Tesla Stock Decline And Tariffs Contribute To Elon Musk's Reduced Net Worth

Table of Contents

Tesla Stock Performance and its Impact on Elon Musk's Wealth

The Volatility of Tesla Stock

Tesla's stock market journey has been nothing short of a rollercoaster. Periods of explosive growth have been punctuated by sharp declines, creating considerable volatility. This inherent instability directly impacts Elon Musk's net worth, as a substantial portion of his wealth is tied up in his Tesla stock ownership. For instance, a 10% drop in Tesla's market capitalization translates directly into a considerable decrease in Musk's personal wealth. Analyzing historical data reveals significant fluctuations in Tesla's Market Cap, with percentage changes ranging from double-digit gains to equally substantial losses within short periods. This inherent risk underscores the precarious nature of wealth heavily invested in a single, highly volatile stock.

Factors Contributing to Tesla Stock Decline

Several factors have contributed to recent declines in Tesla's stock price. These include:

- Tesla Production Challenges: Meeting production targets and maintaining consistent output have proven challenging for Tesla at times, impacting investor confidence.

- EV Competition: The electric vehicle market is becoming increasingly competitive, with established automakers launching their own EVs and challenging Tesla's dominance.

- Economic Downturns: Global economic uncertainties and potential recessions can negatively impact consumer spending on luxury goods like Tesla vehicles.

- Investor Sentiment: News, social media trends, and Elon Musk's own pronouncements can significantly influence investor sentiment and cause rapid stock price fluctuations.

- Tesla Regulations: Regulatory hurdles and investigations can also weigh on Tesla's stock performance and impact investor confidence.

Elon Musk's Stock Ownership and its Correlation to Net Worth

Elon Musk's substantial Tesla stock holdings are intrinsically linked to his net worth. He owns a significant percentage of Tesla shares, meaning that even relatively small percentage changes in Tesla's stock price can result in multi-billion dollar swings in his personal fortune. Visual representations, such as charts and graphs, clearly illustrate the almost direct correlation between Tesla's stock performance and the fluctuations in Elon Musk's Net Worth, making it a prime example of how individual wealth can be so heavily dependent on market performance.

The Role of Global Tariffs and Trade Wars

Impact of Tariffs on Tesla's Global Operations

Global tariffs and trade wars significantly impact Tesla's operations and profitability. Tariffs on imported raw materials, components, and finished goods increase Tesla's production costs, squeezing profit margins. Trade wars and protectionist policies also complicate Tesla's international expansion efforts, creating additional hurdles in accessing key markets and securing stable supply chains. For example, tariffs on certain materials imported into the US for Tesla's production have directly contributed to increased manufacturing costs.

Geographic Impact of Tariffs on Tesla's Sales

Varying tariff structures across different countries pose significant challenges for Tesla's international sales. Higher tariffs in specific regions reduce the competitiveness of Tesla vehicles, affecting sales volumes and overall revenue. This geographic disparity in tariff impacts necessitates a nuanced approach to Tesla's global market strategy, requiring adaptations to pricing and market penetration strategies in tariff-burdened regions.

Conclusion: Understanding the Factors Affecting Elon Musk's Net Worth

In conclusion, the recent decline in Elon Musk's net worth is primarily driven by the volatility of Tesla stock. While other factors contribute, the direct correlation between Tesla's performance and Musk's wealth remains undeniable. Global tariffs and trade wars represent a secondary but still significant contributing factor, adding further complexity to the equation. The interconnectedness of global economics and the volatility of the stock market underscore the dynamic and often unpredictable nature of extreme wealth. Understanding these factors is crucial for any investor following the Tesla story. Stay updated on the latest developments affecting Elon Musk's net worth and Tesla stock by following reputable financial news sources and actively monitoring market trends. Understanding the factors impacting Elon Musk's net worth is crucial for any investor following the Tesla story.

Featured Posts

-

Alaska Protests Large Scale Demonstration Against Doge And Trump Administration

May 09, 2025

Alaska Protests Large Scale Demonstration Against Doge And Trump Administration

May 09, 2025 -

Red Wings Playoff Bid In Jeopardy Following Vegas Setback

May 09, 2025

Red Wings Playoff Bid In Jeopardy Following Vegas Setback

May 09, 2025 -

French Europe Minister Promotes Shared Nuclear Shield Radio Schuman Report

May 09, 2025

French Europe Minister Promotes Shared Nuclear Shield Radio Schuman Report

May 09, 2025 -

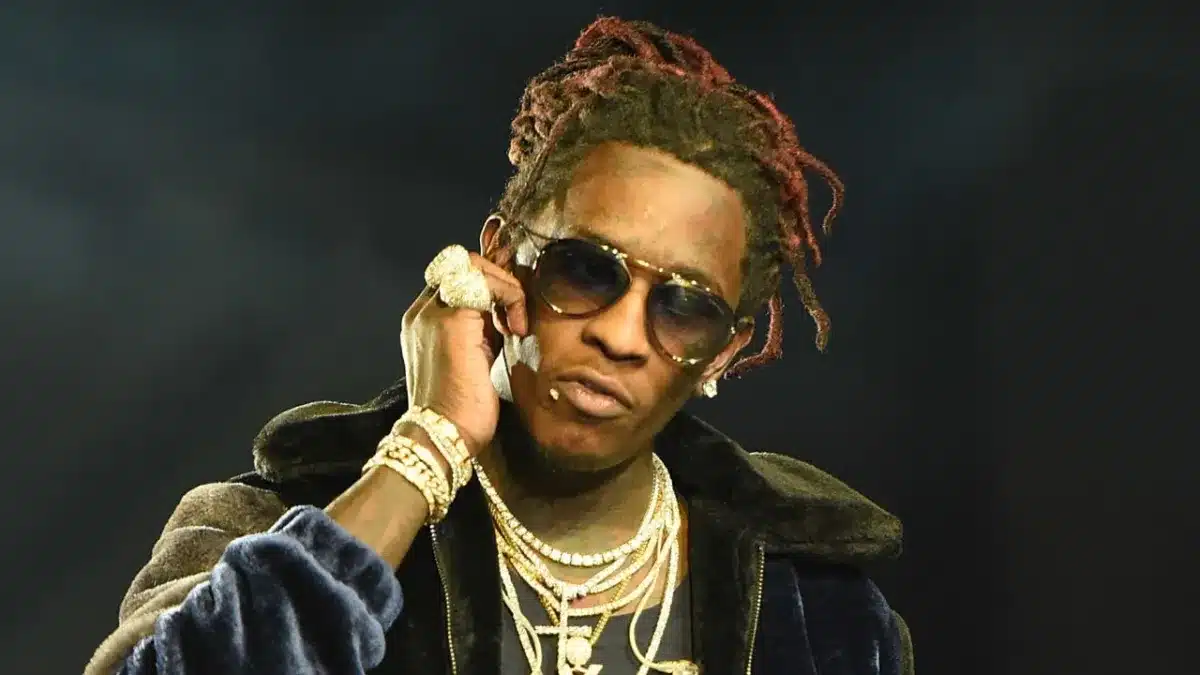

Young Thug Teases Uy Scuti Album Release What We Know So Far

May 09, 2025

Young Thug Teases Uy Scuti Album Release What We Know So Far

May 09, 2025 -

Trumps Surgeon General Nominee Casey Means And The Maha Movement

May 09, 2025

Trumps Surgeon General Nominee Casey Means And The Maha Movement

May 09, 2025