Swissquote Bank: Analyzing The Euro's Rise Against The US Dollar

Table of Contents

Economic Factors Driving the Euro's Strength

Several economic factors have contributed to the Euro's robust performance against the US dollar. Understanding these factors is key to predicting future movements in the EUR/USD exchange rate.

Stronger-than-Expected Eurozone Economic Data

Recent economic indicators from the Eurozone have painted a surprisingly positive picture, boosting investor confidence in the Euro.

- Robust GDP Growth: The Eurozone has shown resilience against global economic headwinds, with GDP growth exceeding expectations in several quarters. This positive momentum indicates a strong economic foundation supporting the Euro's value.

- Inflation Moderation (relative to the US): While inflation remains a concern in the Eurozone, its recent moderation, compared to persistently high inflation in the US, has made the Euro a more attractive investment. This relative stability has fueled the Euro's appreciation against a weaker dollar.

- Improved Employment Rates: Stronger-than-anticipated employment figures across the Eurozone indicate a healthy labor market, further supporting economic growth and bolstering the Euro's value. This positive trend reinforces the Eurozone's economic strength.

- Increased Consumer Confidence: Rising consumer confidence suggests growing optimism about the Eurozone's economic future, contributing to increased demand for the Euro and pushing its value upward.

You can find detailed Eurozone economic data and analysis on the Swissquote Bank website [link to relevant Swissquote page].

European Central Bank (ECB) Monetary Policy

The European Central Bank's (ECB) monetary policy plays a crucial role in influencing the Euro's strength.

- Interest Rate Decisions: The ECB's recent interest rate hikes, aimed at curbing inflation, have made the Euro more attractive to investors seeking higher returns compared to the US dollar. These decisions directly impact the EUR/USD exchange rate.

- Comparison with the Federal Reserve: A comparison of the ECB's monetary policy with the more aggressive interest rate hikes by the Federal Reserve (the US central bank) reveals a contrasting approach. The more cautious approach by the ECB, while impacting inflation, has less severely impacted the Euro than the aggressive stance of the Fed on the USD.

- Quantitative Easing (QE): The ECB's approach to quantitative easing and other monetary tools has also influenced the Euro's value. The winding down of QE programs, for example, can impact investor sentiment and exchange rates.

Swissquote Bank provides insightful analysis of ECB meetings and their implications for the Euro; you can access these reports on their website [link to relevant Swissquote page].

Geopolitical Factors Affecting the Euro

Geopolitical events significantly influence investor sentiment and, consequently, the Euro's value.

- The War in Ukraine: The ongoing conflict in Ukraine and its impact on energy prices and supply chains have created uncertainty in the global market. However, the Eurozone's ability to manage this crisis has, surprisingly, boosted confidence.

- Energy Crisis Management: The Eurozone's efforts to mitigate the energy crisis resulting from the war have shown resilience, contributing to a more positive outlook on the Euro.

- Political Stability: Relative political stability within the Eurozone, compared to certain geopolitical uncertainties elsewhere, has enhanced investor confidence, supporting the Euro's strength.

Swissquote Bank offers regular updates and analyses of these geopolitical factors and their impact on the EUR/USD exchange rate [link to relevant Swissquote news page].

Weakening US Dollar Factors

The weakening of the US dollar against the Euro is not solely due to Euro strength; several factors have contributed to the USD's decline.

US Economic Slowdown Concerns

Concerns about a potential US economic slowdown have dampened investor confidence in the US dollar.

- Weaker-than-Expected GDP Growth: Slower-than-anticipated GDP growth in the US raises concerns about economic health and weakens the dollar's appeal.

- High Inflation and Rising Interest Rates: While the Federal Reserve has been aggressively raising interest rates to combat inflation, this action could potentially trigger a recession, dampening investor confidence and weakening the dollar.

Swissquote Bank offers comprehensive market analysis and data on the US economy [link to relevant Swissquote page].

Federal Reserve's Interest Rate Hikes

The Federal Reserve's interest rate hikes, although intended to curb inflation, may have unintended consequences for the US dollar.

- Effectiveness of Rate Hikes: The market is closely watching whether the Fed's aggressive interest rate hikes are effectively controlling inflation without triggering a recession. Uncertainty surrounding this question weakens the USD.

- Market Expectations for Future Rate Hikes: Market expectations regarding future interest rate hikes play a significant role in influencing the USD's value. Uncertainty contributes to volatility and potential weakness.

Swissquote Bank provides detailed commentary and analysis on the Federal Reserve's monetary policy [link to relevant Swissquote page].

Trading the Euro/US Dollar with Swissquote Bank

Swissquote Bank provides a robust platform for trading the EUR/USD currency pair.

Swissquote Bank's Trading Platform and Tools

Swissquote Bank's advanced trading platform offers several features beneficial for forex trading.

- Charting Tools: Sophisticated charting tools allow traders to analyze price trends and identify potential trading opportunities in the EUR/USD market.

- Analysis Tools: A range of technical and fundamental analysis tools helps traders make informed decisions.

- Order Types: Various order types cater to different trading strategies and risk management preferences.

- Competitive Spreads and Low Commissions: Swissquote Bank offers competitive pricing, making it an attractive platform for traders.

Visit the Swissquote Bank website [link to Swissquote website] to explore their trading platform and its features.

Risk Management Considerations

Forex trading involves significant risk, and effective risk management is paramount.

- Stop-Loss Orders: Utilizing stop-loss orders helps limit potential losses.

- Position Sizing: Careful position sizing ensures that any potential losses remain manageable.

- Diversification: Diversifying your portfolio across different assets reduces risk.

Remember to educate yourself thoroughly about forex trading risks before engaging in any trading activity.

Conclusion

The Euro's rise against the US dollar is a complex phenomenon driven by a confluence of economic and geopolitical factors. The stronger-than-expected Eurozone economic data, the ECB's monetary policy, and concerns regarding a US economic slowdown have all contributed to the EUR/USD exchange rate's movement. Understanding these dynamics is crucial for anyone trading this currency pair. Swissquote Bank, with its comprehensive analysis tools and user-friendly trading platform, provides valuable resources for navigating this dynamic market. Stay informed about the EUR/USD exchange rate by regularly checking Swissquote Bank's market analysis and consider using their platform to leverage the Euro's rise against the US dollar. Visit Swissquote Bank's website today [link to Swissquote website] to start your journey.

Featured Posts

-

Resultats Du Credit Mutuel Am Au T4 2024 Perspectives Et Analyse

May 19, 2025

Resultats Du Credit Mutuel Am Au T4 2024 Perspectives Et Analyse

May 19, 2025 -

Nyt Mini Crossword Answers Today March 12 2025 Hints And Clues

May 19, 2025

Nyt Mini Crossword Answers Today March 12 2025 Hints And Clues

May 19, 2025 -

Is Lumo The Worst Eurovision Mascot A Look At The Controversy

May 19, 2025

Is Lumo The Worst Eurovision Mascot A Look At The Controversy

May 19, 2025 -

Polands Presidential Election What To Expect And Why It Matters

May 19, 2025

Polands Presidential Election What To Expect And Why It Matters

May 19, 2025 -

The Eus Tightening Policies And The Consequent Loss Of European Citizens

May 19, 2025

The Eus Tightening Policies And The Consequent Loss Of European Citizens

May 19, 2025

Latest Posts

-

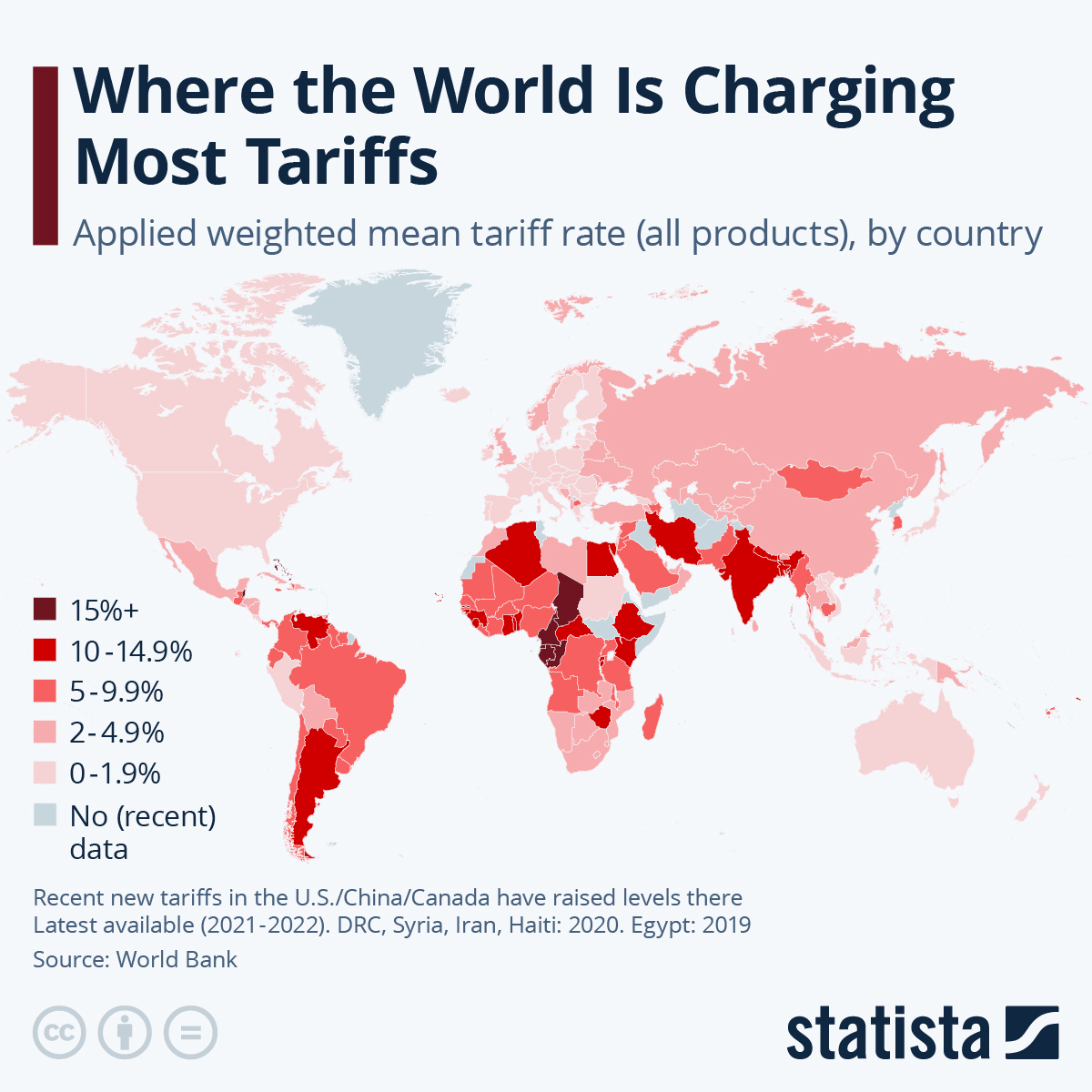

Canada Defends Tariff Stance Against Oxford Report Criticism

May 19, 2025

Canada Defends Tariff Stance Against Oxford Report Criticism

May 19, 2025 -

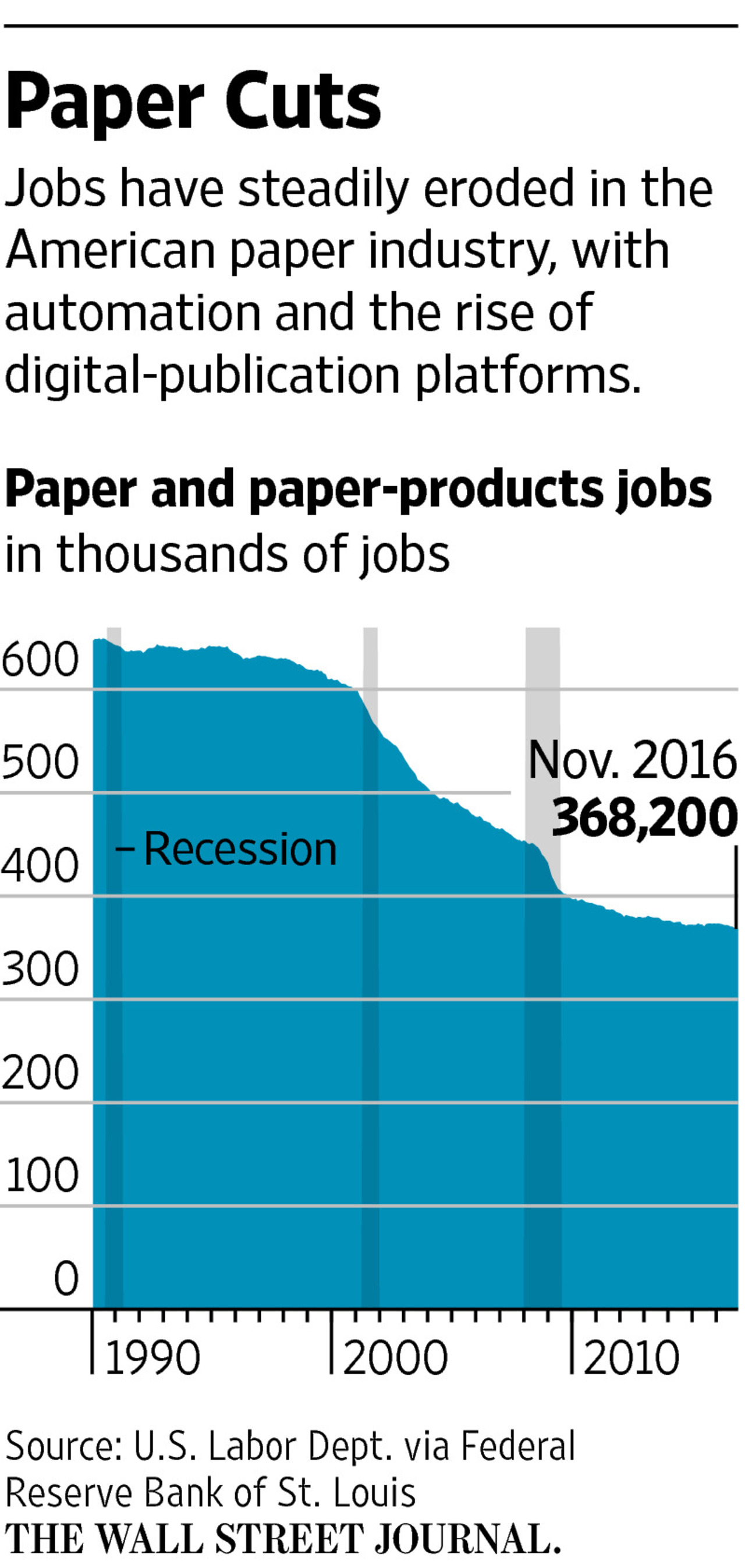

Anchor Brewing Company Shuts Down Impact On The Craft Beer Industry

May 19, 2025

Anchor Brewing Company Shuts Down Impact On The Craft Beer Industry

May 19, 2025 -

Is An Ipo On The Horizon For Sabics Gas Assets In Saudi Arabia

May 19, 2025

Is An Ipo On The Horizon For Sabics Gas Assets In Saudi Arabia

May 19, 2025 -

Canada Rejects Oxford Report Most Us Tariffs Remain

May 19, 2025

Canada Rejects Oxford Report Most Us Tariffs Remain

May 19, 2025 -

Upcoming Polish Presidential Election A Crucial Moment For The Country

May 19, 2025

Upcoming Polish Presidential Election A Crucial Moment For The Country

May 19, 2025