Sunnova Energy Denied $3 Billion Loan Under Trump Administration

Table of Contents

The Sunnova Energy Loan Application

Sunnova Energy, a leading residential solar energy provider, submitted a substantial loan application for $3 billion. This significant sum was intended to fuel the company's expansion plans, encompassing the development of new solar energy infrastructure projects across the US, research and development into next-generation solar technologies, and bolstering their operational capacity to meet the growing demand for residential solar solutions. The loan application, submitted in [Insert Year if available], detailed ambitious plans projected to create thousands of jobs and significantly boost the US economy through increased investment in clean energy.

- Specific projects the loan would have funded: Expansion into new geographic markets, development of large-scale community solar projects, and upgrades to Sunnova's technology infrastructure.

- Projected job creation and economic benefits: The application projected the creation of [Insert Number if available] jobs directly and indirectly through the ripple effect within the supply chain and related industries. Economic benefits were projected to include substantial tax revenue and a boost to local economies where projects were implemented.

- Sunnova's financial standing at the time of application: Sunnova presented robust financial data demonstrating its strong creditworthiness and the viability of its expansion plans, aiming to convince the administration of the loan's minimal risk.

The application process spanned several months, with various stages of review and communication between Sunnova and the relevant government agencies. [Include details about specific deadlines or public statements if available].

The Trump Administration's Rationale for Denial

The Trump administration's official explanation for rejecting Sunnova's $3 billion loan application remained vague and lacked specific details. While no official public statement explicitly detailed the reasons, it’s widely believed that the decision stemmed from a broader policy stance that prioritized fossil fuels over renewable energy sources.

- Statements made by government officials regarding the decision: [Include any quotes or official statements released by relevant government officials at the time]. The lack of transparency surrounding the denial fueled speculation about the underlying motives.

- Comparison to similar loan applications approved or denied during the same period: Analyzing similar loan applications from the same period could shed light on the administration's priorities and potential biases. Were fossil fuel projects favored over renewable energy ventures?

- Potential influence of lobbying groups or political pressure: The influence of powerful lobbying groups representing fossil fuel interests is a factor that cannot be ignored. It's crucial to investigate potential political pressures that may have played a role in the denial.

The Impact of the Denied Loan on Sunnova Energy

The rejection of the $3 billion loan had a considerable impact on Sunnova Energy. While the company remained operational, its growth trajectory was undoubtedly affected.

- Short-term and long-term consequences for Sunnova Energy's business and financial performance: The denial likely forced Sunnova to scale back some expansion plans, potentially impacting its market share and future profitability.

- Stock market reaction: The news of the loan rejection likely caused a negative impact on Sunnova's stock price, reflecting investor concerns about the company's future prospects. [Include details about the stock price fluctuation if possible].

- Changes in Sunnova's investment plans: Sunnova may have been forced to seek alternative funding sources, potentially at higher interest rates, impacting its profitability and long-term sustainability.

Broader Implications for the Renewable Energy Sector

The Sunnova Energy denied $3 billion loan had far-reaching implications extending beyond Sunnova itself. The decision sent a chilling message to investors and the renewable energy sector at large.

- The decision's effect on investor confidence in the renewable energy sector: The denial raised concerns about the stability and predictability of government support for clean energy initiatives, potentially deterring investment in the sector.

- Potential impact on future government funding for similar projects: The rejection set a concerning precedent, casting doubt on the future availability of government funding for renewable energy projects.

- Analysis of the impact on other renewable energy companies: The decision may have influenced other renewable energy companies' investment strategies, causing some to scale back their ambitions due to uncertainty surrounding future government support.

Changes in government policies toward renewable energy: This incident reflects the broader political climate towards renewable energy under the Trump administration.

Discussion of the long-term consequences for the US transition to clean energy: The Sunnova case underscores the challenges inherent in transitioning to a sustainable energy future, especially when faced with political headwinds.

Conclusion: Analyzing the Sunnova Energy Loan Denial

The denial of a $3 billion loan to Sunnova Energy by the Trump administration serves as a significant case study in the interplay between politics, economics, and the renewable energy sector. The decision’s impact on Sunnova Energy, coupled with its broader implications for investor confidence and future government funding for clean energy projects, highlights the need for greater transparency and consistent policy support for renewable energy initiatives. Understanding the circumstances surrounding the Sunnova Energy denied $3 billion loan is crucial for advocating for greater government support of renewable energy initiatives. Stay informed and participate in the conversation to shape the future of clean energy. Learn more about government funding for renewable energy and advocate for policies that support the growth of this vital sector.

Featured Posts

-

Somersets Jewel Baths Splendor Revealed Through Images

May 30, 2025

Somersets Jewel Baths Splendor Revealed Through Images

May 30, 2025 -

Dmps Announces New District Wide Cell Phone Policy For The Upcoming School Year

May 30, 2025

Dmps Announces New District Wide Cell Phone Policy For The Upcoming School Year

May 30, 2025 -

Chinese Bridge Competition Jordan Hosts Final Event In Amman

May 30, 2025

Chinese Bridge Competition Jordan Hosts Final Event In Amman

May 30, 2025 -

Dolberg Rygtes Til London Klub Detaljer Om Potentiel Transfer

May 30, 2025

Dolberg Rygtes Til London Klub Detaljer Om Potentiel Transfer

May 30, 2025 -

Droits De Douane Mode D Emploi Et Reglementation

May 30, 2025

Droits De Douane Mode D Emploi Et Reglementation

May 30, 2025

Latest Posts

-

How To Watch Giro D Italia Online For Free A Complete Guide

May 31, 2025

How To Watch Giro D Italia Online For Free A Complete Guide

May 31, 2025 -

Giro D Italia 2024 Live Mens Race Updates

May 31, 2025

Giro D Italia 2024 Live Mens Race Updates

May 31, 2025 -

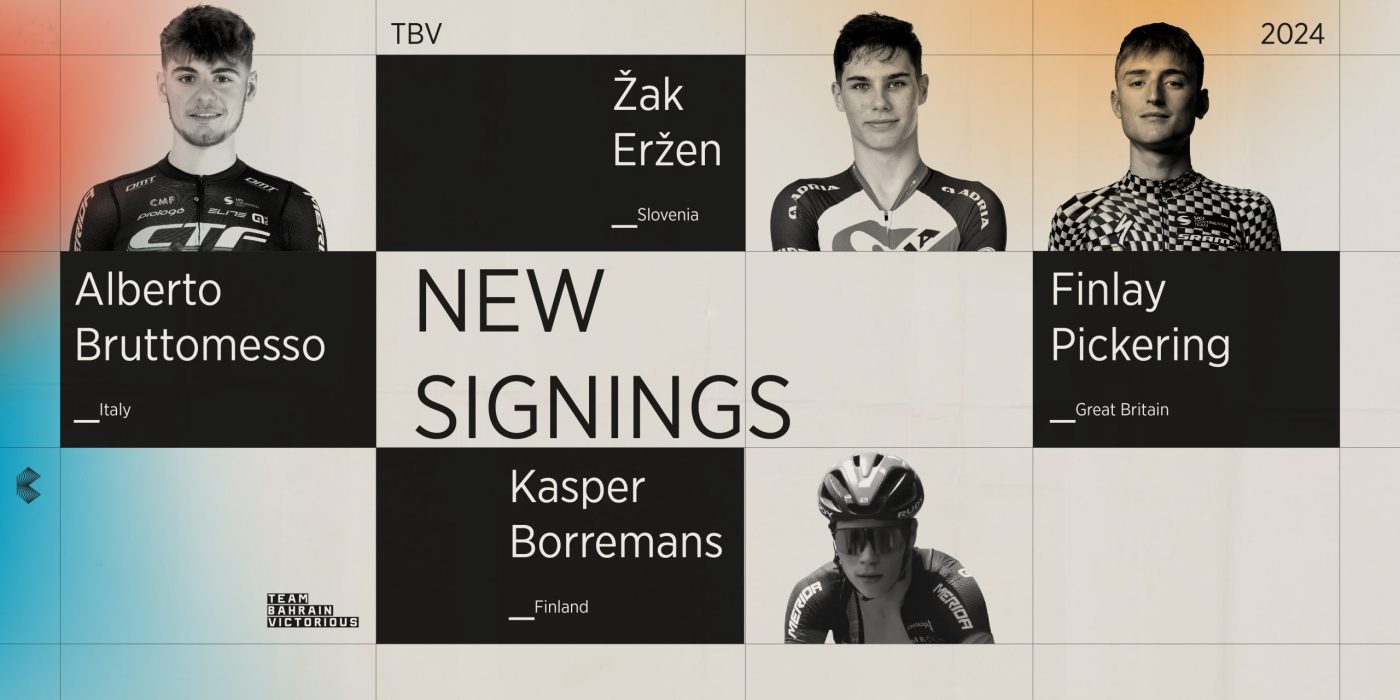

Cyclings Elite Team Victorious At The Tour Of The Alps

May 31, 2025

Cyclings Elite Team Victorious At The Tour Of The Alps

May 31, 2025 -

Canadian Red Cross Wildfire Relief Efforts In Manitoba Your Support Matters

May 31, 2025

Canadian Red Cross Wildfire Relief Efforts In Manitoba Your Support Matters

May 31, 2025 -

Follow The Live Mens Giro D Italia

May 31, 2025

Follow The Live Mens Giro D Italia

May 31, 2025