking, and Senior Executive highlight the gravity of this departure within the financial industry.

Morgan Stanley's Acquisition and Strategic Implications

Morgan Stanley's recruitment of this individual represents a strategic move to bolster its own distressed debt sales capabilities. The acquisition of such a seasoned professional with a proven track record in distressed debt and a strong network within the market speaks volumes about Morgan Stanley’s ambitions. The potential benefits for Morgan Stanley are significant:

- Increased Market Share: The addition of this executive could lead to a greater share of the distressed debt market, allowing them to compete more effectively against rivals like Goldman Sachs and JP Morgan.

- Enhanced Expertise: Their deep understanding of distressed assets, particularly in [mention specific sectors if known], brings a wealth of experience and specialized knowledge.

- Improved Client Relationships: The executive's established connections with key players in the distressed debt space will be invaluable in securing and expanding Morgan Stanley's client base.

Morgan Stanley's current position in the distressed debt market, while strong, is further solidified by this strategic hire. This move signifies a proactive approach to maintaining a competitive advantage in the dynamic world of mergers and acquisitions and distressed asset sales.

Reasons Behind the Sudden Departure

The reasons behind [Insert Executive's Name]'s sudden departure are likely multifaceted. While precise details remain undisclosed, several contributing factors can be considered.

- Enhanced Compensation and Benefits: Morgan Stanley might have offered a significantly more lucrative compensation package, including higher salary, bonuses, and stock options.

- Career Advancement Opportunities: The move might represent a promotion or a chance to take on greater responsibilities and leadership roles within Morgan Stanley's distressed debt division.

- Company Culture and Environment: Differences in company culture or work environment between Deutsche Bank and Morgan Stanley might have played a role.

Speculation also points to potential internal factors within Deutsche Bank that may have contributed to the executive's decision. However, without official statements, it's important to approach such discussions cautiously and rely only on reputable sources. Industry trends, such as increased competition and market volatility, also play a role in shaping executive decisions.

Impact on the Distressed Debt Market

This executive's move has broader ramifications for the distressed debt market. The shift in personnel could lead to several notable consequences:

- Shift in Market Leadership: The move could subtly alter the balance of power within the distressed debt market, potentially increasing Morgan Stanley's influence while diminishing Deutsche Bank's.

- Impact on Deal Flow and Pricing: Competition for deals might intensify, potentially affecting pricing and deal structures.

- Investor Confidence: The departure could impact investor sentiment, especially concerning Deutsche Bank's capabilities in the distressed debt sector.

The long-term effects remain to be seen, but this personnel change is indicative of the fluid and highly competitive nature of the financial industry, particularly within the specialized area of distressed debt.

The Impact of a Sudden Departure: Analyzing the Move of Deutsche Bank's Distressed Sales Head

The sudden departure of this key distressed sales head from Deutsche Bank to Morgan Stanley is a significant event with far-reaching implications. This move highlights the intense competition for top talent in the financial industry and underscores the importance of experienced professionals in navigating the complexities of the distressed debt market. The strategic implications for both banks and the broader market are substantial, impacting deal flow, market share, and investor confidence. The reasons behind the move, while speculative to some extent, offer insights into the factors that influence high-level executive decisions in the financial world. The key takeaway is the dynamic nature of the distressed debt market and the critical role played by experienced distressed sales heads.

Stay tuned for further updates on the evolving landscape of distressed asset sales and the impact of key personnel moves within the financial industry.

Featured Posts

-

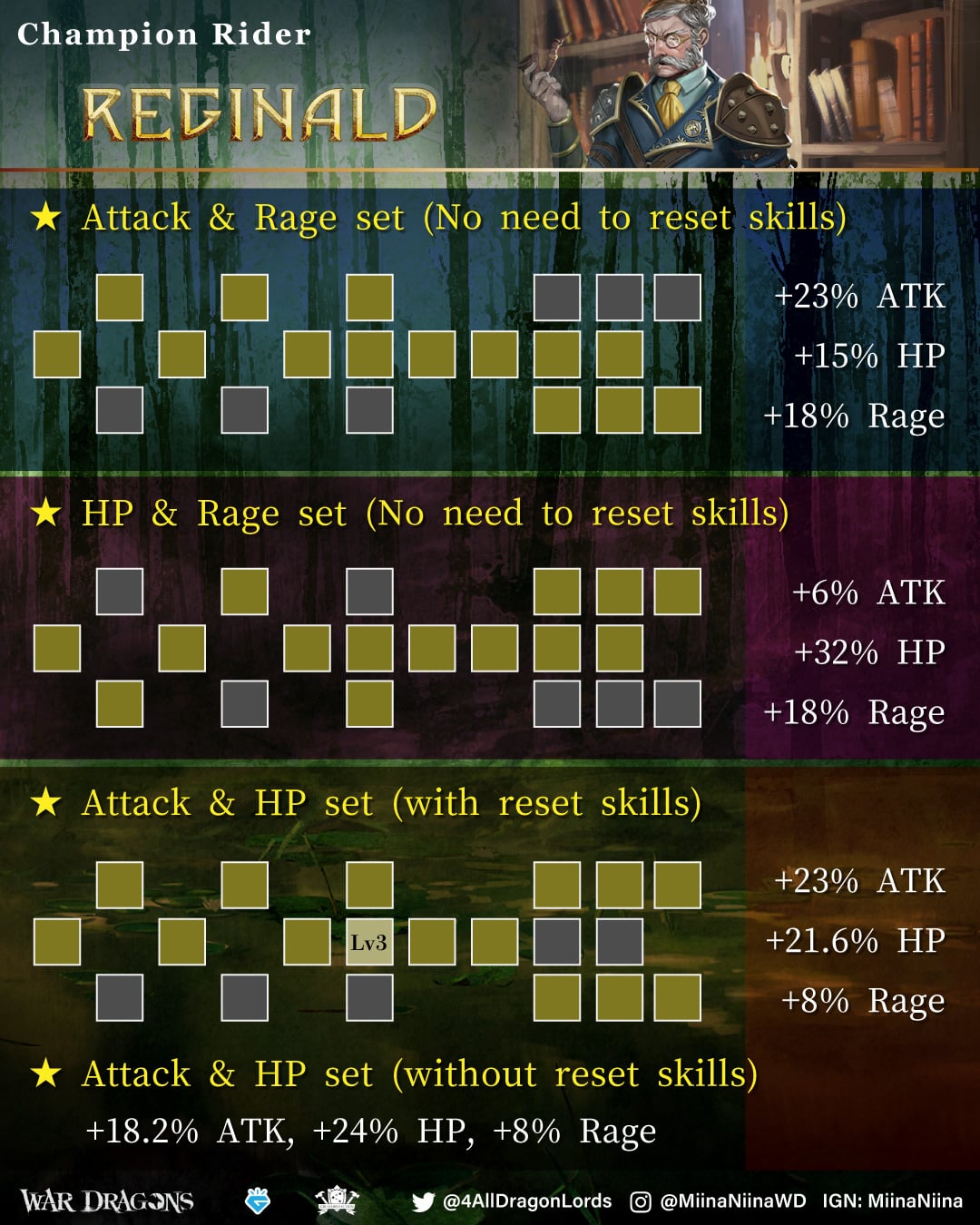

Success On Two Wheels Honda Bikes And Champion Riders

May 30, 2025

Success On Two Wheels Honda Bikes And Champion Riders

May 30, 2025 -

Hugh Jackman And Deborra Lee Furness A Look Back At Their Relationship

May 30, 2025

Hugh Jackman And Deborra Lee Furness A Look Back At Their Relationship

May 30, 2025 -

Oi Kalyteres Tileoptikes Metadoseis Toy Savvatoy 5 4

May 30, 2025

Oi Kalyteres Tileoptikes Metadoseis Toy Savvatoy 5 4

May 30, 2025 -

Frankenstein Del Toros Cryptic Tease And Its Unexpected Narrative Twist

May 30, 2025

Frankenstein Del Toros Cryptic Tease And Its Unexpected Narrative Twist

May 30, 2025 -

Schools Closed Again Winter Storm Brings Another Day Of Closures

May 30, 2025

Schools Closed Again Winter Storm Brings Another Day Of Closures

May 30, 2025