The Future Of Auditing In Sub-Saharan Africa After PwC's Withdrawal

Table of Contents

Impact of PwC's Withdrawal on the Sub-Saharan African Auditing Landscape

PwC held a substantial presence in Sub-Saharan Africa, employing numerous professionals and servicing a wide range of clients across various sectors. Their departure represents a significant loss of expertise and experience, creating immediate and long-term consequences for the region's auditing landscape. The immediate impact includes:

- Reduced Competition: The absence of PwC reduces competition in several markets, potentially leading to less competitive pricing and a less dynamic market overall.

- Potential Increase in Audit Fees: With fewer large firms operating, businesses may face higher audit fees, especially smaller businesses that lack bargaining power. This could disproportionately impact SMEs which form the backbone of many Sub-Saharan economies.

- Challenges for Smaller Firms: Existing smaller audit firms now face the challenge of filling the substantial gap left by PwC, requiring significant expansion and potentially overstretching their resources. This demands strategic planning and a focus on niche expertise to compete effectively.

- Increased Scrutiny on Remaining Audit Firms: The remaining audit firms will be under increased scrutiny from regulatory bodies and investors, requiring higher levels of transparency and accountability in their operations and audit reports. This increased scrutiny is crucial to maintain trust in the financial system.

The loss of PwC's expertise also impacts the availability of specialized services like forensic accounting, and international standards adherence, impacting the overall quality of audits performed. This can potentially deter foreign investment which is vital for the development of many economies within the region.

Opportunities for Growth and Development in the Auditing Sector

While the withdrawal presents challenges, it also unlocks significant opportunities for growth and development within the Sub-Saharan African auditing sector. This is a chance to foster local talent and build a more resilient and sustainable industry. Key opportunities include:

- Increased Demand for Specialized Auditing Skills: The growing need for ESG (Environmental, Social, and Governance) auditing and digital audit expertise presents a lucrative opportunity for specialized firms to thrive. These niche skills are in high demand globally, and Sub-Saharan Africa can capitalize on this trend.

- Growth Potential for African-Owned Audit Firms: This creates a unique opportunity for indigenous African audit firms to expand their client base, enhance their expertise, and become regional leaders. Investment in training and development is essential to seize this opportunity.

- Opportunities for Attracting Foreign Investment: The gap left by PwC could attract investment from other international audit firms seeking to establish a presence in Sub-Saharan Africa, leading to increased competition and improved services. This however necessitates a stable regulatory framework and transparent business environment.

- Adoption of New Audit Technologies: The adoption of AI, data analytics, and blockchain technology can enhance efficiency, accuracy, and transparency in the auditing process, leading to a more modern and robust auditing sector.

Regulatory Responses and Strengthened Governance

Effective regulatory responses are vital to mitigating the negative impacts of PwC's withdrawal and fostering a stable auditing environment. This involves:

- Enhanced Oversight by Regulatory Bodies: Regulatory bodies must strengthen their oversight functions, ensuring compliance with international auditing standards and promptly addressing any potential irregularities.

- Strengthening of Auditing Standards and Frameworks: Harmonizing auditing standards across different countries in the region will create a more consistent and transparent regulatory framework.

- Improved Professional Development Programs: Investment in training and development programs for local auditors will ensure that they possess the necessary skills and expertise to meet the demands of a rapidly evolving auditing landscape. This is particularly critical in filling the expertise gaps left by PwC’s withdrawal.

- Increased Penalties for Audit Failures: Implementing stronger penalties for audit failures will deter negligence and promote higher levels of professional responsibility within the industry. This requires a system of robust investigation and enforcement.

The Role of International Collaboration and Capacity Building

International collaboration is crucial in supporting the development of the auditing sector in Sub-Saharan Africa. This involves:

- Knowledge Sharing Programs: Establishing knowledge-sharing programs with international audit firms can help transfer expertise and best practices to local firms.

- Training Programs: Targeted training programs focusing on advanced auditing techniques, including those related to digitalization and ESG reporting, are vital for capacity building.

- International Funding: Securing international funding for audit sector development initiatives can provide vital resources for training, infrastructure improvements, and technological advancements.

- Partnerships: Partnerships between local and international organizations can foster collaboration, knowledge sharing, and the implementation of effective capacity-building programs.

Navigating the Future of Auditing in Sub-Saharan Africa

PwC's withdrawal presents both significant challenges and unprecedented opportunities for the Sub-Saharan African auditing sector. The long-term implications require a proactive approach focusing on regulatory reform, capacity building, and the embrace of technological advancements. The growth of local audit firms, the development of specialized skills, and strengthened governance are essential for building a robust and reliable audit sector. The future of Sub-Saharan Africa auditing hinges on successful navigation of this transition.

The future of auditing in Sub-Saharan Africa depends on proactive adaptation and collaboration. Share your thoughts on how we can navigate this transition and contribute to building a robust and reliable audit sector in the region. Let's work together to shape a future where strong, ethical, and effective auditing practices drive sustainable economic development across Sub-Saharan Africa.

Featured Posts

-

Beirut Rocked By Israeli Airstrike Following Evacuation Order

Apr 29, 2025

Beirut Rocked By Israeli Airstrike Following Evacuation Order

Apr 29, 2025 -

Extreme V Mware Price Increase At And T Highlights 1050 Cost Jump Proposed By Broadcom

Apr 29, 2025

Extreme V Mware Price Increase At And T Highlights 1050 Cost Jump Proposed By Broadcom

Apr 29, 2025 -

2025 Nfl Season Justin Herbert And The Chargers Head To Brazil

Apr 29, 2025

2025 Nfl Season Justin Herbert And The Chargers Head To Brazil

Apr 29, 2025 -

1050 V Mware Price Hike At And Ts Concerns Over Broadcoms Acquisition

Apr 29, 2025

1050 V Mware Price Hike At And Ts Concerns Over Broadcoms Acquisition

Apr 29, 2025 -

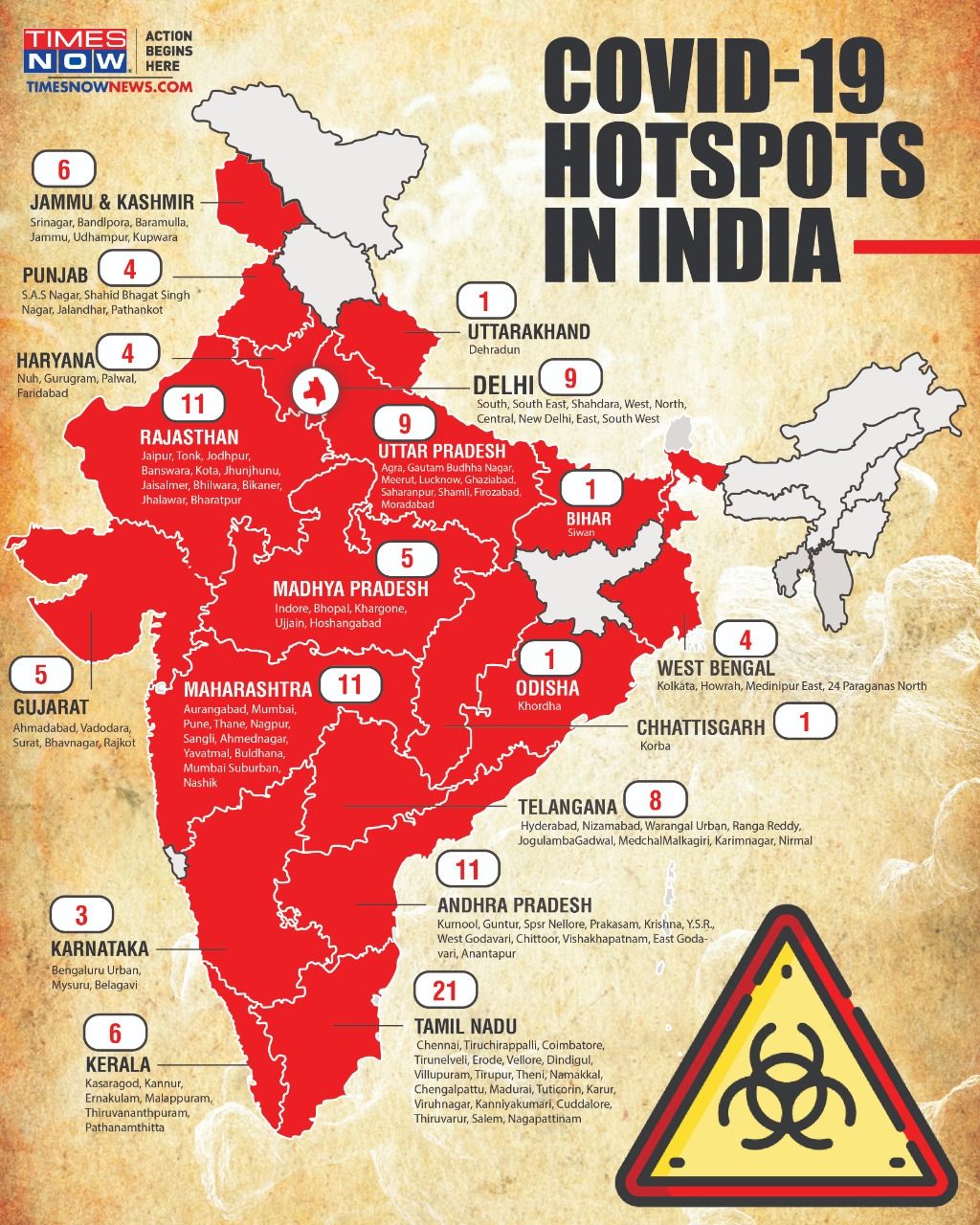

New Business Hotspots Across The Country A Comprehensive Map And Analysis

Apr 29, 2025

New Business Hotspots Across The Country A Comprehensive Map And Analysis

Apr 29, 2025

Latest Posts

-

The Most Emotional Rocky Movie According To Sylvester Stallone

May 12, 2025

The Most Emotional Rocky Movie According To Sylvester Stallone

May 12, 2025 -

Which Rocky Movie Touches Sylvester Stallone The Most

May 12, 2025

Which Rocky Movie Touches Sylvester Stallone The Most

May 12, 2025 -

Stallone Reveals His Top Rocky Movie A Touching Choice

May 12, 2025

Stallone Reveals His Top Rocky Movie A Touching Choice

May 12, 2025 -

Sylvester Stallone Picks His Most Emotional Rocky Film

May 12, 2025

Sylvester Stallone Picks His Most Emotional Rocky Film

May 12, 2025 -

Sylvester Stallones Favorite Rocky Movie The Franchises Most Emotional Entry

May 12, 2025

Sylvester Stallones Favorite Rocky Movie The Franchises Most Emotional Entry

May 12, 2025