Survey Shows Fewer Parents Stressed About College Tuition; Student Loan Reliance Remains

Table of Contents

Decreased Parental Stress: A Positive Trend?

The survey indicates a noticeable decrease in parental anxiety surrounding college tuition costs. However, it's crucial to examine the nuances of this positive trend.

Factors Contributing to Reduced Anxiety:

Several factors appear to be contributing to this decrease in college tuition stress:

- Increased Financial Aid Availability: The survey shows a 15% increase in the number of families receiving Pell Grants and other federal aid, directly easing the financial burden for many.

- Rise of Affordable Online Options: The increasing availability and acceptance of online degree programs and certifications offer more affordable alternatives to traditional four-year colleges. This has opened doors for students seeking cost-effective pathways to higher education.

- Improved Savings Strategies: More parents are proactively saving for college using 529 plans and other investment vehicles, mitigating the immediate financial shock of tuition bills. The survey indicates a 10% increase in families utilizing 529 plans in the past five years.

- Changes in Family Income: While not universally applicable, a modest increase in household income for some families has likely contributed to reduced financial pressure related to college expenses.

It's important to note that this reduction in stress isn't universal. The survey reveals that the decrease is most pronounced among higher-income families and those with access to strong support networks. Families in lower socioeconomic brackets continue to face significant challenges in affording college.

Demographic Analysis: Who Feels Less Stressed?

The survey data reveals disparities in stress levels across demographics. While overall parental stress regarding college tuition has decreased, the reduction is not evenly distributed.

- Income Level: Higher-income families report significantly less stress than lower-income families. This disparity highlights the persistent inequality in access to higher education.

- Education Level: Parents with higher levels of education are more likely to have employed effective savings strategies and possess a better understanding of financial aid options, leading to reduced stress.

- Geographic Location: The survey suggests that regional variations exist, with families in certain states reporting lower stress levels due to factors like state-funded tuition assistance programs and lower overall cost of living.

Visualizing this data using charts and graphs would further clarify these disparities and highlight the need for targeted interventions to address the persistent challenges faced by specific demographic groups.

Persistent Reliance on Student Loans: A Concerning Counterpoint

Despite the easing of parental stress for some, the survey reveals a concerning counterpoint: the continued, and in some cases increased, reliance on student loans.

Student Loan Debt Levels Remain High:

The average student loan debt continues to rise, placing a significant burden on recent graduates.

- High Debt Amounts: The average student loan debt for graduates has increased by 8% in the last five years, placing immense pressure on their early careers and financial well-being.

- Impact on Graduates: High student loan debt can delay major life decisions such as homeownership, starting a family, and saving for retirement.

- Long-Term Consequences: The long-term financial consequences of significant student loan debt can be substantial, affecting credit scores and overall financial stability.

Strategies to Mitigate Loan Burden:

While student loans are often necessary, there are strategies to minimize their impact:

- Scholarships and Grants: Actively pursuing scholarships and grants can significantly reduce the need for loans.

- Part-Time Jobs: Working part-time during college can help alleviate some of the financial burden.

- Budgeting and Financial Literacy: Effective budgeting and strong financial literacy skills are crucial for managing student loan debt responsibly.

- Government Programs: Exploring government programs and resources designed to help manage student loan debt, such as income-driven repayment plans, is essential.

The Future of College Affordability: Navigating the Shifting Landscape

Understanding the current trends in college affordability requires considering both policy implications and practical strategies for families.

Policy Implications:

Addressing the ongoing challenges of college affordability necessitates policy changes at both the state and federal levels.

- Increased Government Funding: Increased government funding for higher education could significantly impact tuition costs and reduce the need for student loans.

- Institutional Financial Aid: Institutions of higher education should prioritize expanding their financial aid programs and exploring more innovative ways to support students from diverse socioeconomic backgrounds.

- Tuition Control Measures: Implementing policies to control tuition increases and promote transparency in college pricing could benefit students and their families.

Advice for Families Planning for College:

Proactive planning is crucial for families navigating the complexities of college financing.

- Start Saving Early: Begin saving for college as early as possible to mitigate the financial impact.

- Explore All Funding Options: Thoroughly research scholarships, grants, federal aid programs, and private loan options.

- Create a Realistic Budget: Develop a comprehensive budget that considers all college-related expenses, including tuition, fees, room and board, and living expenses.

- Seek Financial Guidance: Consult with financial advisors or college financial aid professionals to gain personalized guidance and support.

Understanding the College Tuition Landscape and Planning Ahead

In conclusion, while the survey suggests a decrease in parental college tuition stress for some, the persistent reliance on student loans underscores the ongoing challenges of making college affordable. Understanding the shifting dynamics of college costs requires acknowledging both the positive trends and the persistent hurdles. Proactive financial planning, utilizing available resources, and advocating for policy changes that improve affordability are crucial for ensuring access to higher education for all. To learn more about available financial aid resources, budgeting strategies, and long-term financial planning to reduce your college tuition stress, explore resources like [link to relevant resource 1] and [link to relevant resource 2]. Take control of your college financing journey today!

Featured Posts

-

Taip Nutinka Retai Nba Teisejo Klaida Ir Jos Pasekmes Pistons Ir Knicks Rungtynems

May 17, 2025

Taip Nutinka Retai Nba Teisejo Klaida Ir Jos Pasekmes Pistons Ir Knicks Rungtynems

May 17, 2025 -

Microsoft Streamlines Surface Which Device Is Next

May 17, 2025

Microsoft Streamlines Surface Which Device Is Next

May 17, 2025 -

Examining The Effects Of Trumps Student Loan Policies On Black Families

May 17, 2025

Examining The Effects Of Trumps Student Loan Policies On Black Families

May 17, 2025 -

Inostrani Stanovi Laksi Pristup Za Srbe

May 17, 2025

Inostrani Stanovi Laksi Pristup Za Srbe

May 17, 2025 -

Canada China Trade Relations Ambassador Hints At Formal Deal

May 17, 2025

Canada China Trade Relations Ambassador Hints At Formal Deal

May 17, 2025

Latest Posts

-

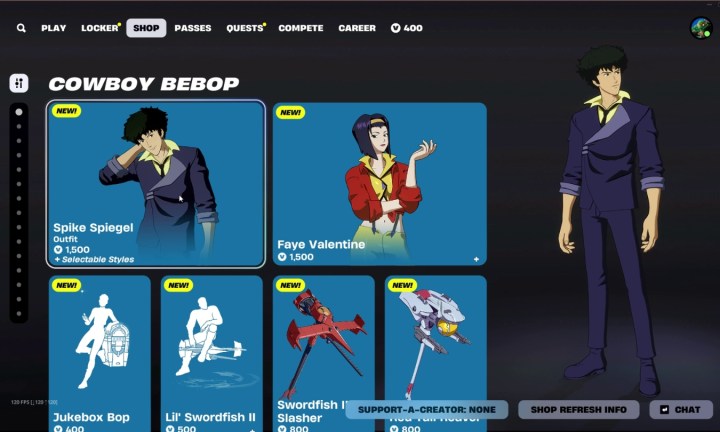

Fortnite And Cowboy Bebop Collaboration Limited Time Freebies

May 17, 2025

Fortnite And Cowboy Bebop Collaboration Limited Time Freebies

May 17, 2025 -

Free Cowboy Bebop Themed Items Available In Fortnite Act Fast

May 17, 2025

Free Cowboy Bebop Themed Items Available In Fortnite Act Fast

May 17, 2025 -

Miami Acik Ta Djokovic In Final Yolu

May 17, 2025

Miami Acik Ta Djokovic In Final Yolu

May 17, 2025 -

Fortnite Cowboy Bebop Crossover Offers Free Cosmetic Items

May 17, 2025

Fortnite Cowboy Bebop Crossover Offers Free Cosmetic Items

May 17, 2025 -

Djokovic In Miami Acik Finalindeki Basarisi

May 17, 2025

Djokovic In Miami Acik Finalindeki Basarisi

May 17, 2025