Swissquote Bank: Sovereign Bond Market Analysis And Outlook

Table of Contents

Current State of the Sovereign Bond Market

Interest Rate Environment

The current interest rate environment significantly impacts sovereign bond yields. Central banks worldwide are navigating a delicate balance between combating inflation and supporting economic growth.

- Impact of Inflation: High inflation erodes the purchasing power of fixed-income investments, leading investors to demand higher yields on sovereign bonds to compensate for this risk.

- Central Bank Actions: Quantitative easing (QE) programs, initially implemented to stimulate economies, have impacted bond yields. Recent interest rate hikes by many central banks, including the Federal Reserve and the European Central Bank, aim to curb inflation but also affect bond prices. This divergence in monetary policies across major economies creates complexities within the global sovereign bond market.

- Yield Curve Dynamics: The shape of the yield curve, which illustrates the relationship between the yields of bonds with different maturities, provides valuable insights into market expectations and economic prospects. An inverted yield curve (where short-term yields exceed long-term yields) is often seen as a recessionary indicator.

The relationship between interest rates and bond prices is inverse: as interest rates rise, bond prices generally fall, and vice versa. For example, countries with higher perceived credit risk often offer higher yields on their sovereign bonds to attract investors.

Inflation and its Influence

Inflation is a primary driver of sovereign bond market dynamics.

- Inflation's Effect on Real Yields: Inflation erodes the real return (yield adjusted for inflation) of fixed-income investments. Investors need to consider the impact of inflation when evaluating the attractiveness of sovereign bonds.

- Hedging Strategies: Inflation-linked bonds (ILBs) are designed to protect investors from the erosion of purchasing power caused by inflation. These bonds offer returns that adjust with inflation, providing a hedge against this risk.

- Inflation Expectations: Market participants’ expectations about future inflation significantly influence bond pricing. If inflation is expected to rise, investors will demand higher yields on sovereign bonds to compensate for the anticipated loss of purchasing power.

Understanding inflation's influence is crucial for making informed decisions in the sovereign bond market.

Geopolitical Risks and Uncertainties

Geopolitical events significantly impact investor sentiment and sovereign bond markets.

- Political Instability: Political instability within a country can increase the risk of default on its sovereign bonds, leading to higher yields demanded by investors.

- Wars and Conflicts: Major geopolitical events, such as the ongoing conflict in Ukraine, create uncertainty and can trigger flight-to-safety capital flows into perceived safer haven assets, such as US Treasury bonds.

- Trade Wars and Sanctions: Trade disputes and sanctions can negatively impact economic growth and increase uncertainty, affecting the attractiveness of sovereign bonds from affected countries.

Geopolitical risks introduce volatility and uncertainty into the sovereign bond market, requiring careful consideration by investors.

Analysis of Key Sovereign Bond Markets

US Treasury Bonds

US Treasury bonds are considered a safe haven asset, benefiting from the stability and size of the US economy.

- Current Yields: US Treasury yields reflect market expectations regarding future interest rates and economic growth. These yields fluctuate based on various factors.

- Yield Curve Inversion: The potential for yield curve inversion in the US is closely watched as a potential recessionary signal.

- Safe Haven Status: The US dollar's role as a global reserve currency strengthens the demand for US Treasury bonds during times of uncertainty.

The outlook for US Treasury bonds is influenced by the Federal Reserve's monetary policy decisions and the overall health of the US economy.

Eurozone Sovereign Bonds

The Eurozone sovereign bond market presents both opportunities and challenges.

- Spread Between German Bunds and Peripheral Bonds: The spread between the yields of German Bunds (considered the benchmark for the Eurozone) and the bonds of peripheral Eurozone countries (like Italy or Greece) reflects the perceived credit risk of these countries.

- European Central Bank Policies: The European Central Bank's (ECB) monetary policies significantly influence the yields of Eurozone sovereign bonds.

- Economic Challenges: Economic disparities within the Eurozone can lead to varying performances among the different national sovereign bond markets.

Analyzing the Eurozone requires careful consideration of the economic and political climate across individual member states.

Emerging Market Sovereign Bonds

Emerging market sovereign bonds offer potentially higher yields but carry increased risk.

- Higher Yields: Emerging market sovereign bonds often offer higher yields to compensate for their increased risk profile compared to developed markets.

- Currency Risks: Fluctuations in exchange rates can significantly impact the returns of investments in emerging market sovereign bonds.

- Political and Economic Risks: Political instability, economic volatility, and currency devaluations are potential risks in emerging markets.

Investors should carefully evaluate the risk-reward profile before investing in emerging market sovereign bonds.

Outlook and Investment Strategies for the Sovereign Bond Market

Potential Investment Opportunities

The sovereign bond market offers a range of investment opportunities depending on risk tolerance and investment goals.

- High-Yield Bonds: High-yield bonds, also known as junk bonds, offer higher yields but carry significantly more credit risk.

- Investment-Grade Bonds: Investment-grade bonds are considered less risky than high-yield bonds but offer lower yields.

- Diversification: Diversifying across different sovereign bond markets and maturities can help reduce overall portfolio risk.

A well-structured investment strategy requires careful consideration of risk tolerance and investment objectives.

Risk Management Considerations

Investing in the sovereign bond market involves several risks that need to be managed effectively.

- Interest Rate Risk: Changes in interest rates can impact bond prices.

- Inflation Risk: Inflation erodes the purchasing power of fixed-income investments.

- Credit Risk: The risk of default by the issuer of the bond.

- Geopolitical Risk: Geopolitical events can significantly impact bond prices.

- Currency Risk: Fluctuations in exchange rates can impact the returns of international bond investments.

Investors can use various hedging techniques and diversification strategies to mitigate these risks.

Conclusion

The sovereign bond market remains a crucial component of a well-diversified investment portfolio. Understanding the current interest rate environment, inflation dynamics, and geopolitical risks is essential for navigating this complex landscape successfully. Swissquote Bank offers a range of investment solutions tailored to individual risk profiles and investment goals within the sovereign bond market. Contact Swissquote Bank today to learn more about building a robust investment strategy using sovereign bonds and benefiting from expert guidance in this dynamic market. Our experts can help you understand the nuances of the government bond market and create a portfolio aligned with your specific needs.

Featured Posts

-

Announcing The 2025 Vermont Presidential Scholars

May 19, 2025

Announcing The 2025 Vermont Presidential Scholars

May 19, 2025 -

The Impact Of Broadcoms V Mware Acquisition A 1050 Price Increase

May 19, 2025

The Impact Of Broadcoms V Mware Acquisition A 1050 Price Increase

May 19, 2025 -

Navigating The Funding Landscape For Sustainable Smes

May 19, 2025

Navigating The Funding Landscape For Sustainable Smes

May 19, 2025 -

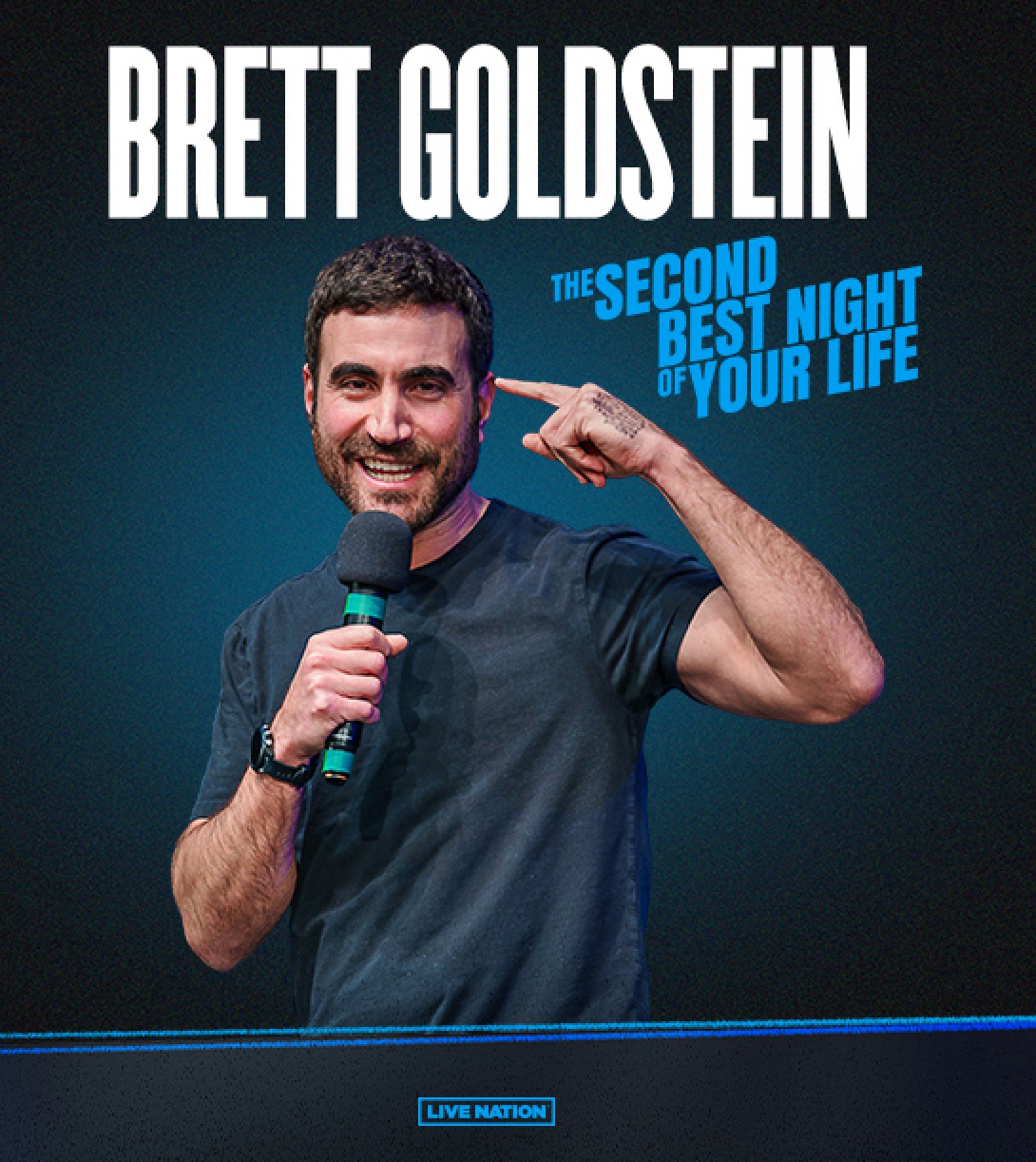

Hbo To Air Brett Goldsteins First Comedy Special This April

May 19, 2025

Hbo To Air Brett Goldsteins First Comedy Special This April

May 19, 2025 -

Hamas October 7th Attacks Evidence Of A Plot Against Israel Saudi Normalization

May 19, 2025

Hamas October 7th Attacks Evidence Of A Plot Against Israel Saudi Normalization

May 19, 2025