Tesla Board Faces Pressure From State Treasurers Over Musk's Priorities

Table of Contents

State Treasurers' Concerns Regarding Musk's Leadership

State treasurers, responsible for managing billions of dollars in public funds, are expressing deep anxieties about Elon Musk's leadership style and its effect on Tesla. Their concerns are primarily centered on the significant resources diverted to Musk's acquisition of Twitter and the perceived distraction from Tesla's core business operations. This concern translates directly into financial implications for state pension funds and other investors holding Tesla stock.

-

Significant drop in Tesla's stock price: Following Musk's Twitter acquisition, Tesla's stock price experienced a dramatic decline, eroding the value of state pension funds' investments. This significant drop represents a substantial financial loss for taxpayers. Analysts point to the distraction caused by Twitter as a key contributing factor to the negative stock performance.

-

Diversion of resources: Concerns are growing regarding the allocation of Tesla's resources. Critics argue that the substantial time, energy, and financial resources dedicated to Twitter are detracting from essential investments in electric vehicle (EV) production, research and development (R&D), and other core business activities. This shift in focus is perceived as a risk to Tesla's competitive advantage in the rapidly evolving EV market.

-

Questions about long-term strategic vision: The recent actions have raised questions about Musk's long-term strategic vision for Tesla. The uncertainty surrounding the company's direction under his leadership is a major source of concern for state treasurers and institutional investors alike. Many are calling for more clarity and a demonstrable commitment to Tesla’s original mission.

-

Calls for increased transparency and accountability: The pressure campaign includes demands for increased transparency and accountability from Tesla's board of directors. State treasurers are seeking a clearer understanding of the company's strategic priorities and financial risk assessment in light of Musk's various ventures. They are pushing for greater oversight and stronger corporate governance mechanisms.

The Role of ESG Investing and State Pension Funds

The increasing influence of Environmental, Social, and Governance (ESG) investing principles is a significant factor driving the state treasurers' actions. Many state pension funds are actively incorporating ESG considerations into their investment decisions, prioritizing companies with strong sustainability practices and sound corporate governance.

-

ESG integration into investment strategies: A growing number of state pension funds are integrating ESG factors into their investment strategies, reflecting a broader societal shift towards responsible investing. This means that companies with poor ESG ratings face increased scrutiny and potential divestment.

-

Concerns about Tesla's ESG ratings: Musk's actions have raised concerns about Tesla's ESG ratings, potentially impacting the attractiveness of the stock to ESG-focused investors. The perception of a lack of focus on sustainable practices and corporate responsibility could lead to capital flight.

-

Potential divestment from Tesla: If the concerns regarding Musk's leadership and Tesla's ESG performance are not adequately addressed, state pension funds may consider divesting from Tesla, leading to further pressure on the company's stock price and overall valuation.

-

Pressure from ESG investors: ESG investors are increasingly vocal in their demands for better corporate governance and a more sustainable business model at Tesla. This pressure from significant investment groups adds another layer of challenge for the Tesla board.

Potential Actions and Outcomes of the Pressure Campaign

The pressure campaign by state treasurers could trigger a series of significant events and outcomes for Tesla. The implications are far-reaching and could reshape the company's future trajectory.

-

Increased regulatory scrutiny: The intense scrutiny from state treasurers may attract increased attention from regulatory bodies, potentially leading to more stringent oversight of Tesla's operations and financial practices.

-

Potential boardroom changes: The pressure could result in changes within Tesla's board of directors, potentially leading to a restructuring or the appointment of new members with greater independence and experience in corporate governance.

-

Pressure on Musk to refocus: The pressure campaign aims to push Elon Musk to refocus his attention and resources on Tesla's core business, prioritizing its long-term success and sustainable growth.

-

Impact on investor relations: The negative publicity and uncertainty surrounding Musk's leadership could damage Tesla's investor relations, making it more challenging to attract new investments and maintain the confidence of existing shareholders.

-

Potential legal challenges: In a worst-case scenario, the pressure could lead to legal challenges or shareholder lawsuits, further impacting Tesla's financial stability and reputation.

The Implications for Corporate Governance and the Future of Tesla

The situation surrounding Tesla Board Pressure has significant implications for corporate governance and the future of Tesla.

-

Importance of strong corporate governance: This situation highlights the critical role of strong corporate governance in publicly traded companies, particularly in the technology sector where rapid growth and innovation can sometimes overshadow the need for careful risk management.

-

Balancing innovation and risk management: The challenge for high-growth companies like Tesla lies in balancing the drive for innovation with the need for responsible risk management and a clear strategic vision.

-

Role of shareholders and stakeholders: The pressure from state treasurers underscores the influence of shareholders and other stakeholders in shaping corporate decision-making and holding leadership accountable.

-

Long-term implications for Tesla: The outcome of this situation will significantly impact Tesla's brand reputation, market position, and its ability to attract and retain top talent. The company’s future success hinges on effectively addressing the concerns raised and restoring investor confidence.

Conclusion:

The mounting Tesla Board Pressure from state treasurers represents a critical juncture for the company and underscores the growing importance of corporate governance and leadership accountability. The concerns raised regarding Elon Musk's priorities and their impact on Tesla's financial performance and sustainability highlight the need for increased transparency, a clearer strategic direction, and a stronger commitment to responsible business practices. The resolution of this situation will have far-reaching implications for Tesla's future and could influence corporate governance practices across various sectors. Stay informed about the unfolding developments surrounding Tesla board pressure to understand its impact on this influential technology company and the broader business landscape. Monitor the situation closely for updates on the evolving narrative around Tesla board oversight and the future of one of the world's most innovative companies.

Featured Posts

-

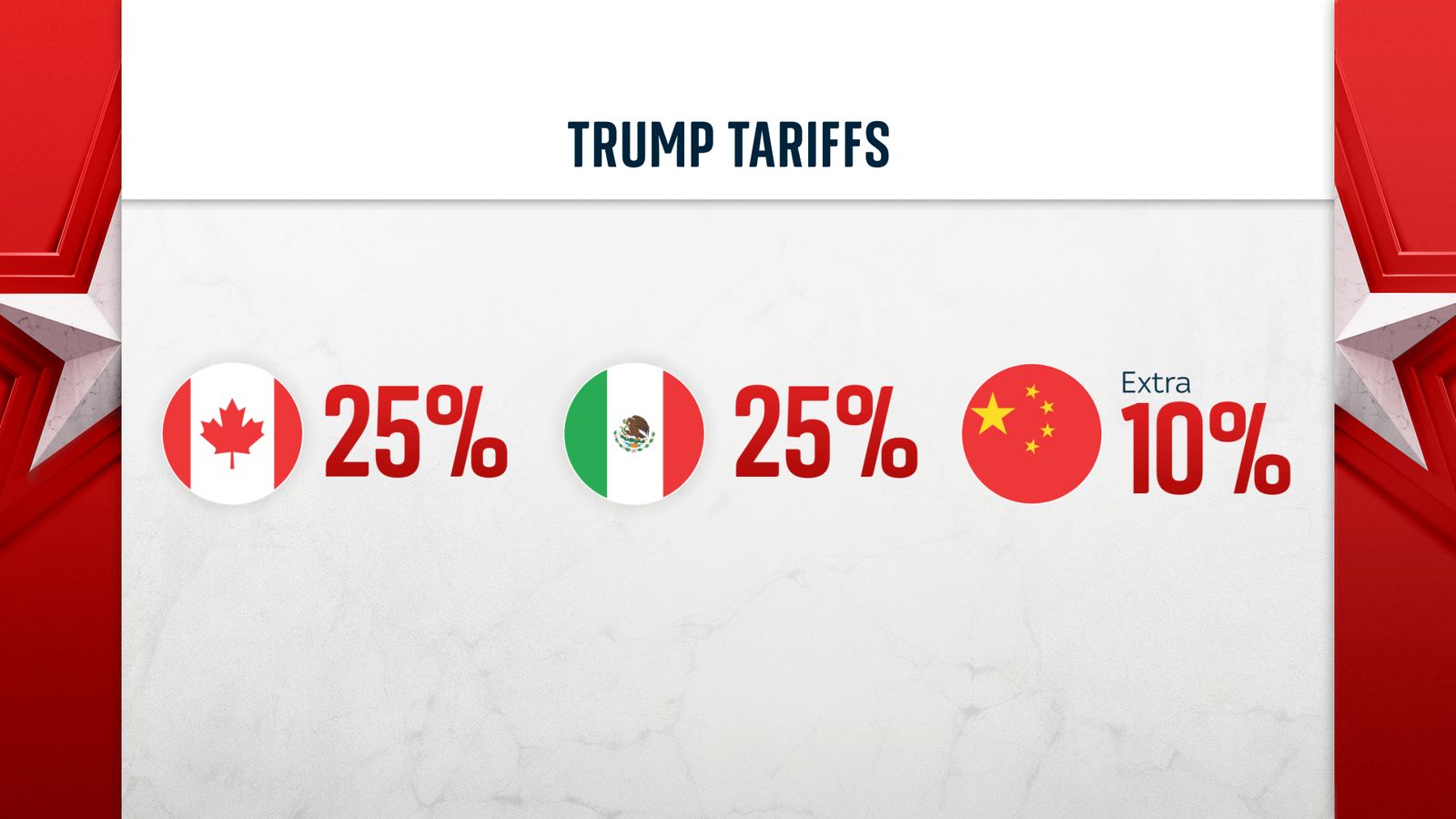

Trumps Tariffs Limited Options For Canadian Consumers

Apr 23, 2025

Trumps Tariffs Limited Options For Canadian Consumers

Apr 23, 2025 -

Flores And Lee Power Sf Giants To Win Against Brewers

Apr 23, 2025

Flores And Lee Power Sf Giants To Win Against Brewers

Apr 23, 2025 -

Erzurum Da Okullar Tatil Mi 24 Subat Pazartesi Kar Tatili Bilgileri

Apr 23, 2025

Erzurum Da Okullar Tatil Mi 24 Subat Pazartesi Kar Tatili Bilgileri

Apr 23, 2025 -

Canadas Growing Role In Chinas Energy Sector Implications Of Us China Trade Relations

Apr 23, 2025

Canadas Growing Role In Chinas Energy Sector Implications Of Us China Trade Relations

Apr 23, 2025 -

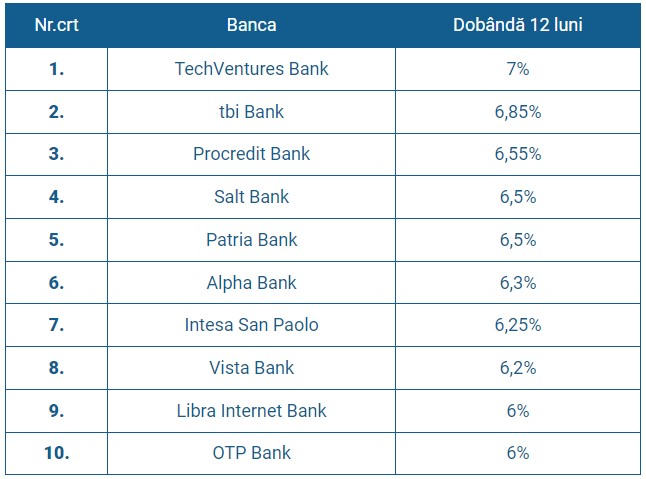

Depozite Bancare Martie 2024 Top Banci Cu Cele Mai Mari Dobanzi

Apr 23, 2025

Depozite Bancare Martie 2024 Top Banci Cu Cele Mai Mari Dobanzi

Apr 23, 2025

Latest Posts

-

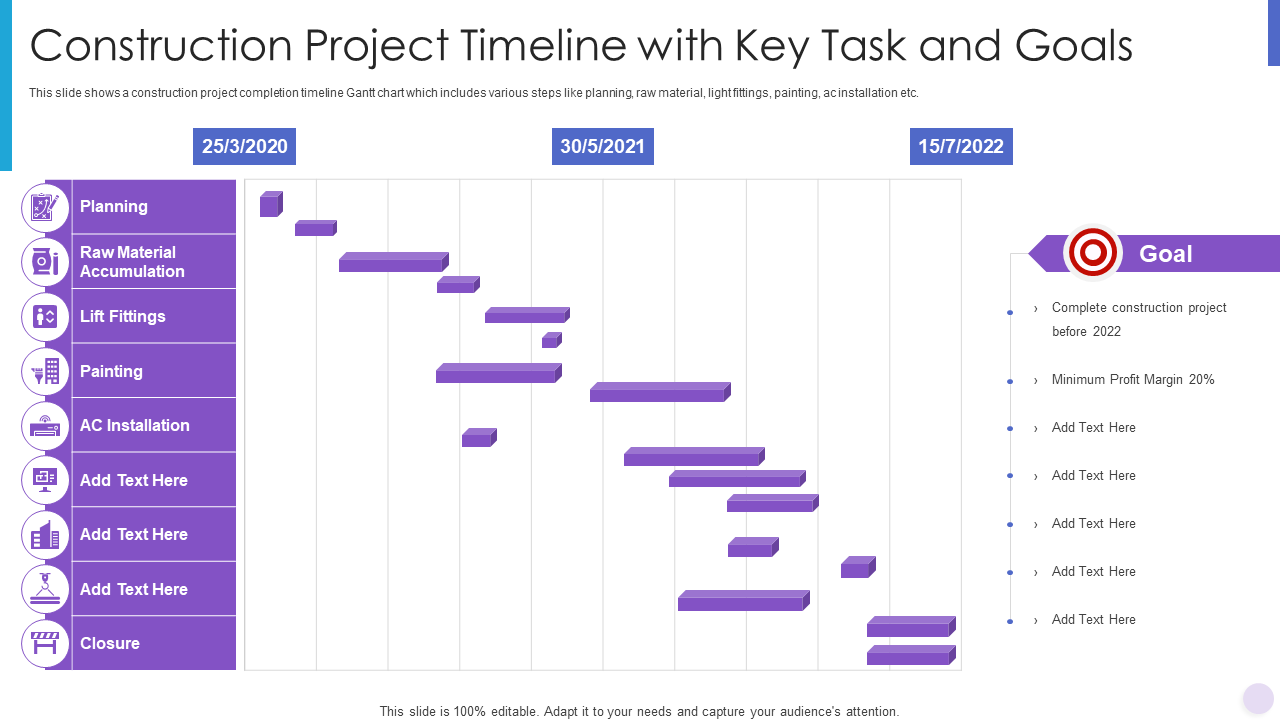

14 Edmonton Schools Accelerated Construction Timeline Announced

May 10, 2025

14 Edmonton Schools Accelerated Construction Timeline Announced

May 10, 2025 -

Edmonton School Construction 14 Projects To Proceed Rapidly

May 10, 2025

Edmonton School Construction 14 Projects To Proceed Rapidly

May 10, 2025 -

Edmontons Tech Sector Takes Off Edmonton Unlimiteds New Growth Strategy

May 10, 2025

Edmontons Tech Sector Takes Off Edmonton Unlimiteds New Growth Strategy

May 10, 2025 -

Edmonton Unlimited Scaling Tech Innovation For Worldwide Impact

May 10, 2025

Edmonton Unlimited Scaling Tech Innovation For Worldwide Impact

May 10, 2025 -

New Strategy From Edmonton Unlimited Boosting Tech And Innovation For Global Reach

May 10, 2025

New Strategy From Edmonton Unlimited Boosting Tech And Innovation For Global Reach

May 10, 2025