Suncor's Record Production: Impact Of Inventory Buildup On Sales Volumes

Table of Contents

Introduction: Suncor Energy, a leading Canadian integrated energy company, recently reported record production levels. While this signifies operational success, a significant inventory buildup raises concerns about its impact on sales volumes and overall financial performance. This article delves into the complexities of Suncor's record production, analyzing the potential consequences of this surplus and its implications for the future. Understanding the interplay between record oil production and inventory management is crucial for assessing Suncor's long-term strategic success.

H2: Record Production Levels at Suncor: A Detailed Look

H3: Production Increase Across Various Segments: Suncor's record production stems from significant increases across multiple segments. This surge isn't limited to a single area but reflects a broader operational triumph.

- Oil Sands Production: Suncor reported a X% increase in oil sands production in Q[Quarter] [Year], reaching [Specific figure] barrels per day. This represents a substantial jump compared to the same period last year ([Specific figure] barrels per day).

- Upstream Operations: Improvements in upstream operations, including enhanced recovery techniques and optimized well performance, contributed significantly to the overall production increase.

- Other Segments: [Mention any other segments like natural gas production with specific data if available].

- Driving Factors: This impressive production surge is attributable to several key factors:

- Implementation of advanced technologies, such as [mention specific technologies].

- Significant investments in capital projects, including [mention specific projects].

- Improved operational efficiency through streamlined processes and workforce optimization.

H3: Factors Contributing to Record Production: Suncor's record production is not a fluke; it's the result of a concerted effort focused on technological advancement and strategic investments.

- Technological Advancements: Suncor has aggressively adopted cutting-edge technologies to improve extraction rates and reduce operational costs. This includes [List specific technologies like steam-assisted gravity drainage (SAGD) improvements or enhanced oil recovery techniques].

- Strategic Investments: Significant investments in new projects and infrastructure upgrades have played a crucial role in boosting production capacity. Examples include [Mention specific capital projects that contributed to increased production].

- Operational Efficiency: Suncor's commitment to operational excellence, through continuous improvement initiatives, has resulted in higher production with fewer resources.

H2: The Impact of Inventory Buildup on Suncor's Sales Volumes

H3: Understanding the Inventory Surplus: The impressive production figures are accompanied by a concerning inventory buildup. This surplus indicates a mismatch between production capacity and market demand or downstream processing capabilities.

- Slower-than-anticipated Downstream Processing: Delays or limitations in Suncor's downstream operations, such as refining capacity constraints, may be contributing to the inventory buildup.

- Reduced Market Demand: Fluctuations in global oil demand, potentially due to economic slowdowns or shifts in energy consumption patterns, could also be a contributing factor.

- Supply Chain Disruptions: Challenges in the transportation and logistics network, impacting the timely delivery of oil products to markets, could be adding to inventory levels.

H3: Implications for Sales Figures: The inventory buildup directly impacts Suncor's sales volume and profitability.

- Correlation between Inventory and Sales: Data analysis is needed to establish a clear correlation between rising inventory levels and slowing sales growth. [Insert hypothetical data if available, e.g., "A 10% increase in inventory correlated with a 5% decrease in sales in Q[Quarter] [Year]."]

- Pricing Pressure: An oversupply of oil in the market can lead to downward pressure on prices, potentially reducing Suncor's revenue per barrel.

- Sales Strategies: Suncor may need to adjust its sales strategies, perhaps focusing on discounted pricing or exploring alternative markets to alleviate the inventory pressure.

H3: Downstream Operations and Refining Capacity: The efficiency of Suncor's downstream operations and refining capacity is central to managing the inventory surplus.

- Refining Capacity: Suncor's refining capacity needs to be assessed to determine if it can effectively process the increased upstream production. [State Suncor's refining capacity and its utilization rate if available].

- Infrastructure Upgrades: Potential expansions or upgrades to Suncor's downstream infrastructure, including refineries and pipelines, are crucial for addressing the inventory imbalance.

H2: Market Dynamics and External Factors Affecting Sales

H3: Global Oil Market Conditions: Global oil market conditions significantly impact Suncor's sales volume.

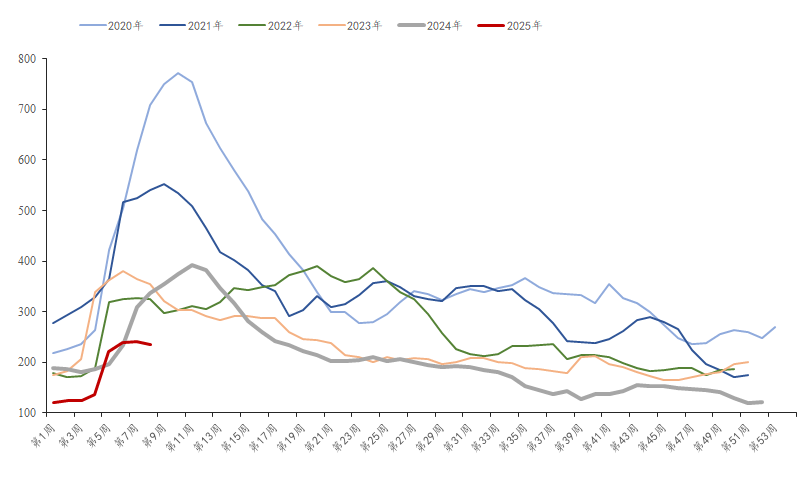

- Oil Price Fluctuations: Volatile oil prices, driven by geopolitical events, economic growth, and OPEC+ decisions, directly influence demand and Suncor's revenue.

- Geopolitical Factors: Geopolitical instability in oil-producing regions can create uncertainty and price volatility, affecting market demand.

- Economic Factors: Global economic growth rates play a significant role in driving oil demand.

H3: Competition in the Energy Sector: Suncor operates in a competitive energy landscape, and competitors' actions impact its market share and sales.

- Competitive Actions: The strategies and actions of competing energy companies influence market dynamics and price levels.

- Market Share: Suncor's market share and sales performance are constantly affected by competitive pressures.

3. Conclusion:

Suncor's record oil production, while impressive, is coupled with a substantial inventory buildup. This surplus highlights the challenges of balancing increased production with market demand and efficient downstream processing. The analysis reveals a complex interplay between upstream operations, downstream capacity, market dynamics, and global economic factors. The impact on sales volume underscores the importance of proactive inventory management strategies. Addressing this inventory surplus requires a strategic response involving optimizing downstream operations, potentially expanding refining capacity, and closely monitoring global market conditions. Continued monitoring of Suncor's inventory management strategies and their impact on future sales volumes is crucial for understanding its long-term financial performance. Stay informed about Suncor's progress in addressing this inventory surplus and its implications for future oil production and sales.

Featured Posts

-

Jeanine Pirro To Speak In North Idaho A Conservative Perspective

May 09, 2025

Jeanine Pirro To Speak In North Idaho A Conservative Perspective

May 09, 2025 -

Is The Colapinto Doohan Imola F1 Swap Just A Rumor

May 09, 2025

Is The Colapinto Doohan Imola F1 Swap Just A Rumor

May 09, 2025 -

Nyt Strands Solutions Tuesday March 4 Game 366

May 09, 2025

Nyt Strands Solutions Tuesday March 4 Game 366

May 09, 2025 -

Inquiry Into Nottingham Attacks Retired Judge Appointed Chair

May 09, 2025

Inquiry Into Nottingham Attacks Retired Judge Appointed Chair

May 09, 2025 -

Androids Design Refresh Success Or Failure With Gen Z

May 09, 2025

Androids Design Refresh Success Or Failure With Gen Z

May 09, 2025