Swissquote Bank: Euro And European Futures Rise As US Dollar And US Futures Fall

Table of Contents

The Strengthening Euro: Factors Contributing to its Rise

The Euro's recent surge against the US dollar is a result of several interconnected factors. Understanding these dynamics is crucial for anyone involved in Euro trading or interested in the performance of European assets.

Increased Interest Rates in the Eurozone

The European Central Bank (ECB) has implemented a series of aggressive interest rate hikes to combat inflation. This monetary policy has significantly impacted the Euro's value.

- July 2023: The ECB raised its key interest rate by 0.25%, a move that signaled a continued commitment to curbing inflation. This resulted in a noticeable strengthening of the Euro against the US dollar.

- September 2023: A further rate hike of 0.25% solidified the ECB's stance, further bolstering investor confidence and driving up the Euro's value.

- Market Reaction: Each rate hike has been met with positive market reaction, indicating a belief in the ECB's ability to control inflation within the Eurozone.

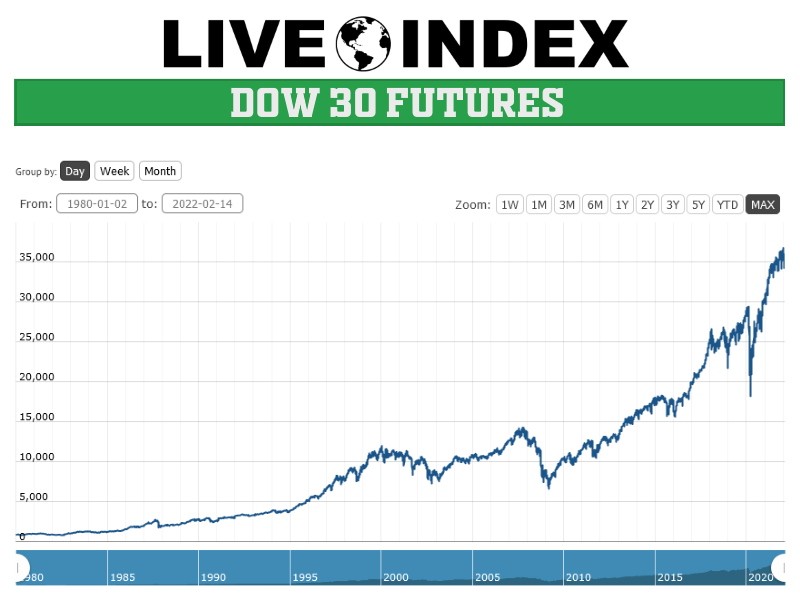

[Insert chart/graph showing Euro/USD exchange rate over the relevant period]

Weakening US Dollar

The decline of the US dollar is a crucial factor contributing to the Euro's rise. Several factors are at play:

- Persistent Inflation: High inflation rates in the US have eroded the purchasing power of the dollar, making it less attractive to international investors.

- Federal Reserve Policies: While the Federal Reserve has also raised interest rates, the pace and extent of these hikes have been less aggressive compared to the ECB, impacting the relative value of the dollar.

- Geopolitical Uncertainty: Ongoing geopolitical events have also contributed to dollar weakness, as investors seek safer havens in other currencies.

Increased Investor Confidence in the Eurozone

Positive economic indicators and news from the Eurozone have significantly boosted investor confidence.

- Stronger-than-expected GDP growth: Recent economic reports indicate a more resilient Eurozone economy than initially predicted.

- Political Stability: A period of relative political stability within the Eurozone has also increased investor confidence.

- Robust Corporate Earnings: Positive corporate earnings reports across various sectors have further fueled investor optimism.

European Futures Market Surge: Analyzing the Upward Trend

The strengthening Euro has naturally led to a surge in the European futures market. Several factors contribute to this upward trend. For those interested in European futures trading, understanding these drivers is crucial.

Increased Demand for European Assets

Investors are increasingly shifting their focus towards European assets, driving up demand.

- Attractive Stock Market Valuations: European stocks are seen as comparatively undervalued compared to their US counterparts, making them attractive investments.

- Strong European Bond Market: The European bond market has shown resilience, further attracting investor interest.

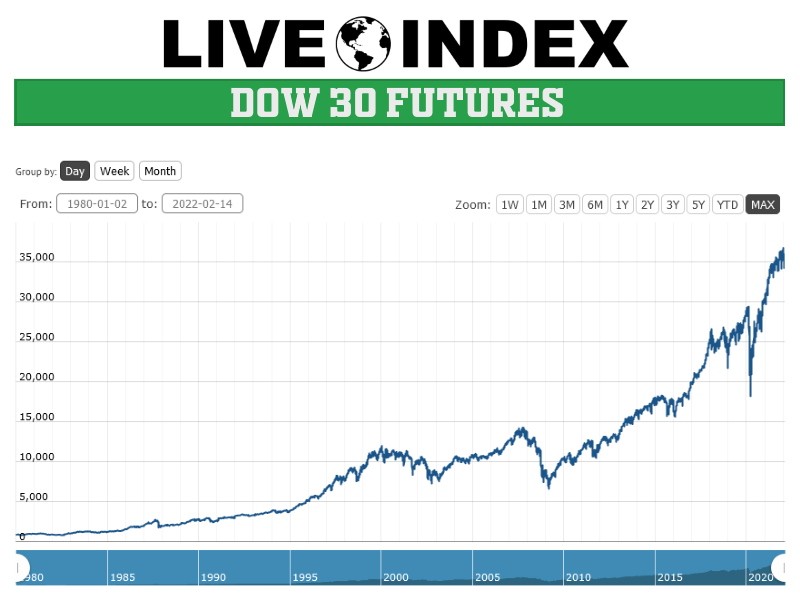

- Commodity Prices: Fluctuations in commodity prices have also impacted the European futures market, with some sectors showing strong performance. [Insert data on trading volumes and market capitalization for relevant European futures contracts]

Positive Outlook for European Economy

Positive economic forecasts for the Eurozone have contributed to the bullish sentiment in the European futures market.

- Financial Institution Predictions: Leading financial institutions have projected continued growth for the Eurozone economy, boosting investor confidence.

- Analyst Forecasts: Economic analysts have pointed to various indicators suggesting a positive outlook for the European economy in the coming quarters.

Geopolitical Factors

Geopolitical developments, while unpredictable, can significantly impact the European futures market.

- Energy Security: The Eurozone's progress in diversifying its energy sources has lessened the vulnerability to geopolitical risks, contributing to positive sentiment.

US Dollar and US Futures Decline: Understanding the Downward Trend

The weakening US dollar and the subsequent decline in US futures are closely linked to several factors.

Inflationary Pressures in the US

High inflation in the US is a primary driver of the dollar's weakness.

- Inflation Rates: Persistent high inflation rates have eroded consumer purchasing power and increased concerns about the US economy's stability.

- Federal Reserve Response: While the Federal Reserve has raised interest rates to combat inflation, the effectiveness of these measures remains a subject of debate.

Concerns About the US Economy

Several factors have fueled concerns about the US economic outlook, impacting the US dollar and futures market.

- Recessionary Fears: Concerns about a potential US recession have dampened investor confidence.

- Job Market Uncertainty: While the unemployment rate remains relatively low, concerns persist about future job growth.

Global Market Dynamics

Global market forces significantly influence the performance of the US dollar and US futures.

- Global Investment Flows: Shifts in global investment flows, with capital moving away from US assets and towards other markets, have contributed to the dollar's decline.

Conclusion: Swissquote Bank – Navigating the Shifting Currency Landscape

In summary, the rise of the Euro and European futures is intertwined with the decline of the US dollar and US futures. Factors such as the ECB's interest rate hikes, the weakening US dollar due to inflation and geopolitical concerns, and increased investor confidence in the Eurozone have all played significant roles. Understanding these dynamics is crucial for successful trading. Swissquote Bank provides the tools and resources necessary to navigate this ever-evolving market landscape. By leveraging Swissquote Bank's platform, you can access real-time market data, insightful analysis, and a range of trading opportunities in Euro, European futures, US dollar, and US futures. Start exploring Swissquote Bank's services today to make informed investment decisions and capitalize on the current market trends. Learn more about Swissquote Bank trading and take control of your financial future.

Featured Posts

-

Canada Posts Future A Report Recommending Changes To Door To Door Mail Service

May 19, 2025

Canada Posts Future A Report Recommending Changes To Door To Door Mail Service

May 19, 2025 -

Ufc 313 Judging Under Scrutiny After Fighters Honest Admission

May 19, 2025

Ufc 313 Judging Under Scrutiny After Fighters Honest Admission

May 19, 2025 -

Haalands Five Goal Haul Norway Dominates World Cup Qualifying

May 19, 2025

Haalands Five Goal Haul Norway Dominates World Cup Qualifying

May 19, 2025 -

Suspensao Encerrada Jannik Sinner Compete Em Hamburgo

May 19, 2025

Suspensao Encerrada Jannik Sinner Compete Em Hamburgo

May 19, 2025 -

The Unraveling Of Trumps Winning 2024 Coalition

May 19, 2025

The Unraveling Of Trumps Winning 2024 Coalition

May 19, 2025