Sudden Shift: ETF Investors Exit Leveraged Semiconductor Funds Ahead Of Price Increase

Table of Contents

The Impact of Anticipated Semiconductor Price Increases

The semiconductor industry is bracing for a substantial price increase, driven by several key factors. Increased raw material costs, particularly for crucial elements like silicon and rare earth minerals, are significantly impacting manufacturing expenses. Furthermore, persistent supply chain disruptions, exacerbated by geopolitical instability and ongoing pandemic-related challenges, continue to constrain production capacity. These combined pressures are squeezing profitability for semiconductor companies, directly affecting the performance of leveraged ETFs tracking their stocks.

- Increased manufacturing costs: Rising energy prices and the cost of specialized equipment contribute to higher production expenses.

- Supply chain bottlenecks impacting production: Delays in procuring essential components hinder the timely manufacturing and delivery of semiconductors.

- Geopolitical factors influencing prices: Trade tensions and sanctions can disrupt supply chains and impact the availability of key materials.

- Potential for decreased demand due to higher prices: Increased semiconductor prices could lead to reduced consumer demand for electronics, further impacting industry revenue.

Analyzing ETF Outflows: Understanding Investor Behavior

The magnitude of the recent ETF outflows from leveraged semiconductor funds is considerable. While precise figures vary depending on the specific ETF, several prominent tickers have experienced double-digit percentage decreases in assets under management over the past week. This substantial shift indicates a growing risk aversion among investors. Many are likely seeking safer investment options in response to the anticipated price increases and the inherent volatility associated with leveraged funds. This trend could have broader implications for the semiconductor market, potentially influencing future investment decisions and overall market stability.

- Specific ETF tickers showing significant outflows: [Insert specific ETF tickers and outflow percentages here – replace bracketed information with real data].

- Comparison to historical ETF outflows in similar situations: Analyzing past trends in ETF outflows during periods of market uncertainty can provide valuable context.

- Expert opinions on investor behavior: Consulting with financial analysts and market experts can offer further insights into the current investor sentiment.

- Correlation with overall market trends: The outflow from leveraged semiconductor funds should be considered within the context of broader market trends and investor behavior across different asset classes.

The Role of Leverage in Amplified Volatility

Leveraged ETFs are designed to magnify both gains and losses. A 2x leveraged ETF, for instance, aims to deliver double the daily return of the underlying index. However, this leverage mechanism also significantly amplifies volatility. The anticipated semiconductor price increase exacerbates this risk. While a price increase could potentially lead to substantial gains in a non-leveraged ETF, the same increase in a leveraged fund could lead to even larger returns, but also to magnified losses if the price increase doesn't materialize or is followed by a price correction. This inherent risk is a major factor driving investors to exit leveraged semiconductor funds.

- Explanation of leverage ratios in ETFs: Clearly explaining how leverage ratios work is crucial for understanding the amplified risk.

- Risk assessment for leveraged semiconductor ETFs: Highlighting the higher risk profile of these ETFs compared to other investment options.

- Comparison to non-leveraged semiconductor ETFs: Showing the difference in volatility and risk between leveraged and non-leveraged options.

Alternative Investment Strategies in the Semiconductor Sector

Investors seeking exposure to the semiconductor sector without the amplified risk of leveraged ETFs have several alternatives. Direct investment in individual semiconductor companies offers a more targeted approach, allowing investors to conduct thorough due diligence on specific companies and their financial performance. Alternatively, investing in non-leveraged semiconductor ETFs provides diversified exposure to the sector with significantly reduced risk compared to their leveraged counterparts.

- Examples of non-leveraged semiconductor ETFs: [Insert examples of non-leveraged semiconductor ETFs here].

- Analysis of individual semiconductor company stocks: Discuss the pros and cons of selecting individual stocks.

- Discussion of other related investment opportunities: Consider mentioning related sectors or technologies that benefit from semiconductor advancements.

Navigating the Shift in Leveraged Semiconductor Funds

The recent exodus from leveraged semiconductor funds underscores the importance of understanding investor behavior and conducting a thorough risk assessment before investing in such products. The anticipated price increase in semiconductors, combined with the inherent volatility of leveraged ETFs, has prompted many investors to seek less risky alternatives. Before investing in leveraged semiconductor funds, carefully assess your risk tolerance and consider alternative investment strategies in this dynamic sector. Thorough research and a diversified portfolio are crucial for navigating the complexities of the semiconductor market and achieving long-term investment success when investing in semiconductor ETFs.

Featured Posts

-

Bar Roma Toronto A Blog To Guide

May 13, 2025

Bar Roma Toronto A Blog To Guide

May 13, 2025 -

Tasman Council Balancing Development And Realistic Road Access

May 13, 2025

Tasman Council Balancing Development And Realistic Road Access

May 13, 2025 -

The Network Of Allegations Surrounding Asap Rocky Involving 50 Cent Tory Lanez And Others

May 13, 2025

The Network Of Allegations Surrounding Asap Rocky Involving 50 Cent Tory Lanez And Others

May 13, 2025 -

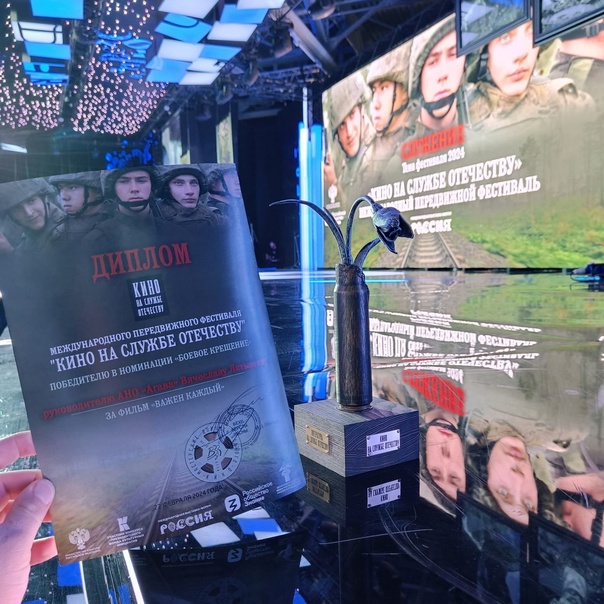

Filmy Festivalya Kino Na Sluzhbe Otechestvu Vzglyad Na Sovremennoe Patrioticheskoe Kino

May 13, 2025

Filmy Festivalya Kino Na Sluzhbe Otechestvu Vzglyad Na Sovremennoe Patrioticheskoe Kino

May 13, 2025 -

Indore Heatwave 40 C And Rising Health Advisory In Effect

May 13, 2025

Indore Heatwave 40 C And Rising Health Advisory In Effect

May 13, 2025

Latest Posts

-

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025 -

Mlb 2025 Season Biggest Winners And Losers After 30 Games

May 14, 2025

Mlb 2025 Season Biggest Winners And Losers After 30 Games

May 14, 2025 -

Gk Barrys Honest Account Navigating Loose Women And Finding Unexpected Help

May 14, 2025

Gk Barrys Honest Account Navigating Loose Women And Finding Unexpected Help

May 14, 2025 -

Another Strong Game For Fitzgerald Leads Giants To Victory

May 14, 2025

Another Strong Game For Fitzgerald Leads Giants To Victory

May 14, 2025 -

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025