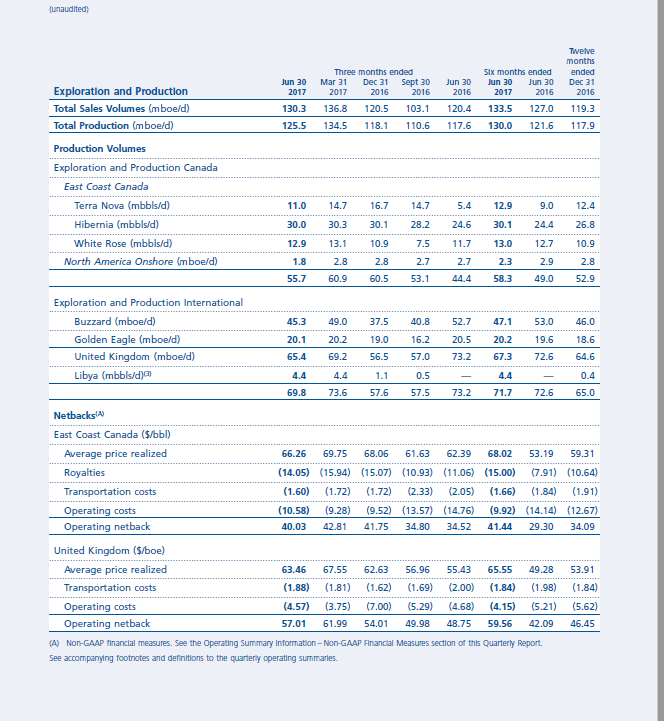

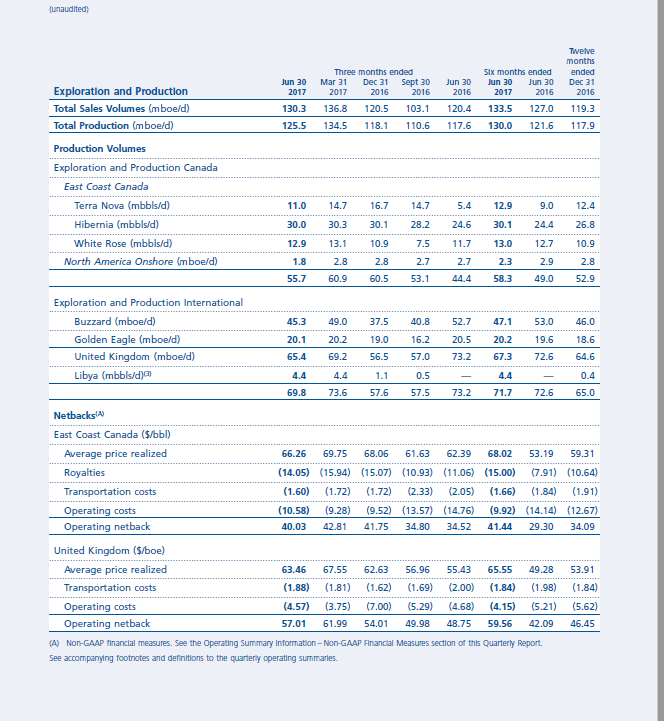

Suncor Production Reaches New High, But Sales Lag Behind

Table of Contents

Record-Breaking Suncor Oil Production: A Detailed Look

Suncor's recent production figures represent a new high watermark for the company, exceeding previous years' performance significantly. While precise numbers require referencing Suncor's official reports, the substantial increase can be attributed to several key factors:

-

Technological Advancements: Suncor has invested heavily in innovative technologies to enhance oil extraction efficiency in its oil sands production operations. This includes improved in-situ recovery methods and optimized extraction techniques, leading to higher yields from existing resources.

-

Operational Efficiency Improvements: Streamlined processes and optimized workflows across Suncor's oil and gas production facilities have significantly boosted output. This includes targeted investments in infrastructure upgrades and workforce training programs.

-

Successful Exploration and Development Projects: New exploration and development projects within existing and new oil sands leases have added to the overall Alberta oil production capacity, significantly contributing to the record-breaking numbers.

-

Oil Sands Production Dominance: The substantial contribution of oil sands production to Suncor's overall output underscores the company's strategic focus on this crucial resource within the Canadian oil production landscape. These operations, while environmentally impactful, remain a cornerstone of Suncor's production capacity.

Lagging Suncor Oil Sales: Understanding the Market Dynamics

Despite the record-breaking Suncor oil production, sales haven't mirrored this growth, presenting a significant challenge. This discrepancy can be attributed to a confluence of factors influencing the global oil market:

-

Global Economic Slowdown: A weakening global economy has reduced energy demand, impacting oil demand and subsequently, prices. Reduced industrial activity and transportation volumes directly translate to lower oil consumption.

-

Competition from Other Oil Producers: Increased production from other global oil producers, particularly OPEC+ nations, has intensified competition, creating downward pressure on oil prices. This makes it more challenging for Suncor to command higher prices for its Suncor oil sales.

-

Geopolitical Instability: Geopolitical uncertainty in various parts of the world further complicates the oil market, leading to price volatility and making it difficult to predict long-term demand.

-

The Rise of Renewable Energy: The growing adoption of renewable energy sources, such as solar and wind power, poses a long-term challenge to the oil industry, reducing the overall energy demand for fossil fuels. This trend will continue to influence the global oil market.

Suncor's Strategic Response to the Production-Sales Imbalance

Suncor is actively addressing the production-sales imbalance through several key strategies:

-

Inventory Management: Optimizing inventory levels to balance supply and demand, preventing excessive stockpiling while ensuring sufficient supply for future sales.

-

Market Diversification: Expanding into new markets and exploring different customer segments to reduce reliance on any single market and mitigate price fluctuations.

-

Investment in Downstream Operations: Investing in downstream operations, such as refineries and petrochemical plants, allows Suncor to add value to its crude oil, generating higher margins and reducing reliance on external markets for processing.

-

Strategic Partnerships and Acquisitions: Exploring strategic alliances and potential acquisitions to expand market access, enhance technology, and optimize operations could be a future strategy.

Investor Sentiment and Future Outlook for Suncor Stock

The production-sales gap has understandably impacted Suncor stock price and investor sentiment. Investors are closely monitoring the company's strategies to address the imbalance and ensure sustainable long-term growth. Concerns remain regarding the company's ability to maintain profitability given the current market conditions. However, Suncor's extensive resources, ongoing technological advancements, and strategic initiatives offer potential for future growth. The outlook hinges on global economic recovery, oil price stabilization, and the success of Suncor's initiatives to bridge the gap between production and sales. The performance of energy stocks in general will also play a crucial role.

Suncor's Production and Sales - A Path Forward

In summary, Suncor's impressive Suncor oil production levels are overshadowed by lagging Suncor oil sales, a consequence of global economic factors, intensified competition, and the evolving energy landscape. The company's strategic responses aim to mitigate these challenges and ensure future profitability. The success of these strategies will determine the long-term outlook for Suncor's production and sales, ultimately impacting Suncor stock and the company's position within the energy market. Stay informed about Suncor Energy's strategies to balance its record-breaking Suncor oil production with increased Suncor oil sales by following our updates and monitoring their official financial reports.

Featured Posts

-

Brutal Racist Stabbing Woman Faces Murder Charges

May 10, 2025

Brutal Racist Stabbing Woman Faces Murder Charges

May 10, 2025 -

Oilers Vs Kings Nhl Playoffs Game 1 Prediction Analysis And Best Odds

May 10, 2025

Oilers Vs Kings Nhl Playoffs Game 1 Prediction Analysis And Best Odds

May 10, 2025 -

Exec Office365 Breach Nets Millions For Crook Feds Say

May 10, 2025

Exec Office365 Breach Nets Millions For Crook Feds Say

May 10, 2025 -

Strictly Come Dancing Star Wynne Evans Breaks Silence On Future Plans

May 10, 2025

Strictly Come Dancing Star Wynne Evans Breaks Silence On Future Plans

May 10, 2025 -

High Potential The Finale That Impressed Abc

May 10, 2025

High Potential The Finale That Impressed Abc

May 10, 2025