The Bank Of Canada And The Challenge Of Rising Core Inflation

Table of Contents

Understanding the Drivers of Rising Core Inflation in Canada

Several interconnected factors contribute to the persistent rise in core inflation in Canada. Let's delve into the key drivers:

The Role of Supply Chain Disruptions

Lingering global supply chain issues continue to exert upward pressure on Canadian prices. The pandemic exposed vulnerabilities in global supply chains, leading to shortages of goods and increased transportation costs. These disruptions are particularly evident in sectors such as:

- Housing: Increased material costs (lumber, concrete) and labor shortages have driven up housing prices significantly.

- Automobiles: Chip shortages and logistical bottlenecks have constrained automobile production, leading to higher prices for new and used vehicles.

Statistics Canada reports show a significant increase in inflation rates for these sectors, exceeding the overall core inflation rate. Keywords: supply chain disruptions, inflation rates, price increases, consumer prices.

Wage Growth and its Impact on Inflation

Rising wages, while generally positive for workers, can contribute to inflationary pressures. This relationship is particularly relevant when wage increases outpace productivity growth. The ongoing debate surrounding wage-price spirals – a cycle where rising wages lead to higher prices, prompting further wage demands – is central to understanding current inflation dynamics. Moreover:

- Labor Shortages: Canada's tight labor market, with significant labor shortages in certain sectors, is driving up wages, contributing to inflationary pressures.

- Increased Consumer Spending: Higher wages fuel increased consumer spending, further adding to demand-pull inflation.

Keywords: wage growth, wage-price spiral, labor market, employment rates.

The Influence of Global Economic Factors

Canada's economy is heavily intertwined with the global economy. Global inflationary pressures significantly impact Canada, particularly through:

- Commodity Prices: Canada is a major exporter of commodities. Rising global commodity prices, especially energy prices, directly affect inflation in Canada.

- Energy Costs: The volatility in global energy markets, often influenced by geopolitical events, directly affects Canadian consumer and producer prices.

- Geopolitical Risks: Global conflicts and geopolitical uncertainty contribute to uncertainty in markets and can fuel inflation.

Keywords: global inflation, commodity prices, energy prices, geopolitical risks.

The Bank of Canada's Response to Rising Core Inflation

The Bank of Canada has implemented several measures to combat rising core inflation. Let's analyze their effectiveness and potential consequences.

Interest Rate Hikes and their Effectiveness

The Bank of Canada has responded aggressively to rising inflation by implementing a series of interest rate hikes. These hikes aim to cool down the economy by making borrowing more expensive, thus reducing consumer spending and investment.

- Effectiveness: While the impact of interest rate hikes takes time to fully manifest, early indicators suggest some slowing of economic growth.

- Negative Consequences: Aggressive interest rate hikes carry the risk of triggering an economic slowdown or even a recession. The impact on highly indebted households and businesses needs careful monitoring.

Keywords: interest rate hikes, monetary policy tools, economic slowdown, recession risk.

Quantitative Tightening and Other Monetary Policy Tools

Beyond interest rate hikes, the Bank of Canada has employed quantitative tightening (QT), reducing its balance sheet by letting government bonds mature without reinvestment. Other tools include:

- Forward Guidance: Communicating the Bank's intentions and expectations to influence market expectations and manage inflation expectations.

- Reserve Requirements: Adjusting the amount of money banks are required to hold in reserve.

The effectiveness of these tools depends on various economic factors and their combined impact is being closely watched. Keywords: quantitative tightening, monetary policy, inflation control, economic stability.

Communication and Transparency

Clear and transparent communication is crucial for the Bank of Canada's effectiveness. The Bank strives to:

- Manage Inflation Expectations: Openly communicating its assessment of the inflation outlook helps to anchor inflation expectations, preventing a self-fulfilling prophecy of runaway inflation.

- Build Market Confidence: Consistent and transparent communication helps maintain confidence in the Bank's ability to manage the economy.

Effective communication plays a vital role in influencing market behavior and managing inflation expectations. Keywords: communication strategy, transparency, market confidence, inflation expectations.

Conclusion: Navigating the Path to Stable Inflation in Canada

Rising core inflation in Canada is driven by a complex interplay of supply chain disruptions, wage growth, and global economic factors. The Bank of Canada's response, involving interest rate hikes, quantitative tightening, and transparent communication, aims to steer the economy towards stable inflation. However, the path ahead remains uncertain, with potential risks including an economic slowdown. It's crucial for Canadians to stay informed about the Bank of Canada's actions and the evolving situation regarding core inflation in Canada. Further reading on Bank of Canada monetary policy and related economic topics will provide a deeper understanding of these complex issues. Stay informed to navigate the challenges of core inflation in Canada effectively.

Featured Posts

-

Potential Ban And Age Restrictions For Kartels Upcoming Trinidad Concert

May 22, 2025

Potential Ban And Age Restrictions For Kartels Upcoming Trinidad Concert

May 22, 2025 -

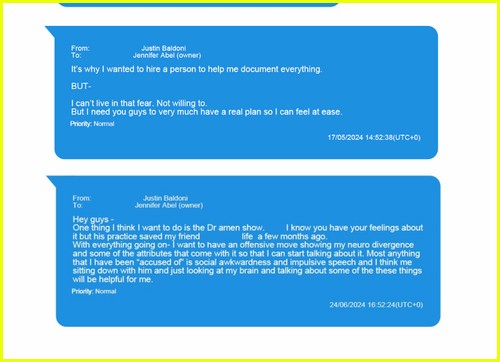

The Blake Lively Allegations A Comprehensive Overview

May 22, 2025

The Blake Lively Allegations A Comprehensive Overview

May 22, 2025 -

Google Ai Smart Glasses Prototype A Comprehensive Review

May 22, 2025

Google Ai Smart Glasses Prototype A Comprehensive Review

May 22, 2025 -

Exclusive Details Taylor Swifts Response To The Blake Lively And Justin Baldoni Lawsuit

May 22, 2025

Exclusive Details Taylor Swifts Response To The Blake Lively And Justin Baldoni Lawsuit

May 22, 2025 -

The Goldbergs Comparing The Show To Other Popular Sitcoms

May 22, 2025

The Goldbergs Comparing The Show To Other Popular Sitcoms

May 22, 2025

Latest Posts

-

Understanding Susquehanna Valley Storm Damage Prevention Mitigation And Insurance

May 22, 2025

Understanding Susquehanna Valley Storm Damage Prevention Mitigation And Insurance

May 22, 2025 -

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025 -

Dauphin County Apartment Building Fire Residents Evacuated

May 22, 2025

Dauphin County Apartment Building Fire Residents Evacuated

May 22, 2025 -

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025 -

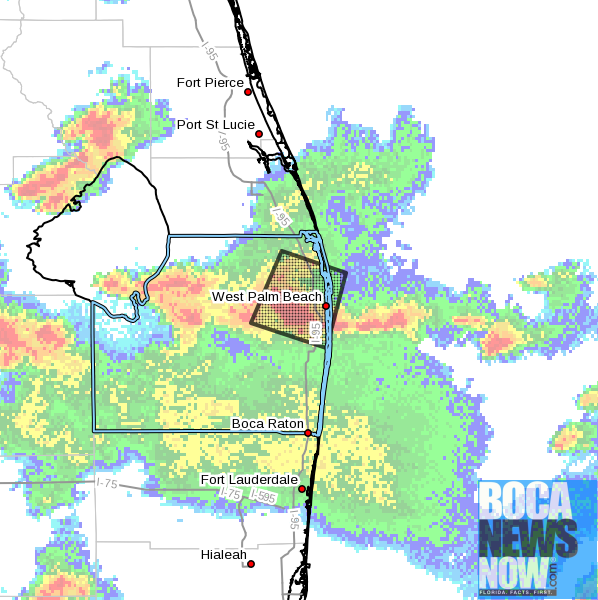

Thunderstorm Warning Urgent Alert For Parts Of South Central Pennsylvania

May 22, 2025

Thunderstorm Warning Urgent Alert For Parts Of South Central Pennsylvania

May 22, 2025