Thames Water: Executive Bonuses And The Company's Financial Troubles

Table of Contents

Thames Water's Mounting Debt and Financial Instability

Thames Water's financial woes are substantial. The company carries a massive debt burden, hindering its ability to invest adequately in essential infrastructure upgrades. This investment shortfall directly contributes to the deterioration of its aging water and sewage systems, leading to increased risk of leaks, pollution incidents, and service disruptions. The reasons for this financial instability are multifaceted, including:

- Underinvestment in Infrastructure: Years of insufficient investment have left Thames Water with a significant backlog of maintenance and renewal projects. This deferred maintenance has resulted in higher repair costs and increased operational challenges.

- Impact on Customers: The financial strain is likely to translate into higher customer bills as the company seeks to address its debt and fund necessary upgrades. Service disruptions, due to aging infrastructure, are also a growing concern.

- Credit Rating Downgrade: The company's credit rating has been downgraded, making it more expensive – if not impossible – to borrow money for future investments. This further exacerbates the financial challenges faced by Thames Water.

- Ofwat's Role: The water regulator, Ofwat, plays a crucial role in overseeing Thames Water’s financial health and performance. Its actions, or inactions, regarding Thames Water’s financial situation are subject to intense public scrutiny. The effectiveness of Ofwat’s regulatory oversight is currently being debated.

Executive Compensation and Public Outrage

While Thames Water grapples with significant debt and infrastructure challenges, the awarding of substantial executive bonuses has ignited a firestorm of public criticism. The disparity between the lucrative compensation packages received by senior executives and the company's financial struggles, coupled with potential increases in customer bills, is seen as unacceptable by many.

- Executive Pay Figures: Precise figures on executive salaries and bonuses vary depending on the source, but reports consistently highlight significant payouts. The sheer amount, particularly during a period of financial distress, fuels public anger.

- Justification (or Lack Thereof): The justifications offered by Thames Water for these payments haven't appeased critics. The argument that bonuses incentivize performance rings hollow when considering the company's overall financial health and service delivery.

- Public and Media Reaction: The public reaction has been overwhelmingly negative, with widespread condemnation in the media. This negative publicity further damages the company’s reputation and fuels calls for greater accountability.

- Industry Comparisons: Comparisons with executive compensation at other water companies, both in the UK and internationally, are being made, highlighting potential discrepancies and further fueling the debate about appropriate levels of executive pay in the context of the current financial circumstances.

The Role of Regulation and Government Intervention

Ofwat's regulatory powers and its response to Thames Water’s predicament are central to resolving the crisis. The effectiveness of current water industry regulation is under intense scrutiny. The potential for government intervention and reforms to the water industry are also being discussed.

- Ofwat's Regulatory Powers: Ofwat possesses certain regulatory powers, including the ability to impose penalties for mismanagement. However, the extent to which these powers are being effectively employed in the case of Thames Water is a subject of ongoing debate.

- Potential Penalties: The potential penalties for Thames Water's mismanagement remain uncertain. Stringent action could involve fines, stricter regulatory oversight, or even the potential for government intervention.

- Effectiveness of Current Regulation: The current regulatory framework is being questioned in light of Thames Water's financial troubles. There are calls for greater transparency and stronger enforcement mechanisms.

- Proposed Changes: Proposals for water pricing reform and increased investment in infrastructure are being considered as part of wider discussions regarding the future of the water industry.

The Future of Thames Water and its Impact on Customers

The long-term outlook for Thames Water remains uncertain. Its financial instability directly impacts customers, potentially resulting in further bill increases and service disruptions.

- Future Water Bills: Customers should anticipate further increases in water bills as the company attempts to tackle its debt and invest in infrastructure improvements.

- Service Quality: The quality of water services could either improve, with increased investment, or further deteriorate, depending on the success of future investment strategies and regulatory action.

- Possible Scenarios: Several scenarios are possible, ranging from the company’s successful restructuring and improved financial performance to more extreme outcomes, including potential privatization or even bankruptcy.

- Long-Term Solutions: A comprehensive solution requires a multi-pronged approach: increased investment in infrastructure, improved regulatory oversight, better corporate governance, and a fairer and more sustainable pricing mechanism.

Conclusion:

The case of Thames Water highlights a significant problem at the intersection of corporate governance, regulation, and public service provision. The awarding of executive bonuses amidst a financial crisis and crumbling infrastructure has understandably sparked public outrage. This situation demands greater transparency, stronger regulatory oversight, and a renewed focus on customer needs. The future of Thames Water and the broader water industry hinges on addressing these issues effectively. Stay informed about the ongoing situation with Thames Water and the future of water management in the UK. Contact your local representatives to voice your concerns and stay informed about the latest developments in this crucial area. Further research into the intricacies of Thames Water executive bonuses and their impact is encouraged.

Featured Posts

-

Zimbabwes Historic Test Win In Sylhet Ending A Two Year Drought

May 23, 2025

Zimbabwes Historic Test Win In Sylhet Ending A Two Year Drought

May 23, 2025 -

Nicolas Tagliafico Man United Players To Blame For Ten Hags Failures

May 23, 2025

Nicolas Tagliafico Man United Players To Blame For Ten Hags Failures

May 23, 2025 -

Memorial Day 2025 Experts Top Picks For Sales And Deals

May 23, 2025

Memorial Day 2025 Experts Top Picks For Sales And Deals

May 23, 2025 -

Joe Jonass Response To A Couple Fighting Over Him A Viral Moment

May 23, 2025

Joe Jonass Response To A Couple Fighting Over Him A Viral Moment

May 23, 2025 -

Excongresista Elias Rodriguez Y App Acusacion De Venganza Politica En La Libertad

May 23, 2025

Excongresista Elias Rodriguez Y App Acusacion De Venganza Politica En La Libertad

May 23, 2025

Latest Posts

-

Jonathan Groffs Just In Time Opening A Star Studded Affair

May 23, 2025

Jonathan Groffs Just In Time Opening A Star Studded Affair

May 23, 2025 -

Jonathan Groff And Just In Time A Tony Awards Prediction

May 23, 2025

Jonathan Groff And Just In Time A Tony Awards Prediction

May 23, 2025 -

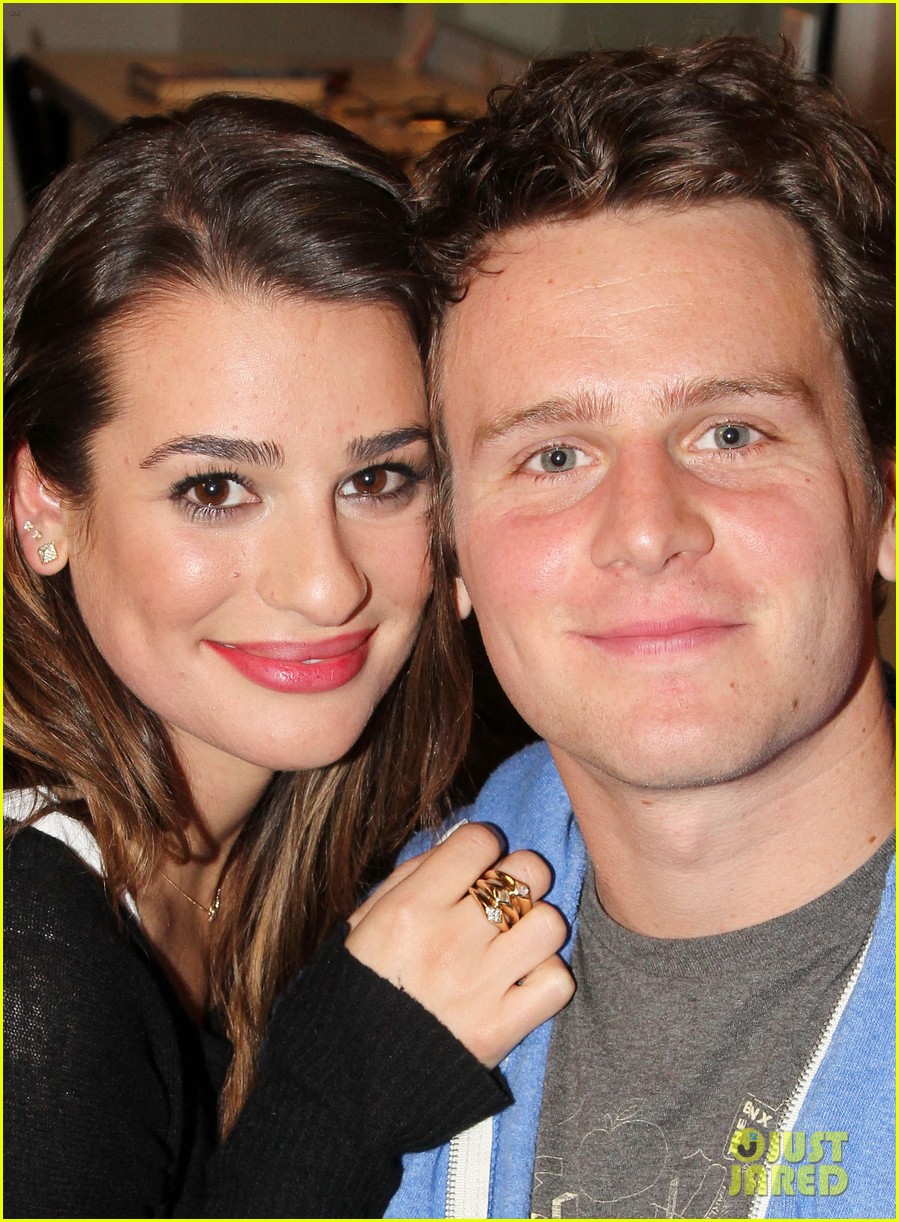

Hilarious Etoile Scene A Spring Awakening Reunion For Glick And Groff

May 23, 2025

Hilarious Etoile Scene A Spring Awakening Reunion For Glick And Groff

May 23, 2025 -

Jonathan Groff A Tony Awards Milestone With Just In Time

May 23, 2025

Jonathan Groff A Tony Awards Milestone With Just In Time

May 23, 2025 -

Etoile A Spring Awakening Reunion Brings Laughter With Glick And Groff

May 23, 2025

Etoile A Spring Awakening Reunion Brings Laughter With Glick And Groff

May 23, 2025