The Billionaire Boy's Guide To Responsible Investing And Philanthropy

Table of Contents

Navigating the Complex World of Responsible Investing

Responsible investing isn't just a trend; it's a fundamental shift in how we approach wealth management. It's about aligning your investments with your values, generating financial returns while contributing to positive social and environmental change.

Defining Responsible Investing (RI)

Responsible investing (RI) encompasses a range of approaches, including Environmental, Social, and Governance (ESG) investing, impact investing, and sustainable investing. These strategies consider factors beyond traditional financial metrics.

- ESG Factors:

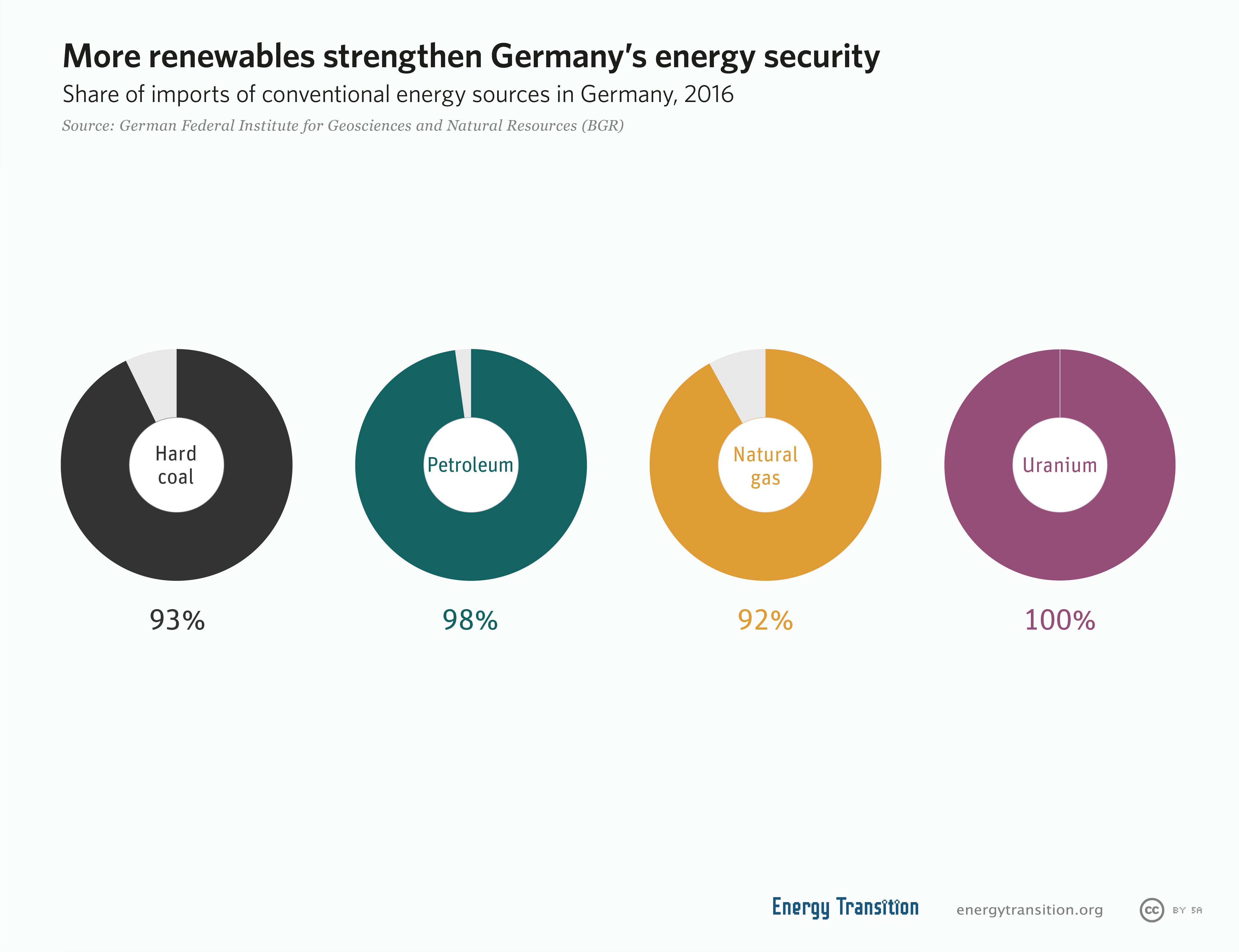

- Environmental: Carbon footprint reduction, renewable energy investments, waste management, pollution control.

- Social: Diversity and inclusion within companies, fair labor practices, community engagement, human rights considerations.

- Governance: Corporate transparency, ethical leadership, board diversity, anti-corruption measures.

- Impact Investing: This focuses on investments intended to generate measurable social and environmental impact alongside a financial return. Examples include:

- Renewable energy projects (solar, wind).

- Affordable housing initiatives.

- Microfinance institutions supporting entrepreneurs in developing countries.

- Benefits of Responsible Investing:

- Long-term value creation: Companies with strong ESG profiles often outperform their peers.

- Positive social impact: Your investments directly contribute to addressing global challenges.

- Reduced risk: By avoiding companies with poor ESG performance, you minimize exposure to potential reputational and financial risks.

Diversifying Your Portfolio for Responsible Growth

Diversification is crucial for minimizing risk and maximizing positive impact. Don't put all your eggs in one basket, even a "responsible" one.

- Responsible Investment Sectors:

- Green technology (solar, wind, energy storage).

- Sustainable agriculture (organic farming, precision agriculture).

- Ethical fashion (brands committed to fair labor practices and sustainable materials).

- Risk Mitigation Strategies:

- Conduct thorough due diligence on potential investments.

- Consult with experienced financial advisors specializing in responsible investing.

- Utilize ESG rating agencies to assess companies' performance.

- Investment Strategies: Consider both long-term (e.g., sustainable infrastructure projects) and short-term (e.g., supporting green startups) responsible investments to balance risk and reward.

Strategic Philanthropy: Making a Meaningful Difference

Your wealth provides an unparalleled opportunity to make a meaningful difference. Strategic philanthropy goes beyond simple donations; it involves thoughtful planning and execution to maximize impact.

Identifying Your Philanthropic Focus

Start by identifying causes that resonate deeply with your values and passions.

- Self-Reflection Exercises:

- What issues are you most passionate about?

- What kind of impact do you want to create?

- What are your long-term goals for your philanthropy?

- Researching Charitable Organizations:

- Assess their financial transparency and track record.

- Evaluate their program effectiveness and impact measurement strategies.

- Look for organizations with strong governance structures.

- Sustainability and Scalability: Choose projects that have the potential for long-term sustainability and scalability.

Effective Philanthropic Strategies

Explore various approaches to maximize your giving's effectiveness.

- Grantmaking: Providing financial support to non-profit organizations.

- Donations: Contributing directly to causes or organizations.

- Impact Investing: Investing in ventures with both financial and social returns.

- Volunteering: Directly contributing time and skills to support causes.

Each strategy has advantages and disadvantages. For example, grantmaking provides direct support but may lack the potential for high returns; impact investing offers both financial and social returns but requires more research and due diligence. Measuring the impact of your philanthropy is critical for ensuring effectiveness; incorporate metrics and regular evaluations.

The Role of Mentorship and Expert Advice

Navigating the complexities of responsible investing and philanthropy requires expert guidance.

Seeking Guidance from Experienced Professionals

Engaging with seasoned professionals is essential.

- Benefits of Expert Advice:

- Access to specialized knowledge and insights.

- Objective assessment of investment opportunities.

- Assistance in developing and implementing a strategic philanthropic plan.

- Questions to Ask Potential Advisors:

- What is your experience with responsible investing and philanthropy?

- What is your fee structure?

- What is your investment philosophy?

- Identifying Reputable Professionals: Seek recommendations from trusted sources and conduct thorough background checks.

Building a Network of Like-minded Individuals

Connecting with other philanthropists and investors can be incredibly valuable.

- Networking Opportunities: Attend conferences, workshops, and events focused on responsible investing and philanthropy.

- Learning from Others: Share experiences and learn from the successes and challenges of others.

- Collaboration: Consider collaborative projects that leverage the resources and expertise of multiple individuals or organizations.

Conclusion: Embracing Responsible Investing and Philanthropy

The journey of responsible investing and philanthropy is a rewarding one, offering both financial returns and the satisfaction of contributing to a better world. By carefully considering your values, diversifying your investments, and seeking expert guidance, you can create a lasting positive impact. Start your journey towards responsible investing today. Explore the world of impactful philanthropy and become a responsible billionaire who leaves a legacy of positive change. To learn more, explore resources from organizations like [link to ESG rating agency], [link to a charitable organization database], and [link to a financial advisor specializing in RI].

Featured Posts

-

Analyzing Big Bear Ai Stock A Motley Fool Inspired Guide For Investors

May 21, 2025

Analyzing Big Bear Ai Stock A Motley Fool Inspired Guide For Investors

May 21, 2025 -

Gaza Food Supply Israel Announces Resumption Of Food Shipments

May 21, 2025

Gaza Food Supply Israel Announces Resumption Of Food Shipments

May 21, 2025 -

Post Nuclear Taiwan Lng Imports And Energy Security

May 21, 2025

Post Nuclear Taiwan Lng Imports And Energy Security

May 21, 2025 -

Funbox Opens First Permanent Location Indoor Bounce Park In Mesa Arizona

May 21, 2025

Funbox Opens First Permanent Location Indoor Bounce Park In Mesa Arizona

May 21, 2025 -

Proposed Texas Legislation Could Ban Minors From Social Media Platforms

May 21, 2025

Proposed Texas Legislation Could Ban Minors From Social Media Platforms

May 21, 2025

Latest Posts

-

New Music And Freedom Vybz Kartels Exclusive Prison Interview

May 22, 2025

New Music And Freedom Vybz Kartels Exclusive Prison Interview

May 22, 2025 -

Vybz Kartels Exclusive Prison Interview Hopes For Freedom And New Music

May 22, 2025

Vybz Kartels Exclusive Prison Interview Hopes For Freedom And New Music

May 22, 2025 -

Nuffy Achieves Dream Touring Alongside Vybz Kartel

May 22, 2025

Nuffy Achieves Dream Touring Alongside Vybz Kartel

May 22, 2025 -

New York City Beenie Mans Streaming Event Announcement

May 22, 2025

New York City Beenie Mans Streaming Event Announcement

May 22, 2025 -

Is The Goldbergs Ending Soon Exploring The Future Of The Show

May 22, 2025

Is The Goldbergs Ending Soon Exploring The Future Of The Show

May 22, 2025