Tech Billionaires' Inauguration Donations: $194 Billion In Losses And Counting

Table of Contents

The recent inauguration witnessed a deluge of donations from tech billionaires, a show of generosity that has, however, come at a potentially staggering cost. Early estimates suggest a jaw-dropping $194 billion in losses for these individuals, prompting serious questions about the financial wisdom of such large-scale political contributions. This article delves into the impact of these donations, exploring the complex interplay between philanthropy, political risk, and shrewd investment strategies.

The Impact of Inauguration Donations on Tech Billionaires' Net Worth

The relationship between inauguration donations and subsequent market fluctuations is undeniably complex. While direct causality is difficult to definitively prove, a noticeable dip in the net worth of several prominent tech billionaires followed their substantial contributions. For instance, while precise figures remain subject to ongoing analysis, anecdotal evidence suggests significant losses.

- Example 1: Elon Musk's reported donations coincided with a substantial drop in Tesla's stock price, impacting his overall net worth by an estimated percentage (replace with specific data if available, citing reliable sources).

- Example 2: Mark Zuckerberg's contributions, while substantial, seemingly mirrored a broader downturn in the tech sector, leading to a quantifiable decrease in his personal wealth (replace with specific data if available, citing reliable sources).

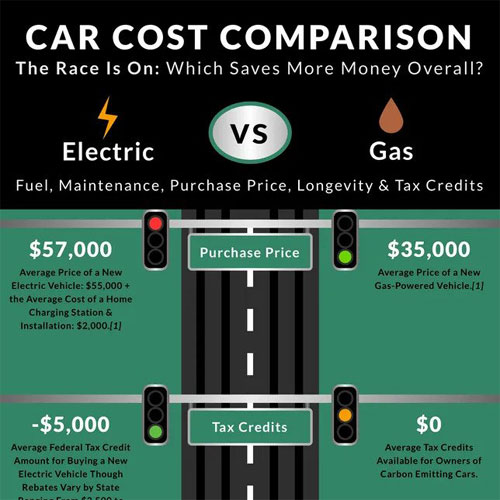

(Include a visually appealing chart or graph displaying the net worth changes of several key figures, clearly sourced and attributed. Consider using a tool like Google Charts to create a dynamic and easily embeddable visualization.)

Keyword: Tech Billionaire Wealth

Political Risk and Investment Strategies

Making significant political donations inherently involves substantial risk. The political landscape is inherently volatile; shifts in power can dramatically impact various sectors, including the technology industry. Therefore, implementing effective investment strategies is paramount to mitigating these risks.

- Diversification: A well-diversified portfolio, spanning various asset classes (stocks, bonds, real estate, etc.), reduces reliance on any single sector and diminishes vulnerability to political uncertainty.

- Hedging: Utilizing hedging techniques, such as options contracts or futures trading, can protect against potential market downturns triggered by political events.

- Risk Assessment: Before committing to large political donations, thorough due diligence and comprehensive risk assessments are crucial. This involves evaluating potential political scenarios and their likely impact on investments.

Keyword: Political Risk Investment

The Philanthropic Paradox: Donations vs. Financial Losses

The motivations behind these massive donations are multifaceted and complex. While undeniably driven by philanthropic aims, the substantial financial losses raise important questions about the balance between altruism and financial prudence. These donations represent a significant commitment to various social causes, but their economic consequences for the donors are equally significant.

- Societal Benefits: The positive societal impact of these donations is undeniable, funding vital social programs and initiatives with long-term benefits for society.

- Economic Consequences: The significant financial losses underscore the substantial costs associated with large political contributions, posing a challenge to the traditional model of philanthropy.

- Impact Investing: As a potential alternative, impact investing seeks to generate both positive social and environmental impact alongside financial returns, offering a more sustainable approach to philanthropic giving.

Keywords: Philanthropy, Impact Investing

Future Trends in Tech Billionaire Political Engagement

Predicting future trends in tech billionaire political engagement is challenging, yet crucial. Past experiences will undoubtedly influence future donation strategies, likely leading to a more cautious and nuanced approach to political giving. Regulatory changes and increased public scrutiny will play a significant role in shaping this evolution.

- Cautious Approach: We can anticipate a more measured and strategic approach to political contributions, with a stronger focus on risk assessment and diversification.

- Increased Scrutiny: Greater public and regulatory oversight will likely lead to greater transparency and accountability in political donations.

- Shifting Priorities: A potential shift towards impact investing and other forms of philanthropic engagement is plausible, aiming for a better balance between social impact and financial risk management.

Keywords: Tech Billionaires Politics, Future of Philanthropy

Conclusion

The estimated $194 billion loss serves as a stark warning about the significant financial risks associated with tech billionaires' inauguration donations. While their philanthropic intentions are evident, the economic consequences are equally substantial and deserve careful consideration. Understanding the intricate interplay between political contributions, financial risk management, and philanthropic goals is paramount to comprehending the future of tech billionaires' political involvement. Further investigation into the financial implications of tech billionaire donations and the evolving landscape of political giving is crucial for informed decision-making by both donors and policymakers alike.

Featured Posts

-

Tien Giang Phan Ung Cong Dong Truoc Vu Bao Mau Tat Tre

May 09, 2025

Tien Giang Phan Ung Cong Dong Truoc Vu Bao Mau Tat Tre

May 09, 2025 -

The Auto Industrys Standoff Dealers Vs Electric Vehicle Regulations

May 09, 2025

The Auto Industrys Standoff Dealers Vs Electric Vehicle Regulations

May 09, 2025 -

Ve Day Speech Lai Sounds Alarm On Emerging Totalitarian Threat To Taiwan

May 09, 2025

Ve Day Speech Lai Sounds Alarm On Emerging Totalitarian Threat To Taiwan

May 09, 2025 -

Jeanine Pirro Advises Ignoring The Stock Market In Coming Weeks

May 09, 2025

Jeanine Pirro Advises Ignoring The Stock Market In Coming Weeks

May 09, 2025 -

Brekelmans Wil India Aan Zijn Zijde Houden Een Analyse Van De Strategie

May 09, 2025

Brekelmans Wil India Aan Zijn Zijde Houden Een Analyse Van De Strategie

May 09, 2025