The Factors Behind Uber's Double-Digit April Stock Performance

Table of Contents

April saw Uber's stock price experience a significant double-digit surge, catching the attention of investors and analysts alike. This unexpected rally sent shockwaves through the financial markets, prompting many to question the underlying factors driving this remarkable performance. This article delves into the key elements contributing to this impressive growth in Uber's stock price, analyzing the contributing factors and offering insights into the potential future trajectory of this ride-sharing giant.

Stronger-than-Expected Q1 2024 Earnings Report

Uber's impressive April stock performance was largely fueled by its stronger-than-expected Q1 2024 earnings report. The results significantly exceeded analyst predictions, boosting investor confidence and sending the Uber stock price soaring.

Revenue Growth and Profitability

Uber's Q1 revenue not only met but surpassed expectations, showcasing robust growth across both its core ride-sharing and delivery segments. This success can be attributed to several key factors:

- Increased ride volume: A significant increase in the number of rides booked globally contributed substantially to overall revenue.

- Higher average fares: Strategic pricing adjustments and increased demand led to higher average fares per ride, boosting profitability.

- Improved operational efficiency: Streamlined operations and optimized driver allocation resulted in reduced operational costs and increased margins.

- Successful cost-cutting measures: The company successfully implemented cost-cutting initiatives, improving its bottom line and demonstrating financial prudence.

Key performance indicators (KPIs) further illustrated this positive trend. Gross bookings showed a substantial year-over-year increase, exceeding analyst consensus estimates. Adjusted EBITDA also surpassed expectations, demonstrating improved operational efficiency and profitability. Net income, while still modest, indicated a positive trajectory compared to previous quarters, further strengthening the positive sentiment surrounding Uber stock.

Improved Operational Efficiency

Beyond revenue growth, Uber’s improved operational efficiency played a crucial role in its strong Q1 performance. This was achieved through several strategic initiatives:

- Technological advancements: Investments in AI-powered driver allocation and dispatch systems led to faster ride times and increased driver satisfaction, resulting in improved efficiency.

- Reduction in operational costs: Effective cost management strategies across various departments contributed to increased profitability.

- Successful marketing campaigns: Targeted marketing campaigns increased brand visibility and user acquisition, fueling growth in both ride-sharing and delivery segments.

Positive Investor Sentiment and Market Conditions

The positive Q1 results weren't the only factor contributing to Uber's April stock surge. Broader market conditions and improved investor sentiment also played a significant role.

Improved Market Confidence in the Ride-Sharing Sector

The technology sector as a whole experienced a surge in investor confidence during this period. Positive macroeconomic indicators and increased investor appetite for growth stocks created a favorable environment for companies like Uber. This positive market trend further amplified the impact of Uber’s strong earnings.

- Positive macroeconomic indicators: Improved economic outlook and decreased inflation concerns contributed to increased investor risk tolerance.

- Increased investor appetite for growth stocks: The market showed a preference for growth stocks, benefiting high-growth companies like Uber.

- Competitors' performance: The relative performance of competitors within the ride-sharing sector also influenced investor perception of Uber's position in the market.

Analyst Upgrades and Positive Ratings

Leading financial analysts responded positively to Uber's Q1 earnings, issuing upgrades and positive ratings. This further reinforced the positive investor sentiment surrounding the stock.

- Goldman Sachs raised its price target: Goldman Sachs, a prominent investment bank, increased its target price for Uber stock, citing strong Q1 results and positive growth prospects.

- Morgan Stanley upgraded its rating: Morgan Stanley upgraded its rating on Uber stock, highlighting the company's improved profitability and operational efficiency.

- Other analysts followed suit: Several other reputable analyst firms issued positive commentary and upward revisions to their target prices for Uber stock. These positive ratings contributed significantly to the increased demand and the resulting price surge.

Strategic Initiatives and Long-Term Growth Prospects

Uber's positive April stock performance was also influenced by its ongoing strategic initiatives and long-term growth prospects.

Expansion into New Markets and Services

Uber's continuous expansion into new geographic markets and diversification into new service offerings contributed to its overall growth.

- New market penetration: Uber's expansion into new regions across the globe created new revenue streams and opportunities for growth.

- New service offerings: The expansion into new services, such as freight and the exploration of autonomous vehicle technology, demonstrates the company's commitment to innovation and future growth.

- Strategic partnerships: Successful partnerships and strategic alliances enhanced Uber's reach and market position.

Technological Advancements and Innovation

Uber's substantial investment in technological advancements continues to drive efficiency and fuel future growth.

- Investments in AI and machine learning: Uber's ongoing investment in AI and machine learning is improving its operational efficiency, optimizing pricing strategies, and enhancing the customer experience.

- Autonomous vehicle technology: The development of autonomous vehicle technology holds significant long-term potential for cost reduction and improved service delivery. Though still in its early stages, this initiative signals a commitment to innovation and a focus on the future of transportation.

Conclusion

Uber's double-digit April stock performance can be attributed to a confluence of factors: stronger-than-expected Q1 earnings demonstrating improved profitability and revenue growth, positive investor sentiment buoyed by favorable market conditions and analyst upgrades, and a continued focus on strategic initiatives and long-term growth prospects through expansion and technological innovation. Understanding these factors provides valuable insights into the dynamics of the ride-sharing market and the potential future performance of Uber stock.

Call to Action: Understanding the factors behind Uber's impressive April stock performance provides valuable insights for investors. Continue to monitor Uber's financial reports and strategic moves to make informed decisions regarding your investments in this dynamic ride-sharing and delivery giant. Stay informed on the latest developments influencing Uber stock and its continued growth.

Featured Posts

-

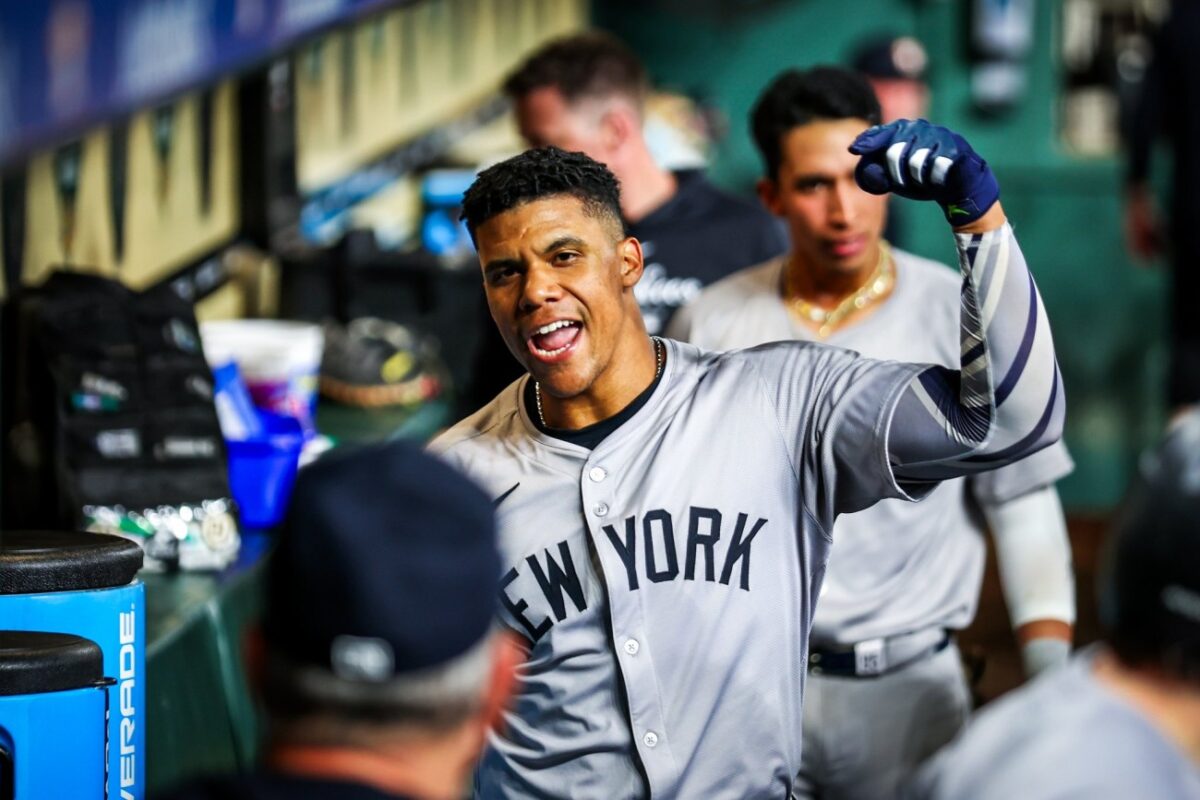

Juan Sotos Slow Start Why He Ll Still Excel With The Mets

May 19, 2025

Juan Sotos Slow Start Why He Ll Still Excel With The Mets

May 19, 2025 -

Morales Winning Streak Continues Another Bonus At Ufc Vegas 106

May 19, 2025

Morales Winning Streak Continues Another Bonus At Ufc Vegas 106

May 19, 2025 -

North Carolina Tar Heels Weekly Athletics Roundup March 3 9

May 19, 2025

North Carolina Tar Heels Weekly Athletics Roundup March 3 9

May 19, 2025 -

Grupo Finlandes Representara A Suecia En Eurovision 2024 En Sueco

May 19, 2025

Grupo Finlandes Representara A Suecia En Eurovision 2024 En Sueco

May 19, 2025 -

Farewell Tour Johnny Mathis Final Concerts

May 19, 2025

Farewell Tour Johnny Mathis Final Concerts

May 19, 2025