Thailand's Central Bank Governor Search: Navigating Looming Tariff Challenges

Table of Contents

Economic Headwinds Facing Thailand's Next Central Bank Governor

The next Thailand Central Bank Governor will face a formidable array of economic headwinds, demanding both expertise and strategic foresight.

The Impact of Global Trade Wars

The ongoing US-China trade war, along with other global trade disputes, has created significant headwinds for Thailand's export-oriented economy. These tensions have had a demonstrably negative effect:

- Decreased Demand for Thai Goods: Reduced global demand, particularly from China and the US, has impacted key Thai export sectors, including electronics, automobiles, and agricultural products. This has led to slower economic growth and increased unemployment in certain sectors.

- Supply Chain Disruptions: Trade disputes have disrupted global supply chains, leading to increased costs and uncertainties for Thai businesses. Many companies rely on components and raw materials imported from countries involved in the trade wars, making them vulnerable to disruptions.

- Increased Uncertainty: The unpredictable nature of global trade policy creates significant uncertainty for investors and businesses, hindering long-term investment and economic planning. This uncertainty impacts everything from Thai exports to domestic investment.

Further tariff escalations could exacerbate these problems, potentially pushing Thailand's economy into a more significant slowdown. The government's response to these challenges, including efforts to diversify export markets and promote domestic consumption, will also play a crucial role in shaping the economic landscape for the new governor.

Managing Inflation and Currency Volatility

Maintaining price stability and exchange rate stability is paramount. Currently, inflation rate Thailand remains relatively low; however, global uncertainties could trigger inflationary pressures.

- Potential Inflationary Pressures: Rising global commodity prices, coupled with any potential weakening of the Baht exchange rate, could lead to imported inflation. This necessitates careful monitoring of inflation indicators and proactive policy responses.

- Impact on the Thai Baht: Global economic uncertainty can cause significant volatility in the Thai Baht. Capital flows, driven by investor sentiment, can quickly impact the currency's value, creating challenges for both businesses and consumers.

- Tools for Managing Inflation and Currency: The Central Bank Governor will have a range of tools at their disposal to manage inflation and currency fluctuations, including adjusting interest rates, managing foreign exchange reserves, and implementing other monetary policy measures.

Maintaining Financial Stability

The health of Thailand's banking sector and overall financial stability Thailand is crucial for long-term economic prosperity.

- Thai Banking Sector Health: While generally robust, the Thai banking sector faces potential risks, including high household debt levels and potential increases in non-performing loans in certain sectors.

- Risks to Financial Stability: Global economic shocks, coupled with domestic vulnerabilities, could increase the risk of capital flight and threaten financial stability. Rapid changes in global interest rates can also pose challenges.

- Central Bank's Role in Risk Mitigation: The Central Bank plays a pivotal role in mitigating these risks through banking supervision, regulation, and the provision of liquidity to the financial system when necessary.

Qualities and Experience Needed for the Next Governor

The next governor will require a specific blend of skills and experience to effectively navigate the complexities of the Thai economy.

Monetary Policy Expertise

A deep understanding of monetary policy and macroeconomic management is non-negotiable.

- Experience in Central Banking: Proven experience in a central bank or similar institution is essential. This ensures a practical understanding of the policy tools and their impact.

- International Economic Understanding: A comprehensive understanding of international economic forces, including global trade, finance, and monetary policy, is vital. The ability to anticipate and respond to global economic shocks is critical.

Leadership and Communication Skills

Strong leadership and communication are paramount.

- Leadership in Central Banking: The governor must effectively lead the Central Bank, building consensus among staff and stakeholders. This includes fostering a culture of collaboration and effective decision-making.

- Effective Communication: The ability to clearly articulate policy decisions to the public, businesses, and international organizations is crucial for building confidence and managing expectations. Strong communication skills and public relations expertise are essential.

Crisis Management Capabilities

The ability to navigate economic crises is crucial.

- Risk Management Expertise: A proven track record in risk management and crisis management is vital. This includes the ability to identify potential risks, develop contingency plans, and make timely and effective decisions during times of economic stress.

- Economic Resilience: The governor should be able to foster economic resilience within the Thai economy, enabling it to better withstand global economic shocks and adapt to changing circumstances.

The Selection Process and Political Considerations

The selection process for the Thailand Central Bank Governor involves a rigorous assessment of candidates based on their qualifications and experience. However, political considerations inevitably play a role in the final decision. The influence of government officials and political parties can shape the selection process, potentially impacting the final appointee's orientation towards economic policy. The appointment's impact on Thailand's overall economic trajectory is considerable.

Conclusion

The selection of Thailand's next Central Bank Governor is of paramount importance to the country's economic future. The successful candidate will need a profound understanding of monetary policy, a sharp awareness of global trade dynamics, and strong leadership abilities to address the looming tariff challenges and preserve financial stability. Effective communication of policy decisions and consensus-building are also critical. Careful consideration of these factors is essential to ensure the appointment of a governor capable of guiding Thailand's economy through these turbulent times. The ongoing search for a Thailand Central Bank Governor demands a meticulous evaluation of candidates based on their experience and suitability for this pivotal role. Thorough comprehension of the multifaceted challenges facing the next governor is crucial for successfully navigating these demanding economic times.

Featured Posts

-

11 Yjet E Psg Se Qe Zoterojne Fushen

May 09, 2025

11 Yjet E Psg Se Qe Zoterojne Fushen

May 09, 2025 -

2500 M De Vignes Plantes A Dijon Secteur Des Valendons

May 09, 2025

2500 M De Vignes Plantes A Dijon Secteur Des Valendons

May 09, 2025 -

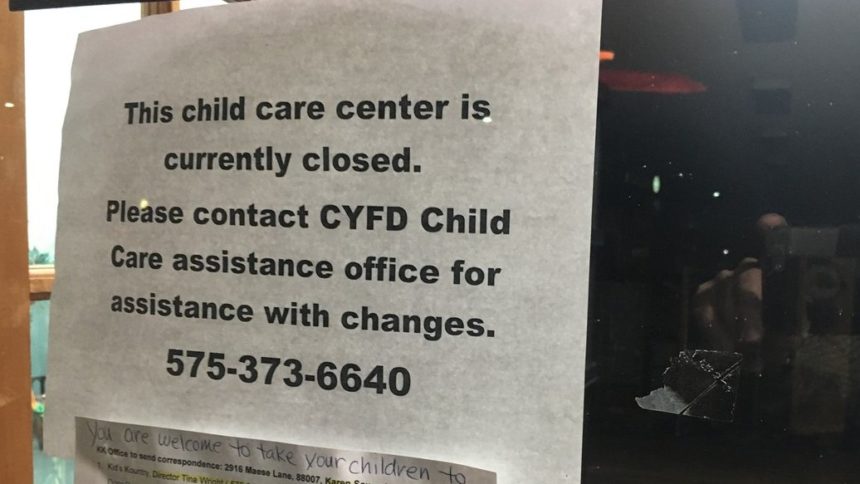

Nc Daycare Suspended State Action And Investigation Details

May 09, 2025

Nc Daycare Suspended State Action And Investigation Details

May 09, 2025 -

Stricter Uk Visa Rules For Nigerian And Pakistani Applicants

May 09, 2025

Stricter Uk Visa Rules For Nigerian And Pakistani Applicants

May 09, 2025 -

Man Faces Felony Charges After Crashing Car Through Jennifer Anistons Gate

May 09, 2025

Man Faces Felony Charges After Crashing Car Through Jennifer Anistons Gate

May 09, 2025