The Canadian Tire-Hudson's Bay Merger: Implications And Analysis

Table of Contents

Synergies and Potential Benefits of the Merger

The Canadian Tire and Hudson's Bay merger promises significant synergies across various aspects of their operations. This strategic alliance aims to create a retail powerhouse in Canada.

Enhanced Retail Footprint and Market Reach

The combined entity boasts a significantly expanded retail footprint, leveraging the existing extensive network of Canadian Tire and Hudson's Bay stores. This translates to:

- Increased brand visibility and recognition: The combined presence strengthens brand awareness across a wider customer base.

- Improved supply chain efficiency through shared infrastructure: Consolidating logistics and distribution networks promises cost savings and improved operational efficiency.

- Expansion into new markets and demographics: The merger allows for targeted expansion into new geographic areas and diverse customer segments, reaching previously untapped markets. This could involve strategic store openings and targeted marketing campaigns.

Diversification of Product Offerings and Brand Portfolio

Canadian Tire's strong presence in automotive, home improvement, and sporting goods perfectly complements HBC's fashion, home furnishings, and luxury goods offerings. This diversification offers:

- Cross-selling opportunities and increased customer spending: Customers can now find a wider range of products under one roof, leading to increased spending per visit.

- Reduced reliance on individual product categories for revenue: Diversification mitigates risk and provides a more stable revenue stream.

- Creation of a more comprehensive and attractive shopping experience: The expanded product range creates a one-stop shop for a wider variety of consumer needs.

Cost Savings and Operational Efficiencies

Consolidating operations and supply chains is expected to lead to significant cost reductions. Key areas of potential savings include:

- Economies of scale in purchasing, distribution, and marketing: Bulk purchasing and streamlined logistics will significantly reduce costs.

- Streamlined management and administrative structures: Eliminating redundancies in management and administration will contribute to cost savings.

- Potential for investment in technology and innovation: Cost savings can be reinvested in technological advancements and innovative retail solutions.

Challenges and Potential Risks Associated with the Merger

While the merger offers significant potential, several challenges and risks must be addressed for its success.

Integration Challenges and Cultural Differences

Merging two distinct corporate cultures presents a significant hurdle. Successful integration requires careful planning and execution to overcome potential issues, including:

- Potential for employee resistance and disruption: Change management strategies are crucial to minimize employee disruption during the integration process.

- Difficulties in aligning brand identities and marketing strategies: Maintaining the distinct identities of both brands while creating a unified brand image is a delicate balance.

- Need for effective communication and change management strategies: Open communication and clear plans are essential to ensure a smooth transition.

Competition and Market Dynamics

The merger may face regulatory scrutiny and potential antitrust concerns, impacting the competitive landscape.

- Increased market dominance and potential for anti-competitive behaviour: The combined entity will hold a significant market share, potentially impacting competition.

- Response from competitors seeking to capitalize on the merger's challenges: Competitors may aggressively pursue market share while the merged entity navigates integration issues.

- Need to adapt to evolving consumer preferences and online shopping trends: The merged entity must adapt to the changing retail landscape and embrace e-commerce strategies.

Financial Risks and Debt Management

The merger likely involves substantial debt financing, requiring careful financial planning and management to avoid potential issues such as:

- Potential impact on credit rating and investor confidence: High debt levels could negatively affect the company's credit rating and investor perception.

- Need for effective risk mitigation strategies to manage debt levels: Strategic debt management is critical to minimize financial risk.

- Dependence on successful integration and synergy realization: The success of the merger hinges on achieving the projected synergies and cost savings.

Consumer Impact and Future Outlook

The Canadian Tire-Hudson's Bay merger will undoubtedly impact consumers in various ways.

Changes in Pricing and Product Availability

The merger could lead to significant changes in pricing strategies, product availability, and overall shopping experience:

- Potential for price increases or discounts depending on market response: Pricing strategies will depend on factors such as market competition and cost efficiencies.

- Expansion of product lines or reduction of overlapping items: The merger may lead to the expansion of product lines or the elimination of redundant products.

- Changes in loyalty programs and customer service initiatives: Consolidation of loyalty programs and customer service strategies is likely.

Long-Term Implications for the Canadian Retail Landscape

This merger sets a precedent for future consolidation in the Canadian retail sector:

- Potential for further mergers and acquisitions among major players: The merger may trigger a wave of consolidation within the industry.

- Increased competition and innovation within the retail landscape: The merger will intensify competition and stimulate innovation among retail players.

- Long-term effects on employment and economic growth: The merger's long-term impact on employment and the Canadian economy requires further analysis.

Conclusion

The Canadian Tire-Hudson's Bay merger is a landmark event in Canadian retail, presenting both substantial opportunities and significant risks. While potential synergies and cost savings are attractive, successful integration demands meticulous planning and execution. The consumer impact will likely be multifaceted, influencing pricing, product availability, and the overall shopping experience. Continuous monitoring of market dynamics and competitive responses is crucial to fully understand the long-term implications of this merger. Stay informed on further developments surrounding this significant event in the Canadian retail industry. Understanding the intricacies of the Canadian Tire-Hudson's Bay merger is vital for investors, businesses, and consumers alike.

Featured Posts

-

Top 5 Smartphones Longue Duree Pour Une Journee Entiere

May 28, 2025

Top 5 Smartphones Longue Duree Pour Une Journee Entiere

May 28, 2025 -

Will Man United Make A Move For Rayan Cherki This Summer

May 28, 2025

Will Man United Make A Move For Rayan Cherki This Summer

May 28, 2025 -

Padres Unbeaten Streak Merrills Homer Powers 7 0 Start

May 28, 2025

Padres Unbeaten Streak Merrills Homer Powers 7 0 Start

May 28, 2025 -

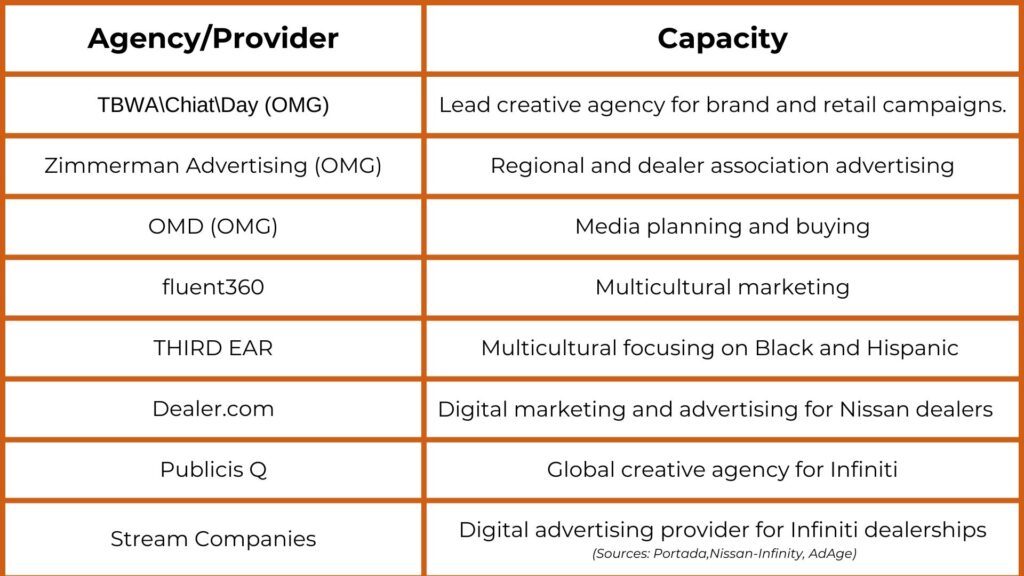

Climate Changes Effect On Rainfall Levels In Western Massachusetts

May 28, 2025

Climate Changes Effect On Rainfall Levels In Western Massachusetts

May 28, 2025 -

Waspada Maraknya Kawin Kontrak Di Bali Libatkan Warga Asing

May 28, 2025

Waspada Maraknya Kawin Kontrak Di Bali Libatkan Warga Asing

May 28, 2025

Latest Posts

-

Western Massachusetts Rainfall The Impact Of Climate Change

May 31, 2025

Western Massachusetts Rainfall The Impact Of Climate Change

May 31, 2025 -

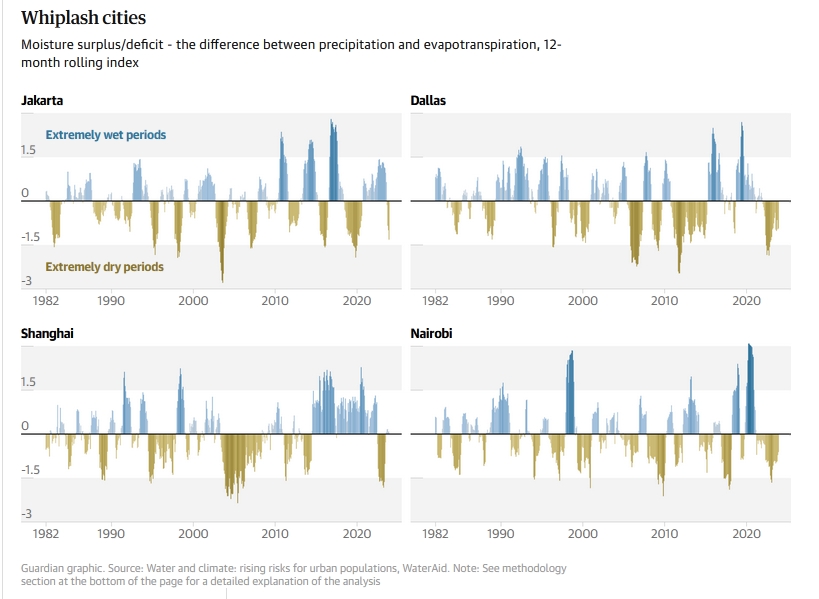

The Impact Of Dangerous Climate Whiplash A Global City Perspective

May 31, 2025

The Impact Of Dangerous Climate Whiplash A Global City Perspective

May 31, 2025 -

Dangerous Climate Whiplash A Growing Threat To Cities Around The World

May 31, 2025

Dangerous Climate Whiplash A Growing Threat To Cities Around The World

May 31, 2025 -

The Link Between Corporate Targets And Increasing Uk Pet Vet Bills

May 31, 2025

The Link Between Corporate Targets And Increasing Uk Pet Vet Bills

May 31, 2025 -

New Report Highlights Dangerous Climate Whiplash Impacts On Global Cities

May 31, 2025

New Report Highlights Dangerous Climate Whiplash Impacts On Global Cities

May 31, 2025