Ten-Month High For Reliance Shares: Earnings Drive Significant Gains

Table of Contents

Stellar Q2 Earnings Results Fuel Reliance Share Price Rise

Reliance Industries' Q2 (July-September 2023) earnings results played a pivotal role in propelling the Reliance share price to a ten-month high. The company reported a net profit that significantly outperformed analyst estimates, showcasing robust revenue growth and a healthy EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

-

Key Figures: [Insert actual Q2 2023 net profit, revenue growth percentage, and EBITDA figures here. Compare these figures to the previous quarter and the same quarter of the previous year for context]. This impressive performance showcases the strength and resilience of RIL's diversified business model.

-

Sector-wise Performance: Key sectors contributing to this strong performance include:

- Petrochemicals: [Insert details on petrochemical segment performance, including specific data points like production volumes, sales figures, and profit margins].

- Refining: [Insert details on refining segment performance, highlighting operational efficiency, margins, and any strategic initiatives undertaken].

- Telecom (Reliance Jio): [Briefly mention Jio's contribution – detailed analysis in the next section].

- Retail (Reliance Retail): [Briefly mention Retail's contribution – detailed analysis in the next section].

-

Exceeding Expectations: The Q2 results pleasantly surprised analysts, with the net profit exceeding consensus estimates by [Insert Percentage]%. This positive surprise fueled a surge in investor confidence, driving up the Reliance share price.

Strong Growth in Reliance Jio and Retail Segments

The stellar performance of Reliance Jio and Reliance Retail significantly contributed to the overall strength of RIL's Q2 earnings and the subsequent rise in Reliance share price.

-

Reliance Jio's Growth: Reliance Jio continues to demonstrate impressive growth, driven by a substantial increase in its subscriber base and a healthy rise in ARPU (Average Revenue Per User). [Insert specific data on subscriber growth and ARPU increase]. Jio's expansion into new technologies and its strategic partnerships are contributing to its sustained growth.

-

Reliance Retail Expansion: Reliance Retail continues to expand its footprint and market share, leveraging its successful omnichannel strategy. Its growth across various segments, including grocery, fashion, and electronics, is noteworthy. [Insert data points like revenue figures and store expansion numbers]. The company's investments in technology and supply chain optimization are further enhancing its competitiveness.

Positive Investor Sentiment and Market Outlook

The robust Q2 earnings report generated a highly positive market reaction, significantly boosting investor confidence in Reliance Industries.

-

Analyst Upgrades: Several brokerage firms upgraded their target prices for Reliance shares following the release of the Q2 results, reflecting a bullish outlook on the company's future prospects. [Mention specific analyst upgrades and target prices].

-

Overall Market Sentiment: The positive sentiment surrounding Reliance shares is further amplified by the generally positive outlook for the Indian stock market. [Mention any relevant macroeconomic factors contributing to the positive market sentiment]. This overall bullish market sentiment has created a supportive environment for RIL's share price appreciation.

Future Prospects and Growth Potential for Reliance Shares

Reliance Industries' future growth plans and strategies suggest continued potential for share price appreciation.

-

Strategic Initiatives: RIL's ongoing investments in new energy, digital services, and retail expansion are expected to fuel future growth. [Mention specific examples of upcoming projects and investments]. The company's diversification strategy mitigates risks and positions it for long-term success.

-

Long-Term Outlook: The combination of strong fundamentals, strategic initiatives, and a positive market outlook points towards a promising future for Reliance shares. Analysts predict continued growth, making RIL an attractive investment opportunity for long-term investors.

Conclusion

The recent ten-month high for Reliance shares is a direct result of strong Q2 earnings, fueled by robust performance in its key sectors, particularly Reliance Jio and Reliance Retail. Positive investor sentiment and a bullish market outlook further contribute to this significant gain. The company's strategic initiatives and future prospects suggest continued growth potential for Reliance shares.

Call to Action: Stay updated on the latest developments concerning Reliance shares and explore investment opportunities in this dynamic company. Analyze the performance of Reliance shares and make informed investment decisions based on your risk tolerance and financial goals. Learn more about investing in Reliance shares today!

Featured Posts

-

Understanding The Delays In Kentuckys Storm Damage Assessments

Apr 29, 2025

Understanding The Delays In Kentuckys Storm Damage Assessments

Apr 29, 2025 -

The Untapped Potential Of Middle Managers Driving Business Growth And Employee Engagement

Apr 29, 2025

The Untapped Potential Of Middle Managers Driving Business Growth And Employee Engagement

Apr 29, 2025 -

Porsche Cayenne Ev 2026 Leaked Spy Shots Offer Early Look

Apr 29, 2025

Porsche Cayenne Ev 2026 Leaked Spy Shots Offer Early Look

Apr 29, 2025 -

Mhairi Black And The Systemic Misogyny Affecting Womens Safety

Apr 29, 2025

Mhairi Black And The Systemic Misogyny Affecting Womens Safety

Apr 29, 2025 -

European Power Prices Plunge Solar Energy Surplus Drives Negative Prices

Apr 29, 2025

European Power Prices Plunge Solar Energy Surplus Drives Negative Prices

Apr 29, 2025

Latest Posts

-

The Challenges Of Filming Alligators In Floridas Crystal Clear Springs

May 12, 2025

The Challenges Of Filming Alligators In Floridas Crystal Clear Springs

May 12, 2025 -

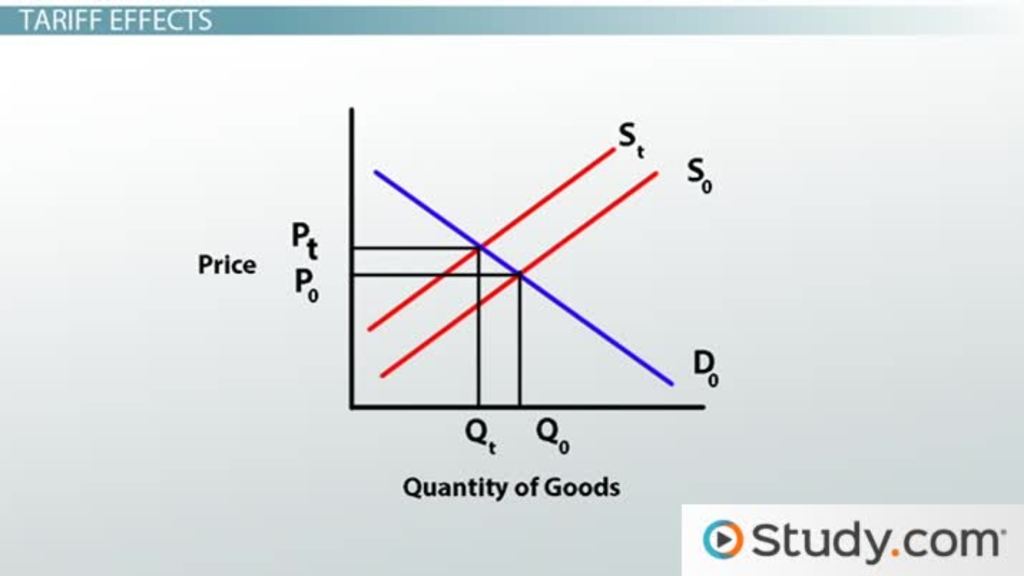

Small Businesses Bear The Brunt Examining The Effects Of Trumps Tariffs

May 12, 2025

Small Businesses Bear The Brunt Examining The Effects Of Trumps Tariffs

May 12, 2025 -

Documenting Floridas Alligator Population A Filming Perspective In Springs

May 12, 2025

Documenting Floridas Alligator Population A Filming Perspective In Springs

May 12, 2025 -

Exclusive Interview Tom Conrad Sonos Interim Ceo On The Future Of Sound

May 12, 2025

Exclusive Interview Tom Conrad Sonos Interim Ceo On The Future Of Sound

May 12, 2025 -

The Devastating Impact Of Trumps Tariffs On Small Businesses

May 12, 2025

The Devastating Impact Of Trumps Tariffs On Small Businesses

May 12, 2025