The Economic Fallout Of Trump's China Tariffs: Higher Costs And Supply Chain Disruptions

Table of Contents

Increased Costs for Consumers and Businesses

Trump's China tariffs directly increased the price of countless imported goods from China. These tariffs, essentially taxes on imports, were levied on a wide range of products, impacting both businesses and consumers. Everyday items such as consumer electronics (smartphones, laptops), furniture, clothing, and toys saw significant price increases.

Businesses faced a difficult choice: absorb these increased import costs, reducing profit margins, or pass them on to consumers, leading to higher prices and potentially reduced demand. This ripple effect contributed significantly to inflation, eroding consumer purchasing power and impacting overall economic growth.

- Higher prices for everyday goods: The increased cost of imported goods led to a noticeable increase in prices across various retail sectors.

- Reduced consumer purchasing power: As prices rose, consumers had less disposable income, impacting spending and overall economic activity.

- Increased business operating costs: Businesses faced higher input costs, squeezing profit margins and hindering investment.

- Impact on profit margins: Reduced profit margins forced many businesses to cut costs, potentially leading to job losses or reduced investment.

- Data points: Inflation rates in the US during the period of the China tariffs showed a clear upward trend, directly correlating with the increased cost of imported goods. (Specific data and sources would be inserted here in a fully realized article.)

Significant Supply Chain Disruptions

The tariffs also significantly disrupted established global supply chains. Companies were forced to reassess their sourcing strategies, searching for alternative suppliers outside of China. This process proved costly, time-consuming, and often resulted in less efficient and more expensive production processes.

Relocating production involved substantial upfront investments, including setting up new factories, training staff, and navigating new regulatory environments. This led to increased lead times, delivery delays, and increased uncertainty for businesses reliant on timely delivery of goods. The added logistical complexity and risks further hindered economic activity.

- Increased shipping costs and lead times: Finding alternative suppliers often meant longer shipping routes and higher transportation costs.

- Difficulties finding reliable alternative suppliers: Building new relationships with suppliers takes time and effort, potentially leading to production delays.

- Production delays and shortages: The disruption in the supply chain led to shortages of certain goods and delays in product launches.

- Increased logistical complexity: Managing multiple suppliers and navigating new logistical challenges increased operational costs and complexity.

- Examples of companies affected: (Specific examples of companies and their responses to the tariffs would be included here.)

Impact on Specific Industries

Certain industries were disproportionately affected by the Trump tariffs. The manufacturing sector, heavily reliant on imported components from China, faced significant challenges. The agricultural sector also experienced difficulties, with tariffs impacting both exports and imports. The retail industry struggled with increased costs, impacting profit margins and consumer spending.

- Analysis of the impact on the manufacturing sector: The increased cost of imported components led to higher production costs and reduced competitiveness for many US manufacturers.

- The effect on agricultural exports and imports: Tariffs on agricultural products led to reduced trade volumes and impacted farmers' incomes.

- The retail industry's struggle with increased costs: Retailers faced higher prices for goods, forcing them to either absorb the costs or pass them on to consumers.

- Specific examples of companies impacted: (Specific examples of companies in different sectors and the impact of the tariffs on their operations would be detailed here.)

Long-Term Economic Consequences

The economic consequences of the Trump-era China tariffs extend far beyond the initial period of imposition. The disruption to established trade relationships and the uncertainty created by the trade war have had long-lasting effects on global trade and investment. The potential for reduced long-term economic growth, strained US-China relations, and increased uncertainty in global trade remain significant concerns.

- Potential for reduced long-term economic growth: The increased costs and reduced trade flows could hinder long-term economic growth in both the US and China.

- Strained US-China relations: The trade war significantly damaged the relationship between the two largest economies in the world.

- Uncertainty in global trade: The unpredictable nature of trade policy creates uncertainty for businesses, discouraging investment and hindering economic growth.

- Long-term effects on inflation: The increased costs of goods could contribute to persistent inflationary pressures.

Conclusion: Understanding the Lasting Impact of Trump's China Tariffs

The Trump administration's China tariffs resulted in significant increased costs for consumers and businesses, coupled with widespread supply chain disruptions. These impacts extended beyond the initial period, leading to long-term economic consequences, including strained US-China relations and uncertainty in global trade. The full economic fallout is still being assessed, but it’s clear that these tariffs had a profound and lasting impact.

To fully grasp the complexities of this economic event, further research into the China tariff effects, trade war consequences, supply chain resilience, and detailed economic analysis is essential. Understanding the lasting repercussions of these policies is crucial for navigating future trade relations and building more resilient supply chains.

Featured Posts

-

The Ccp United Front In Minnesota A Comprehensive Analysis

Apr 29, 2025

The Ccp United Front In Minnesota A Comprehensive Analysis

Apr 29, 2025 -

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 29, 2025

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 29, 2025 -

Heavy Rain And Flooding Prompts State Of Emergency Declaration In Kentucky

Apr 29, 2025

Heavy Rain And Flooding Prompts State Of Emergency Declaration In Kentucky

Apr 29, 2025 -

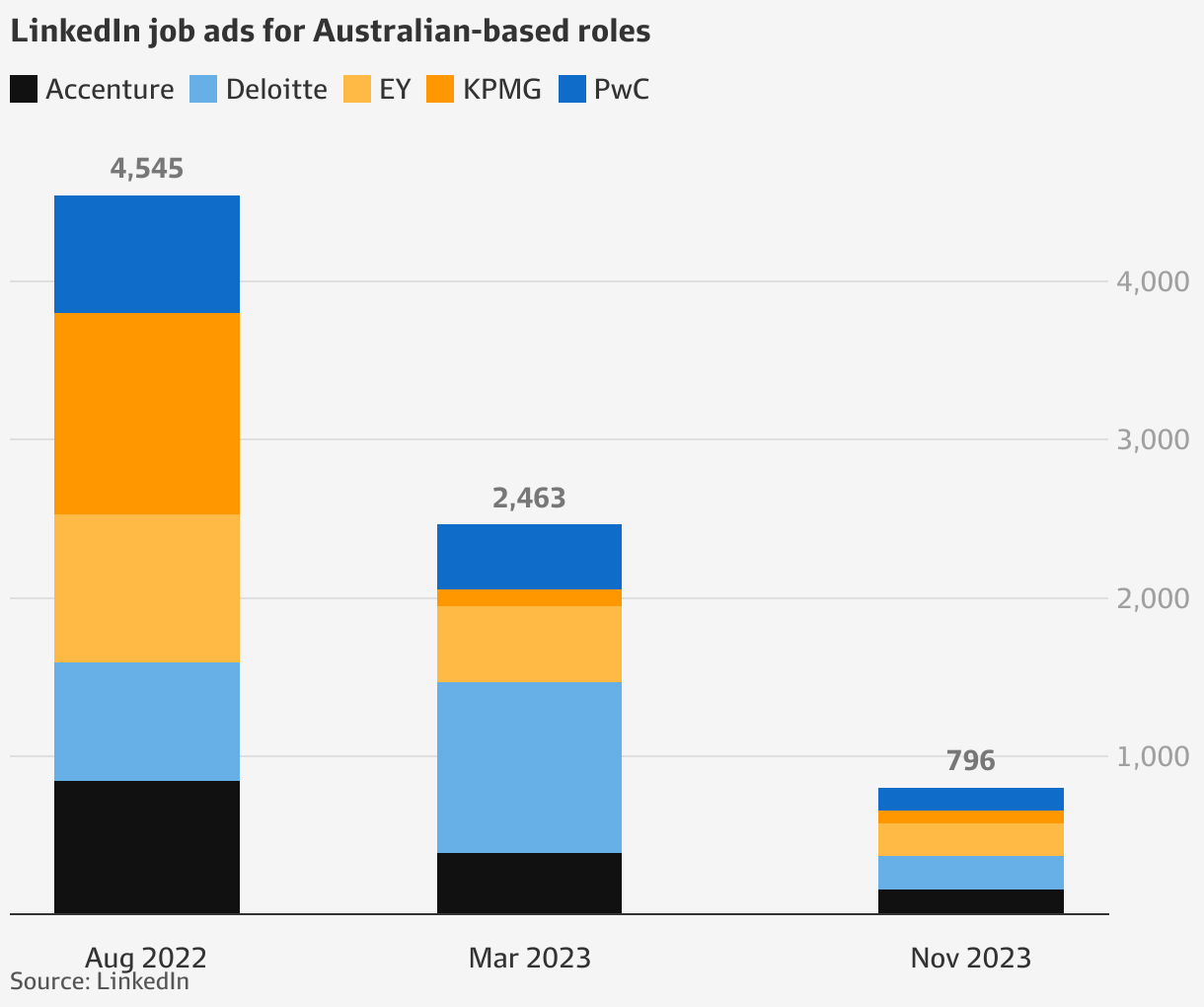

Pif Suspends Pw Cs Advisory Services For 12 Months

Apr 29, 2025

Pif Suspends Pw Cs Advisory Services For 12 Months

Apr 29, 2025 -

New Report Details The Horrifying D C Blackhawk Passenger Jet Crash

Apr 29, 2025

New Report Details The Horrifying D C Blackhawk Passenger Jet Crash

Apr 29, 2025

Latest Posts

-

No Confidence Vote Fails Against Asylum Minister Faber

May 12, 2025

No Confidence Vote Fails Against Asylum Minister Faber

May 12, 2025 -

Marjolein Fabers Lawsuit Hitler Mustache Photo Controversy

May 12, 2025

Marjolein Fabers Lawsuit Hitler Mustache Photo Controversy

May 12, 2025 -

Asylum Minister Faber Survives No Confidence Vote

May 12, 2025

Asylum Minister Faber Survives No Confidence Vote

May 12, 2025 -

Legal Action Marjolein Faber Responds To Altered Image At Protest

May 12, 2025

Legal Action Marjolein Faber Responds To Altered Image At Protest

May 12, 2025 -

Marjolein Faber To Sue Over Hitler Mustache Photo At Protest

May 12, 2025

Marjolein Faber To Sue Over Hitler Mustache Photo At Protest

May 12, 2025