Tariff Wars And Ryanair's Future: The Significance Of The Buyback

Table of Contents

The Impact of Tariff Wars on Ryanair's Operations

The impact of tariff wars on Ryanair's operations is multifaceted, extending beyond simple fuel price increases.

Rising Fuel Costs and Hedging Strategies: Fuel costs represent a significant portion of Ryanair's operational expenditure. Tariffs on oil and other commodities directly inflate these costs. Ryanair, like many airlines, employs hedging strategies to mitigate price volatility.

- Mechanics of Hedging: Ryanair uses a combination of fuel contracts and financial instruments, like options and futures, to lock in fuel prices at predetermined rates.

- Effectiveness and Risks: While hedging reduces exposure to sudden price spikes, it's not a foolproof solution. Unexpectedly large price swings or unforeseen geopolitical events can still impact profitability. Furthermore, effective hedging requires accurate forecasting, which is inherently challenging in the volatile energy market. Unhedged portions of fuel consumption remain exposed to price fluctuations caused by commodity tariffs.

- Keyword integration: Fuel costs, Hedging, Oil prices, Commodity tariffs

Aircraft Manufacturing and Maintenance Costs: Tariffs also affect the cost of aircraft parts and maintenance services, creating further challenges. Many components are sourced globally, and trade barriers increase prices and potentially cause delays.

- Potential Delays and Increased Expenses: Increased lead times for parts and higher repair costs can disrupt maintenance schedules and lead to operational inefficiencies.

- Sourcing Strategies: Ryanair needs to explore alternative sourcing strategies, potentially diversifying its suppliers and potentially opting for regional suppliers to mitigate the effects of import tariffs on aircraft manufacturing and maintenance costs.

- Keyword integration: Aircraft manufacturing, Maintenance costs, Supply chain disruptions

Impact on Passenger Demand: Economic uncertainty stemming from tariff wars can significantly affect consumer behavior, impacting air travel demand.

- Changes in Travel Behavior: Consumers might postpone non-essential travel or opt for cheaper alternatives during times of economic instability.

- Pricing Strategies: Ryanair might need to adjust its pricing strategies – potentially offering discounts – to maintain passenger numbers and revenue in response to reduced consumer spending.

- Overall Impact on Revenue: Reduced passenger numbers and potential downward pressure on fares both directly affect Ryanair's revenue streams.

- Keyword integration: Passenger demand, Air travel, Economic uncertainty

Ryanair's Buyback Program as a Strategic Response

Ryanair's buyback program is a significant strategic response to the challenges presented by tariff wars and global economic uncertainty.

The Rationale Behind the Buyback: The decision to initiate a share buyback suggests that Ryanair's management believes its stock is undervalued in the current market.

- Undervaluation of Ryanair's Stock: The buyback indicates a belief that the market is not accurately reflecting Ryanair's intrinsic value, potentially due to short-term market sentiment influenced by the broader economic situation.

- Strengthening the Balance Sheet: By repurchasing shares, Ryanair reduces the number of outstanding shares, potentially increasing earnings per share and improving key financial ratios. This demonstrates financial strength and stability.

- Signaling Effect to Investors: The buyback can signal confidence in the company's future prospects, potentially boosting investor confidence and driving up the stock price.

- Keyword integration: Share buyback, Stock repurchase, Investor confidence

Financial Implications of the Buyback: The buyback has substantial financial implications for Ryanair.

- Impact on Debt Levels: The funding for the buyback could affect Ryanair's debt levels, either increasing or decreasing it depending on the financing method used.

- Impact on Equity: Repurchasing shares increases the value of remaining shares, improving the equity position.

- Future Investment Possibilities: The buyback could limit funds available for future investments in fleet modernization, expansion, or other strategic initiatives. This needs to be carefully balanced against the benefits of the buyback.

- Keyword integration: Financial stability, Debt reduction, Capital allocation

Buyback vs. Alternative Investments: Ryanair chose a buyback over other potential investment avenues.

- Comparison with Expansion Plans: Instead of expanding its network or adding new routes (which may be riskier in an uncertain market), Ryanair opted for a more conservative approach.

- Fleet Modernization: Investment in new aircraft might have been another option, but the buyback suggests a prioritization of returning capital to shareholders rather than significant capital expenditure.

- Keyword integration: Investment strategy, Return on equity, Capital expenditure

Long-Term Outlook: Ryanair's Resilience in the Face of Tariff Wars

Ryanair's ability to weather the storm of tariff wars hinges on its inherent strengths and adaptability.

Adaptability and Operational Efficiency: Ryanair has a long history of operational efficiency and cost-cutting.

- Operational Strategies: Its highly efficient, point-to-point route structure, coupled with aggressive cost control measures, provides a significant competitive advantage.

- Technological Investments: Investments in technology and data analytics allow Ryanair to optimize operations, manage resources efficiently, and respond to market changes quickly.

- Adapting to Changing Market Conditions: The buyback demonstrates a strategic decision to adapt to the challenging economic environment and prioritize financial strength.

- Keyword integration: Operational efficiency, Cost reduction, Technological innovation

Market Positioning and Competitive Advantage: Ryanair's low-cost model gives it a competitive edge.

- Low-Cost Strategy: Its unwavering focus on low costs allows it to offer competitive fares and remain attractive to price-sensitive customers even during economic downturns.

- Network Optimization: Ryanair’s extensive route network across Europe offers significant resilience against localized market fluctuations.

- Competition: While competition remains intense, Ryanair's cost structure and operational efficiency provide a robust defense against rivals.

- Keyword integration: Low-cost carrier, Market share, Competition

Tariff Wars and Ryanair's Future: The Significance of the Buyback – Conclusion

This analysis reveals that tariff wars pose significant challenges to Ryanair's operations, impacting fuel costs, aircraft maintenance, and passenger demand. However, Ryanair's strategic response, particularly the share buyback program, demonstrates financial prudence and a focus on long-term stability. The buyback, coupled with Ryanair's inherent operational efficiency and strong market positioning, positions the airline for resilience in the face of ongoing global trade uncertainty. The key takeaways are the importance of adaptability, financial prudence, and strategic decision-making in navigating turbulent economic climates. To gain a deeper understanding of Ryanair's response to tariff wars and the effectiveness of its buyback program, further research into its financial reports and strategic communications is recommended. Follow Ryanair's news and announcements for updates on their long-term plans and continued response to the evolving landscape of tariff wars and global economic uncertainty.

Featured Posts

-

Chivas Regals Collaboration With Charles Leclerc Details And Impact

May 20, 2025

Chivas Regals Collaboration With Charles Leclerc Details And Impact

May 20, 2025 -

Dzhennifer Lourens Ta Yiyi Druga Ditina Detali Pro Popovnennya V Rodini

May 20, 2025

Dzhennifer Lourens Ta Yiyi Druga Ditina Detali Pro Popovnennya V Rodini

May 20, 2025 -

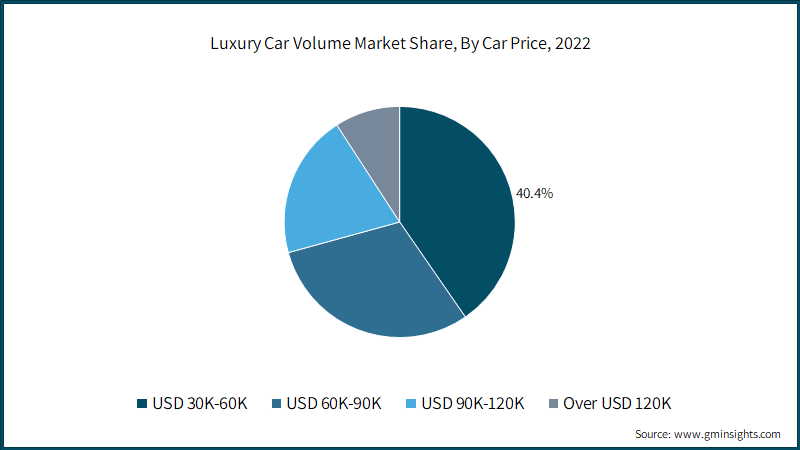

Navigating The Luxury Car Market Porsches Balancing Act Between Ferrari And Mercedes Amidst Trade Headwinds

May 20, 2025

Navigating The Luxury Car Market Porsches Balancing Act Between Ferrari And Mercedes Amidst Trade Headwinds

May 20, 2025 -

Solve The Nyt Mini Crossword Answers For March 22

May 20, 2025

Solve The Nyt Mini Crossword Answers For March 22

May 20, 2025 -

The Complete Guide To Agatha Christies Hercule Poirot Stories

May 20, 2025

The Complete Guide To Agatha Christies Hercule Poirot Stories

May 20, 2025

Latest Posts

-

Good Morning America Job Cuts Stars Fear Backstage Turmoil

May 20, 2025

Good Morning America Job Cuts Stars Fear Backstage Turmoil

May 20, 2025 -

Broadcast Networks Abc Cbs And Nbc Accused Of Censorship Following New Mexico Gop Arson Attack

May 20, 2025

Broadcast Networks Abc Cbs And Nbc Accused Of Censorship Following New Mexico Gop Arson Attack

May 20, 2025 -

Find Nyt Mini Crossword Answers April 20 2025

May 20, 2025

Find Nyt Mini Crossword Answers April 20 2025

May 20, 2025 -

Nyt Mini Crossword April 20 2025 Complete Solution Guide

May 20, 2025

Nyt Mini Crossword April 20 2025 Complete Solution Guide

May 20, 2025 -

Solve The Nyt Mini Crossword April 20 2025 Answers And Hints

May 20, 2025

Solve The Nyt Mini Crossword April 20 2025 Answers And Hints

May 20, 2025