The Fate Of Trump's Tax Bill: Internal GOP Divisions And The Path Forward

Table of Contents

Fractured Republican Party: The Source of Discord

The Republican party’s approach to Trump's Tax Bill isn't monolithic. Deep ideological divisions are preventing a unified front on its future.

Differing Ideologies within the GOP

The GOP encompasses a spectrum of views on taxation, ranging from staunch fiscal conservatism to more moderate approaches. These differing viewpoints create significant friction when discussing the long-term implications of the Trump tax cuts.

- Corporate Tax Rates: Some Republicans advocate for maintaining low corporate tax rates to stimulate economic growth, arguing that it fosters job creation and attracts investment. Others express concerns about the potential for increased income inequality and a widening national debt.

- Individual Tax Cuts: Similar debates surround individual tax cuts. While some Republicans champion across-the-board tax reductions, others prioritize targeted tax relief for specific income brackets or families. There's ongoing disagreement on the fairness and efficiency of the existing structure.

- Tax Expenditures: Another point of contention is the use of tax expenditures (tax breaks and deductions). Some Republicans favor eliminating or reducing these, while others argue that they are essential for supporting specific sectors or social programs.

For instance, Senator [Insert Name of a Republican Senator known for fiscal conservatism] has publicly stated concerns about the sustainability of the current tax code, while Representative [Insert Name of a Republican Representative known for a more moderate approach] has emphasized the need to protect certain tax breaks for middle-class families. These differing perspectives illustrate the complexity of navigating the internal GOP debate on Trump’s tax legislation.

The Role of Trump's Legacy

Donald Trump's influence continues to cast a long shadow over the GOP's approach to his signature tax legislation. His fervent supporters within the party largely advocate for maintaining the status quo, while others are more open to revisions or even outright repeal.

- Trump's Rhetoric: Trump’s repeated claims about the economic success under his administration, largely attributed to the tax cuts, continue to resonate among his base, pressuring party members to defend the legislation.

- Loyalty to Trump: Many Republicans remain loyal to Trump, making them resistant to any significant alterations to a policy they associate with his presidency.

- Fear of Primary Challenges: The threat of primary challenges from Trump-endorsed candidates keeps many Republicans from openly criticizing the tax bill.

Economic Impact and Public Opinion: Fueling the Debate

The economic consequences of Trump’s Tax Bill and public perception of it are central to the ongoing political struggle.

Analyzing the Economic Consequences

The actual economic outcomes of the Trump tax cuts remain a subject of intense debate. While proponents point to initial GDP growth, critics highlight the increased national debt and growing income inequality.

- GDP Growth: While there was a period of increased GDP growth following the bill's passage, disentangling the specific contribution of the tax cuts from other economic factors is complex and remains a subject of ongoing economic analysis.

- National Debt: The national debt significantly increased after the tax cuts were implemented, raising concerns about long-term fiscal sustainability.

- Income Inequality: Studies suggest the tax cuts disproportionately benefited high-income earners, exacerbating existing income inequality.

Economists offer varying interpretations of the data, with some emphasizing the short-term benefits and others highlighting the long-term risks. Independent analyses from organizations like the Congressional Budget Office (CBO) offer valuable insights into these complex economic effects.

Public Perception and Political Ramifications

Public opinion polls reveal a mixed public response to Trump's Tax Bill. The lack of widespread popular support weakens the political position of those firmly defending the legislation.

- Corporate Tax Cuts: Public support for corporate tax cuts is generally lower than support for individual tax breaks. This division creates further complexities within the Republican party, forcing them to balance competing priorities and political considerations.

- Individual Tax Breaks: While individual tax cuts generally enjoy higher public approval, their impact on different income groups is a significant factor influencing public opinion and shaping political strategy.

Understanding public sentiment is crucial for any GOP strategy regarding the future of Trump's tax legislation. The political ramifications of aligning with or against specific aspects of the bill could have significant consequences in upcoming elections.

Potential Paths Forward: Legislative Options and Future Implications

The future of Trump's Tax Bill is far from settled. Various legislative options and their long-term implications are actively being debated.

Possible Legislative Revisions

Several scenarios for modifying Trump's tax legislation are plausible, each reflecting the interests of different factions within the GOP.

- Targeted Tax Cuts: Some Republicans may advocate for more targeted tax cuts, focusing on specific demographics or sectors deemed crucial for economic growth. This approach aims to balance economic stimulation with fiscal responsibility.

- Increased Taxes on Certain Sectors: Conversely, some might propose increasing taxes on specific sectors, such as large corporations or high-income earners, to address income inequality and reduce the national debt.

- Sunset Provisions: Another approach is to allow existing tax cuts to expire, gradually reverting to pre-Trump tax rates. This option avoids direct confrontation with the legislation but could lead to its dismantling through inaction.

The feasibility and political implications of each proposal depend heavily on the balance of power within the Republican party and the broader political landscape.

Long-Term Effects on Tax Policy

The ongoing debate surrounding Trump's Tax Bill has far-reaching implications for future tax legislation and the overall political landscape.

- Shifting Priorities: The debate is influencing the GOP’s future policy priorities, highlighting tensions between economic growth, fiscal responsibility, and social equity.

- Impact on Future Elections: The public’s perception of the tax bill and its impact will likely shape voter behavior in future elections, influencing the composition of Congress and the President's agenda.

- Increased Polarization: The ongoing debate underscores the growing polarization within the Republican party and the broader political landscape.

The legacy of Trump's tax legislation will undoubtedly shape the parameters of future tax policy discussions, influencing the priorities and strategies of the Republican party for years to come.

Conclusion: The Future of Trump's Tax Bill Remains Uncertain

The future of Trump's Tax Bill is uncertain, heavily influenced by internal divisions within the Republican party. Ideological clashes over taxation, the bill’s economic consequences, and its impact on public opinion have created a complex and fluid situation. The potential paths forward range from targeted revisions to a gradual phase-out. The long-term implications of this legislation will shape the Republican party's platform, affect future elections, and influence tax policy for years to come. To stay informed on the ongoing debate and its impact on the US economy and political landscape, continue to follow reputable news sources and economic analysis. Understanding the intricacies of Trump tax legislation is crucial for informed civic engagement. Learn more about the complexities of tax policy and the ongoing debate within the Republican party by exploring resources from the Congressional Budget Office and reputable academic institutions.

Featured Posts

-

Possible Dexter Resurrection Trailer Release Date Unveiled

May 22, 2025

Possible Dexter Resurrection Trailer Release Date Unveiled

May 22, 2025 -

Core Weave Inc Crwv Stock Surge On Tuesday Reasons Behind The Rise

May 22, 2025

Core Weave Inc Crwv Stock Surge On Tuesday Reasons Behind The Rise

May 22, 2025 -

Wildlife Rescue A New Film On Helping Pronghorn After A Devastating Winter

May 22, 2025

Wildlife Rescue A New Film On Helping Pronghorn After A Devastating Winter

May 22, 2025 -

Betalbaarheid Woningen Nederland Verschillen Tussen Geen Stijl En Abn Amro

May 22, 2025

Betalbaarheid Woningen Nederland Verschillen Tussen Geen Stijl En Abn Amro

May 22, 2025 -

Ford And Nissan Partner On Battery Plant Amidst Ev Market Slowdown

May 22, 2025

Ford And Nissan Partner On Battery Plant Amidst Ev Market Slowdown

May 22, 2025

Latest Posts

-

Update Two Cows Loose In Lancaster County Park

May 22, 2025

Update Two Cows Loose In Lancaster County Park

May 22, 2025 -

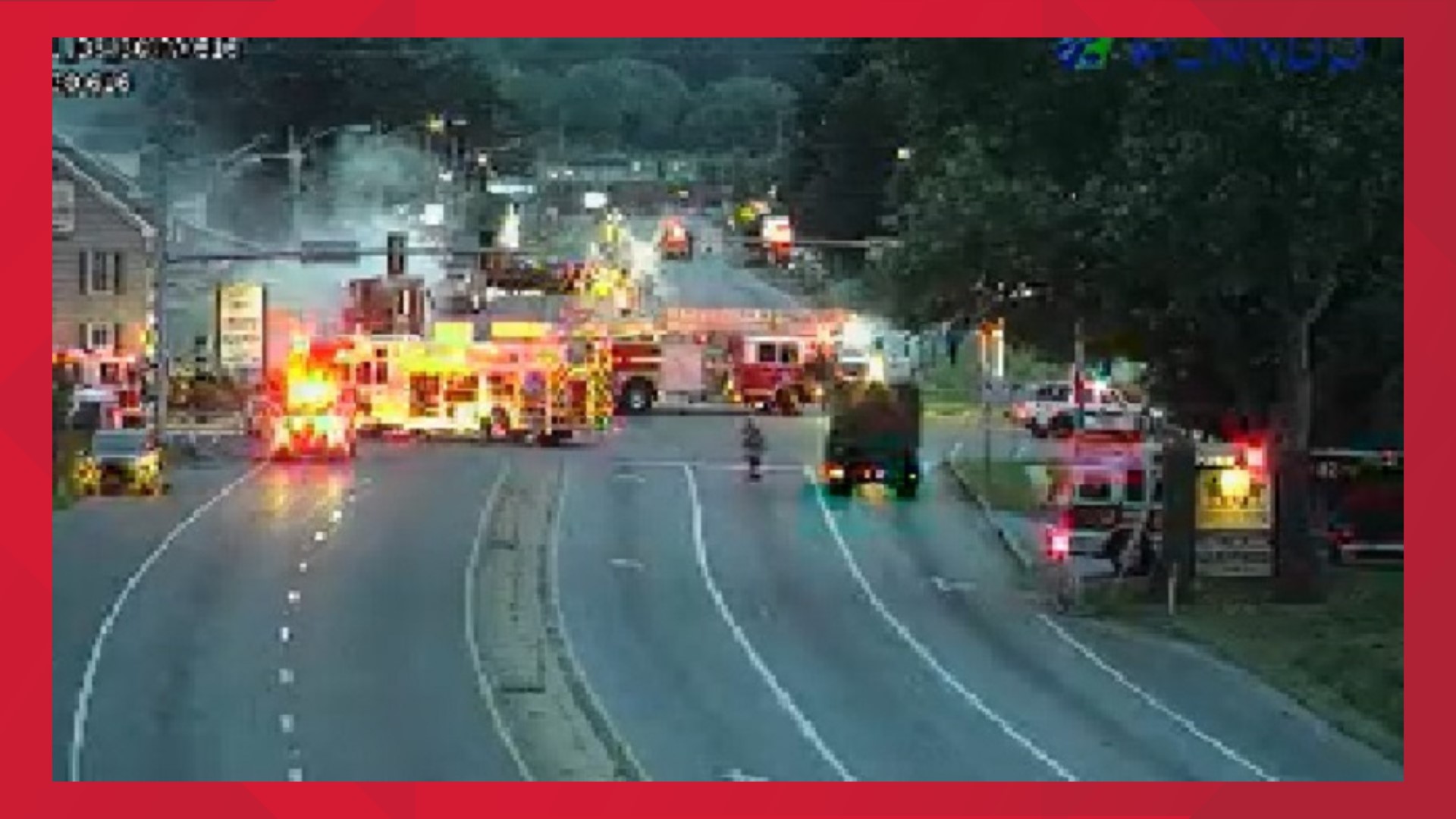

Significant Fire Damage Reported At York County Pa Property

May 22, 2025

Significant Fire Damage Reported At York County Pa Property

May 22, 2025 -

Loose Cows Spotted In Lancaster County Park

May 22, 2025

Loose Cows Spotted In Lancaster County Park

May 22, 2025 -

Lehigh Valley Burn Center Discharge Pilots Son Recovering From Lancaster County Accident

May 22, 2025

Lehigh Valley Burn Center Discharge Pilots Son Recovering From Lancaster County Accident

May 22, 2025 -

Lancaster County Park Two Cows On The Loose

May 22, 2025

Lancaster County Park Two Cows On The Loose

May 22, 2025