The BCE Inc. Dividend Cut: What It Means For Your Investment Strategy

Table of Contents

Reasons Behind the BCE Inc. Dividend Cut

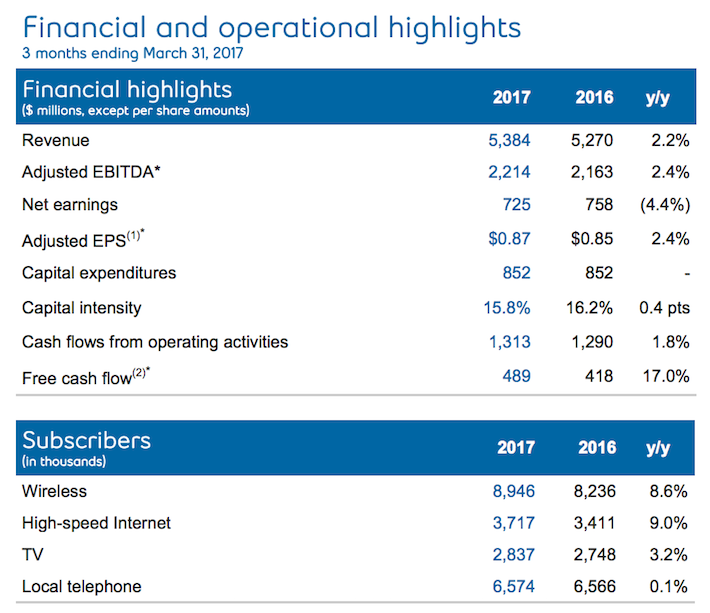

BCE Inc.'s decision to reduce its dividend wasn't arbitrary. The company cited several factors contributing to this significant change. Understanding these underlying reasons is crucial for assessing the long-term prospects of the company and the impact on your investment. Let's delve into the key drivers behind the BCE Inc. dividend cut and examine BCE financial performance in detail.

-

Increased Investment in Network Infrastructure: BCE is heavily investing in upgrading its network infrastructure, particularly in 5G rollout and fiber optic expansion. This capital expenditure, while crucial for long-term growth and competitiveness in the telecom industry, significantly impacts short-term profitability. This represents a substantial component of the reasoning behind the BCE Inc. dividend cut.

-

Higher Interest Rates Impacting Borrowing Costs: The current economic climate of rising interest rates has increased BCE's borrowing costs. Higher debt servicing expenses directly affect the company's cash flow, impacting its ability to maintain the previous dividend payout. Examining BCE debt levels provides valuable context to this issue.

-

Pressure from Competitors Impacting Market Share and Profitability: The telecom industry is fiercely competitive. Intense competition from rivals has put pressure on BCE's market share and profitability, further constraining its ability to sustain its previous dividend level. This analysis of BCE financial performance highlights these competitive pressures within the telecom industry competition.

-

Strategic Realignment Focusing on Long-Term Growth: BCE may be prioritizing long-term growth and strategic investments over immediate dividend payouts. This strategic realignment suggests a focus on future profitability, even if it means a temporary reduction in dividends.

Impact on BCE Inc. Stock Price and Valuation

The BCE Inc. dividend cut has had a noticeable impact on the company's stock price and valuation. Understanding these changes is essential for making informed investment decisions.

-

Short-Term Price Drop: Immediately following the announcement, BCE's stock price experienced a significant drop, reflecting the market's initial reaction to the reduced dividend. The decrease in the BCE stock price highlights the immediate market sentiment.

-

Potential for Long-Term Recovery: The long-term impact on the BCE stock price depends heavily on the company's future financial performance. If BCE successfully executes its strategic investments and improves profitability, the stock price could potentially recover and even surpass its pre-cut levels. Analyzing BCE valuation metrics will give a clearer picture.

-

Changes in Investor Sentiment and Trading Volume: The dividend cut has undoubtedly shifted investor sentiment. We can observe changes in trading volume, reflecting increased uncertainty and potential shifts in investment strategies. Analyzing BCE valuation through metrics such as P/E ratio and dividend yield provides further insight. The change in dividend yield, in particular, is a direct consequence of the BCE Inc. dividend cut.

Implications for Income-Seeking Investors

For investors relying on BCE's dividend for income, the cut represents a significant reduction in their passive income stream. This necessitates a reassessment of their investment strategy and the exploration of alternative income-generating options.

-

Reduced Passive Income Stream: The BCE Inc. dividend cut directly reduces the passive income received by shareholders, forcing a reevaluation of their income stream.

-

Need to Re-evaluate Portfolio Diversification: The reliance on a single stock for income is inherently risky. The BCE Inc. dividend cut underscores the importance of portfolio diversification across different asset classes and sectors.

-

Explore Alternative High-Yield Dividend Stocks or Other Income-Generating Assets: Investors need to explore alternatives like high-yield bonds, REITs, or other dividend-paying stocks to compensate for the reduced income from BCE. Diversification into other income investing strategies is crucial.

Re-evaluating Your Investment Strategy After the BCE Inc. Dividend Cut

The BCE Inc. dividend cut necessitates a thorough review of your investment strategy, focusing on portfolio adjustments and risk management.

-

Review Your Overall Investment Objectives and Risk Tolerance: Re-evaluate your long-term goals and assess your risk tolerance to ensure your portfolio aligns with your investment objectives, especially considering the implications of the BCE Inc. dividend cut.

-

Assess Your Reliance on BCE for Income and Adjust Accordingly: Determine how significantly the BCE dividend contributed to your overall income and adjust your investment plan to compensate for the loss.

-

Consider Diversifying into Other Sectors or Asset Classes: Broaden your portfolio to reduce reliance on any single stock or sector. Consider diversifying your holdings to mitigate future risks associated with the volatility of individual stocks.

-

Monitor BCE's Future Performance and Financial Reports Closely: Keep a close eye on BCE's financial performance and future announcements to inform future investment decisions. Regular monitoring is key to adapting your investment strategy after the BCE Inc. dividend cut.

Conclusion: Navigating the Aftermath of the BCE Inc. Dividend Cut

The BCE Inc. dividend cut presents both challenges and opportunities for investors. Income-seeking investors need to adapt their strategies, while long-term investors should carefully assess the company's future prospects. The key takeaway is the importance of portfolio diversification and a proactive approach to risk management. Don't let the BCE Inc. dividend cut catch you off guard. Re-evaluate your investment strategy today! Carefully analyze your portfolio's exposure to BCE and consider the implications of the BCE Inc. dividend cut on your long-term financial goals. Take proactive steps to adjust your investment strategy now to mitigate potential risks and seek alternative income-generating opportunities.

Featured Posts

-

The Papal Conclave Exploring Potential Candidates To Replace Pope Francis

May 12, 2025

The Papal Conclave Exploring Potential Candidates To Replace Pope Francis

May 12, 2025 -

Tam Krwz Awr Mdah Jwte Ka Waqeh Awr Hyran Kn Rdeml

May 12, 2025

Tam Krwz Awr Mdah Jwte Ka Waqeh Awr Hyran Kn Rdeml

May 12, 2025 -

Selena Gomezs Accidental Reveal A Glimpse Into Benny Blancos Private Life

May 12, 2025

Selena Gomezs Accidental Reveal A Glimpse Into Benny Blancos Private Life

May 12, 2025 -

Thomas Muellers Bayern Legacy Examining The Reactions To His Possible Transfer

May 12, 2025

Thomas Muellers Bayern Legacy Examining The Reactions To His Possible Transfer

May 12, 2025 -

Virginia Giuffre Skandalen En Analyse Av Hendelsene Og Reaksjonene

May 12, 2025

Virginia Giuffre Skandalen En Analyse Av Hendelsene Og Reaksjonene

May 12, 2025

Latest Posts

-

74 Ludi By Odmietlo Prenajom Nehnutelnosti Romovi Prekvapujuce Statistiky

May 13, 2025

74 Ludi By Odmietlo Prenajom Nehnutelnosti Romovi Prekvapujuce Statistiky

May 13, 2025 -

Funeral For Teenager Killed In School Stabbing

May 13, 2025

Funeral For Teenager Killed In School Stabbing

May 13, 2025 -

School Stabbing Victim 15 Laid To Rest

May 13, 2025

School Stabbing Victim 15 Laid To Rest

May 13, 2025 -

Sheffield United Escapes Red Card In Fiery Leeds Clash Commentators Claim

May 13, 2025

Sheffield United Escapes Red Card In Fiery Leeds Clash Commentators Claim

May 13, 2025 -

15 Year Old Stabbed At School Funeral Services Announced

May 13, 2025

15 Year Old Stabbed At School Funeral Services Announced

May 13, 2025