Tesla's Defense Against Shareholder Claims: The Musk Compensation Fallout

Table of Contents

The astronomical compensation package awarded to Elon Musk, CEO of Tesla, has ignited a firestorm of controversy, leading to numerous shareholder claims alleging mismanagement and breaches of fiduciary duty. This article delves into Tesla's defense strategies against these mounting legal challenges, examining the arguments used to justify Musk's compensation and the potential outcomes of this high-stakes legal battle. The fallout from this situation has significant implications for corporate governance, executive compensation practices, and investor confidence in the electric vehicle giant.

The Core Arguments in Tesla's Defense

Tesla's defense against these shareholder claims will likely center on several key arguments, aiming to demonstrate that Musk's compensation is both justified and in line with established corporate practices.

Performance-Based Justification

Tesla will undoubtedly argue that Musk's compensation is directly tied to the company's exceptional performance and growth under his leadership. This performance-based justification will be a cornerstone of their defense.

- Specific Milestones Achieved: Tesla will highlight milestones such as achieving record-breaking market capitalization growth, exceeding ambitious production targets for its electric vehicles (EVs), and pioneering advancements in battery technology and autonomous driving capabilities.

- Structure of the Compensation Plan: A detailed breakdown of the compensation plan will be presented, emphasizing the performance-based metrics tied to the awarding of stock options and other compensation. The argument will focus on how these metrics directly align with shareholder value creation and long-term growth.

- Keywords: Performance-based pay, shareholder value, stock options, performance metrics, growth trajectory, EV production, autonomous driving.

Market-Driven Compensation

Another crucial element of Tesla's defense will be the assertion that Musk's compensation is comparable to, or even below, that of CEOs at similar high-growth technology companies. This comparative analysis seeks to normalize the seemingly exorbitant package.

- Comparable CEO Compensation Packages: Tesla will likely cite examples of comparable CEO compensation packages from leading tech companies, highlighting similar growth trajectories and market positions.

- Data Comparison: Statistical data will be presented to compare Musk's compensation with that of CEOs at comparable companies, demonstrating that his compensation falls within, or even below, the industry average for CEOs of companies of similar size and growth.

- Keywords: CEO compensation, peer group analysis, industry benchmarks, market rates, executive pay, technology industry, comparable companies.

Board Approval and Oversight

Tesla will emphasize the formal approval process undertaken by its Board of Directors, stressing the due diligence and independent oversight involved in approving Musk's compensation plan. This aims to deflect accusations of mismanagement and self-dealing.

- Board Approval Process: Tesla will detail the thorough process of board approval, including independent evaluations and recommendations from compensation committees and outside consultants. Minutes from board meetings and relevant documentation will support this claim.

- Board Composition and Independence: The composition of the board and the independence of its members will be highlighted, emphasizing the presence of independent directors with relevant expertise and a fiduciary duty to act in the best interests of shareholders.

- Keywords: Board of Directors, corporate governance, fiduciary duty, independent directors, due diligence, compensation committee, shareholder interests.

The Legal Strategies Employed by Tesla

Tesla will likely employ a multi-pronged legal strategy to defend against the shareholder claims, combining aggressive legal maneuvering with potential negotiation.

Motion to Dismiss

A primary legal tactic will be filing motions to dismiss the shareholder claims, arguing that they lack legal merit and fail to meet the necessary legal standards.

- Grounds for Dismissal: Common grounds for dismissal, such as failure to state a claim upon which relief can be granted or lack of standing, will be utilized. Tesla will argue that the plaintiffs haven't adequately demonstrated a valid legal cause of action.

- Legal Arguments: Tesla's legal team will employ detailed legal arguments supported by relevant case law and legal precedent to support their motion to dismiss.

- Keywords: Motion to dismiss, legal precedent, pleading requirements, standing, jurisdiction, failure to state a claim.

Settlement Negotiations

To avoid lengthy and costly litigation, Tesla may also explore settlement negotiations with the shareholders involved.

- Potential Settlement Terms: Potential settlement terms could include adjustments to future compensation plans, public statements acknowledging certain concerns, or financial settlements.

- Factors Influencing Settlement: The decision to settle versus litigate will depend on various factors, including the strength of the shareholder claims, the potential costs of litigation, and the risk of an unfavorable court ruling.

- Keywords: Settlement agreement, litigation costs, risk mitigation, alternative dispute resolution, negotiation.

Counterclaims

In certain instances, Tesla might file counterclaims against shareholders, alleging frivolous litigation or other misconduct.

- Potential Counterclaims: Potential counterclaims could include accusations of bad faith litigation, abuse of process, or seeking to improperly leverage the legal system for personal gain.

- Impact of Counterclaims: Filing counterclaims could significantly impact the legal proceedings, potentially deterring further litigation and shifting the focus of the case.

- Keywords: Counterclaim, frivolous lawsuit, abuse of process, legal sanctions, bad faith litigation.

Potential Outcomes and Implications

The outcome of these shareholder claims against Tesla remains uncertain, with several possibilities emerging.

- Possible Outcomes: Possible outcomes range from dismissal of the claims, a negotiated settlement, or a final court ruling on the merits of the case after a full trial.

- Impact on Tesla: Each outcome will significantly impact Tesla's reputation, stock price, and future corporate governance practices. A negative outcome could erode investor confidence and potentially lead to regulatory scrutiny.

- Keywords: Litigation outcome, legal precedent, corporate reputation, investor confidence, stock performance, regulatory scrutiny.

Conclusion

Tesla's defense against shareholder claims arising from Elon Musk's compensation is a complex legal battle with far-reaching consequences. The company's arguments—performance-based justification, market-driven compensation, and board approval—will be central to the outcome. The legal strategies employed, including motions to dismiss and the potential for settlement negotiations, will shape the trajectory of these lawsuits. Understanding the potential outcomes and implications for Tesla's future is critical for investors and stakeholders. Staying informed on the developments in this ongoing legal battle regarding Tesla’s shareholder claims is essential for anyone interested in the future of the company and the implications of executive compensation practices in the tech industry.

Featured Posts

-

Taran Killam On His Important Relationship With Amanda Bynes

May 18, 2025

Taran Killam On His Important Relationship With Amanda Bynes

May 18, 2025 -

Damiano David Funny Little Fears Debut Solo Album Announcement

May 18, 2025

Damiano David Funny Little Fears Debut Solo Album Announcement

May 18, 2025 -

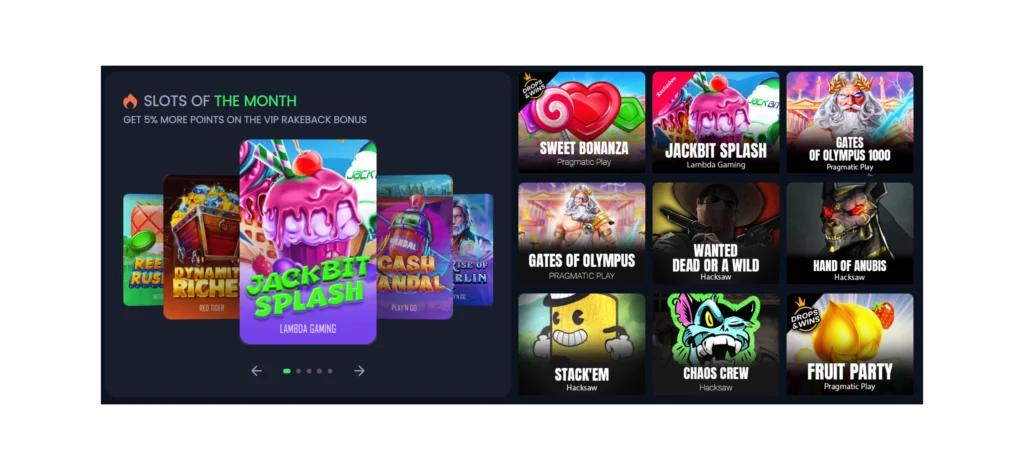

Jack Bit Review Is It The Best Bitcoin Casino In 2025

May 18, 2025

Jack Bit Review Is It The Best Bitcoin Casino In 2025

May 18, 2025 -

2025 Spring Breakout Rosters A Comprehensive Guide

May 18, 2025

2025 Spring Breakout Rosters A Comprehensive Guide

May 18, 2025 -

Casinos And Gaming The Strats Unconventional Promotional Path From Historic Vegas World

May 18, 2025

Casinos And Gaming The Strats Unconventional Promotional Path From Historic Vegas World

May 18, 2025